Baby Bath Products Market Size

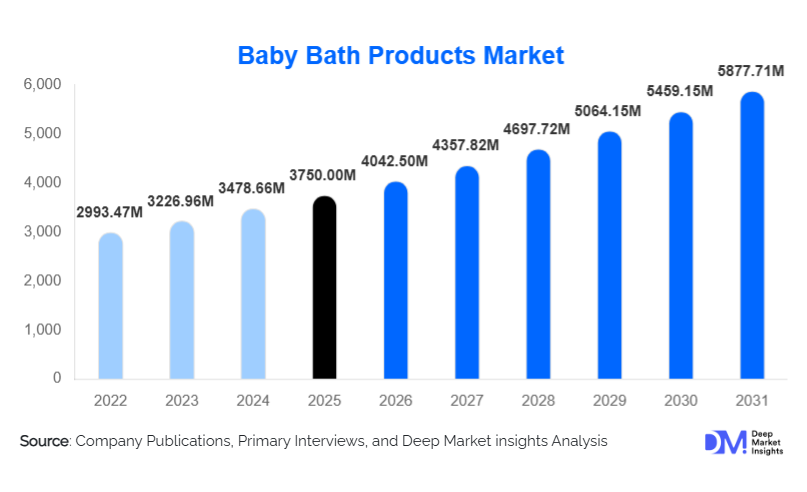

According to Deep Market Insights, the global baby bath products market size was valued at USD 3750 million in 2025 and is projected to grow from USD 4042.5 million in 2026 to reach USD 5877.71 million by 2031, expanding at a CAGR of 7.8% during the forecast period (2026–2031). The baby bath products market growth is primarily driven by rising parental awareness regarding infant hygiene and skin health, increasing penetration of premium and organic baby care products, and the rapid expansion of e-commerce and direct-to-consumer baby care brands globally.

Key Market Insights

- Natural and organic baby bath products are gaining strong traction, driven by rising concerns over chemical exposure and infant skin sensitivity.

- Baby soaps and cleansers dominate product demand, supported by high daily usage frequency and essential hygiene needs.

- Asia-Pacific leads global demand, accounting for the largest share due to high birth rates and growing urban middle-class populations.

- North America and Europe lead in value terms, supported by premium pricing and higher per-capita spending on baby care.

- Online retail is the fastest-growing distribution channel, fueled by convenience, subscription models, and digital brand engagement.

- Stricter safety regulations and clean-label requirements are reshaping formulation, packaging, and testing standards across the industry.

What are the latest trends in the baby bath products market?

Rapid Shift Toward Natural, Organic, and Hypoallergenic Products

One of the most prominent trends in the baby bath products market is the accelerated shift toward natural, organic, and hypoallergenic formulations. Parents are increasingly avoiding products containing parabens, sulfates, synthetic fragrances, and artificial dyes, opting instead for plant-based, dermatologist-tested alternatives. This trend has prompted manufacturers to reformulate existing products, introduce herbal and ayurvedic variants, and secure organic certifications to enhance consumer trust. Premium natural products are witnessing higher growth rates compared to conventional offerings, particularly in developed markets.

Digitalization and Direct-to-Consumer Expansion

Digital platforms are transforming how baby bath products are marketed and sold. Brands are leveraging e-commerce, social media, and influencer-driven campaigns to reach millennial and Gen Z parents. Subscription-based replenishment models, personalized product recommendations, and digital ingredient transparency tools are becoming common. This shift is reducing reliance on traditional retail and enabling new entrants to scale rapidly with lower upfront investments.

What are the key drivers in the baby bath products market?

Rising Awareness of Infant Hygiene and Skin Health

Growing awareness among parents regarding infant skin sensitivity, allergies, and hygiene-related conditions is a major growth driver. Pediatricians and healthcare professionals increasingly recommend specialized baby bath products that are gentle, pH-balanced, and dermatologically tested. This has significantly boosted demand for purpose-built baby bath solutions across both developed and emerging markets.

Premiumization of Baby Care Products

Parents are increasingly willing to spend more on baby care products that ensure safety, quality, and sustainability. Premium baby bath products featuring organic ingredients, eco-friendly packaging, and ethical sourcing command higher price points and margins. This premiumization trend is especially strong in North America, Europe, and urban Asia-Pacific markets.

What are the restraints for the global market?

High Regulatory Compliance and Testing Costs

Baby bath products are subject to stringent safety, quality, and labeling regulations. Compliance with regional standards, frequent testing, and certification requirements increases production costs and time-to-market, particularly for small and emerging manufacturers. These regulatory complexities act as a barrier to entry and expansion.

Volatility in Raw Material Prices

Fluctuating prices of key raw materials such as essential oils, herbal extracts, and sustainable packaging materials impact profit margins. This is especially challenging for manufacturers focused on natural and organic product lines, where input costs are inherently higher.

What are the key opportunities in the baby bath products industry?

Expansion in Emerging Economies

Emerging markets in Asia-Pacific, Latin America, and parts of Africa present significant growth opportunities due to rising birth rates, increasing disposable incomes, and improving awareness of infant hygiene. Localization strategies such as affordable pack sizes, region-specific formulations, and local manufacturing can help companies tap into these high-growth markets.

Innovation in Sustainable Packaging and Smart Products

Sustainability-focused innovations, including biodegradable packaging, refill packs, and water-saving bath accessories, offer strong differentiation opportunities. Additionally, smart packaging solutions with QR-based ingredient traceability and digital engagement features are enhancing brand transparency and customer loyalty.

Product Type Insights

Baby soaps and cleansers account for approximately 38% of the global market in 2025, making them the leading product category due to daily usage and essential hygiene requirements. Baby shampoos follow closely, driven by demand for tear-free and sensitive scalp formulations. Bath additives and accessories represent a growing niche, supported by premium bath experiences and increasing demand for safety-enhancing bath products such as bath seats and anti-slip solutions.

Ingredient Type Insights

Natural and organic baby bath products represent around 34% of the total market and are the fastest-growing ingredient segment. Conventional formulations continue to hold a substantial share due to affordability and wide availability, while hypoallergenic and dermatologist-tested products are gaining popularity among parents of infants with sensitive skin or medical conditions.

Distribution Channel Insights

Supermarkets and hypermarkets remain the largest distribution channel, accounting for nearly 31% of global sales. However, online retail is the fastest-growing channel, contributing about 29% of total market revenue in 2025. Pharmacies and specialty baby stores continue to play a crucial role, particularly for medically endorsed and premium products.

End-Use Insights

Household consumers dominate the baby bath products market, accounting for approximately 82% of total demand, driven by recurring usage and rising hygiene awareness. Hospitals and maternity centers represent a stable institutional segment, while daycare and childcare facilities are emerging as a niche growth area due to increasing participation of working parents globally.

| By Product Type | By Ingredient Type | By Price Category | By Distribution Channel | By End-User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global baby bath products market with around 41% share in 2025. China and India are the largest contributors, driven by high birth rates, rapid urbanization, and growing middle-class spending on baby care. Japan, South Korea, and Southeast Asian countries contribute a steady demand for premium and natural formulations.

North America

North America accounts for approximately 24% of the global market share, with the United States alone contributing nearly 18%. Demand is driven by premiumization, strong regulatory standards, and high adoption of organic baby care products.

Europe

Europe holds about 21% of the global market, led by Germany, the U.K., and France. Strict safety regulations and high consumer preference for sustainable and eco-certified products support market growth.

Latin America

Latin America is witnessing moderate growth, led by Brazil and Mexico. Expanding middle-class populations and improving retail infrastructure are driving demand for mid-range and premium baby bath products.

Middle East & Africa

The Middle East & Africa region is the fastest-growing, expanding at over 9% CAGR, supported by rising birth rates, improving healthcare infrastructure, and increasing imports of premium baby care products, particularly in the UAE and Saudi Arabia.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|