Bathroom Scales Market Size

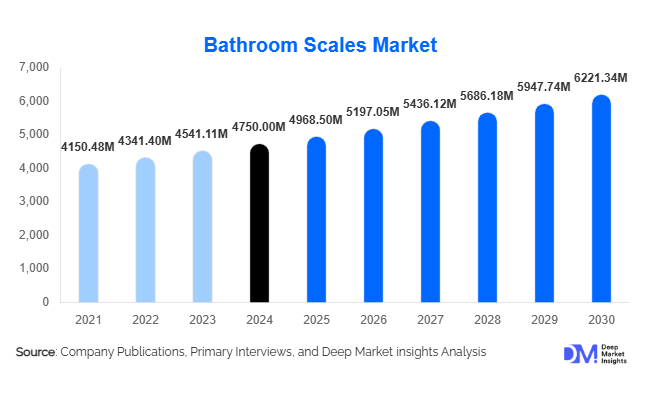

According to Deep Market Insights, the global bathroom scales market size was valued at USD 4,750.00 million in 2024 and is projected to grow from USD 4,968.50 million in 2025 to reach USD 6,221.34 million by 2030, expanding at a CAGR of 4.6% during the forecast period (2025–2030). This growth trajectory is driven by rising health awareness, increasing adoption of digital and smart health devices, and expanding global demand for home-health monitoring tools.

Key Market Insights

- Digital and smart scales have become the dominant product type, reflecting consumer demand for accuracy, convenience, and added body-composition metrics beyond mere body weight.

- Household usage remains the primary driver of market volume, as consumers increasingly integrate regular weight and health monitoring into daily routines at home.

- Online retail is rapidly overtaking offline distribution, propelled by the growth of e-commerce, ease of delivery, and wider geographic reachespecially in emerging markets.

- Asia-Pacific is emerging as the fastest-growing region, driven by rising urbanization, growing middle-class incomes, increasing health consciousness, and large population size.

- Commercial adoption is expanding beyond households, with gyms, wellness centers, healthcare facilities, and telehealth services increasingly deploying body-composition scales as part of wellness and preventive-health offerings.

- Smart health-ecosystem integration is reshaping the value proposition, with scales offering mobile-app connectivity, multi-user profiles, health tracking over time, and data synchronization with broader wellness platforms.

What are the latest trends in the bathroom scales market?

Smart health-ecosystem integration is gaining traction

Manufacturers are increasingly offering smart scales that go beyond simple weight measurement: modern devices provide body-composition metrics (body fat, water percentage, muscle mass, bone mass, BMI), multi-user support, data tracking over time, and seamless integration with mobile apps, wearables, and digital wellness platforms. This trend appeals strongly to health-conscious and fitness-oriented consumers who view scales as part of a broader home-health toolkit rather than a one-off purchase. As home fitness and remote health monitoring become more common, smart scales are increasingly seen as essential home devices, not just convenience gadgets.

E-commerce and online retail expansion

The global penetration of e-commerce and digitally enabled retail channels has transformed distribution dynamics for bathroom scales. Consumers, especially in urban and semi-urban areas, prefer the convenience of direct-to-consumer online shopping, a variety of choices (from budget to premium smart scales), and home delivery. This has significantly expanded reach into previously under-penetrated regions, including emerging markets, and catalyzed a shift away from traditional offline retail. Lower logistical and distribution barriers, combined with competitive online pricing, continue to drive strong growth in online sales.

What are the key drivers in the bathroom scales market?

Rising global health awareness and lifestyle diseases

The increasing prevalence of obesity, diabetes, cardiovascular conditions, and other lifestyle-related health issues worldwide has prompted consumers to take preventive health measures, including regular weight and body composition monitoring. As individuals become more conscious of maintaining a healthy weight and tracking fitness metrics, demand for bathroom scales, especially digital and smart variants, has surged. This trend is particularly pronounced in urban populations with sedentary lifestyles and increasing health risks.

Technological advancements in digital and smart scales

Advances in sensor accuracy, electronics miniaturization, connectivity (Bluetooth/Wi-Fi), and software have transformed bathroom scales into advanced health-monitoring tools. Smart scales offer more than just weight; they deliver body-composition analysis, long-term data tracking, trend visualization, and multi-user management. Such features significantly enhance perceived value over traditional analog or basic digital scales, motivating consumers to upgrade and driving overall market growth.

Expansion of e-commerce and online distribution channels

The widespread growth of online retail globally, including in emerging economies, has made bathroom scales more accessible and convenient to purchase. Lower barriers to entry, broader geographic reach, competitive pricing, and home-delivery logistics make online retail a preferred distribution channel. This has facilitated market penetration in regions where traditional retail infrastructure is limited or underdeveloped.

What are the restraints for the global market?

Price sensitivity in emerging and price-conscious markets

Premium digital or smart bathroom scales with advanced features come at higher price points, which may deter budget-conscious consumers, especially in emerging economies or price-sensitive segments. This price barrier can limit the penetration of premium products and restrain overall market growth unless manufacturers offer affordable alternatives or entry-level digital models.

Limited replacement cycles and product durability

Bathroom scales are durable consumer products with relatively long lifespans. Once purchased, many households may not replace them for years, reducing the frequency of repeat purchases. Unless there is a significant upgrade in features (e.g., smart functionality, body-composition metrics), the replacement cycle may remain long, potentially limiting sustained growth.

What are the key opportunities in the bathroom scales industry?

Integration into smart-wellness ecosystems

As consumers embrace holistic health tracking, there is an opportunity to position bathroom scales as central nodes in home wellness ecosystems. Manufacturers can integrate scales with mobile apps, wearables, telehealth platforms, and health-management systems, offering subscription-based health tracking, analytics, and personalized insight. This not only adds value for consumers but also opens recurring revenue streams via software, data analytics, and app-based services.

Growth potential in emerging markets (APAC, LATAM, MEA)

Emerging economies, particularly in the Asia-Pacific, Latin America, and parts of the Middle East & Africa, offer significant latent demand. Rising urbanization, increasing disposable incomes, expanding e-commerce infrastructure, and growing health awareness create fertile ground for market expansion. Entry-level digital scales and value-for-money smart models can capture price-sensitive segments, driving volume growth at scale.

Expansion of commercial and institutional demand (healthcare, fitness, tele-health)

Beyond household consumption, there is a growing demand from gyms, wellness centers, hospitals, clinics, corporate wellness programs, and telehealth providers. As preventive healthcare and remote monitoring become mainstream, bathroom scalesespecially smart, network-enabled onescan become standard tools in institutional health and wellness settings. Catering to B2B clients represents a stable growth avenue and helps diversify revenue beyond consumer retail channels.

Product Type Insights

Traditional analog/mechanical scales are gradually losing ground as consumers shift toward digital alternatives offering greater accuracy and ease of reading. Within digital, there is a clear trend toward smart scales equipped with connectivity, body-composition analysis, multi-user profiles, and app integration. Although analog scales may continue to hold a small niche among budget-conscious or simplicity-seeking consumers, digital and smart scales dominate both volume and value. Mid-tier digital scales appeal to value-seeking buyers, while premium smart models target health-conscious and tech-savvy users looking for comprehensive wellness tracking.

Application Insights

Household use remains the core application, as individuals increasingly place value on regular self-monitoring of weight and body composition. Fitness centers and gyms are emerging as another important application area, where scales are used for client body composition tracking and progress monitoring. In the healthcare sector, including hospitals, clinics, rehabilitation centers, and tele-health providers, demand for accurate, connected bathroom scales is rising for patient monitoring, preventive health check-ups, and chronic disease management. Additionally, hospitality, wellness resorts, and spas are beginning to incorporate body-composition scales to enhance guest wellness offerings and support lifestyle-oriented services.

Distribution Channel Insights

Offline retail, such as specialty appliance stores, supermarkets, and consumer-electronics shops, continues to serve a portion of the market (particularly in less digitally penetrated regions). However, online retail has become the dominant distribution channel, offering convenience, broad reach, and competitive pricing. B2B direct sales to gyms, healthcare providers, wellness centers, and corporate wellness programs are also growing, enabling manufacturers to tap institutional demand beyond consumer retail. This multi-channel distribution strategy helps address varied consumer segments from budget-conscious buyers to commercial clients and supports market expansion globally.

User Type Insights

The largest and fastest-growing user segment comprises health-conscious individuals, urban dwellers, and working adults who monitor weight and body composition for fitness or preventive health reasons. Fitness-oriented users, including gym-goers and wellness enthusiasts, increasingly prefer smart scales for detailed body metrics. Older adults and elderly users form a growing demographic as well, particularly for health monitoring: as populations age globally, more individuals seek accurate weight and composition tracking for wellness monitoring and chronic-disease management. Additionally, individuals managing weight, obesity, or health conditions represent a significant segment. Demand from such users is rising as awareness of lifestyle diseases increases.

Age Group Insights

Adults aged 25–50 years account for the largest share of market use, combining disposable income, health awareness, and interest in fitness and home-health monitoring. Younger adults (18–24 years) also contribute significantly, especially among fitness enthusiasts and tech-savvy users looking for smart, connected devices. Older adults (50+ years) represent a steadily growing segment, increasingly adopting bathroom scales for health monitoring, weight management, and chronic-disease oversight. As populations in many regions age and prioritize health, this older age group may emerge as a high-value user base.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains a mature and significant market, supported by high disposable income, widespread adoption of digital health products, and strong health- and fitness-conscious consumer behavior. In 2024, it likely contributed around 25–30% of global market value. Adoption is high among households, gyms, and healthcare providers. However, growth is expected to be moderate through 2030 because of market maturity and long replacement cycles.

Europe

Europe contributes roughly 20–25% of the global market value in 2024. Countries like Germany, the UK, and France lead demand thanks to high living standards, strong health awareness, aging populations, and emphasis on preventive healthcare. While analog scales still retain a small niche among value-conscious buyers, digital and smart scales dominate. The growth trajectory in Europe is stable but modest, given saturation and comparatively slower adoption rates in some regions.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for approximately 30–35% of global market value in 2024. Rapid urbanization, rising disposable incomes, large population bases, and increasing health consciousness, especially in countries like China, India, Japan, and Southeast Asia, are driving demand. The region is characterized by high growth potential, especially for affordable digital scales and mid-range smart models tailor-made for emerging middle-class buyers. Over the forecast period, APAC is expected to outpace other regions in growth rate and incremental market value.

Latin America

Latin America holds a smaller but growing share of the market, roughly 5–8% in 2024. As urbanization increases and retail/e-commerce infrastructure improves, demand for bathroom scales is gradually rising. Countries such as Brazil, Mexico, and Argentina are witnessing increasing adoption, especially of affordable digital scales. The region represents a growing opportunity for value-oriented manufacturers and exporters targeting emerging markets.

Middle East & Africa

The Middle East & Africa account for about 5–7% of the global market value in 2024. Although the overall share is modest, improving urbanization, rising incomes in certain Gulf and urban centers, growing health awareness, and increased retail penetration are fueling gradual demand growth. As infrastructure and e-commerce develop further, MEA markets may become more relevant, particularly in urbanized areas with rising interest in preventive healthcare and wellness devices.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bathroom Scales Market

- Tanita Corporation

- Omron Healthcare

- Beurer GmbH

- Soehnle (Leifheit Group)

- Etekcity Corporation

- Camry Electronic (Zhongshan Camry)

- Salter UK

- Withings SA

- Xiaomi Corporation

- Huawei Technologies

- Panasonic Corporation

- Philips (Philips Consumer Lifestyle / Health division)

- iHealth Labs

- Garmin Ltd.

- HBF (Health & Fitness Brands) / local Asian scale manufacturers

Recent Developments

- In early 2025, Withings unveiled a next-generation smart scale with expanded body-composition analytics and seamless integration with leading fitness and health apps, aiming to strengthen its positioning in the premium home-health segment.

- In mid-2025, Etekcity announced the expansion of its manufacturing capacity in Southeast Asia to support growing export volumes, especially to Latin America and Middle-East retail markets, targeting value-conscious buyers with affordable digital scales.

- In late 2024, Tanita launched a new line of body-composition scales tailored for clinical and telehealth use, featuring higher accuracy sensors and multi-user patient-profiling to cater to hospitals, clinics, and corporate wellness providers.

- In 2025, Omron Healthcare partnered with a telemedicine platform in North America to integrate its smart scales into remote patient-monitoring programs, enabling physicians to track patients’ weight and body composition metrics in real-time.

- In mid-2025, Xiaomi expanded its smart-scale offerings in India and Southeast Asia through online flash sales, targeting budget-conscious millennials and first-time buyers to capture emerging-market demand.