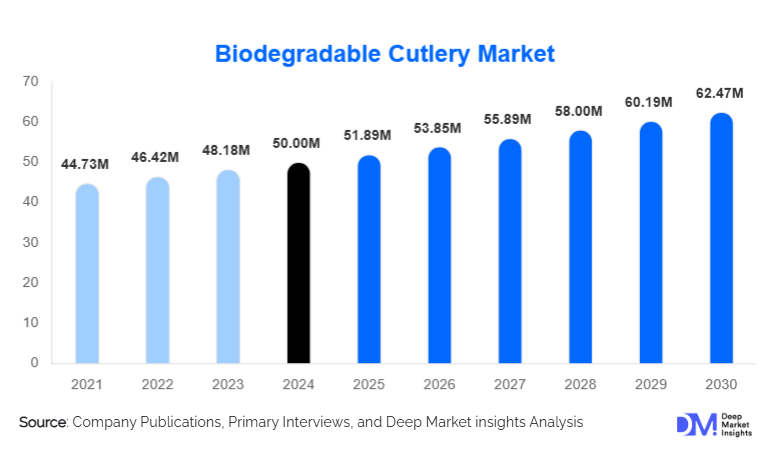

Biodegradable Cutlery Market Size

According to Deep Market Insights, the global biodegradable cutlery market size was valued at USD 50.00 million in 2024 and is projected to grow from USD 51.89 million in 2025 to reach USD 62.47 million by 2030, expanding at a CAGR of 3.78% during the forecast period (2025–2030). Market expansion is being propelled by stringent restrictions on single-use plastics, rising consumer preference for compostable and eco-friendly foodservice products, and rapid adoption of biodegradable cutlery across commercial, institutional, and household applications.

Key Market Insights

- Biodegradable materials such as PLA, CPLA, bagasse, and wood are gaining rapid acceptance as sustainable alternatives to single-use plastic utensils.

- Europe leads global demand, supported by strict plastic bans, circular-economy policies, and strong consumer sustainability preferences.

- Asia-Pacific is the fastest-growing region due to abundant raw materials, expanding foodservice sectors, and rising environmental awareness.

- Foodservice and commercial applications dominate consumption, accounting for more than half of global demand in 2024.

- Bioplastics hold the largest material share, supported by higher durability, scalability, and industrial compostability certifications.

- Technological improvements in molding, material science, and waste-management integration are improving product quality and lowering production costs.

What are the latest trends in the biodegradable cutlery market?

Regulation-Driven Sustainable Product Adoption

Governments across Europe, North America, and the Asia-Pacific continue introducing bans, levies, or phased elimination programs targeting single-use plastics. This regulatory environment is reshaping procurement patterns in the foodservice, retail, and institutional sectors, making biodegradable cutlery a mandatory replacement in many jurisdictions. Countries such as France, Germany, India, and Canada have adopted strict restrictions on plastic cutlery, significantly accelerating market penetration. Businesses increasingly incorporate biodegradable utensils into ESG commitments, with green procurement policies becoming standardized across hospitality chains, corporate cafeterias, and large event organizers.

Material Innovation and Quality Enhancement

Manufacturers are investing heavily in next-generation biopolymers, fiber composites, and engineered bagasse formulations to enhance durability, heat resistance, and usability. Emerging technologies, such as reinforced PLA, high-density bamboo fiber, and multi-layer bio-composites, are helping biodegradable cutlery more closely match the performance of traditional plastics. Automated molding lines, lightweighting techniques, and precision finishing are further reducing defects and improving product aesthetics. These innovations are opening new opportunities in airline catering, institutional dining, and premium foodservice environments where product performance is critical.

What are the key drivers in the biodegradable cutlery market?

Growing Environmental Awareness and Consumer Preference for Sustainable Products

Consumers and corporations are increasingly shifting toward environmentally responsible purchasing. Rising awareness of plastic pollution, ocean waste, and landfill overflow has fueled the adoption of biodegradable alternatives. Major restaurant chains, event organizers, and delivery platforms are actively replacing plastic cutlery with compostable options to meet consumer expectations and strengthen sustainability branding.

Expansion of Global Foodservice, Takeaway, and Delivery Sectors

Rising on-the-go consumption, rapid urbanization, and the growth of delivery platforms have significantly increased global demand for disposable cutlery. Biodegradable cutlery benefits from this trend, offering convenient single-use options without the environmental drawbacks associated with plastics. High-volume demand from QSR chains, cloud kitchens, and catering services is strengthening market growth. The shift toward packaged meals and event-driven consumption further boosts demand for eco-friendly utensils.

Government Regulations and Plastic Bans

Increasingly stringent policy actions are among the strongest growth catalysts. Numerous jurisdictions mandate compostable or biodegradable cutlery in retail, foodservice, and institutional applications. Government initiatives encouraging bio-based production, such as “Make in India” and EU Circular Economy directives, are accelerating investments in manufacturing facilities and local supply chains.

What are the restraints for the global market?

Higher Cost Compared to Plastic Cutlery

Biodegradable products remain more expensive due to higher raw material and processing costs. PLA, wood, and bagasse-based items typically cost 20–60% more than plastic equivalents, limiting adoption among price-sensitive food vendors and emerging markets. Manufacturers must continue optimizing supply chains, automation, and material innovation to narrow the price gap.

Limited Composting Infrastructure and Perceived Quality Issues

Many regions lack large-scale composting facilities or segregated waste collection systems, reducing the environmental benefits of biodegradable cutlery. Additionally, consumers sometimes perceive bio-based cutlery as less durable, especially for hot or dense foods. These perceptions, along with infrastructural gaps, remain barriers to full-scale adoption.

What are the key opportunities in the biodegradable cutlery industry?

Regulatory Momentum and Public Sector Adoption

Governments are increasingly mandating sustainable procurement in public institutions, schools, universities, hospitals, and government offices. This presents a large, stable, and long-term demand base for biodegradable cutlery. Policy frameworks such as extended producer responsibility (EPR) and circular economy mandates will further propel adoption.

High-Growth Demand in Asia-Pacific and Emerging Economies

APAC’s expanding foodservice industry, rising disposable incomes, and availability of low-cost agricultural residues position the region as the fastest-growing market. India, China, Indonesia, and Vietnam offer strong opportunities for local manufacturing hubs supplying both domestic and export markets. The ability to utilize bagasse, rice husk, and bamboo provides a cost advantage while promoting agricultural waste valorization.

Advances in Biopolymers and Closed-Loop Waste Systems

Material science innovations, such as heat-resistant PLA, bio-composite blends, and improved fiber structures, enable higher performance and wider application suitability. Coupled with emerging compost-collection systems, partnerships between manufacturers and waste-management firms create circular, low-impact disposal models. This integration offers major differentiation for sustainability-driven foodservice buyers.

Product Type Insights

Among material categories, bioplastics (PLA/CPLA) lead with around 40% market share in 2024 owing to durability, scalability, and compatibility with industrial composting. Spoons dominate product type demand (25% of total revenue) due to their broad use across delivery meals, desserts, beverages, and catering applications. Offline distribution channels retain more than 60% share due to entrenched procurement systems among foodservice operators, though online channels are expanding rapidly. Foodservice/commercial applications remain the largest end-use segment, representing roughly 55% of global market demand in 2024.

Application Insights

The foodservice industry, including restaurants, cafés, QSRs, cloud kitchens, and catering services, remains the dominant application category. Institutional segments such as schools, hospitals, and corporate cafeterias are adopting biodegradable cutlery through green procurement mandates and sustainability programs. Household usage is growing steadily, fueled by e-commerce penetration and consumer preference for eco-friendly products. Export-driven applications are expanding as manufacturers in India, China, and Southeast Asia supply biodegradable cutlery to Europe and North America, where plastic bans are strict.

Distribution Channel Insights

Offline channels, comprising wholesalers, supermarkets, and B2B distributors, maintain the majority share due to bulk purchasing by foodservice operators and institutional buyers. However, online platforms (B2B portals, e-commerce marketplaces, and D2C brand websites) are experiencing high growth, especially for household and SME customers. Digitization of procurement, real-time pricing, and subscription-based supply models are reshaping the supply landscape. Manufacturers increasingly invest in online visibility and direct-branding strategies to reach global buyers and reduce distributor dependence.

End-Use Insights

The foodservice & commercial sector is the largest consumer of biodegradable cutlery, driven by high-volume takeaway and delivery orders. Institutional buyers, schools, universities, healthcare, and corporate cafeterias, represent one of the fastest-growing end-user categories, supported by sustainability-focused procurement. Household adoption is expanding through retail and e-commerce channels. Emerging applications include airline catering, event management, cruise tourism, and eco-certified hospitality operations. Export demand from Europe and North America provides additional revenue streams for cost-advantaged Asian manufacturers.

| By Raw Material | By Product Type | By End-Use Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for roughly 15–20% of global biodegradable cutlery consumption. Demand is supported by sustainability-driven corporate procurement, city-level bans on plastic utensils, and high food-delivery volumes. The U.S. leads regional consumption, while Canada is expanding quickly with strong public-sector adoption.

Europe

Europe leads the global market with a 25–30% share. Strong regulatory enforcement, such as the EU Single-Use Plastics Directive, combined with consumer sustainability preferences, makes Europe the most mature market. Germany, France, Italy, and the U.K. drive the majority of regional demand. Institutional adoption and retail penetration are particularly strong.

Asia-Pacific

APAC is the fastest-growing region, driven by expanding foodservice activity, urbanization, and cost-effective manufacturing. Countries such as China, India, Indonesia, and Vietnam are emerging as global supply hubs leveraging agricultural residues for raw material sourcing. APAC's market share in 2024 is estimated at 20–25%, with the highest CAGR expected through 2030.

Latin America

LATAM holds 5–10% of the global share, with moderate but growing demand. Brazil, Mexico, and Argentina lead adoption, driven by improving awareness of plastic waste issues. Price sensitivity remains a challenge, but government-backed sustainability programs are improving market penetration.

Middle East & Africa

MEA represents around 5–10% of global demand. The region shows rising adoption in hospitality, tourism, and event-driven consumption. South Africa, the UAE, and Saudi Arabia lead regional growth. Government sustainability initiatives and tourism expansion indirectly support demand for biodegradable cutlery.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Biodegradable Cutlery Market

- Huhtamaki

- Vegware

- Eco-Products

- World Centric

- Biopak

- BioFutura

- StalkMarket

- Bamboozle

- NatureHouse

- Leafware

- Dart Container Corporation

- Pactiv

- Papstar

- Solia

- Greenware