Artistic Ceramic Decal Market Size

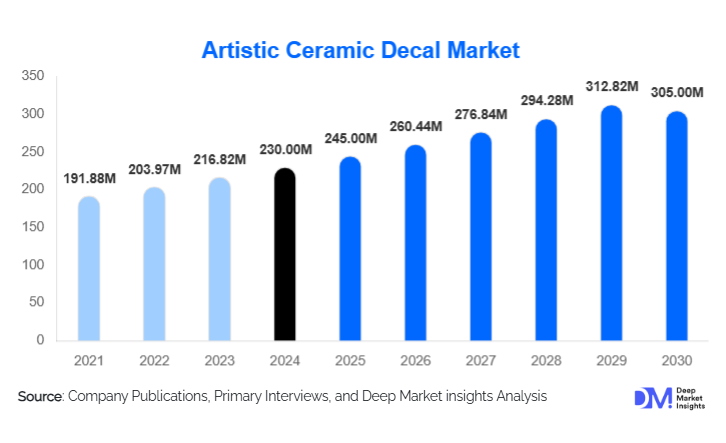

According to Deep Market Insights, the global artistic ceramic decal market size was valued at USD 230 million in 2024 and is projected to grow from USD 244.49 million in 2025 to reach USD 331.84 million by 2030, expanding at a CAGR of 6.3% during the forecast period (2025–2030). The market growth is primarily driven by the increasing demand for customized ceramic artwork, the rising adoption of digital decal printing technologies, and the expanding global interest in home décor and interior design personalization.

Key Market Insights

- Digital decal technology is transforming ceramic art production through high-resolution printing, enabling affordable small-batch customization for artists and manufacturers alike.

- Asia-Pacific dominates global production and consumption due to its strong ceramics manufacturing base and growing domestic demand for decorative homeware.

- Residential décor applications lead the market, accounting for over half of total demand in 2024 as consumers seek aesthetic, artisanal home accessories.

- Europe and North America remain key markets for premium, eco-compliant decals that meet strict regulatory standards on heavy metals and safety.

- Sustainability and eco-friendly ink formulations are gaining traction, driven by environmental compliance and rising consumer awareness.

- E-commerce and direct-to-consumer channels are rapidly expanding, allowing artisans and SMEs to reach global markets with low entry barriers.

What are the latest trends in the artistic ceramic decal market?

Digital Printing Revolutionizing Ceramic Design

Digital decal printing is reshaping the artistic ceramic decal market by enabling quick turnaround times, full-color gradients, and cost-effective small-batch production. This technology allows artisans, designers, and manufacturers to produce intricate designs without a costly silkscreen setup. With advancements in color accuracy, UV stability, and thermal resistance, digital decals are now being used for both decorative and functional ceramic items. The integration of digital workflows also supports mass customization, aligning with global consumer trends toward personalized décor and on-demand production.

Eco-Friendly and Lead-Free Ink Adoption

Environmental regulations in Europe and North America are accelerating the shift toward sustainable materials in ceramic decoration. Manufacturers are investing in lead-free and cadmium-free pigments, water-based adhesives, and low-emission firing processes to meet food safety and environmental standards. This transition not only ensures compliance but also enhances brand positioning among environmentally conscious consumers. In parallel, innovations in biodegradable decal papers and energy-efficient kilns are further reducing the carbon footprint of ceramic decal manufacturing.

Rise of Artisan and Handmade Décor Movements

The global resurgence of craftsmanship and artisanal décor is directly influencing the demand for artistic ceramic decals. Consumers are gravitating toward limited-edition, hand-finished ceramics featuring locally inspired designs. Artisan studios and small-batch producers are using decals to create high-quality, intricate artworks at affordable prices. The trend aligns with broader movements such as slow living, DIY crafts, and boutique interior styling, where authenticity and uniqueness are key value drivers.

What are the key drivers in the artistic ceramic decal market?

Growing Demand for Personalized and Aesthetic Home Décor

The home décor sector is witnessing a paradigm shift toward personalization. Decorative ceramics featuring artistic decals allow consumers to express individuality through custom designs, motifs, and color palettes. Rising disposable incomes and social media–inspired interior aesthetics have created a thriving market for artistic homeware, particularly in urban centers. Customized ceramic vases, tiles, and sculptures are now seen as status symbols and conversation pieces, driving sustained demand.

Technological Advancements in Decal Manufacturing

Recent innovations in inkjet and hybrid printing are expanding design possibilities for ceramic decorators. Digital and silkscreen hybrid techniques enable sharper images, multi-layer effects, and improved heat resistance. Automation and precise temperature control during firing enhance decal durability and color vibrancy. As these technologies become more affordable, even small manufacturers and artisans can produce professional-grade results, fostering the democratization of high-quality ceramic art production.

Expansion of E-Commerce Distribution Channels

Online marketplaces and direct-to-consumer (D2C) websites have become essential growth avenues for the artistic ceramic decal industry. E-commerce platforms allow global visibility for small and mid-sized producers, facilitating international orders without intermediaries. This digital transformation is supported by social media marketing, influencer collaborations, and customizable ordering systems where customers can upload their own designs. The convenience and accessibility of online retail are accelerating sales of both ready-made decals and finished decorative ceramics.

What are the restraints for the global market?

High Production and Compliance Costs

Despite growing demand, the artistic ceramic decal market faces cost challenges stemming from energy-intensive firing processes and raw material expenses. Compliance with international standards, particularly regarding lead and cadmium restrictions, increases production costs. Smaller producers struggle to maintain profitability while meeting safety and environmental regulations. Additionally, fluctuating pigment prices and rising energy costs can compress margins and slow investment in innovation.

Competition from Alternative Decoration Methods

Alternative technologies such as direct digital ceramic printing, heat transfer films, and surface coating methods are competing with traditional decal techniques. These substitutes can offer faster application or lower per-unit cost for high-volume production. Furthermore, non-ceramic décor materials such as vinyl stickers or 3D-printed objects are capturing segments of decorative art demand. To remain competitive, decal manufacturers must emphasize design flexibility, durability, and eco-compliance as differentiating factors.

What are the key opportunities in the artistic ceramic decal industry?

Adoption of Digital and Hybrid Printing Technologies

The transition from silkscreen to digital decal printing presents a significant growth opportunity. Companies that invest in digital technology can offer small-batch customization and quicker turnaround timesideal for artisans, boutique décor brands, and hospitality clients. Digital processes also reduce waste and enable more complex designs, expanding the creative potential of ceramic decoration. Hybrid printing, combining silkscreen and digital methods, is expected to become a mainstream production model.

Sustainability and Eco-Compliant Innovation

With increasing environmental awareness, demand is rising for decals made using lead-free inks, recyclable substrates, and energy-efficient processes. Manufacturers can differentiate by obtaining eco-label certifications and aligning with circular economy principles. The development of biodegradable decal papers and water-based pigments offers potential for premium pricing and access to regulated markets in Europe and North America.

Emerging Market Expansion in Asia-Pacific and Latin America

Rapid urbanization, a growing middle class, and cultural emphasis on home aesthetics are fueling demand for decorative ceramics in emerging economies. India, Vietnam, Brazil, and Mexico represent high-potential markets for both production and consumption. Manufacturers that localize designs and leverage low-cost production can tap into rising domestic demand while also strengthening export competitiveness.

Product Type Insights

Digital decals are the dominant technology segment, accounting for nearly 30% of global market value in 2024. The segment is expanding rapidly as digital printing eliminates setup costs and supports personalized designs. Traditional silkscreen and litho decals still hold significant shares in mass production, especially for tiles and tableware, but face gradual displacement by digital methods offering superior flexibility and visual effects.

Application Insights

Decorative art pieces, vases, and sculptures represent the fastest-growing application segment, holding roughly 25% of the 2024 market share. These items attract consumers seeking high-value, aesthetic décor products with artistic flair. Tableware and decorative tiles remain core applications by volume, but premium art objects generate higher revenue margins and align closely with global artisan décor trends.

Distribution Channel Insights

Offline retail channels such as art and home décor stores currently dominate with about 65% of sales in 2024, supported by tactile consumer experiences and local artisan markets. However, online sales are the fastest-growing channel with an expected CAGR above 8%, driven by digital customization tools and global customer reach.

End-Use Insights

Residential décor applications lead the artistic ceramic decal market with an estimated 55–60% share in 2024. Consumers are investing in ceramic art, decorative tiles, and tableware that reflect individual style and craftsmanship. The commercial sectorincluding hospitality, retail, and corporate interiors the next major segment, showing steady growth as hotels and restaurants adopt customized ceramics to enhance branding and aesthetics.

| By Product Type | By Application | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global artistic ceramic decal market, accounting for approximately 35% of total revenue in 2024. China leads both production and exports, supported by a strong ceramic manufacturing infrastructure. India and Vietnam are emerging as new growth hubs, combining affordable labor with expanding domestic consumption. Rising urbanization, tourism, and cultural emphasis on decorative homeware are key growth enablers.

Europe

Europe represents around 25% of the global market value, led by Germany, Italy, and the U.K. The region emphasizes premium quality, artistic heritage, and strict eco-compliance. European consumers favor sustainable, lead-free decals and artisanal craftsmanship, making it a lucrative region for high-end manufacturers. Growth is steady, driven by cultural appreciation for ceramics and luxury interior design trends.

North America

North America holds roughly a 20–22% share in 2024, with the U.S. as the major market. Demand is strong in boutique home décor, artisanal ceramics, and hospitality design. E-commerce penetration is high, and consumers prefer eco-certified and custom-made decorative pieces. Growth remains moderate but stable, driven by premium product adoption and digital retail expansion.

Latin America

In Latin America, particularly Brazil and Mexico, demand is emerging in residential and hospitality décor. The region’s cultural affinity for vibrant design and handmade craftsmanship supports market entry for decal producers. However, market penetration remains limited by import tariffs and fluctuating raw material costs.

Middle East & Africa

The Middle East & Africa market is growing rapidly due to luxury real estate and tourism development in the Gulf states. The UAE and Saudi Arabia are major consumers of premium ceramics for hotels, malls, and residential interiors. African countries such as South Africa and Egypt show growing interest in decorative ceramics, supported by cultural tourism and local artisan industries.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Artistic Ceramic Decal Market

- Stecol Ceramic Crafts Co., Ltd.

- Tangshan Jiali Ceramic Co., Ltd.

- Handan Ceramic

- Jiangsu Nanyang

- Concord Ceramics

- Leipold International GmbH

- Hi-Coat

- Tullis Russell Coaters Ltd.

- Design Point Decal

- Tony Transfer

- Bel Decal

- Deco Art

- Yimei

- Bailey Decal Ltd.

- Siak Transfers

Recent Developments

- In March 2025, Stecol Ceramic Crafts announced the launch of a new line of eco-friendly water-based decals targeting European and North American markets.

- In February 2025, Tangshan Jiali introduced a hybrid printing system combining silkscreen and digital techniques for multi-color, gradient effects.

- In January 2025, Concord Ceramics invested in energy-efficient kilns to reduce emissions by 20% and enhance production sustainability.