Bladeless Fan Market Size

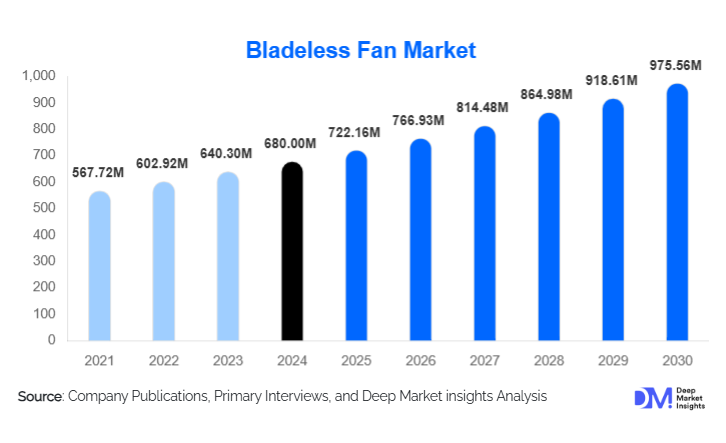

According to Deep Market Insights, the global bladeless fan market size was valued at USD 680.00 million in 2024 and is projected to grow from USD 722.16 million in 2025 to reach USD 975.56 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). Market growth is driven by rising demand for safe, energy-efficient, and aesthetically designed cooling solutions, increasing penetration of smart home ecosystems, and growing awareness around indoor air quality and noise reduction.

Key Market Insights

- Bladeless fans are transitioning from luxury appliances to premium mainstream products, supported by declining unit costs and wider product availability.

- Smart and connected bladeless fans are gaining rapid adoption, accounting for a significant share of new product launches globally.

- North America dominates the global market, supported by high disposable incomes and strong smart home adoption.

- Asia-Pacific is the fastest-growing region, driven by urbanization, rising middle-class income, and premium appliance demand.

- Online sales channels are reshaping distribution, enabling direct-to-consumer strategies and faster global reach.

- Integration of air purification and AI-based climate control is becoming a key differentiator among leading manufacturers.

What are the latest trends in the bladeless fan market?

Smart and AI-Integrated Cooling Solutions

Manufacturers are increasingly embedding smart connectivity features such as Wi-Fi, Bluetooth, voice assistant compatibility, and mobile app control into bladeless fans. AI-enabled models can automatically adjust airflow based on room temperature, occupancy, and time of day, improving energy efficiency and user comfort. This trend aligns strongly with the expansion of smart home ecosystems and is particularly prominent in North America, Europe, and developed Asia-Pacific markets.

Multifunctional and Health-Oriented Designs

Bladeless fans are increasingly being designed as multifunctional appliances, combining cooling with air purification, humidification, and heating. Growing concerns around indoor air quality and allergens are driving demand for fans equipped with HEPA filters and air-quality sensors. These hybrid models command higher price points and are gaining traction in urban residential and commercial environments.

What are the key drivers in the bladeless fan market?

Rising Demand for Safety and Aesthetic Appeal

Bladeless fans eliminate exposed blades, making them safer for households with children and pets, as well as for healthcare and educational facilities. Additionally, their sleek, modern designs complement contemporary interiors, driving adoption in premium residential apartments, offices, and hospitality spaces.

Growing Focus on Energy Efficiency and Noise Reduction

Compared to traditional fans and air conditioners, bladeless fans offer lower energy consumption and quieter operation. Rising electricity costs and stricter energy-efficiency regulations globally are encouraging consumers and businesses to adopt efficient cooling alternatives, supporting steady market growth.

What are the restraints for the global market?

High Initial Cost

Bladeless fans are priced significantly higher than conventional bladed fans due to advanced motor technology, design complexity, and smart features. This limits adoption in price-sensitive markets and restricts demand primarily to middle- and high-income consumers.

Perceived Lower Airflow Performance

Some consumers perceive bladeless fans as delivering lower airflow compared to traditional fans, particularly in extremely hot climates. Overcoming this perception through technological improvements and consumer education remains a challenge for manufacturers.

What are the key opportunities in the bladeless fan industry?

Expansion into Emerging Markets

Asia-Pacific, Latin America, and the Middle East present strong growth opportunities due to rising urban populations and increasing disposable income. Localization of manufacturing and pricing strategies can significantly improve affordability and adoption in these regions.

Sustainability and Green Appliance Positioning

Bladeless fans align well with global sustainability goals due to their energy efficiency and potential use of recyclable materials. Positioning these products as eco-friendly alternatives to air conditioning systems creates opportunities to capture environmentally conscious consumers and institutional buyers.

Product Type Insights

Tower bladeless fans dominate the global bladeless fan market, accounting for approximately 38% of total revenue in 2024. Their leadership is driven primarily by a combination of space-efficient vertical design, superior airflow distribution, and premium aesthetic appeal, making them highly suitable for urban apartments, offices, and hospitality environments where floor space optimization is critical. Tower models also offer greater flexibility for integrating advanced features such as smart connectivity, oscillation control, and air purification modules, further reinforcing their dominance in both residential and commercial applications.

Desk and tabletop bladeless fans represent a stable and growing segment, particularly within home offices, dormitories, and small living spaces. Growth in this category is supported by the global rise in remote and hybrid working models, increasing demand for compact, portable, and low-noise cooling solutions. These models are generally positioned at mid-range price points, making them accessible to a broader consumer base.

End-Use Insights

The residential segment leads the bladeless fan market, accounting for nearly 58% of global demand in 2024. Growth in this segment is supported by rapid urban housing development, rising disposable income, and increasing consumer preference for premium, safe, and visually appealing home appliances. Bladeless fans are particularly favored in households with children and pets due to their enhanced safety profile, as well as in modern apartments where noise reduction and design integration are important purchasing factors.

The commercial segment is the fastest-growing end-use category, expanding at over 13% CAGR during the forecast period. Offices, hotels, healthcare facilities, and retail spaces are increasingly adopting bladeless fans due to their quiet operation, consistent airflow, and low maintenance requirements. In healthcare and hospitality environments, bladeless fans are preferred for hygiene, safety, and energy-efficiency reasons, while corporate offices value their compatibility with smart building management systems. Continued expansion of commercial real estate and premium hospitality infrastructure globally is expected to further accelerate demand from this segment.

Distribution Channel Insights

Online distribution channels account for approximately 41% of global bladeless fan sales, reflecting a major structural shift in consumer purchasing behavior. Brand-owned websites and large e-commerce platforms enable manufacturers to directly engage consumers, offer wider product customization, and provide detailed product demonstrations through digital content. Online channels are particularly effective for tech-savvy consumers seeking smart and multifunctional bladeless fans, and they allow companies to maintain stronger pricing control and higher margins.

Despite rapid online growth, offline retail remains a critical channel, especially for premium and high-value models. Physical electronics stores and appliance showrooms allow consumers to experience airflow performance, noise levels, and build quality firsthand, factors that strongly influence purchasing decisions. Offline retail continues to play a significant role in North America and Europe, where consumers often prefer in-store demonstrations before investing in premium home appliances.

| By Product Type | By End-Use | By Distribution Channel | By Technology | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 34% of the global bladeless fan market, with the United States accounting for the majority of regional demand. Growth is driven by high smart home penetration, strong consumer purchasing power, and early adoption of premium appliance technologies. The region’s focus on energy efficiency, coupled with rising electricity costs and demand for quiet indoor cooling solutions, supports steady adoption. Additionally, widespread availability of advanced models through both online and offline channels, along with strong brand recognition, continues to reinforce North America’s market leadership.

Europe

Europe accounts for nearly 27% of the global market, led by the UK, Germany, and France. Regional growth is strongly influenced by strict energy-efficiency regulations, sustainability-focused consumer behavior, and high urban population density. European buyers demonstrate a strong preference for eco-friendly, low-noise, and design-oriented appliances, making bladeless fans an attractive alternative to traditional cooling solutions. Government policies promoting energy-efficient appliances and reduced carbon emissions further support market expansion across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at over 14% CAGR, driven by China, Japan, South Korea, and India. Key growth drivers include rapid urbanization, expanding middle-class income, rising exposure to premium lifestyle products, and increasing awareness of indoor air quality. China and Japan lead in technology adoption and manufacturing scale, while India and Southeast Asian countries represent high-growth markets due to increasing residential construction and aspirational demand for modern appliances. Localization of manufacturing and competitive pricing strategies are further accelerating adoption across the region.

Latin America

Latin America represents an emerging growth market, with Brazil and Mexico driving gradual adoption. Demand is supported by urban residential development, increasing penetration of premium consumer electronics, and the growth of organized retail and e-commerce platforms. While price sensitivity remains a constraint, rising interest in modern home appliances among affluent urban consumers is creating opportunities for mid-range and premium bladeless fan models.

Middle East & Africa

Demand in the Middle East & Africa is driven primarily by luxury residential construction, hospitality sector expansion, and extreme climatic conditions. The UAE and Saudi Arabia lead regional adoption due to high disposable incomes, large-scale real estate developments, and strong demand for premium indoor cooling solutions. In addition, high-end hotels, offices, and mixed-use developments increasingly favor bladeless fans for their safety, low noise, and modern design, supporting long-term market growth across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|