Battle Ropes Market Size

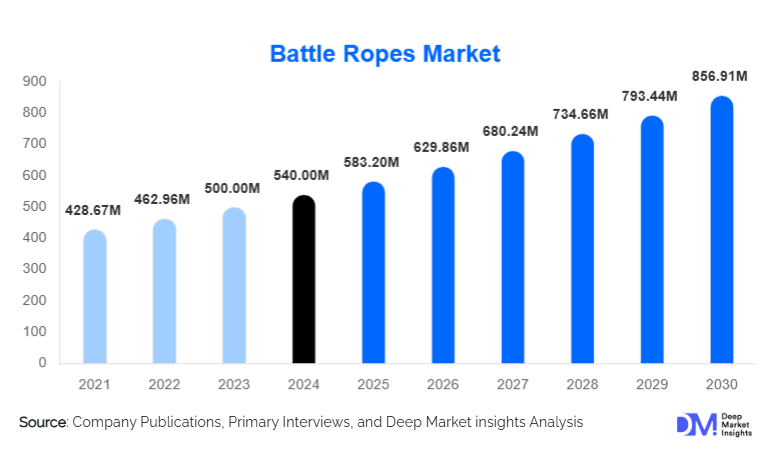

According to Deep Market Insights, the global battle ropes market size was valued at USD 540.00 million in 2024 and is projected to grow from USD 583.20 million in 2025 to reach USD 856.91 million by 2030, expanding at a CAGR of 8.0% during the forecast period (2025–2030). Market growth is primarily driven by the rapid expansion of functional training, the rising adoption of home fitness equipment, and the increasing integration of battle ropes into strength, HIIT, and athletic conditioning programs across gyms, sports academies, and military training facilities worldwide.

Key Market Insights

- Functional training and HIIT integration are the strongest demand drivers, as battle ropes have become essential equipment in modern gym layouts and performance centers.

- Online distribution dominates global sales, with e-commerce channels accounting for more than half of all purchases due to accessibility, competitive pricing, and growing D2C fitness brands.

- North America leads global demand due to high gym memberships, a mature fitness culture, and the rapid adoption of home workout tools.

- Asia-Pacific remains the fastest-growing regional market, supported by rising disposable incomes, youth-oriented fitness trends, and the expansion of commercial gyms.

- Poly Dacron ropes dominate material usage because of their high durability, fray resistance, and suitability for both commercial and home environments.

- Smart battle ropes and tech-integrated training tools are emerging as new avenues for differentiation for manufacturers targeting advanced athletes and digital fitness users.

What are the latest trends in the battle ropes market?

Technologically Enhanced Training Tools

Manufacturers are increasingly developing smart battle ropes equipped with sensors that track speed, power output, movement patterns, and calorie expenditure. These ropes sync with mobile apps and digital coaching platforms, providing analytics-driven feedback for users. This trend is particularly attractive to performance athletes and home users seeking measurable improvements in strength and endurance workouts. Integration with wearable technology ecosystems and AI-driven training recommendations is reshaping how consumers interact with simple functional equipment, making battle ropes more competitive in a digitally oriented fitness environment.

Shift Toward Functional and Hybrid Training Programs

Gyms and sports academies are transitioning toward functional training zones, replacing traditional machine-heavy setups. Battle ropes are foundational tools in these spaces due to their ability to deliver full-body engagement and metabolic conditioning. Hybrid programs such as rope-based HIIT circuits, CrossFit WODs, and rehabilitation sessions have expanded usage beyond conventional strength training. Corporate wellness programs and group fitness studios are increasingly incorporating battle rope workouts as part of holistic fitness offerings, further driving market penetration.

What are the key drivers in the battle ropes market?

Growing Adoption of Home Fitness

Home fitness continues to expand globally as consumers prioritize convenience and cost-effective training tools. Battle ropes have gained popularity in this segment due to their affordability, ease of setup, and versatility across cardio, strength, and endurance routines. E-commerce platforms make comparisons straightforward, driving strong demand for mid-range ropes priced between USD 80–150.

Expansion of Functional Training in Gyms

Commercial gyms are increasingly emphasizing functional strength areas, integrating equipment that supports HIIT and multidisciplinary workouts. Battle ropes have become standard equipment in these spaces because they offer scalable resistance training and support group fitness sessions. Gym expansions in Asia-Pacific, the Middle East, and Latin America are significantly boosting B2B rope purchases.

What are the restraints for the global market?

Competition from Substitute Training Tools

Battle ropes face competition from more compact or multipurpose fitness tools such as resistance bands, adjustable dumbbells, suspension trainers, and weighted sleds. For gyms with limited budgets or constrained floor space, these substitutes often become higher-priority investments, posing a threat to battle rope adoption.

Durability and Quality Concerns

Lower-quality ropes tend to fray or degrade, especially under outdoor use or high-friction conditions. This has led to consumer skepticism in some markets. Frequent replacement cycles increase operational costs for gyms, reinforcing the need for higher-quality materials and better product engineering from manufacturers.

What are the key opportunities in the battle ropes industry?

Growth in Military and Tactical Conditioning Programs

Defense forces in the U.S., China, India, and Gulf nations are increasingly emphasizing functional fitness and agility training. Battle ropes, due to their durability and power-conditioning capabilities, are widely adopted in military obstacle courses and tactical fitness routines. Manufacturers providing reinforced heavy-duty ropes are well-positioned to capitalize on procurement contracts and long-term supply agreements.

Expansion in Emerging Markets and Gym Infrastructure Development

Rapid gym chain expansion in India, Indonesia, Brazil, and the Middle East presents a major opportunity for suppliers. As these markets adopt global training trends, battle ropes become essential equipment in modern gym layouts. Local manufacturing and distribution partnerships can help brands capture price-sensitive emerging markets and expand global footprints.

Product Type Insights

Heavy battle ropes (≥40 mm) dominate the global market, capturing approximately 36% of the 2024 revenue share. Their widespread usage in commercial gyms, CrossFit boxes, and tactical fitness programs drives this dominance. Medium ropes serve mainstream fitness users, while lightweight variations appeal to beginners and home users. Smart sensor-enabled ropes represent a nascent but rapidly growing segment, offering differentiated value through tracking metrics and app-based training.

Application Insights

CrossFit and functional training represent the largest application segment, contributing around 33% of total demand. Incorporation of battle ropes in high-intensity WODs, metabolic conditioning, and strength circuits continues to drive growth. Strength training and cardio conditioning form strong secondary segments, while rehabilitation centers are increasingly adopting battle ropes for controlled movement and grip-strength recovery. Military and defense applications are expanding due to rising investments in tactical fitness infrastructure.

Distribution Channel Insights

Online sales dominate with nearly 55% market share in 2024. E-commerce channels allow consumers to compare specifications, read reviews, and access mid-priced and premium ropes with ease. Direct-to-consumer brand websites benefit from influencer partnerships and performance-driven content marketing. Offline channels, including sporting goods retailers and B2B gym equipment suppliers, remain important for premium commercial-grade ropes and institutional procurement.

End-User Insights

Commercial gyms hold the largest share at 41%, driven by recurring equipment upgrades and functional area expansions. Home users are the fastest-growing segment, expanding at more than 9% CAGR, supported by urban fitness trends and online retail growth. CrossFit boxes, military centers, and sports academies combined contribute over 22% of demand, with a rising global focus on athletic conditioning.

| By Product Type | By Material Composition | By Sales Channel | By Application | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of the global market, driven by a well-developed fitness infrastructure, strong gym membership rates, and early adoption of functional training. The U.S. leads with high penetration of home fitness equipment and premium rope purchases, while Canada shows rising demand from sports academies and boutique studios.

Europe

Europe represents around 26% of global demand, with Germany, the U.K., and France being the strongest contributors. The rising popularity of CrossFit, wellness studios, and corporate fitness programs supports market growth. Scandinavian countries demonstrate high spending on premium-quality ropes due to consumer preference for durable, long-lasting fitness tools.

Asia-Pacific

APAC is the fastest-growing region with a CAGR exceeding 9.5%. China and India lead demand due to rapid gym chain expansion, youth-oriented fitness trends, and government wellness initiatives. Australia remains a mature market with strong adoption of home fitness and performance-focused training tools.

Latin America

Latin America is experiencing steady growth driven by Brazil and Mexico. CrossFit communities and sports performance institutions are major end users, while economic improvement in key markets is boosting mid-range rope purchases.

Middle East & Africa

The region is seeing rising investments in luxury gyms, hotel fitness centers, and military conditioning facilities. The UAE and Saudi Arabia dominate demand, while South Africa and Nigeria represent key emerging markets with growing urban fitness cultures.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Battle Ropes Market

- Onnit

- TRX Training

- Rogue Fitness

- Hyperwear

- Power Guidance

- Titan Fitness

- Rep Fitness

- Fringe Sport

- Valor Fitness

- Body-Solid

- ProGear

- Nordic Lifting

- Gymgear

- Again Faster

- Lifeline Fitness