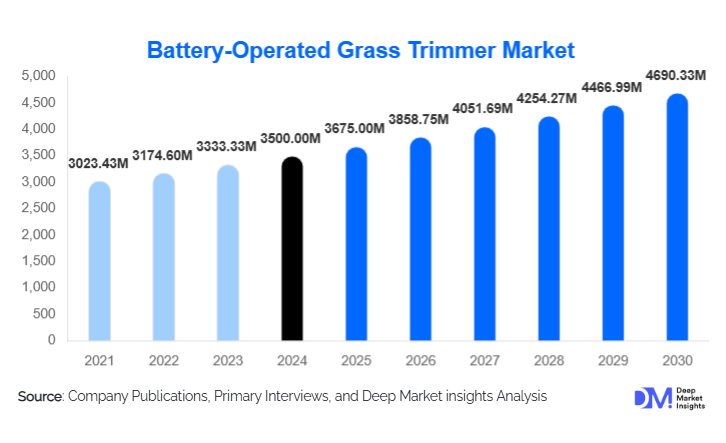

Battery-Operated Grass Trimmer Market Size

According to Deep Market Insights, the global battery-operated grass trimmer market size was valued at USD 3,500.00 million in 2024 and is projected to grow from USD 3,675.00 million in 2025 to reach USD 4,690.33 million by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). Market growth is primarily driven by the rapid shift away from gasoline-powered outdoor equipment, tightening emissions and noise regulations, and continuous advancements in lithium-ion battery and brushless motor technologies. Battery-operated grass trimmers are increasingly preferred across residential, commercial, and municipal applications due to their low maintenance, zero direct emissions, and improved performance parity with fuel-powered alternatives.

Key Market Insights

- Lithium-ion battery trimmers dominate the market, accounting for nearly four-fifths of global revenue due to superior energy density, lighter weight, and longer lifecycle.

- Residential users remain the largest demand segment, supported by rising home ownership, DIY gardening trends, and urban lawn maintenance needs.

- Commercial landscaping adoption is accelerating, driven by electrification mandates, lower operating costs, and suitability for noise-restricted zones.

- North America leads global demand, supported by high lawn ownership rates and stringent emissions regulations.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, infrastructure development, and rising disposable incomes.

- Battery ecosystem compatibility and fast-charging technology are becoming critical differentiators among leading manufacturers.

What are the latest trends in the battery-operated grass trimmer market?

Shift Toward High-Voltage and Multi-Tool Battery Platforms

Manufacturers are increasingly launching grass trimmers within shared battery ecosystems, allowing users to interchange batteries across multiple outdoor power tools such as blowers, hedge trimmers, and lawn mowers. Voltage ranges between 20V and 40V are gaining popularity as they provide an optimal balance of runtime, power, and portability. This trend is particularly strong among residential users and professional landscapers seeking operational efficiency and lower total cost of ownership. Higher-voltage platforms above 40V are also emerging for heavy-duty commercial applications, signaling continued performance improvements in battery-powered equipment.

Rising Adoption of Smart and Ergonomic Designs

Smart features such as battery health indicators, overload protection, and automatic power adjustment are increasingly integrated into modern battery-operated grass trimmers. Ergonomic improvements, including adjustable shafts, lightweight composite materials, and vibration-reduction systems, are enhancing user comfort and reducing fatigue. These innovations are expanding adoption among older consumers and professional users who operate equipment for extended durations. Additionally, sustainability-focused designs using recyclable plastics and modular battery packs are gaining traction as environmental awareness rises.

What are the key drivers in the battery-operated grass trimmer market?

Regulatory Push Against Gasoline-Powered Equipment

Stricter environmental and noise regulations across North America and Europe are significantly accelerating the transition toward battery-operated grass trimmers. Several cities and municipalities have introduced restrictions or outright bans on small gasoline engines, particularly for public infrastructure and landscaping services. Battery-powered alternatives align well with these regulations, offering zero tailpipe emissions and substantially lower noise levels, thereby supporting long-term market growth.

Advancements in Battery and Motor Technology

Continuous innovation in lithium-ion battery chemistry and brushless motor systems has narrowed the performance gap between battery-operated and gasoline-powered trimmers. Modern trimmers offer longer runtimes, faster charging cycles, and improved torque output, making them suitable for thicker grass and extended use. Declining battery costs are also improving affordability, encouraging wider adoption across both residential and commercial segments.

What are the restraints for the global market?

Higher Upfront Costs Compared to Gasoline Models

Despite lower long-term operating costs, battery-operated grass trimmers typically carry higher initial purchase prices, especially for premium and commercial-grade models. This price differential remains a barrier in cost-sensitive markets, particularly in developing regions where gasoline equipment is still perceived as more economical.

Battery Lifecycle and Recycling Challenges

Battery degradation over time and the cost of replacement pose challenges for users, particularly professionals with high utilization rates. Additionally, growing regulatory scrutiny around lithium-ion battery disposal and recycling may increase compliance costs for manufacturers, potentially affecting pricing and margins.

What are the key opportunities in the battery-operated grass trimmer industry?

Municipal and Public Infrastructure Electrification

Governments worldwide are increasing investments in sustainable urban infrastructure, creating strong opportunities for battery-operated grass trimmers in public parks, road medians, and municipal green spaces. Electrification mandates and green procurement policies are driving steady replacement demand, particularly in Europe and developed Asian economies.

Emerging Market Expansion and Local Manufacturing

Rapid urbanization in Asia-Pacific, Latin America, and the Middle East presents significant growth potential. Local manufacturing initiatives such as “Make in India” and “Made in China 2025” are improving cost competitiveness and accelerating market penetration. New entrants can leverage regional production and localized product designs to capture untapped demand.

Product Type Insights

Lithium-ion battery-operated grass trimmers dominate the market, accounting for approximately 78% of total revenue in 2024. Their lightweight design, superior energy efficiency, and declining battery costs make them the preferred choice across all end-use segments. NiMH trimmers occupy a smaller niche, primarily in entry-level applications, while lead-acid models continue to decline due to weight and performance limitations. Premium trimmers above 40V are gaining traction in professional landscaping, while mid-range models remain the most popular choice for residential users.

End-Use Insights

Residential applications account for roughly 52% of global demand, driven by DIY lawn care trends, suburban housing growth, and increased online availability. Commercial landscaping services represent the fastest-growing end-use segment, expanding at double-digit growth rates due to electrification mandates and lower operating costs. Municipal and public infrastructure maintenance is emerging as a stable demand source, supported by government spending on green urban spaces.

Distribution Channel Insights

Offline retail channels, including home improvement stores and specialty garden equipment outlets, account for approximately 55% of sales, benefiting from in-store demonstrations and professional guidance. Online direct-to-consumer channels are the fastest-growing, capturing around 27% of the market, driven by competitive pricing, product reviews, and doorstep delivery. Professional equipment dealers continue to serve commercial buyers seeking high-performance and after-sales support.

| By Battery Technology | By Voltage Capacity | By Cutting Width | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 34% of global market revenue, led by the United States, which alone represents about 26% of worldwide demand. High lawn ownership, strong DIY culture, and strict emissions regulations are key growth drivers. Canada also shows steady adoption, particularly in suburban residential markets.

Europe

Europe holds nearly 29% of the global market, with Germany, the U.K., and France leading demand. Regulatory pressure to reduce emissions from small engines is accelerating the shift toward battery-operated equipment. The region is also characterized by high adoption of premium and eco-certified products.

Asia-Pacific

Asia-Pacific represents around 24% of global demand and is the fastest-growing region, expanding at over 11% CAGR. China, Japan, Australia, and South Korea are key markets, supported by urban landscaping projects, rising disposable incomes, and government green initiatives.

Latin America

Latin America accounts for roughly 8% of the market, led by Brazil and Mexico. Growth is driven by expanding residential construction and increasing adoption of professional landscaping services in urban centers.

Middle East & Africa

The Middle East & Africa region holds about 5% of global demand. Gulf countries such as the UAE and Saudi Arabia are driving growth through large-scale urban landscaping and smart city projects, while South Africa remains the leading market within Africa.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Manufacturers in the Battery-Operated Grass Trimmer Market

- Husqvarna Group

- Stanley Black & Decker

- Makita Corporation

- STIHL Holding

- Robert Bosch GmbH

- Techtronic Industries

- HiKOKI

- Greenworks Tools

- Einhell Germany AG

- Ryobi

- Toro Company

- Yamabiko Corporation

- EGO Power+

- Snapper (Briggs & Stratton)

- Worx (Positec)