Baseboard Heater Market Size

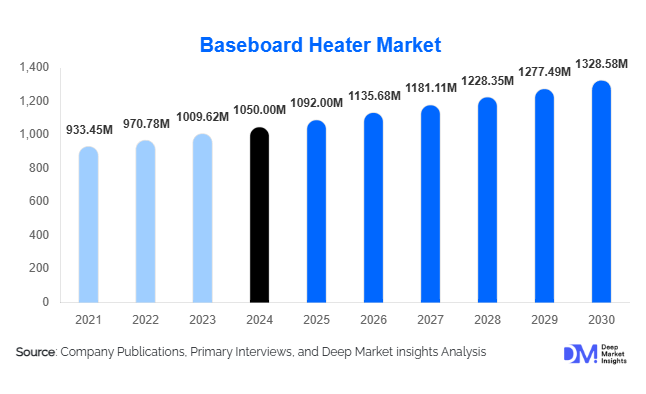

According to Deep Market Insights, the global baseboard heater market size was valued at USD 1,050 million in 2024 and is projected to grow from USD 1,092.00 million in 2025 to reach USD 1,328.58 million by 2030, expanding at a CAGR of 4% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for energy-efficient zoned heating, retrofit of older building stock, and increasing adoption of smart, connected heating solutions across residential and commercial applications.

Key Market Insights

- Electric baseboard heaters dominate the market, accounting for 70% of the global share in 2024 due to ease of installation, cost-effectiveness, and compatibility with electrified buildings.

- Residential applications lead globally, with multi-family and single-family homes comprising 55% of the market, driven by demand for zoned heating and retrofit solutions.

- Europe is the largest regional market, representing 50% of global demand in 2024, supported by older building stock, stringent energy-efficiency regulations, and cold climates.

- North America follows closely, contributing 30% of global demand, with growth driven by multi-family housing, renovation projects, and regulatory incentives.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, new residential construction, and electrification in countries such as China, Japan, South Korea, and India.

- Smart and IoT-enabled baseboard heaters, including programmable thermostats and remote control features, are reshaping product offerings and enhancing adoption in retrofit and new-build segments.

Latest Market Trends

Smart and Connected Heating Solutions

Manufacturers are increasingly integrating IoT and smart controls into baseboard heaters, allowing users to remotely manage heating schedules, track energy consumption, and connect to home automation systems. These solutions appeal to energy-conscious consumers and retrofit markets where older heating systems are being replaced. Features such as programmable thermostats, voice-assistant compatibility, and remote diagnostics enable higher user convenience and efficiency, allowing manufacturers to offer premium-priced products. Smart baseboards also support energy-efficiency regulations in Europe and North America, making them attractive to both consumers and building developers.

Growth in Retrofit and Replacement Projects

Retrofit projects in residential and commercial buildings are a major driver of market growth. Many buildings rely on outdated or inefficient heating systems, creating demand for cost-effective zone-based solutions. Baseboard heaters provide easy installation and minimal disruption compared to central HVAC replacements, particularly in apartments, multi-family homes, and commercial offices. Aging infrastructure and government-backed incentives for energy-efficient building upgrades amplify this trend, making the retrofit segment one of the fastest-growing areas in the market.

Baseboard Heater Market Drivers

Demand for Energy-Efficient Zoned Heating

Consumers increasingly prefer heating solutions that allow room-by-room control, reducing overall energy consumption. Baseboard heaters are ideal for zoned heating, offering low-maintenance and cost-effective options compared to duct-based systems. Rising electricity costs and environmental concerns further drive adoption, particularly in Europe and North America.

Expansion of Smart and Connected Products

The integration of IoT-enabled features, programmable thermostats, and voice-assistant compatibility has created opportunities for differentiated products. Smart baseboard heaters provide energy management, remote control, and predictive maintenance, appealing to tech-savvy consumers and supporting higher-margin product offerings.

Retrofit and Renovation of Older Buildings

Renovation projects in aging building stock are fueling demand for baseboard heaters, especially in residential multi-family housing and commercial offices. Retrofit installations are simpler and less costly than replacing entire HVAC systems, making baseboard heaters the preferred solution for many building upgrades.

Market Restraints

Competition from Alternative Heating Solutions

Baseboard heaters face competition from heat pumps, radiant floor heating, and centralized HVAC systems, which often offer higher efficiency and multi-functional capabilities. This limits market expansion in regions where alternative systems are cost-effective and preferred.

Electricity Cost and Infrastructure Limitations

High electricity tariffs and infrastructure requirements can restrict adoption in certain regions. Electric baseboards may be expensive to operate in areas with high energy costs, while hydronic systems require boiler compatibility and piping infrastructure, increasing installation complexity.

Baseboard Heater Market Opportunities

Expansion into Smart Home Integration

Integrating baseboard heaters with home automation systems, energy management platforms, and IoT devices presents a high-growth opportunity. Smart retrofits allow manufacturers to target existing building stock and offer value-added features such as remote scheduling, energy monitoring, and predictive maintenance.

Electrification and Energy-Efficiency Initiatives

Government incentives promoting electrification and low-carbon heating systems create opportunities for growth in residential and commercial sectors. Countries with stringent energy codes or retrofit subsidies present attractive markets for baseboard heater adoption.

Retrofit of Older Buildings

Renovation and replacement of outdated heating systems in residential and commercial buildings provide a stable growth avenue. Manufacturers focusing on easy-to-install, high-efficiency units can capture demand from retrofit and refurbishment projects, particularly in Europe and North America.

Product Type Insights

Electric baseboard heaters dominate the market, offering simplicity, low installation costs, and compatibility with electrified homes. Hydronic baseboards are preferred in specific commercial or multi-family applications due to efficiency and silent operation. Smart and hybrid models are emerging as premium options, enabling higher-margin product offerings.

Application Insights

Residential applications remain the primary driver, led by single-family homes and multi-family dwellings. Commercial applications, including offices and small retail outlets, are also adopting baseboard heaters for zone heating. Industrial and public sector applications provide incremental growth, particularly for warehouses and schools requiring spot or supplemental heating.

Distribution Channel Insights

Offline retail channels remain dominant, accounting for 60% of sales, with home improvement stores and HVAC distributors leading. Online sales through e-commerce platforms are growing rapidly, supported by direct-to-consumer strategies, digital marketing, and smart product adoption.

End-Use Insights

Multi-family residential housing and retrofit projects are the fastest-growing end-use segments, driven by the ease of installation and zone-control benefits. Commercial retrofit projects are emerging as an additional growth avenue, while industrial and public infrastructure applications contribute steadily to overall market expansion.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for 30% of global demand, with the U.S. leading adoption due to multi-family housing, renovations, and regulatory incentives. Canada also contributes, particularly in colder regions where electric and hydronic baseboards are preferred for supplemental heating.

Europe

Europe dominates with a 50% market share, driven by older building stock, cold climates, and energy-efficiency regulations. Key countries include Germany, the U.K., France, Italy, and Nordic countries, all of which favor electrified and retrofit-friendly heating solutions.

Asia-Pacific

APAC is the fastest-growing region, driven by urbanization, new residential construction, and electrification policies in China, Japan, South Korea, and India. Smart and IoT-enabled baseboards are increasingly adopted in high-density urban projects.

Latin America

Latin America remains a smaller market, with demand concentrated in Argentina, Chile, and Brazil. Growth is moderate, with a focus on niche applications in cooler regions and commercial sectors.

Middle East & Africa

MEA has limited demand due to warm climates, though some high-altitude or luxury resort applications exist. Intra-African and Middle Eastern markets are slowly emerging as niche growth areas.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Baseboard Heater Market

- Glen Dimplex Group

- Marley Engineered Products

- Slantfin

- King Electric Manufacturing Co.

- Stelpro Design Inc.

- Ouellet

- Cadet Manufacturing

- TPI Corporation

- Lasko Products

- Honeywell International Inc.

- STIEBEL ELTRON GmbH & Co. KG

- Danfoss A/S

- Fahrenheat

- Ouellet Canada Inc.

- Thermor (Groupe Atlantic)

Recent Developments

- In March 2025, Glen Dimplex launched a smart baseboard heater series with integrated IoT thermostats for European retrofit markets.

- In January 2025, Marley Engineered Products expanded its hydronic baseboard offerings to North America with energy-efficient models suitable for multi-family buildings.

- In June 2024, Slantfin introduced hybrid electric-hydronic baseboard heaters in APAC, supporting urban new-build and retrofit projects with smart connectivity.