Blanket Insulation Market Size

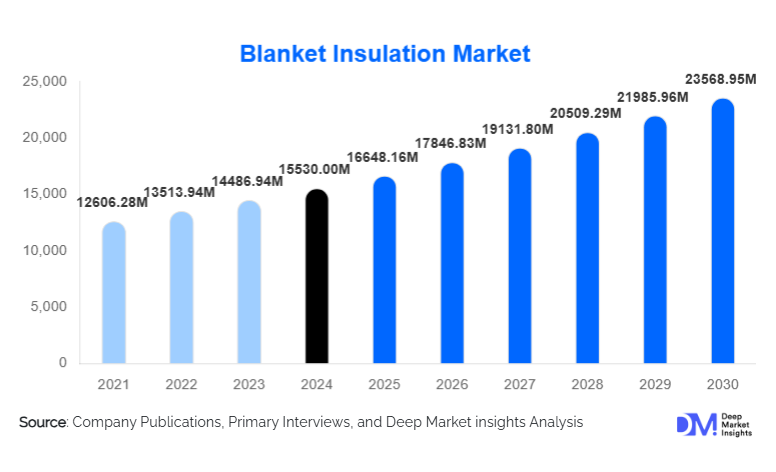

According to Deep Market Insights, the global blanket insulation market size was valued at USD 15,530.00 million in 2024 and is projected to grow from USD 16,648.16 million in 2025 to reach USD 23,568.95 million by 2030, expanding at a CAGR of 7.20% during the forecast period (2025–2030). Market growth is primarily driven by accelerating global construction activity, stricter energy-efficiency mandates, the modernization of industrial infrastructure, and rising adoption of high-performance insulation solutions across oil & gas, power generation, and manufacturing sectors.

Key Market Insights

- Fiberglass remains the dominant insulation material, accounting for approximately 48% of the global market in 2024 due to its low cost, versatility, and compatibility with green building standards.

- Medium-temperature blanket insulation (250–650°C) leads global adoption, driven by widespread use in HVAC, industrial equipment, and commercial buildings.

- Asia-Pacific is the fastest-growing region, supported by rapid industrialization, infrastructure megaprojects, and growing energy conservation initiatives.

- Construction & infrastructure applications represent over half of global demand, propelled by stricter energy codes and the push for sustainable building materials.

- Aerogel and natural fiber blanket insulation technologies are emerging as high-value, eco-friendly alternatives, reflecting a global shift toward lightweight and sustainable materials.

- Industrial refurbishment and efficiency-driven retrofits in the petrochemical, steel, and power industries are creating recurring long-term demand.

What are the latest trends in the blanket insulation market?

Growing Adoption of Energy-Efficient and Green Building Materials

The shift toward sustainable construction is accelerating the adoption of blanket insulation products with high R-values, low embodied carbon, and recyclable content. Governments across Europe, North America, and Asia have implemented aggressive energy-efficiency legislation that mandates improved thermal performance in residential, commercial, and industrial buildings. As a result, manufacturers are developing higher-performance fiberglass and mineral wool blankets with improved fire resistance and sound absorption. Natural fiber insulation, such as hemp, cotton, and sheep wool, is gaining traction among eco-conscious builders seeking renewable and biodegradable alternatives to synthetic materials. This sustainability-driven trend is expected to reshape procurement patterns across the construction industry.

Technological Advancements in High-Performance Insulation Materials

Advanced insulation technologies, particularly aerogel blankets, are transforming the market with superior thermal performance, reduced weight, and thinner profiles. These materials are increasingly used in oil & gas pipelines, industrial processing plants, LNG terminals, and aerospace applications where space constraints and high temperatures demand exceptional efficiency. Digital tools such as thermal simulation software, automated installation equipment, and IoT-enabled monitoring systems are entering mainstream use, helping industrial facilities optimize heat-loss management. Automation and robotics in manufacturing processes are also enabling consistent quality, reduced waste, and lower operating costs, accelerating adoption across high-value industrial segments.

What are the key drivers in the blanket insulation market?

Surge in Global Construction and Infrastructure Development

Rapid urbanization across Asia-Pacific, the Middle East, and emerging African economies is creating sustained demand for blanket insulation in residential, commercial, and institutional buildings. Governments are investing heavily in smart cities, metro systems, industrial parks, and energy-efficient housing, all of which require thermal insulation to reduce operational energy consumption. Renovation and retrofit activity in Europe and North America further strengthens demand, particularly as building owners focus on lowering heating and cooling costs.

Increasing Emphasis on Energy Conservation and Emission Reduction

Blanket insulation reduces heat loss in buildings and industrial equipment by up to 35%, making it indispensable for organizations pursuing carbon-neutral or net-zero goals. Rising energy prices, combined with regulatory pressure to improve system efficiency, are motivating industries to upgrade aging insulation infrastructure. Industrial applications such as boilers, turbines, pipelines, and heat-treatment equipment are experiencing renewed adoption of medium- and high-temperature blanket insulation solutions.

What are the restraints for the global market?

Raw Material Price Volatility and Supply Chain Disruptions

The blanket insulation market heavily depends on petrochemical derivatives, silica sand, basalt, and slag. Volatility in global commodity markets, driven by geopolitical instability, energy price fluctuations, and trade restrictions, causes unpredictable production costs. Smaller manufacturers struggle to absorb these price swings, which can reduce competitiveness and hinder expansion efforts. Supply chain bottlenecks further exacerbate cost pressures, especially for aerogel and specialized mineral wool materials.

Workplace Safety Regulations and Installation Challenges

Fiberglass and mineral wool pose handling challenges due to airborne fibers that necessitate protective equipment and strict adherence to occupational safety standards. Compliance with these regulations increases installation costs and complicates workforce training. Moreover, alternative insulation materials (such as spray foam and rigid boards) continue to challenge blanket insulation in certain segments, potentially slowing market penetration where installation space allows alternative solutions.

What are the key opportunities in the blanket insulation industry?

Energy-Efficient Industrial Modernization

Refineries, petrochemical plants, LNG facilities, and power generation sites are undergoing modernization programs to meet energy-efficiency and emission targets. High-temperature blanket insulation, including aerogel-based solutions, is in high demand for pipelines, boilers, furnaces, and processing equipment. Emerging industries such as hydrogen production and carbon capture are expected to create additional opportunities for advanced insulation technologies in extreme temperature environments.

Eco-Friendly and Lightweight Insulation Solutions

Growing environmental awareness is driving demand for natural fiber insulation and recyclable materials. Hemp and wool blankets offer excellent thermal performance with minimal environmental impact, making them attractive in sustainable construction. Lightweight aerogel blankets are increasingly adopted in aerospace, marine, and electric vehicle sectors due to their high insulation value and minimal bulk. As global industries shift toward sustainability-led procurement, companies offering low-carbon, high-performance solutions are poised to capture premium market segments.

Product Type Insights

Fiberglass blanket insulation dominates the global market, supported by its affordability, fire resistance, and versatility across residential, commercial, and industrial settings. Mineral wool follows as a preferred option for high-temperature applications, particularly in heavy industries, due to its superior fire and sound resistance. Aerogel blanket insulation, although comprising a smaller share, is the fastest-growing category thanks to its unmatched thermal efficiency and rising adoption in oil & gas, aerospace, and LNG transportation. Natural fiber insulation represents a growing niche driven by green construction mandates and eco-conscious consumers, while foam-based blankets serve specialized industrial and pipeline applications.

Application Insights

Thermal building insulation accounts for the largest application share, representing over 50% of the market due to ongoing residential and commercial construction worldwide. HVAC insulation is expanding rapidly as building operators prioritize energy management and system efficiency. Industrial processing applications, including petrochemical refining, steel manufacturing, and power generation, represent a significant growth area for high-temperature blanket insulation. Emerging applications include EV battery thermal protection, aerospace heat shielding, and renewable energy infrastructure, all of which require advanced, lightweight blanket materials.

Distribution Channel Insights

Direct B2B sales dominate the market, accounting for nearly 58% of global revenue, as large industrial and construction firms rely on long-term supplier contracts for cost and supply stability. Distributors and wholesalers serve smaller contractors and building materials suppliers, enabling wide product availability. Retail channels target DIY consumers in developed markets, while online platforms are gaining traction for bulk purchases and procurement of specialty insulation products. Digital catalogs, virtual product simulations, and online certifications are enhancing buyer confidence and simplifying procurement processes.

End-User Insights

The construction and infrastructure sector leads global demand, driven by mandatory energy-efficiency regulations and building modernization initiatives. The oil & gas and petrochemical industries are major consumers of high-temperature blanket insulation used to minimize thermal losses in pipelines, reactors, and storage tanks. Power generation, especially thermal and renewable energy facilities, continues to expand insulation use for operational efficiency. Automotive and aerospace industries represent fast-growing end users adopting lightweight insulation to improve safety and energy efficiency. New applications in data centers, hydrogen facilities, and carbon capture plants are expected to significantly expand the market’s industrial base.

| By Material Type | By Temperature Rating | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 27% of the market, driven by stringent building codes, active industrial retrofit programs, and widespread adoption of energy-efficient materials. The U.S. leads demand due to large commercial construction activity and the modernization of manufacturing facilities. Canada’s cold climate and strong sustainability focus further reinforce insulation requirements across residential and industrial structures.

Europe

Europe remains a major blanket insulation market with a 24% share in 2024, supported by the EU’s aggressive energy-efficiency directives, the ambitious Renovation Wave strategy, and longstanding insulation adoption in Germany, France, and the U.K. Industrial demand remains strong across Central and Eastern Europe, where manufacturing facilities continue to upgrade thermal systems.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, driven by extensive infrastructure development, large-scale industrialization, and rising construction activities in China, India, Indonesia, and Vietnam. China alone represents nearly 18% of the global demand, while India’s insulation market is expanding at over 9% CAGR due to urbanization and government infrastructure programs.

Latin America

Latin America’s demand is concentrated in Brazil and Mexico, where industrial expansion and commercial construction are growing steadily. Adoption of energy-efficient building solutions is increasing as governments implement sustainability-focused policy frameworks. The region presents a moderate growth opportunity driven by improving economic fundamentals and rising awareness of insulation benefits.

Middle East & Africa

MEA demand is driven primarily by oil & gas, petrochemical, and LNG projects in Saudi Arabia, UAE, and Qatar. High-temperature insulation is widely used across refineries, pipelines, and industrial processing units. Africa is gradually expanding insulation adoption as countries invest in infrastructure, power generation, and construction modernization initiatives.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Blanket Insulation Market

- Knauf Insulation

- Owens Corning

- Rockwool International

- Johns Manville

- Saint-Gobain ISOVER

- Armacell International

- Aspen Aerogels

- Kingspan Group

- Morgan Advanced Materials

- L’Isolante K-Flex

- Paroc Group

- Thermafiber Inc.

- Superglass Insulation

- Nippon Aerosil

- Uralita Group

Recent Developments

- In 2025, Aspen Aerogels expanded its production capacity in the U.S. to meet rising demand for high-performance aerogel insulation in the energy and EV sectors.

- In 2025, Knauf Insulation announced a new sustainable fiberglass line using over 80% recycled materials aimed at Europe’s energy-efficient construction initiatives.

- In 2025, Rockwool International invested in a new manufacturing hub in India to support APAC demand for high-temperature and fire-resistant blanket insulation.