Baby High Chairs Market Size

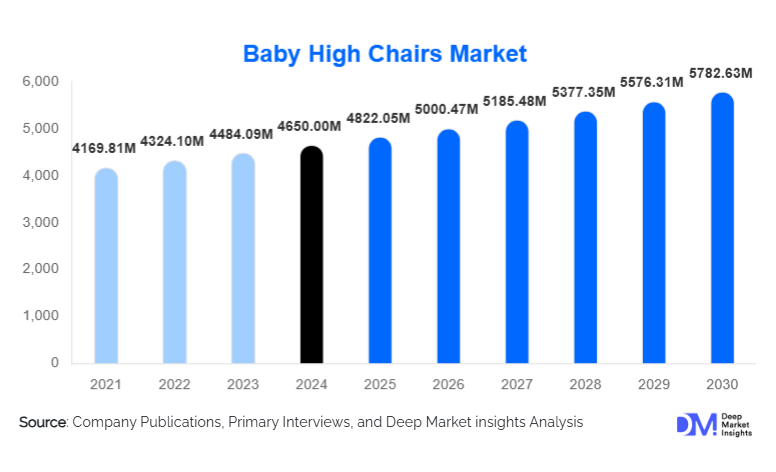

According to Deep Market Insights, the global baby high chairs market size was valued at USD 4,650.00 million in 2024 and is projected to grow from USD 4,822.05 million in 2025 to reach USD 5,782.63 million by 2030, expanding at a CAGR of 3.7% during the forecast period (2025–2030). Market growth is primarily driven by rising parental awareness of infant safety and ergonomics, increasing disposable incomes in emerging economies, and the rapid expansion of multifunctional and premium high chairs that offer enhanced convenience, durability, and adjustability for modern households.

Key Market Insights

- Standard high chairs continue to dominate global demand, accounting for roughly 32% of the 2024 market due to affordability and widespread availability.

- Plastic high chairs remain the most widely used material type, holding approximately 49% of global share thanks to low cost, lightweight design, and easy cleaning.

- Babies aged 6–12 months represent the largest user segment, capturing nearly 56% of the market, as this is the primary age range for transitioning to solid foods.

- Offline retail remains the leading sales channel, with about 66% share, reflecting parental preference to physically inspect safety-related baby products before purchasing.

- North America dominates the global market with nearly 44% share in 2024, driven by strong safety awareness and high purchasing power.

- E-commerce and D2C channels are rapidly expanding, reshaping customer engagement, and enabling broader product access across both developed and emerging regions.

What are the latest trends in the baby high chairs market?

Premium & Convertible High Chairs Gaining Momentum

There is a clear shift toward multifunctional high chairs that grow with the child, transitioning from infant feeding seats to toddler chairs or booster seats. This trend is driven by parental desire for long-term value and durability. Premium models featuring ergonomic seating, adjustable height settings, eco-friendly materials, and modern aesthetics are increasingly popular among urban, dual-income households. Manufacturers are integrating sustainable woods, recycled plastics, and advanced safety harness systems, appealing to environmentally aware consumers. As the global demand for premium baby products rises, brands are prioritizing design innovation, extended usability, and enhanced safety features.

Technology-Enabled Customer Experience & Digital Retail Growth

Online product discovery and purchasing have transformed the baby high chair market. Parents now rely on AR-based product visualization, video demonstrations, safety certification displays, and reviews to guide decisions. Digital-native brands are leveraging social media influencers, parenting communities, and targeted online ads to educate buyers on ergonomics and safety. Smart innovations, such as easy-clean detachable trays, antimicrobial surfaces, and tool-less assembly mechanisms, are becoming competitive differentiators. E-commerce’s role is particularly strong in emerging economies where physical specialty stores are limited, making digital platforms the primary discovery and purchase channel.

What are the key drivers in the baby high chairs market?

Growing Parental Awareness of Safety & Ergonomics

Modern parents place high emphasis on infant safety, posture, cleanliness, and feeding ergonomics. High chairs provide essential back support, secure harnessing, and proper seating posture during feeding, key factors influencing product demand. Global dissemination of safety guidelines through pediatric associations, parenting blogs, and social media further amplifies consumer awareness.

Rising Disposable Incomes & Urban Lifestyles

Urbanization and the growth of dual-income households have contributed to a strong preference for convenient, space-saving baby gear. Foldable, portable, and compact high chairs are especially appealing to apartment dwellers. As spending power increases across APAC, LATAM, and MEA, demand for functional baby feeding products continues to expand.

Shift Toward Premium, Multi-Functional, and Sustainable Products

Parents are increasingly opting for long-lasting, aesthetically appealing high chairs that also provide multi-stage utility. Premium high chairs made from sustainable materials, featuring adjustable configurations, and offering enhanced durability command higher margins for manufacturers. This premiumization trend is reshaping the competitive landscape and expanding profit pools.

What are the restraints for the global market?

Declining Birth Rates in Developed Regions

Many developed markets, including Western Europe, Japan, and parts of North America, face declining birth rates, limiting long-term demand growth for baby high chairs. With fewer births, product demand becomes more dependent on premiumization and replacement cycles rather than volume expansion.

Short Usage Period & Limited Repeat Purchases

High chairs are typically used for a narrow age window, leading to a lower frequency of repeat purchases. Parents may also opt for lower-cost alternatives, such as booster seats, which further limit growth potential. This short lifecycle requires companies to constantly innovate to maintain sales momentum.

What are the key opportunities in the baby high chairs industry?

High-Growth Potential in Emerging Markets

Asia-Pacific, Latin America, and Africa represent significant untapped potential due to rising birth rates, growing middle-class populations, and fast-expanding e-commerce ecosystems. Localized product manufacturing, value-priced offerings, and region-customized marketing can help global players capture market share in these fast-growing segments.

Premium & Eco-Friendly Product Expansion

Sustainable materials, such as FSC-certified wood, recycled plastics, and toxin-free coatings, are becoming strong differentiators for modern consumers. Brands offering convertible high chairs, designer aesthetics, and advanced ergonomics can attract premium buyers seeking long-term investment pieces.

Digital Commerce, Subscription Models & D2C Growth

The rapid expansion of online retail creates opportunities for D2C brands to enter the market with minimal capital investment. Subscription or rental-based baby gear services also present new monetization models, especially in dense urban markets where convenience is a priority. Digital engagement, through AR try-outs, user-generated content, and safety education, further strengthens brand loyalty and accelerates conversions.

Product Type Insights

Standard high chairs lead the market, representing approximately 32% of global demand due to their affordability, familiarity, and presence across mass retail channels. Foldable and portable high chairs are growing rapidly, appealing to urban families and travel-oriented parents seeking compact, lightweight solutions. Convertible/multifunctional high chairs are the fastest-growing segment, driven by premiumization and the desire for products that evolve with the child. Space-saver and hook-on designs are gaining traction among households with limited space, particularly in large metropolitan cities.

Application Insights

The residential segment dominates global demand, driven by first-time parents, nuclear families, and urban households seeking safe and ergonomic feeding solutions. The institutional segment, including daycare centers and preschools, is expanding steadily as childcare enrollment increases worldwide. Rising interest in export-driven high chair manufacturing, particularly from low-cost production regions, is further augmenting global supply chains. Growth in institutional and export applications supplements core residential demand, making the market more resilient.

Distribution Channel Insights

Offline retail leads with nearly 66% market share due to the importance of physical inspection for safety-related baby products. Specialty baby stores, hypermarkets, and large-format retailers continue to anchor this segment. However, online channels are experiencing the highest growth rate, fueled by transparent pricing, detailed product reviews, comparison tools, and home delivery convenience. D2C platforms enable brands to educate consumers through videos, FAQs, and interactive demos, significantly influencing purchase decisions. Social media marketing and parent influencer collaborations also contribute to the rapid rise of e-commerce sales.

End-Use Insights

The largest end-use segment is household consumption, where high chairs serve as essential feeding tools during infancy and toddlerhood. The fastest-growing segment is urban nuclear families, driven by rising disposable incomes and a preference for organized, hygienic feeding environments. Daycare facilities make up an important secondary segment, purchasing high chairs in bulk and driving demand for durable, easy-clean, and safety-certified models. Export-driven manufacturing in regions such as China, Vietnam, and India supports global supply and stabilizes pricing. As online education around child ergonomics grows, end-use expansion is expected across both residential and institutional markets.

| By Product Type | By Material Type | By Baby Age Group | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global market with approximately 44% share in 2024. The U.S. and Canada exhibit strong demand for premium, multifunctional, and safety-certified high chairs. High purchasing power, established retail networks, and stringent product safety regulations drive the region’s dominance. Premiumization trends, especially among millennial parents, continue to shape product innovation.

Europe

Europe follows closely, driven by strong regulatory standards, high consumer awareness, and the adoption of eco-friendly materials. Germany, the U.K., France, and the Nordic countries exhibit strong demand for wooden and designer high chairs. Europe demonstrates strong growth in sustainability-oriented segments.

Asia-Pacific

APAC is the fastest-growing region, supported by rising birth rates, rapid urbanization, growing middle-class wealth, and high smartphone penetration. China and India lead demand, while Southeast Asia is rapidly emerging as a price-sensitive yet high-volume market. Online retail plays a critical role in sales growth across APAC.

Latin America

Latin America is experiencing steady demand, particularly in Brazil and Mexico, where expanding middle-class populations and exposure to global parenting trends are driving adoption. Price-sensitive buyers prefer mid-range and compact high chair formats.

Middle East & Africa

MEA represents a smaller but steadily growing market. High-income households in GCC nations favor premium and designer high chairs. Growing childcare infrastructure and young demographic profiles in African nations support long-term market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Baby High Chairs Market

- Artsana Group (Chicco)

- Graco Inc.

- Evenflo Company Inc.

- Stokke AS

- Peg Perego

- Goodbaby International

- Hauck

- BabyBjörn

- Phil & Teds

- 4moms

- Inglesina

- Mothercare

- Joovy

- Ingenuity

- Cosco Kids