Ballet Pointe Shoes Market Size

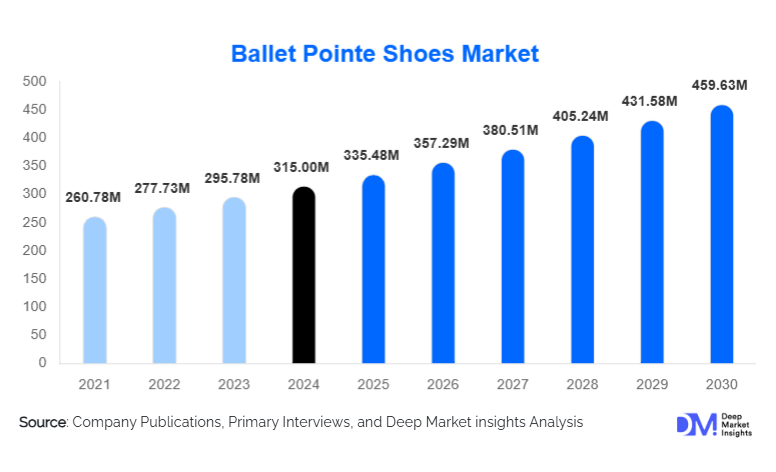

According to Deep Market Insights, the global ballet pointe shoes market size was valued at USD 315 million in 2024 and is projected to grow from USD 335.48 million in 2025 to reach USD 459.63 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). Market growth is primarily driven by rising enrollment in ballet education programs, increasing professionalization of performing arts, and continuous innovation in pointe shoe design focused on comfort, durability, and injury prevention.

Key Market Insights

- Handcrafted pointe shoes dominate the premium segment, driven by strong preference from professional ballet companies and elite academies.

- Europe remains the largest regional market, supported by strong cultural heritage, institutional funding, and established ballet ecosystems.

- Asia-Pacific is the fastest-growing region, led by China, Japan, and South Korea, due to expanding dance education infrastructure.

- Intermediate and pre-professional dancers account for the highest consumption volume, owing to frequent replacement cycles during training.

- Physical retail remains critical, as in-store fitting continues to be essential for pointe shoe selection despite rising online sales.

- Sustainability and customization are emerging differentiators, with growing interest in eco-friendly materials and semi-custom designs.

What are the latest trends in the ballet pointe shoes market?

Customization and Biomechanical Design Innovation

Manufacturers are increasingly investing in biomechanical research to develop pointe shoes that align more precisely with dancer anatomy. Semi-custom and modular pointe shoes with interchangeable shanks, adaptive box structures, and enhanced arch support are gaining traction, particularly among professional dancers. Digital foot-scanning technologies and personalized fitting solutions are enabling brands to reduce injury risk and extend product lifespan, allowing companies to command premium pricing while improving dancer performance and comfort.

Sustainable and Ethical Manufacturing Practices

Sustainability is emerging as a key trend as ballet institutions and younger dancers prioritize environmentally responsible products. Manufacturers are experimenting with biodegradable components, responsibly sourced satin, and water-based adhesives to reduce environmental impact. Ethical labor practices and transparent sourcing are also becoming more important, especially in Europe and North America, where institutional procurement policies increasingly favor suppliers aligned with ESG standards.

What are the key drivers in the ballet pointe shoes market?

Expansion of Ballet Education and Training Programs

The steady expansion of ballet academies, conservatories, and private dance schools globally is a major growth driver. Intermediate and advanced students consume multiple pairs annually, generating consistent replacement-driven demand. Government and private investments in arts education across Europe and the Asia-Pacific are further strengthening institutional purchasing power.

Rising Demand from Professional Ballet Companies

Professional ballet dancers replace pointe shoes frequently due to intensive rehearsal and performance schedules. The post-pandemic recovery of live performances and renewed cultural funding have increased procurement by ballet companies, supporting high-value demand for premium handcrafted pointe shoes.

What are the restraints for the global market?

High Cost and Short Product Lifespan

Pointe shoes have a limited usable lifespan, particularly for professionals, leading to high cumulative costs. This restricts the adoption of premium products in price-sensitive regions and among lower-income students, limiting broader market penetration.

Limited Addressable Consumer Base

The market is inherently niche, catering only to trained ballet dancers. Growth is closely tied to participation rates in classical ballet, making geographic expansion dependent on the development of dance education infrastructure.

What are the key opportunities in the ballet pointe shoes industry?

Growth in Asia-Pacific Ballet Ecosystems

Asia-Pacific presents significant untapped potential as ballet gains popularity across China, South Korea, and Southeast Asia. Localized sizing, pricing strategies, and partnerships with regional academies can enable manufacturers to capture long-term recurring demand from students progressing into professional careers.

Premium Custom-Fit Pointe Shoes

Rising awareness of injury prevention and performance optimization is creating opportunities for custom-fit and technology-integrated pointe shoes. Brands that invest in R&D and direct-to-dancer customization platforms are well-positioned to capture higher margins.

Product Type Insights

Traditional handcrafted pointe shoes account for approximately 42% of the global market in 2024, making them the leading product type segment by value. This dominance is primarily driven by their superior craftsmanship, anatomical precision, balance control, and durability, which are critical for professional and pre-professional dancers. Handcrafted pointe shoes are typically produced using time-intensive techniques that allow for nuanced shaping of the box, shank, and vamp, enabling better alignment and reduced injury risk. As a result, professional ballet companies and elite academies globally continue to mandate handcrafted models for performances and advanced training, sustaining premium pricing and repeat demand.

Semi-handcrafted pointe shoes represent the mid-range segment and are gaining traction among intermediate dancers and institutional buyers. These products balance performance reliability with improved affordability by combining manual craftsmanship with limited mechanization. Growth in this segment is driven by rising enrollment in ballet academies, particularly in Asia-Pacific and Latin America, where students transition from beginner to advanced levels and seek higher-quality footwear without the full cost of bespoke models.

Material Insights

Satin-based pointe shoes dominate the global market with a 61% market share in 2024, reflecting their long-standing status as the industry standard for stage and performance use. Satin offers an optimal balance of aesthetics, grip, flexibility, and durability, making it the preferred material for professional performances and examinations. The visual appeal of satin shoes under stage lighting, combined with their compatibility with traditional ballet attire, continues to reinforce their widespread adoption.

Canvas-based and reinforced-material pointe shoes are increasingly adopted in rehearsal and training environments, where breathability, moisture control, and durability are prioritized over visual presentation. These materials are particularly popular in ballet schools and intensive training programs, as they allow dancers to train longer with reduced discomfort. Additionally, emerging innovation in hybrid materials and eco-friendly textiles is gradually gaining attention, driven by sustainability initiatives and institutional procurement preferences in Europe and North America.

Distribution Channel Insights

Specialty dance retail stores account for nearly 47% of global sales, maintaining their position as the leading distribution channel. The dominance of physical retail is largely driven by the necessity of professional fitting, as pointe shoe performance is highly dependent on foot shape, strength, and technique level. In-store consultations with trained fitters significantly reduce injury risk and product mismatch, making this channel indispensable for first-time buyers and advanced students.

Brand-owned online stores and third-party e-commerce platforms are experiencing steady growth, particularly for repeat purchases where dancers already know their preferred brand, size, and model. Digital channels are benefiting from improved sizing guidance, virtual fitting tools, and direct-to-consumer strategies adopted by leading manufacturers. While online sales currently complement rather than replace physical retail, they are expected to contribute an increasing share of revenue over the forecast period, especially in regions with limited access to specialty dance stores.

End-Use Insights

Ballet academies and dance schools represent the largest end-use segment, contributing approximately 45% of total global demand in 2024. This segment’s leadership is driven by structured training programs, compulsory pointe work at intermediate and advanced levels, and high replacement frequency as students progress technically. Institutional purchasing policies, instructor recommendations, and examination requirements strongly influence brand selection and purchasing volumes.

Professional ballet companies, while smaller in volume, generate disproportionately higher revenue per unit due to their reliance on premium handcrafted pointe shoes and extremely high replacement rates. Professional dancers may use multiple pairs per week during performance seasons, creating consistent demand for high-end products. Individual and freelance dancers form a stable retail segment, driven by independent training, competitions, and freelance performance engagements, particularly in North America and Europe.

| By Product Type | By Material | By User Level | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe leads the global ballet pointe shoes market with an estimated 36% share in 2024, supported by a deeply entrenched ballet heritage and a dense concentration of professional ballet companies and historic academies across France, the UK, Italy, and Russia. Regional growth is driven by sustained government funding for arts and culture, public ballet institutions, and national conservatories. Europe also benefits from strong domestic manufacturing capabilities, high adoption of premium handcrafted shoes, and early uptake of sustainable and ethically produced footwear, reinforcing both volume stability and value growth.

North America

North America accounts for approximately 29% of the global market, led by the United States. Growth in this region is driven by high disposable income, widespread availability of private ballet schools, and a strong culture of extracurricular arts education. North America also demonstrates strong demand for premium and technologically advanced pointe shoes, particularly among pre-professional dancers. The region’s growth is further supported by advanced retail infrastructure, professional fitting services, and early adoption of customization technologies.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, registering a CAGR above 8% during the forecast period. China, Japan, and South Korea are key demand centers, driven by the rapid expansion of ballet education programs, rising middle-class income, and increasing participation in Western performing arts. Government-backed cultural initiatives, international ballet collaborations, and growing aspirations for professional dance careers are accelerating adoption. The region also presents strong growth opportunities for mid-range and semi-handcrafted pointe shoes as student populations expand.

Latin America

Latin America represents an emerging growth region, with Brazil and Argentina leading demand. Growth is driven by urbanization, increasing exposure to global ballet culture, and government-supported cultural and performing arts programs. While price sensitivity remains a factor, rising enrollment in metropolitan dance academies is supporting steady demand growth, particularly for mid-range and training-oriented pointe shoes.

Middle East & Africa

Demand in the Middle East & Africa remains niche but is gradually expanding, particularly in the UAE and South Africa. Growth drivers include the presence of international schools, expatriate populations, and increasing investment in cultural infrastructure. Premium ballet academies and performing arts centers in major cities are contributing to incremental demand, while institutional support for arts education is expected to enhance long-term market potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ballet Pointe Shoes Market

- Bloch

- Capezio

- Grishko

- Freed of London

- Sansha

- Gaynor Minden

- Russian Pointe

- Repetto

- Merlet

- So Danca