Bicycle Tube Market Size

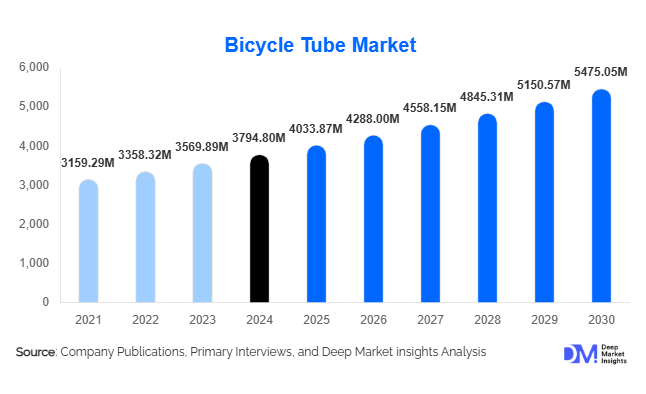

According to Deep Market Insights, the global bicycle tube market size was valued at USD 3,794.80 million in 2024 and is projected to grow from USD 4,033.87 million in 2025 to reach USD 5,475.05 million by 2030, expanding at a CAGR of 6.30% during the forecast period (2025–2030). Market growth is largely driven by rising global bicycle adoption, increased demand for replacement inner tubes, and the rapid penetration of e-bikes and shared mobility fleets across both developed and emerging economies.

Key Market Insights

- Butyl rubber tubes dominate the global material mix, accounting for nearly 60–65% of total demand due to durability and cost efficiency.

- Aftermarket sales represent the largest revenue share, contributing nearly 65–70% of global bicycle tube consumption in 2024.

- Asia-Pacific leads the global market with approximately 35–40% share, driven by extensive bicycle usage and large-scale manufacturing in China, India, and Southeast Asia.

- Europe is the fastest-growing region with high adoption of commuter bicycles, e-bikes, and premium cycling accessories.

- Innovation in puncture-resistant and lightweight tubes is accelerating demand in the performance cycling and mountain biking segments.

- E-bike expansion, driven by urban mobility policies, is fueling strong replacement cycle demand for heavy-duty and reinforced tubes.

What are the latest trends in the bicycle tube market?

Shift Toward Puncture-Resistant and Performance Tubes

Consumers are increasingly prioritising durability, performance, and low-maintenance cycling solutions. As a result, puncture-resistant tubes, latex-based performance tubes, and polyurethane lightweight tubes are rapidly gaining traction. The trend is particularly strong in Europe and North America, where mountain biking, gravel riding, and long-distance touring are popular. Manufacturers are investing in multi-layer composite designs, sealant-compatible tubes, and reinforced bead constructions to differentiate their products. The shift toward specialised tubes is raising the average selling price and expanding premium segment revenues.

Growing Influence of E-Bike Adoption

E-bikes are transforming the cycling landscape, creating a high-consumption segment for reinforced, thicker, and more durable inner tubes. Since e-bikes are heavier and often ridden over longer distances, their tubes experience higher wear rates, accelerating replacement cycles. As cities expand e-bike sharing and micro-mobility infrastructure, aftermarket tube suppliers are seeing exponential demand growth. This trend is also pushing manufacturers to develop heat-resistant and higher load-bearing tubes optimised for e-mobility needs.

What are the key drivers in the bicycle tube market?

Global Cycling Boom and Urban Mobility Growth

Growing urban congestion, rising fuel prices, and sustainability-focused mobility policies are driving global bicycle adoption. Cities worldwide are investing in cycling lanes, commuter incentives, and bike-sharing programs, which in turn boost demand for bicycle components such as inner tubes. Increased recreational cycling, particularly in Europe and North America, also strengthens aftermarket demand across premium and sport segments.

Expansion of the Aftermarket and Replacement Sector

The bicycle tube market is heavily reliant on the replacement cycle, as inner tubes wear out or puncture frequently. Commuters, delivery fleets, and shared bicycles require frequent tube replacements due to intensive daily use. This recurring demand is a major growth driver, giving retailers, distributors, and e-commerce platforms a robust and stable customer base. The aftermarket’s dominance ensures continuous revenue flow even when global bicycle sales experience fluctuations.

Advancements in Tube Material Technology

Innovations in rubber compounds, thermoplastic elastomers (TPE), polyurethane, and self-sealing technologies are enhancing the performance of modern bicycle tubes. These materials improve puncture resistance, reduce weight, and offer better heat management for high-speed or e-bike applications. Technological advancements also support market expansion into premium and professional cycling segments, where consumers willingly pay a premium for performance enhancements.

What are the restraints for the global market?

Increasing Adoption of Tubeless Tire Systems

Tubeless technology is expanding among high-end bicycles, particularly mountain bikes and road racing bikes. Tubeless tyres reduce the need for inner tubes, posing a threat to traditional tube demand in the premium segment. As this technology becomes more accessible, it may limit market share growth for high-end tube manufacturers unless they diversify.

Volatility in Rubber and Raw Material Prices

Natural and synthetic rubber prices are subject to global commodity volatility, environmental constraints, and supply chain disruptions. These fluctuations directly affect production costs and price stability for bicycle tube manufacturers. Cost-sensitive markets in Latin America, Asia, and Africa may experience reduced demand when retail prices increase, creating downward pressure on margins.

What are the key opportunities in the bicycle tube industry?

Rising Demand from E-Bike and Shared Mobility Fleets

The growing global network of shared bicycles and e-bike fleets presents a major opportunity. These fleets require regular tube replacements due to heavy usage, making them reliable, recurring bulk purchasers. Manufacturers that develop reinforced tubes tailored for fleet environments can secure lucrative long-term contracts with mobility operators.

Sustainable and Eco-Friendly Tube Materials

Consumers and governments are growing more eco-conscious, creating demand for tubes made from recycled rubber, sustainably sourced natural rubber, or biodegradable materials. Developing environmentally responsible products can give manufacturers a competitive edge and attract institutional buyers focused on carbon reduction and circular economy initiatives.

Premium Tube Development for Performance Cycling

The surge in professional and recreational cycling events, gravel riding, and long-distance touring has created demand for high-performance, lightweight, and competition-grade tubes. Manufacturers that innovate with cutting-edge materials such as advanced latex blends or composite elastomers can capture high-margin segments and differentiate in an otherwise price-sensitive marketplace.

Product Type Insights

Standard butyl rubber tubes dominate the market due to affordability and widespread compatibility with commuter bicycles, capturing nearly 60–65% of global demand. Puncture-resistant tubes are gaining strong momentum, particularly within mountain biking, e-bike, and fleet applications. Performance tubes, such as latex and polyurethane variants, serve competitive cyclists, representing a niche but fast-growing category fueled by increased awareness of weight reduction and ride efficiency benefits. Self-sealing and composite tubes are emerging as premium alternatives that appeal to riders seeking reduced maintenance and enhanced durability.

Application Insights

Commuter and hybrid bicycles represent the largest application segment, driven by daily transportation needs and high tube replacement frequency. Mountain bikes contribute significantly due to rugged terrain use that accelerates tube wear. The e-bike segment is the fastest-growing application, supported by urban mobility policies and the expansion of electric bicycle fleets. BMX, road racing, and touring bikes contribute steady demand, especially for performance-oriented tube designs. Rental and shared mobility applications are rapidly expanding, creating high-volume demand for durable tubes optimised for intensive use.

Distribution Channel Insights

The aftermarket channel dominates bicycle tube distribution, accounting for nearly 65–70% of global sales. Retail bike shops, e-commerce platforms, and D2C brand websites play a major role in fulfilling replacement demand. OEM channels remain important but represent a smaller share, tied to new bicycle production. Online platforms are gaining traction due to accessibility, price comparison tools, and growing consumer preference for home-delivered spare parts. Fleet operators, bike-sharing programs, and courier/delivery services represent an increasingly important B2B distribution channel that values long-term contracts and bulk purchasing agreements.

End-Use Insights

Personal bicycles and recreational cycling constitute the majority of tube demand globally. The fastest-growing end-use segment is e-bikes, which require more durable and frequent tube replacements. Shared mobility fleets, rental bikes, and delivery bicycles are emerging as major end users due to high wear-and-tear cycles. Export-driven manufacturing, particularly in China, India, Vietnam, and Thailand, supports global demand by supplying Europe, North America, and South America with large volumes of economy to mid-range tubes. As micro-mobility expands, new opportunities are emerging in commercial and institutional fleet procurement.

| By Material Type | By Tube Type | By Bicycle Type | By End-Use / Sales Channel | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for roughly 15–20% of global bicycle tube demand, supported by a strong recreational cycling culture and steady aftermarket activity. The U.S. sees rising demand from mountain biking, gravel riding, and e-bike commuting. Replacement cycles are frequent due to sport-oriented usage. E-commerce and big-box retailers play a significant role in distribution. Growth is moderate but steady, driven by high adoption of premium tubes and steady replacement activity.

Europe

Europe holds around 20–25% market share and is the fastest-growing region for bicycle tubes. Strong cycling infrastructure, eco-friendly mobility policies, and widespread e-bike usage drive sustained demand. Germany, the Netherlands, France, and the U.K. are major markets. European consumers show a high willingness to purchase premium and puncture-resistant tubes, driving innovation and higher profit margins for manufacturers.

Asia-Pacific

Asia-Pacific leads with 35–40% of global demand. High population density, extensive bicycle use for commuting, and concentrated manufacturing activity create a strong growth environment. China and India together account for a large portion of demand. The region is also a major exporter of bicycle tubes to Europe and North America. E-bike adoption in Southeast Asia is rapidly accelerating market expansion. APAC remains both the largest and fastest-growing producer and consumer of bicycle tubes.

Latin America

Latin America captures approximately 5–7% of global demand, led by Brazil, Argentina, and Mexico. Demand is primarily driven by cost-effective commuter bicycles. Economic conditions and the limited availability of premium cycling infrastructure constrain high-end product adoption. Nevertheless, replacement demand remains stable, and online distribution channels are expanding accessibility across urban areas.

Middle East & Africa

MEA accounts for 3–5% of the global market. Key markets include South Africa, Kenya, Nigeria, and the UAE. Cycling adoption is gradually increasing due to health awareness and expanding recreational cycling communities. However, infrastructure limitations and lower disposable income restrict rapid market expansion. Replacement demand is steady, particularly in delivery fleets and urban commuter segments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bicycle Tube Market

- Continental AG

- Kenda Rubber Industrial Co., Ltd.

- Michelin

- Maxxis International

- Schrader International

- Vittoria Industries

- Hwa Fong Rubber

- Schwalbe (Ralf Bohle GmbH)

- Specialised Bicycle Components (Tube Division)

- Tannus International

- Innova Rubber

- Cheng Shin Rubber

- Ralson India

- Apollo Vredestein

- Hutchinson Cycling

Recent Developments

- In May 2025, Continental AG introduced a new line of reinforced e-bike tubes designed for heavy-load commuting and shared mobility fleets, offering improved puncture protection and heat resistance.

- In April 2025, Maxxis announced a significant expansion of its Thailand production facility to meet increasing global demand for aftermarket bicycle tubes.

- In February 2025, Schwalbe launched its first fully recyclable tube program in Europe, supporting circular economy initiatives and eco-friendly tube manufacturing.