Beauty Drinks Market Size

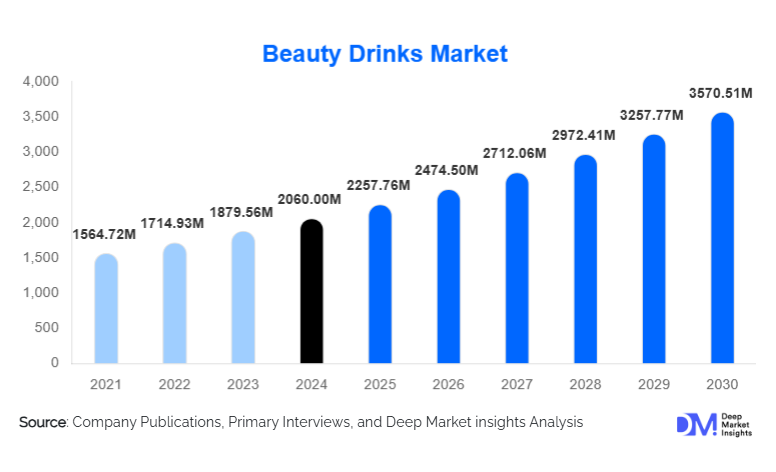

According to Deep Market Insights, the global beauty drinks market size was valued at USD 2,060.00 million in 2024 and is projected to grow from USD 2,257.76 million in 2025 to reach USD 3,570.51 million by 2030, expanding at a CAGR of 9.60% during the forecast period (2025–2030). The market is witnessing rapid adoption driven by rising consumer preference for “beauty-from-within” solutions, growing awareness of nutritional skincare, and accelerating demand for collagen-, vitamin-, and antioxidant-rich beverages. Increasing personalization, clean-label formulations, and e-commerce penetration are further strengthening global market growth.

Key Market Insights

- Collagen-based drinks dominate global sales, driven by strong demand for anti-aging, skin elasticity, and hydration benefits.

- Online and direct-to-consumer (D2C) channels lead distribution growth, supported by influencer-led marketing and digital consumer education.

- Asia-Pacific remains the largest and fastest-growing regional market, propelled by rising beauty consciousness and expanding middle-class incomes.

- Personalized beauty nutrition, and functional formulations integrating antioxidants, peptides, and botanical extracts are reshaping product innovation.

- Clinical validation, ingredient transparency, and clean-label formulations are increasingly influencing consumer purchase decisions.

- Premium beauty drinks are expanding rapidly, appealing to affluent consumers seeking holistic wellness and preventive skincare solutions.

What are the latest trends in the beauty drinks market?

Personalized Nutritional Beauty is gaining mainstream adoption

Beauty drinks are evolving beyond generic offerings toward personalized, data-driven formulations tailored to consumer age, skin type, lifestyle, and nutritional needs. Brands are integrating AI-driven assessments, DNA testing insights, and skin microbiome mapping to deliver targeted solutions, such as collagen blends for aging skin, hydration elixirs for dry skin, and antioxidant beverages for urban consumers exposed to pollution. Subscription-based personalized beauty drinks are rising sharply, increasing customer lifetime value and strengthening brand loyalty. This trend reflects consumer demand for scientifically backed, made-for-me products that offer measurable improvements in skin texture, radiance, and overall wellness.

Clean-label, botanical, and plant-based formulations on the rise

Consumers are increasingly demanding natural, organic, and plant-based beauty beverages, shifting away from artificial additives or synthetic ingredients. Botanical extracts, adaptogens, superfruits, and phytonutrients, such as acerola cherry, turmeric, hibiscus, and ashwagandha, are now prominent in beauty drink formulations. Clean-label products emphasizing transparency, sustainability, and minimal processing are gaining momentum, especially among millennial and Gen Z consumers. Companies are investing in cold-pressed extraction, non-GMO sourcing, and eco-friendly packaging to enhance appeal and improve environmental credibility.

What are the key drivers in the beauty drinks market?

Growing Beauty-From-Within Movement

Consumers increasingly recognize the connection between nutrition and skin health, driving strong adoption of ingestible beauty products. Beauty drinks delivering collagen peptides, vitamins, hyaluronic acid, and antioxidants support visible improvements in elasticity, hydration, and radiance, benefits highly valued across all age groups. The shift from topical-only skincare to holistic internal wellness solutions is expanding market size and accelerating repeat purchases, especially among women aged 25–50.

Acceleration of E-commerce and Digital Beauty Ecosystems

Beauty drinks are ideally positioned for online sales, with influencers, dermatologists, and wellness creators driving demand through social media platforms. E-commerce enables extensive product education, before-and-after testimonials, and subscription-based replenishment models, all essential for repeat revenue. Digital-native brands are rapidly gaining share by offering convenience, personalization, and interactive customer experiences.

What are the restraints for the global market?

Regulatory and Health-Claim Limitations

Beauty drinks often make claims related to anti-aging, elasticity, hydration, and detoxification. However, regulatory authorities in the U.S., EU, and Asia impose stringent restrictions on allowable claims without clinical evidence. This challenge limits aggressive marketing, increases compliance costs, and creates barriers for smaller brands seeking global expansion.

High Ingredient Costs and Pricing Challenges

Premium active ingredients, such as marine collagen, botanical antioxidants, and hyaluronic acid, carry high sourcing and production costs. As a result, retail prices for beauty drinks often skew toward premium categories. In price-sensitive regions, this restricts adoption and slows mass-market penetration. Manufacturers must balance affordability with quality to maintain competitiveness.

What are the key opportunities in the beauty drinks industry?

Wellness-Beauty Hybrids and Holistic Preventive Health

The convergence of wellness and beauty presents a major opportunity. Consumers increasingly seek products that support skin health + overall wellness, including immunity, gut health, stress reduction, and joint support. Hybrid drinks that combine collagen with probiotics, adaptogens, hydration boosters, and vitamins can appeal to broader demographics. Positioning beauty drinks as part of preventive healthcare opens new distribution pathways in pharmacies, wellness centers, and fitness retail.

Expansion Across Emerging Markets

Countries across Asia-Pacific, Latin America, and the Middle East present untapped demand fueled by rising incomes and beauty-conscious young populations. Localized flavors, culturally relevant ingredients, and region-specific marketing can help global brands gain an early-market advantage. Cross-border e-commerce and influencer-driven demand enable rapid expansion without heavy retail infrastructure investment.

Product Type Insights

Collagen drinks dominate the product landscape, accounting for an estimated 30–35% of global revenue in 2024. Their popularity stems from strong associations with anti-aging, wrinkle reduction, and improved skin elasticity. Marine collagen, in particular, is preferred for its high bioavailability. Vitamin-infused beauty drinks represent the second-largest category, targeting hydration, radiance, and antioxidant protection. Botanical and superfruit beverages are rising rapidly due to clean-label and plant-based preferences among younger consumers. Hyaluronic acid and peptide-enriched formulations, though niche, are the fastest-growing due to increasing clinical validation and demand for high-efficacy beauty solutions.

Application Insights

Anti-aging remains the top application, representing nearly 40% of the total market. This segment is driven by mature consumers seeking long-term skin health solutions and younger consumers adopting preventive routines. Hydration and radiance-enhancing drinks are surging in popularity, supported by urban environments, pollution exposure, and increased demand for healthy, glowing skin. Detoxification and antioxidant blends appeal to fitness-focused and wellness consumers seeking metabolic balance and immunity support. Multi-functional formulations that improve skin, hair, and nail health simultaneously are attracting repeat buyers and supporting premium price points.

Distribution Channel Insights

Online channels lead global sales, accounting for approximately 25–30% of revenue in 2024. E-commerce platforms and D2C websites enable companies to deliver educational content, influencer integration, subscription plans, and personalized recommendations. Pharmacies and health stores remain critical for credibility and clinical positioning, while supermarkets and mass retail drive volume in mainstream markets. Beauty salons, dermatology clinics, and wellness centers are emerging as high-margin channels for premium ingestible beauty brands that benefit from professional endorsements.

Consumer Type Insights

Women aged 25–45 remain the core consumer base, driven by strong interest in anti-aging, hydration, and skin-brightening benefits. Men’s adoption of ingestible beauty is rising quickly, especially in categories such as hair health, skin clarity, and vitality-support formulations. Fitness-oriented consumers and wellness enthusiasts increasingly integrate beauty beverages into daily routines for holistic internal skincare.

Age Group Insights

Consumers aged 31–50 represent the largest share of beauty drink purchases due to higher disposable incomes and heightened focus on anti-aging. The 18–30 segment is growing fastest, driven by interest in preventive skincare, K-beauty trends, and influencer-led consumption. Older adults (50+) increasingly use collagen drinks for joint support in addition to skin health, expanding cross-functional usage.

| By Product Type | By Application (Functional Benefits) | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for an estimated 20–25% of global beauty drink demand in 2024. The U.S. leads with strong adoption of collagen and vitamin hydration beverages, supported by high e-commerce penetration and fitness-wellness culture. Growing interest in clinical-grade formulations and personalized nutrition is accelerating premium product sales.

Europe

Europe represents approximately 20–25% of the market, with strong demand from Germany, the U.K., France, and Italy. Consumers prioritize clean-label, science-backed, and sustainably packaged beauty drinks. Anti-aging and hydration formulations dominate, while botanical beverages are rapidly gaining share.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, contributing 30–35% of global market revenue. Japan and South Korea are highly mature markets where nutricosmetics are deeply integrated into daily routines. China, India, and Southeast Asia are experiencing explosive adoption due to rising middle-class affluence and strong influencer ecosystems.

Latin America

LATAM is an emerging market, with Brazil, Mexico, and Chile showing growing interest in collagen drinks and antioxidant-rich botanicals. Urban consumers seek affordable beauty-from-within products that complement skincare routines.

Middle East & Africa

MEA demand is rising steadily, led by the UAE, Saudi Arabia, and South Africa. Premium beauty drinks appeal strongly to affluent consumers, while regional wellness trends support broader adoption of hydration and detox beverages.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Beauty Drinks Market

- Shiseido Co., Ltd.

- Amorepacific Corporation

- Vital Proteins LLC

- The Bountiful Company (NeoCell)

- Suntory Holdings Limited

- Nestlé Health Science

- Kinohimitsu

- DyDo DRINCO, Inc.

- Sappe Public Company Limited

- Lacka Foods Ltd.

- Big Quark LLC

- Rejuvenated Ltd.

- Skinade

- Minerva Research Labs (Gold Collagen)

- MGC Derma

Recent Developments

- In March 2025, Shiseido expanded its collagen drink portfolio into Europe with new clinically validated formulations targeting elasticity and wrinkle reduction.

- In January 2025, Vital Proteins launched a ready-to-drink collagen beauty water featuring electrolytes and hyaluronic acid for dual hydration benefits.

- In April 2025, Kinohimitsu introduced a new botanical beauty beverage line leveraging hibiscus and acerola cherry extracts for antioxidant protection.