Baby Changing Stations Market Size

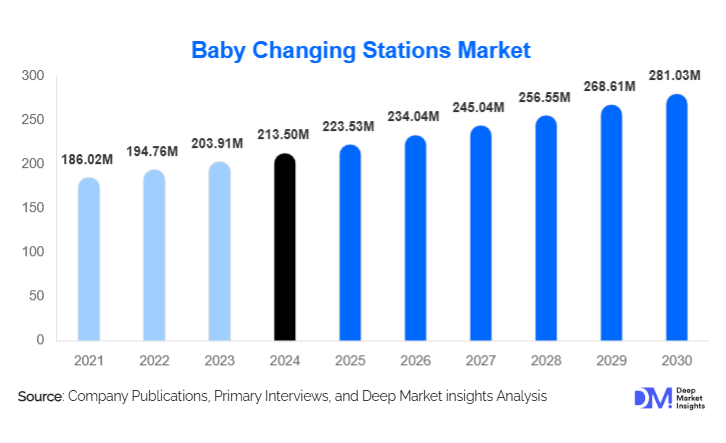

According to Deep Market Insights, the global baby changing stations market size was valued at USD 213.50 million in 2024 and is projected to grow from USD 223.53 million in 2025 to reach USD 281.03 million by 2030, expanding at a CAGR of 4.7% during the forecast period (2025–2030). The market growth is primarily driven by increasing public awareness of infant hygiene, rising demand for child-friendly facilities in commercial and public spaces, and technological innovations such as automated and sensor-enabled changing stations.

Key Market Insights

- Demand for hygienic and safe baby changing stations is increasing globally, driven by rising awareness among parents and caregivers.

- Commercial establishments dominate the market, with airports, malls, and hospitals adopting modern and durable stations to comply with regulatory requirements.

- North America holds the largest market share, supported by stringent public facility regulations and high adoption in commercial spaces.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, new public infrastructure, and rising awareness of child care hygiene.

- Smart and automated baby changing stations are gaining traction, with integration of IoT, antimicrobial surfaces, and hygiene monitoring becoming key differentiators.

- Sustainable and eco-friendly materials, including recyclable plastics and composite designs, are increasingly preferred by commercial and residential buyers.

What are the latest trends in the baby changing stations market?

Technological Integration and Smart Stations

Manufacturers are increasingly offering smart baby changing stations equipped with sensors, automated sanitization systems, and usage monitoring. These innovations enhance user convenience, reduce maintenance challenges, and improve hygiene, making them attractive for high-traffic public and commercial spaces. Mobile applications linked to smart stations allow facility managers to monitor usage patterns, plan cleaning schedules, and ensure regulatory compliance. This trend is particularly strong in North America and Europe, where advanced infrastructure and consumer willingness to pay for premium features are driving adoption.

Eco-Friendly and Sustainable Designs

As sustainability becomes a core concern, eco-conscious buyers are seeking baby changing stations made from recyclable plastics, stainless steel, or composite materials. Sustainable design initiatives include low-energy manufacturing processes and the use of recycled materials without compromising durability. This trend is especially noticeable in Europe and APAC, where regulations and consumer awareness promote green building practices. Manufacturers integrating sustainability are gaining a competitive advantage and premium pricing opportunities.

What are the key drivers in the baby changing stations market?

Rising Public Awareness of Child Hygiene

Parents and caregivers increasingly prioritize hygienic, safe, and convenient baby changing facilities in public and commercial spaces. Regulatory requirements for child-friendly restrooms in airports, malls, and hospitals further drive demand. Adoption of high-quality, easy-to-clean stations is now a benchmark for establishments aiming to attract families, thereby fueling market growth.

Expansion of Public Infrastructure and Commercial Spaces

Growth in shopping malls, airports, hospitals, hotels, and daycare centers globally is boosting demand for baby changing stations. Rapid urbanization in APAC and LATAM, combined with increasing commercial investment, provides significant opportunities for manufacturers. Governments are also encouraging child-friendly facilities through regulatory mandates and public spending.

Technological Advancements in Product Design

Smart and automated baby changing stations, sensor-enabled systems, and antimicrobial surfaces are becoming standard in high-traffic spaces. These technological innovations improve hygiene and operational efficiency, attracting premium buyers. Integration with mobile monitoring systems and IoT-based solutions is reshaping user expectations and influencing purchase decisions.

What are the restraints for the global market?

High Initial Costs of Premium Stations

Sensor-enabled and stainless-steel stations are cost-intensive, limiting adoption in price-sensitive regions. Budget constraints in smaller commercial establishments and developing markets restrict the uptake of technologically advanced solutions, slowing overall market penetration.

Maintenance and Hygiene Challenges

Improper maintenance or cleaning can lead to hygiene concerns, particularly in high-traffic areas. Facility managers need regular upkeep and cleaning protocols, creating operational challenges that may hinder adoption in certain regions.

What are the key opportunities in the baby changing stations market?

Expansion in Emerging Economies

Urbanization and rising public infrastructure spending in APAC and LATAM offer significant growth opportunities. Airports, malls, hospitals, and hotels in these regions are increasingly incorporating child-friendly facilities, creating a large untapped market. Manufacturers can capitalize on regional partnerships and institutional sales to drive adoption.

Smart and Automated Station Adoption

Integration of IoT, sensors, and automated cleaning mechanisms is a growing trend. Premium institutions are willing to invest in smart solutions to enhance hygiene, reduce labor costs, and comply with regulations. Companies offering these innovations can differentiate themselves and achieve higher profit margins.

Government Regulations and Initiatives

Government mandates for child-friendly restrooms in public spaces drive demand across North America, Europe, and parts of APAC. Programs such as "Make in India" and "Made in China 2025" further support local manufacturing, infrastructure spending, and innovation, providing opportunities for market expansion.

Product Type Insights

Wall-mounted baby changing stations dominate the global market, accounting for approximately 45% of total market share in 2024. Their leadership is driven by a combination of space efficiency, cost-effectiveness, and regulatory suitability, making them the preferred choice for high-traffic commercial environments such as airports, shopping malls, hospitals, restaurants, and public restrooms. These stations require minimal floor space, are easy to install, and comply with safety and accessibility standards in most developed markets, which significantly accelerates adoption.

Freestanding baby changing stations are witnessing steady demand growth, particularly in daycare centers, childcare facilities, and temporary or multi-purpose venues where flexibility and mobility are essential. Portable and foldable stations are gaining traction in residential applications and small childcare businesses, supported by rising nuclear family structures and increased online retail penetration. Meanwhile, smart and automated baby changing stations are emerging as a high-value premium segment, especially in North America and Europe. These advanced systems integrate features such as antimicrobial surfaces, automated sanitization, usage sensors, and IoT-enabled monitoring, catering to premium commercial facilities seeking enhanced hygiene, compliance, and operational efficiency.

Material Insights

Plastic baby changing stations lead the market by material type, capturing around 52% of global demand in 2024. Their dominance is driven by lightweight construction, corrosion resistance, affordability, and ease of maintenance, making them highly suitable for large-scale deployment across commercial and institutional environments. Polypropylene and ABS plastics are widely preferred due to their durability, safety, and ability to withstand frequent cleaning without degradation.

Stainless steel baby changing stations represent a fast-growing segment in high-traffic and vandal-prone locations such as airports, transit hubs, stadiums, and public facilities. Their superior durability, resistance to tampering, and high hygiene standards justify premium pricing in these environments. Composite materials, which combine metal and polymer elements, are increasingly adopted in premium and design-focused installations. These materials offer enhanced structural strength, improved aesthetics, and longer service life, appealing to upscale commercial establishments and modern healthcare facilities.

Application Insights

Commercial spaces constitute the largest application segment, accounting for approximately 40% of global baby changing station demand in 2024. Growth in this segment is driven by regulatory mandates for child-friendly public facilities, rising footfall in airports and shopping malls, and increasing competition among hospitality and retail operators to enhance customer experience for families. Airports, hotels, restaurants, and entertainment venues increasingly view baby changing facilities as essential infrastructure rather than optional amenities.

Healthcare facilities, including hospitals, clinics, and pediatric centers, represent a steadily expanding application segment due to strict hygiene requirements and the need for durable, easy-to-clean equipment. Educational institutions, particularly daycare centers and early learning facilities, are also contributing to demand growth as safety and child care regulations tighten globally. Residential applications are emerging as a niche but growing segment, driven by higher disposable incomes, urban living, and the availability of compact, aesthetically designed stations through online retail platforms.

Distribution Channel Insights

Offline distribution channels dominate the global market, accounting for nearly 55% of total sales in 2024. This dominance is primarily driven by B2B and institutional procurement, where commercial establishments, healthcare facilities, and public infrastructure projects rely on direct supplier relationships, bulk purchasing, and compliance-driven installations. Offline channels also allow buyers to physically evaluate product quality, durability, and safety certifications before purchase.

Online distribution channels are expanding rapidly, supported by the growth of e-commerce, direct-to-consumer sales models, and digital procurement platforms. Online channels offer broader product visibility, customization options, and access to premium and smart baby changing stations, particularly for residential buyers and small commercial customers. B2B institutional sales remain critical for large-scale deployments in airports, hospitals, malls, and government buildings, often secured through long-term contracts and tender-based procurement processes.

| By Product Type | By Material | By Application | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, with the U.S. and Canada collectively accounting for approximately 35% of global demand in 2024. Regional leadership is driven by high awareness of infant hygiene, stringent public facility and accessibility regulations, and strong enforcement of child-friendly infrastructure standards. The region also exhibits high adoption of premium, smart, and stainless-steel baby changing stations, particularly in airports, healthcare facilities, and large commercial complexes. High disposable income, well-developed retail infrastructure, and rapid technological adoption further support sustained market growth.

Europe

Europe holds around 28% of the global market share, led by Germany, the U.K., and France. Growth in the region is driven by strict regulatory frameworks mandating child-friendly public facilities, strong sustainability initiatives, and high consumer expectations for hygiene and product quality. European buyers show a strong preference for eco-friendly, recyclable, and durable materials, accelerating demand for stainless steel and composite stations. Public infrastructure upgrades, healthcare investments, and green building standards continue to support premium product adoption across the region.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, driven by China, India, and Japan. Rapid urbanization, expanding retail and airport infrastructure, and increasing awareness of child hygiene are key growth drivers. China accounts for approximately 10% of global demand, supported by large-scale public infrastructure projects and government-backed manufacturing initiatives. India contributes around 5%, with demand rising due to growing daycare facilities, healthcare investments, and the modernization of public amenities. Rising middle-class income levels and increasing regulatory focus on child-friendly spaces are expected to accelerate adoption across the region.

Middle East & Africa

The Middle East & Africa region is experiencing moderate but steady growth, with the UAE and Saudi Arabia leading demand. Key drivers include airport expansions, hospitality sector growth, tourism development, and government investments in public infrastructure. High-end commercial establishments and international airports in the Gulf region are increasingly adopting premium and stainless-steel baby changing stations to meet global standards. In Africa, gradual improvements in healthcare and urban infrastructure are supporting incremental market expansion.

Latin America

Latin America shows steady growth, with Brazil and Argentina emerging as the primary contributors. Market expansion is driven by urban infrastructure development, increasing retail penetration, and gradual regulatory alignment with international hygiene standards. While adoption remains lower than in developed regions, commercial establishments and healthcare facilities are increasingly installing baby changing stations. Imports from Asia-Pacific and Europe dominate supply, and improving economic stability is expected to support long-term growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Baby Changing Stations Market

- Koala Kare Products

- Rubbermaid Commercial Products

- Diaper Depot

- BabyBjörn

- CWS-boco

- Cambro Manufacturing

- American Specialties Inc.

- Akcora Baby Products

- Panda Baby

- Sancare Solutions

- Astron

- Shaws Manufacturing

- Rosenberg Products

- Munchkin Inc.

- Childcare International