Bath and Toilet Tissue Market Size

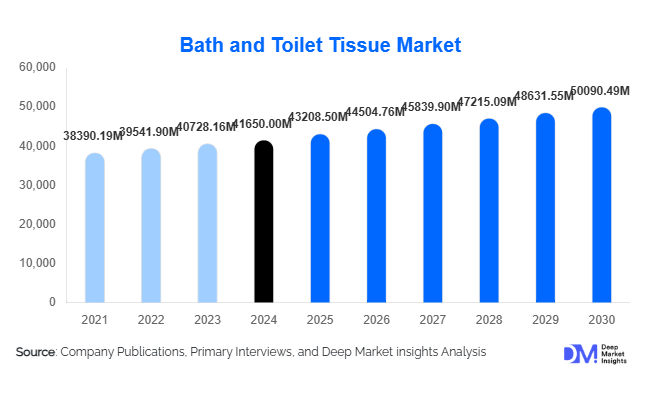

According to Deep Market Insights, the global bath and toilet tissue market size was valued at USD 41,950.00 million in 2024 and is projected to grow from USD 43,208.50 million in 2025 to reach USD 50,090.49 million by 2030, expanding at a CAGR of 3.0% during the forecast period (2025–2030). The market growth is primarily driven by increasing awareness of personal hygiene, rising urban population, expanding sanitation infrastructure in emerging economies, and growing consumer preference for premium and sustainable tissue products.

Key Market Insights

- Premium and eco-friendly tissue products are gaining traction globally, driven by consumers seeking higher quality, multi-ply, and sustainable options.

- Residential demand dominates the market, while commercial, healthcare, and hospitality segments are witnessing accelerated growth due to institutional hygiene standards.

- Asia-Pacific is the fastest-growing region, with India and China driving volume growth from expanding sanitation coverage and rising per-capita tissue consumption.

- Technological innovations, including AI-enabled production, water-efficient machinery, and digital distribution platforms, are reshaping manufacturing efficiency and market access.

- Supermarkets and hypermarkets remain the primary distribution channel, while online retail and B2B institutional contracts are rapidly growing.

- Sustainability and regulatory compliance are key differentiators for global players, influencing brand perception and market share.

What are the latest trends in the bath and toilet tissue market?

Premiumization and Sustainability

Manufacturers are increasingly focusing on premium and eco-friendly products such as bamboo-based tissue, recycled pulp tissue, and multi-ply variants. Consumers in North America, Europe, and Asia-Pacific are willing to pay higher prices for products that offer superior softness, absorbency, and sustainable sourcing. Private labels are also enhancing quality to capture mid-range demand. The trend of sustainability extends to biodegradable packaging and FSC-certified sourcing, positioning brands to meet ESG expectations while differentiating from competitors.

Technological Integration in Production and Distribution

Emerging technologies are being adopted to enhance tissue production efficiency and reduce environmental impact. AI-powered quality control, automation in tissue machines, and water and energy-efficient pulping processes improve yield and consistency. On the distribution side, e-commerce, D2C platforms, and AI-enabled demand forecasting are streamlining B2B and B2C operations, offering convenience, timely supply, and dynamic pricing strategies. These innovations appeal to both institutional buyers and digital-savvy residential consumers.

What are the key drivers in the bath and toilet tissue market?

Rising Hygiene Awareness

Increased awareness of sanitation and hygiene, especially post-pandemic, has driven higher tissue consumption across households, healthcare facilities, and public infrastructure. Regulatory mandates for hygiene in hospitals, schools, and offices ensure consistent demand growth, making tissue products a staple in both residential and institutional settings.

Urbanization and Population Growth

Rapid urban migration, particularly in the Asia-Pacific and Africa, is creating more households and increasing demand for personal hygiene products. Urban consumers are adopting mid-range and premium tissue products, which supports higher value growth and recurring revenue streams for manufacturers.

Product Innovation and Eco-Friendly Offerings

Innovation in tissue softness, strength, absorbency, and multi-ply formats, along with sustainable material adoption such as bamboo and recycled pulp, is driving consumer preference. These innovations not only meet evolving quality expectations but also address environmental concerns, boosting brand loyalty and market penetration.

What are the restraints for the global market?

Volatile Raw Material Prices

Price fluctuations in wood pulp, bamboo, and energy costs can significantly impact manufacturing margins. Competitive pricing and private-label pressure limit the ability to pass on cost increases to consumers, creating operational and financial challenges.

Regulatory and Environmental Compliance Costs

Strict regulations regarding deforestation, wastewater management, and carbon emissions increase production costs. Smaller manufacturers may struggle to meet compliance requirements, limiting their ability to scale and expand internationally.

What are the key opportunities in the bath and toilet tissue market?

Emerging Market Sanitation Expansion

Governments in Asia-Pacific, Africa, and Latin America are investing heavily in public hygiene infrastructure, improving access to indoor plumbing and sanitation. This creates first-time adoption demand for toilet tissue products, particularly in India, Indonesia, Nigeria, and the Philippines, offering a significant growth opportunity for manufacturers and new entrants.

Premium and Sustainable Product Adoption

Consumers in developed and urban markets are increasingly willing to pay for multi-ply, soft, and environmentally responsible tissue products. Bamboo-based, recycled-fiber, and plastic-free packaging solutions are expanding shelf space, creating opportunities for brands to differentiate and command higher pricing.

Technological and Digital Integration

Advanced tissue-making machinery, AI-enabled quality control, and energy-efficient pulping technologies enhance production efficiency. Digital distribution channels, D2C subscriptions, and AI-driven demand forecasting allow manufacturers to optimize supply chains and reach new consumer segments, improving both operational efficiency and revenue generation.

Product Type Insights

Toilet tissue rolls dominate the market, accounting for approximately 48% of global 2024 revenue due to universal household adoption. Facial tissues, paper towels, and wet wipes are gaining attention for specialized applications. Multi-ply variants, particularly two-ply, represent 44% of the market, balancing cost and comfort. Mid-range tissue products account for 46% of market value, supported by mass-market affordability and quality perception, while premium tissue is growing rapidly.

End-Use Insights

Residential demand dominates with 67% of global tissue consumption in 2024, driven by daily household use. Healthcare, commercial, and hospitality segments are growing faster, particularly hospitals and hotels, due to hygiene mandates. Healthcare tissue demand reached USD 9,800 million in 2024, growing at 6.5% CAGR. New applications include premium washroom experiences in luxury retail, airports, and smart buildings.

Distribution Channel Insights

Supermarkets and hypermarkets account for 39% of sales, while online retail, convenience stores, and B2B institutional supply are expanding rapidly. E-commerce and D2C channels are facilitating growth through convenience, subscription models, and targeted promotions, particularly in urban and high-income regions.

| By Product Type | By Raw Material | By Price Positioning | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 26% of the global market, led by the U.S. with 20% share, driven by high per-capita consumption, premium product adoption, and strong retail infrastructure. Rising awareness of sustainable tissue products further supports demand.

Europe

Europe holds 24% of the market, with Germany, the UK, France, and Italy leading demand. Sustainability-focused purchasing and preference for premium multi-ply tissue products are shaping market dynamics. Europe is also seeing strong adoption of recycled and eco-friendly tissue products.

Asia-Pacific

Asia-Pacific represents 32% of the global market and is the fastest-growing region. India and China drive volume growth due to expanding sanitation access and rising per-capita consumption. Southeast Asia is also witnessing strong first-time adoption trends.

Latin America

Latin America contributes 10% of global demand, led by Brazil, Argentina, and Mexico. Outbound tissue imports and urbanization support growth, with rising adoption in commercial and hospitality segments.

Middle East & Africa

Africa, the origin of several tissue manufacturers and infrastructure projects, along with Middle Eastern countries like the UAE, Saudi Arabia, and Qatar, represents 8% of the market share. Growth is supported by high-income populations, luxury tissue adoption, and improving sanitation facilities in emerging African economies.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Bath and Toilet Tissue Market

- Procter & Gamble

- Kimberly-Clark

- Essity

- Georgia-Pacific

- Sofidel Group

- Clearwater Paper

- Asia Pulp & Paper (APP)

- CMPC

- Hengan International

- Vinda International

- Kruger Products

- Metsä Group

- WEPA Group

- Cascades

- Resolute Forest Products

Recent Developments

- In 2025, Procter & Gamble expanded its recycled-pulp tissue production line in the U.S., increasing annual capacity by 15% to meet growing eco-friendly product demand.

- In 2025, Kimberly-Clark launched a bamboo-based tissue brand in Asia-Pacific, targeting premium urban households and sustainable retail channels.

- In 2025, Essity invested in AI-enabled manufacturing facilities in Europe, reducing water and energy usage while improving quality consistency across tissue products.