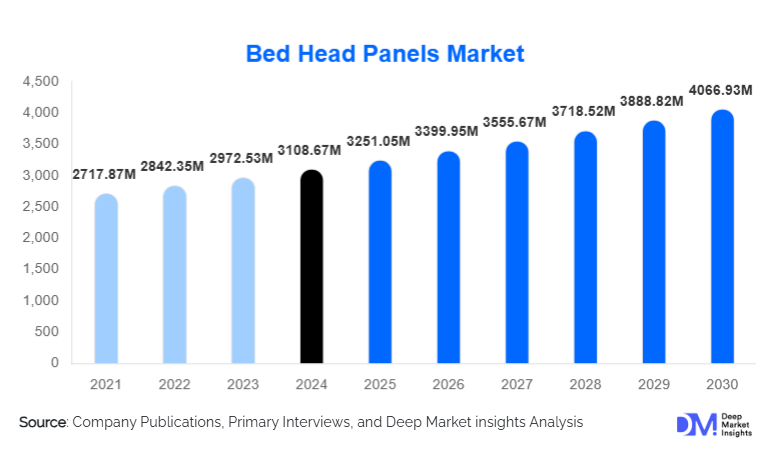

Bed Head Panels Market Size

According to Deep Market Insights, the global bed head panels market size was valued at USD 3,108.67 million in 2024 and is projected to grow from USD 3,251.05 million in 2025 to reach USD 4,066.93 million by 2030, expanding at a CAGR of 4.58% during the forecast period (2025–2030). The market growth is primarily driven by rising hospital infrastructure investments, increasing adoption of integrated bedside utility systems, and the growing shift toward smart and modular healthcare environments.

Key Market Insights

- Hospitals remain the dominant end-use segment, accounting for nearly two-thirds of global demand due to mandatory regulatory requirements for bedside utilities.

- Aluminum-based bed head panels lead material adoption owing to superior hygiene, corrosion resistance, and lightweight construction.

- Advanced and multifunctional bed head panels with integrated medical gases, lighting, and IT ports represent over half of total installations.

- Asia-Pacific is the fastest-growing regional market, supported by large-scale hospital construction in China, India, and Southeast Asia.

- Smart and IoT-enabled panels are gaining traction, particularly in developed healthcare systems transitioning toward digital hospitals.

- Surface-mounted installations dominate retrofit and renovation projects due to lower structural modification requirements.

What are the latest trends in the bed head panels market?

Shift Toward Smart and Digital Bed Head Panels

One of the most prominent trends in the bed head panels market is the transition toward smart and digitally integrated systems. Modern panels are increasingly designed to support nurse call systems, patient monitoring devices, electronic medical record access, and IoT connectivity. These advanced panels improve workflow efficiency, enable real-time alerts, and support predictive maintenance, reducing downtime in critical care environments. Hospitals adopting smart infrastructure view bed head panels as an extension of connected care ecosystems rather than static utilities.

Modular and Prefabricated Panel Designs

Healthcare providers are favoring modular bed head panels that simplify installation and allow easy reconfiguration. Prefabricated designs reduce construction timelines and minimize disruption during hospital expansions or renovations. This trend is particularly strong in emerging markets and large hospital chains, where scalability and standardization are critical for cost control and long-term facility planning.

What are the key drivers in the bed head panels market?

Expansion and Modernization of Healthcare Infrastructure

Rising investments in hospital construction and renovation globally are a primary growth driver. Governments and private healthcare operators are expanding ICU capacity, emergency departments, and specialty wards, all of which require compliant bed head panel systems. The replacement of aging infrastructure in developed regions further supports steady demand.

Increasing Complexity of Bedside Care Delivery

Modern patient care requires simultaneous access to medical gases, electrical power, data ports, lighting, and communication systems. Integrated bed head panels reduce clutter, enhance patient safety, and improve clinical efficiency, making them indispensable in high-acuity care settings.

What are the restraints for the global market?

High Initial Installation and Customization Costs

Customized bed head panels involve higher upfront costs due to integration with medical gas pipelines, electrical systems, and IT infrastructure. This can limit adoption among smaller hospitals and clinics in cost-sensitive regions.

Regulatory and Certification Complexity

Bed head panels must comply with stringent medical gas, electrical safety, and infection-control standards. Navigating multiple regional certifications increases product development costs and extends approval timelines, particularly for new entrants.

What are the key opportunities in the bed head panels industry?

Growth of Long-Term Care and Home Healthcare Facilities

Aging populations in North America, Europe, and parts of Asia are driving demand for nursing homes and long-term care facilities. These environments require simplified, cost-effective bed head panels, creating new growth avenues beyond acute hospital settings.

Emerging Market Hospital Construction

Rapid healthcare infrastructure expansion in Asia-Pacific, the Middle East, and Africa presents significant opportunities. Greenfield Hospital projects favor modular, standardized bed head panel systems that reduce installation time and lifecycle costs.

Product Type Insights

Horizontal bed head panels dominate the global market, accounting for approximately 42% of total market share in 2024. Their leadership is primarily driven by ease of installation, standardized configurations, and widespread adoption across general wards and multi-bed hospital rooms. Horizontal panels allow efficient linear distribution of medical gases, electrical outlets, lighting, and nurse call systems along the patient bed line, making them the preferred choice for high-bed-density environments. Their compatibility with both new construction and retrofit projects further strengthens adoption, particularly in public hospitals and large healthcare networks.

Vertical bed head panels hold a significant share in specialized care environments such as intensive care units (ICUs), emergency rooms, and private patient rooms. Their compact design supports vertical stacking of utilities, optimizing wall space in constrained environments and improving ergonomic access for clinicians. Vertical panels are increasingly favored in critical care settings where advanced monitoring equipment and multiple medical devices must be accommodated within limited bedside space.

Material Insights

Aluminum-based bed head panels lead the global market with nearly 48% share, supported by their superior hygiene compliance, corrosion resistance, lightweight structure, and ease of cleaning. Aluminum panels meet stringent infection-control standards, making them ideal for acute care environments such as ICUs, operating rooms, and isolation wards. Their durability and compatibility with modular designs also make them suitable for high-utilization healthcare facilities, contributing to their dominant adoption worldwid Steel-based bed head panels are primarily used in high-impact and high-durability environments where structural strength is a priority. These panels are commonly deployed in trauma centers, emergency departments, and military or government hospitals, where equipment load and long-term robustness outweigh weight considerations.

Plastic and composite bed head panels are gaining adoption in cost-sensitive markets and non-acute care settings such as clinics, ambulatory surgical centers, and long-term care facilities. These materials offer lower upfront costs, design flexibility, and aesthetic customization, making them attractive for outpatient and residential healthcare environments. Growing demand for economical yet compliant solutions in emerging markets is expected to support the steady growth of this material segment.

End-Use Insights

Hospitals represent approximately 67% of total global bed head panel demand, driven by regulatory mandates, high patient bed density, and continuous expansion of acute and critical care capacity. Large public and private hospitals require standardized, compliant bedside utility systems across wards, ICUs, and specialty units, ensuring consistent baseline demand. Ongoing hospital renovation and modernization projects in developed markets further reinforce this segment’s dominance. Clinics and ambulatory surgical centers (ASCs) are expanding steadily as healthcare systems shift toward outpatient care and same-day surgical procedures. These facilities require compact, cost-efficient bed head panels that support essential utilities while maintaining rapid patient turnover and operational efficiency.

Long-term care facilities and nursing homes are the fastest-growing end-use segment, supported by aging populations, rising prevalence of chronic diseases, and increased demand for post-acute and rehabilitative care. These environments favor simplified, patient-friendly bed head panel designs that balance functionality, safety, and residential aesthetics. Growth in this segment is expected to accelerate further as healthcare systems prioritize decentralized and long-duration care models.

| By Product Type | By Material | By Functionality | By Installation Type | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global market share in 2024, led predominantly by the United States. Regional growth is driven by high healthcare expenditure, strict compliance requirements for medical gas and electrical safety, and continuous hospital infrastructure upgrades. The replacement of aging hospital facilities, expansion of ICU capacity, and growing adoption of smart hospital technologies are key demand drivers. Additionally, the strong presence of leading manufacturers and the high penetration of advanced, customized bed head panels support sustained market leadership.

Europe

Europe holds nearly 28% of the global market, with Germany, the U.K., and France leading adoption. Growth in the region is supported by publicly funded healthcare systems, consistent investments in hospital renovation, and stringent patient safety and infection-control regulations. Europe is also witnessing increased demand for energy-efficient and modular bed head panel systems as hospitals focus on sustainability, long-term operational efficiency, and compliance with evolving healthcare infrastructure standards.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, registering a CAGR exceeding 11% during the forecast period. China and India dominate demand due to large-scale hospital construction programs, rapid urbanization, and expanding access to healthcare services. Government-led healthcare infrastructure initiatives, rising private hospital investments, and increasing medical tourism are key growth drivers. The region is also witnessing strong demand for modular and cost-efficient bed head panel systems, particularly in secondary and tertiary care hospitals.

Latin America

Latin America accounts for approximately 7% of global demand, led by Brazil and Mexico. Market growth is driven by increasing private healthcare investments, expansion of urban hospitals, and the gradual modernization of healthcare infrastructure. While public healthcare budgets remain constrained in some countries, the growing role of private hospital networks and medical tourism is supporting demand for compliant and mid-range bed head panel solutions.

Middle East & Africa

The Middle East & Africa region represents around 6% of the global market, with strong demand concentrated in GCC countries such as Saudi Arabia, the UAE, and Qatar. Growth is driven by large-scale hospital mega-projects, government-led healthcare diversification strategies, and rising medical tourism. Investments in world-class healthcare facilities and smart hospitals are increasing the adoption of advanced and customized bed head panel systems. In Africa, gradual improvements in healthcare access and international funding for hospital development are supporting steady, long-term market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Bed Head Panels Market

- Hillrom

- Dräger

- Getinge

- Amico Group

- Arjo

- BeaconMedaes

- Modular Services Company

- Tedisel Medical

- Silbermann Technologies

- INMED S.A.

- Novair Medical

- AmcareMed

- Skytron

- Brandon Medical

- Trumpf Medical