AV Receiver Market Size

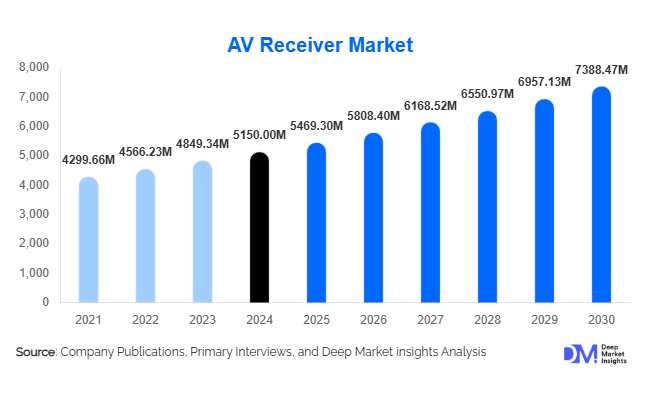

According to Deep Market Insights, the global AV Receiver market size was valued at USD 5,150 million in 2024 and is projected to grow from USD 5,469.30 million in 2025 to reach USD 7,388.47 million by 2030, expanding at a CAGR of 6.2% during the forecast period (2025–2030). The market growth is primarily driven by the rising adoption of home theater systems, integration of smart and wireless technologies, and growing demand for high-definition audio-visual experiences in residential and commercial applications.

Key Market Insights

- Home theater AV receivers dominate the market, accounting for a significant share due to increasing consumer demand for immersive audio-visual setups.

- HDMI and wireless connectivity are leading trends, enabling seamless integration with TVs, gaming consoles, and multi-room audio systems.

- North America holds the largest market share, led by the U.S. and Canada, driven by high disposable income and widespread adoption of advanced audio-visual systems.

- Asia-Pacific is the fastest-growing region, fueled by rising middle-class income, urbanization, and smart home adoption in India, China, and Southeast Asia.

- Technological advancements, including AI-driven sound optimization, Dolby Atmos support, and network-enabled features, are reshaping the AV receiver landscape.

- Residential and commercial applications are both expanding, with commercial venues such as auditoriums and hotels increasingly deploying high-performance AV receivers.

What are the latest trends in the AV Receiver market?

Integration of Smart Home and Wireless Technologies

Modern AV receivers are increasingly integrated into smart home ecosystems, offering voice control, automated audio calibration, and multi-room audio functionality. Wireless connectivity options such as Bluetooth, Wi-Fi, and network streaming have become standard, reducing dependency on traditional wiring and enhancing convenience for users. Consumers are adopting receivers that allow seamless connection with streaming devices, gaming consoles, and other smart devices, creating opportunities for manufacturers to offer bundled solutions. The trend towards wireless and AI-enabled receivers also aligns with growing consumer preference for minimalistic home setups without compromising on performance.

High-Resolution and Immersive Audio Adoption

High-definition formats, including 4K, 8K, and Dolby Atmos audio, are driving the development of next-generation AV receivers. Consumers increasingly demand cinematic audio experiences at home, leading to higher sales of multi-channel, high-power receivers. Network-enabled receivers capable of processing high-resolution audio and video signals are gaining traction. Additionally, multi-room audio setups are becoming popular in luxury homes and commercial installations, enabling synchronized playback across multiple spaces. This trend is particularly evident in North America and Europe, where premium home theater adoption is high.

What are the key drivers in the AV Receiver market?

Growing Home Entertainment Adoption

The proliferation of streaming platforms, gaming consoles, and high-quality content is driving demand for AV receivers. Consumers are investing in home theater systems to achieve immersive audio-visual experiences, increasing sales of multi-channel and high-power receivers. The trend is reinforced by the rise of work-from-home setups and home-based entertainment, particularly in developed markets.

Technological Advancements and Innovation

AI-based sound optimization, wireless connectivity, multi-room audio, and Dolby Atmos support are major technological drivers in the AV Receiver market. Companies focusing on innovation have witnessed higher adoption rates and customer loyalty. Smart features, such as automated calibration and app-based control, are encouraging users to upgrade from older receivers or alternative audio devices.

Commercial Deployment Expansion

AV receivers are increasingly adopted in commercial venues, including hotels, conference rooms, and auditoriums. Growing infrastructure investments, particularly in North America and Asia-Pacific, support deployment in professional and public spaces. These installations provide long-term revenue opportunities through large-volume contracts and service maintenance agreements.

What are the restraints for the global market?

High Cost of Advanced AV Receivers

Premium AV receivers with multi-channel support, high power output, and smart features are expensive, limiting adoption in price-sensitive regions. Consumers often opt for compact soundbars or integrated audio systems as more cost-effective alternatives, which can reduce the potential market growth for traditional AV receivers.

Competition from Alternative Audio Systems

Compact audio solutions such as soundbars, smart speakers, and wireless home audio systems are gaining popularity, particularly among consumers seeking minimalistic and easy-to-install solutions. This trend poses a challenge for conventional AV receiver manufacturers, requiring continuous innovation to maintain market relevance.

What are the key opportunities in the AV Receiver market?

Emerging Markets Expansion

Countries like India, Brazil, and Southeast Asia offer significant growth opportunities due to rising disposable income, urbanization, and increasing adoption of smart homes. Manufacturers can target these regions with affordable, feature-rich AV receivers to capture new consumer segments.

Integration with Advanced Technologies

Next-generation AV receivers integrating AI, voice control, network streaming, and Dolby Atmos capabilities present a substantial opportunity for differentiation. Early adoption of these technologies can attract tech-savvy consumers and drive higher market share.

Commercial and Institutional Deployment

Commercial spaces such as hotels, auditoriums, and educational institutions are increasingly installing AV receivers for professional audio-visual setups. Governments and private institutions investing in infrastructure create opportunities for long-term contracts and large-scale deployments, enhancing revenue potential for manufacturers.

Product Type Insights

Home theater AV receivers dominate the market, capturing approximately 60% of the 2024 revenue share. Their popularity is attributed to the rising home theater adoption trend, multi-channel audio support, and compatibility with advanced audio formats such as Dolby Atmos. Stereo AV receivers are gaining traction in budget-conscious segments, while professional AV receivers are growing in commercial and institutional deployments.

Application Insights

Residential home entertainment remains the leading application, accounting for 65% of total market share. Commercial applications, including conference rooms, hotels, and auditoriums, are experiencing steady growth. Public venues and institutional deployments are emerging as new areas of demand, particularly in the education and corporate sectors.

Distribution Channel Insights

Online retail platforms account for 40% of the total market share due to convenience, price transparency, and wider product availability. Specialty stores and large retail chains continue to serve traditional buyers seeking hands-on experience and expert guidance. Direct-to-consumer channels are gaining traction as manufacturers enhance their digital presence and offer bundled smart home solutions.

End-User Insights

Residential end-users represent the largest segment, driven by home theater adoption and gaming setups. Commercial deployments in hotels, auditoriums, and conference centers are expanding steadily. Emerging uses in educational institutions and public spaces are opening new avenues for AV receiver adoption, contributing to overall market growth.

| By Product Type | By Channel / Connectivity | By Application | By End-User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest market, contributing 35% to global revenue in 2024. The U.S. leads due to high disposable income, early adoption of smart home systems, and preference for high-quality home theater setups. Canada also shows strong demand, particularly in residential and commercial applications.

Europe

Europe accounts for 25% of the market, with Germany, the U.K., and France driving growth. Consumers prioritize high-performance and multi-room audio systems, while commercial installations in auditoriums and hotels further support the market. Europe is witnessing the steady adoption of eco-friendly and energy-efficient AV receivers.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with a CAGR of 7.1%. India, China, and Southeast Asia lead the growth due to rising middle-class income, urbanization, and smart home adoption. Residential and commercial applications are driving increased AV receiver sales.

Latin America

Latin America represents 8% of the market, with Brazil and Mexico leading adoption. Affluent consumers are investing in home theaters, while outbound adoption of advanced AV receivers is gradually increasing.

Middle East & Africa

Africa remains the hub for professional AV installations, with South Africa, Kenya, and Nigeria seeing significant commercial adoption. Middle Eastern countries, including the UAE and Saudi Arabia, are investing in luxury residential and corporate AV setups, driving regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the AV Receiver Market

- Yamaha Corporation

- Denon

- Marantz

- Onkyo Corporation

- Pioneer Corporation

- Sony Corporation

- Harman International

- Bose Corporation

- Cambridge Audio

- NAD Electronics

- Anthem

- Rotel

- Integra

- Arcam

- Klipsch

Recent Developments

- In March 2025, Yamaha Corporation launched a new line of AI-enabled AV receivers with Dolby Atmos support and multi-room wireless connectivity, targeting premium home theater consumers.

- In February 2025, Denon introduced a compact, network-enabled AV receiver optimized for smart home ecosystems, gaining rapid adoption in North America and Europe.

- In January 2025, Marantz expanded its professional AV receiver portfolio with commercial-grade multi-channel solutions for hotels and auditoriums in APAC, driving institutional adoption.