Bio-Furnishing Market Size

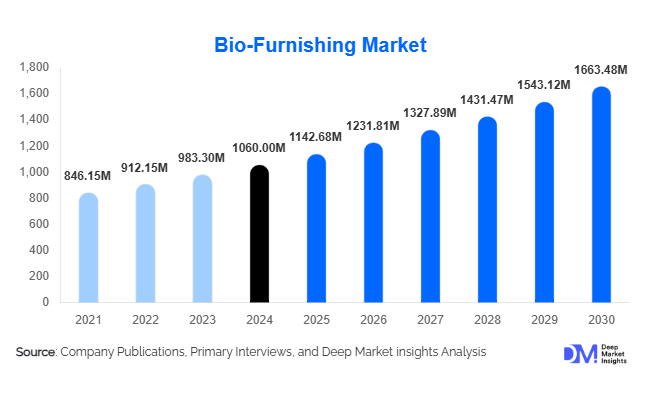

According to Deep Market Insights, the global bio-furnishing market size was valued at USD 1,060.00 million in 2024 and is projected to grow from USD 1,142.68 million in 2025 to reach USD 1,663.48 million by 2030, expanding at a CAGR of 7.8% during the forecast period (2025–2030). The bio-furnishing market growth is primarily driven by rising consumer awareness of sustainability, increasing adoption of green building standards, and strong demand from residential, commercial, and hospitality sectors for eco-friendly interior solutions.

Key Market Insights

- Bio-furnishings are transitioning from niche to mainstream, supported by global sustainability regulations and ESG-driven procurement policies.

- Residential interiors dominate demand, fueled by home renovation trends and preference for non-toxic, renewable materials.

- Europe holds the largest market share, driven by strict environmental regulations and strong adoption of certified sustainable furniture.

- Asia-Pacific is the fastest-growing region, supported by urbanization, rising middle-class income, and export-oriented manufacturing.

- Hospitality and commercial real estate are key growth engines as green-certified buildings gain traction.

- Innovation in bio-materials, including bio-composites and mycelium-based materials, is reshaping product design and scalability.

What are the latest trends in the bio-furnishing market?

Rise of Certified and Circular Furnishings

Manufacturers are increasingly focusing on certified sustainable materials such as FSC-certified wood, reclaimed timber, and natural fibers to meet regulatory and consumer expectations. Circular economy principles are gaining traction, with companies designing furniture for recyclability, refurbishment, and extended product life. Take-back programs, modular designs, and recyclable bio-composites are becoming standard practices, particularly in Europe and North America. These trends are reinforcing trust among institutional buyers and eco-conscious consumers.

Integration of Advanced Bio-Materials

Technological advancements in biomaterial engineering are enabling the use of mycelium-based structures, plant-based resins, and engineered natural fiber composites. These materials offer improved durability, lightweight properties, and lower carbon footprints compared to traditional furniture materials. Adoption is accelerating in commercial and hospitality applications where sustainability credentials influence purchasing decisions. Early adopters are gaining competitive advantages through material innovation and intellectual property development.

What are the key drivers in the bio-furnishing market?

Growing Emphasis on Sustainability and ESG Compliance

Governments, corporations, and consumers are increasingly prioritizing sustainability. Green building certifications such as LEED, BREEAM, and WELL are driving demand for eco-friendly interiors, directly benefiting bio-furnishing manufacturers. Corporate ESG commitments are influencing procurement policies, particularly in offices, hotels, and public infrastructure projects, accelerating large-scale adoption.

Expansion of Green Real Estate and Hospitality

The growth of green commercial buildings and eco-conscious hospitality projects is a major driver. Hotels, resorts, and office developers are using bio-furnishings to enhance brand image, reduce carbon footprints, and meet sustainability benchmarks. This trend is particularly strong in Europe, North America, and emerging luxury hospitality markets in the Asia-Pacific and the Middle East.

Design Innovation and Customization Capabilities

Advancements in digital fabrication, CNC machining, and modular furniture design have improved the aesthetics and functionality of bio-furnishings. Customization capabilities allow manufacturers to cater to premium residential and B2B contract segments, improving margins and customer loyalty.

What are the restraints for the global market?

Higher Upfront Costs

Bio-furnishings typically carry a price premium of 15–30% compared to conventional furniture due to certified raw materials and specialized manufacturing processes. This limits adoption in price-sensitive markets, particularly in developing economies, despite lower lifecycle costs.

Raw Material Supply Volatility

Dependence on natural materials such as bamboo, cork, and certified wood exposes manufacturers to supply fluctuations and price volatility. Climate variability, land-use restrictions, and certification bottlenecks can impact scalability and cost stability.

What are the key opportunities in the bio-furnishing industry?

Government-Led Green Infrastructure Spending

Public investments in sustainable infrastructure and housing present long-term opportunities. Policies promoting low-carbon construction and local manufacturing, including initiatives such as “Make in India” and “Made in China 2025,” are supporting capacity expansion and export growth for bio-furnishing manufacturers.

Direct-to-Consumer (D2C) and Premium Residential Demand

Digitally native D2C brands are capitalizing on eco-conscious consumer behavior by offering traceability, customization, and transparent sustainability claims. Premium residential buyers are willing to pay higher prices for ethical sourcing, healthy indoor environments, and design differentiation.

Product Type Insights

Seating furniture represents the largest product segment, accounting for approximately 28% of the 2024 market, driven by high replacement frequency across residential, office, and hospitality spaces. Tables and desks follow, supported by demand from home offices and co-working spaces. Storage furniture and bedroom furniture are growing steadily, particularly in residential applications, while bio-based décor and panels are gaining traction in commercial interiors.

Application Insights

Residential interior furnishing dominates the market with around 41% share, supported by renovation activity and lifestyle shifts toward sustainable living. Commercial interiors, including offices and retail spaces, are expanding rapidly due to ESG-driven procurement. Hospitality applications are among the fastest-growing, as hotels and resorts adopt bio-furnishings to align with green certifications and eco-tourism trends.

Distribution Channel Insights

Specialty furniture retailers and project-based B2B sales collectively account for over 45% of global revenue, driven by institutional and commercial contracts. E-commerce and D2C channels are growing at double-digit rates, particularly for residential buyers, offering customization, wider product access, and brand storytelling. Traditional retail remains relevant in premium and design-led markets.

End-Use Insights

Households account for nearly 38% of global demand, followed by corporate offices and hospitality establishments. The hospitality segment is growing at over 12% CAGR, driven by sustainable tourism and green hotel development. Healthcare and educational institutions are emerging end-use sectors, leveraging bio-furnishings for wellness-oriented and low-emission interiors.

| By Material Type | By Product Type | By Application | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe leads the global bio-furnishing market with approximately 34% share in 2024. Germany, the U.K., France, and Nordic countries drive demand due to stringent environmental regulations, high consumer awareness, and widespread adoption of green building standards.

North America

North America accounts for around 29% of the market, led by the U.S. and Canada. Strong ESG adoption, corporate office demand, and premium residential spending support market growth. The region is also a major importer of bio-furnishings.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 12.8% CAGR. China and India dominate manufacturing and export volumes, while Japan and Australia contribute steady domestic demand driven by sustainable design preferences.

Latin America

Latin America is an emerging market, led by Brazil and Mexico, supported by natural material availability and growing export-oriented production of sustainable furniture.

Middle East & Africa

Demand is rising in the UAE and Saudi Arabia due to green infrastructure investments and luxury hospitality projects. Africa also serves as a source of natural raw materials and niche artisanal bio-furnishings.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bio-Furnishing Market

- IKEA

- Steelcase

- Herman Miller

- Haworth

- Vitra

- Kinnarps

- Muuto

- Okamura

- Natuzzi

- HNI Corporation

- Godrej Interio

- Nilkamal

- Emeco

- Roche Bobois

- Humanscale