Artificial Turf for Playgrounds Market Size

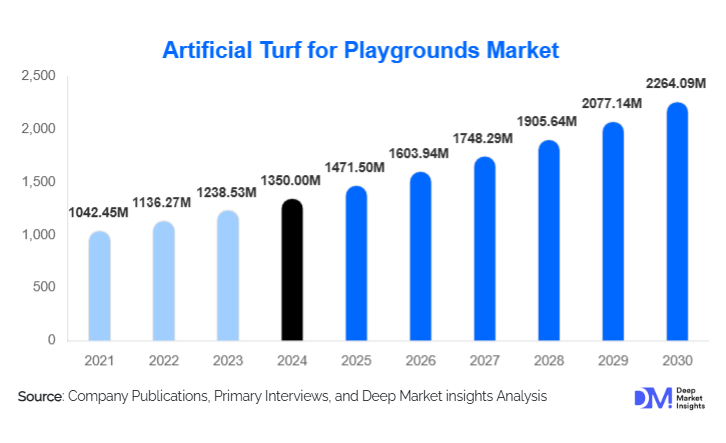

According to Deep Market Insights, the global artificial turf for playgrounds market size was valued at USD 1,350.00 million in 2024 and is projected to grow from USD 1,471.50 million in 2025 to reach USD 2,264.09 million by 2030, expanding at a CAGR of 9.0% during the forecast period (2025–2030). The market growth is primarily driven by increasing investments in child-safe recreational infrastructure, rising urbanization, growing preference for low-maintenance playground surfaces, and stringent enforcement of playground safety and accessibility standards across developed and emerging economies.

Key Market Insights

- Safety-certified artificial turf systems dominate new playground installations, driven by global enforcement of ASTM F1292 and EN 1177 impact-attenuation standards.

- School playgrounds remain the largest demand center, supported by government funding for education infrastructure and injury-prevention initiatives.

- North America leads the global market, backed by high replacement demand and strict safety compliance requirements.

- Asia-Pacific is the fastest-growing region, fueled by urban development, expanding education infrastructure, and smart-city projects.

- Sustainability-focused turf solutions, including recyclable backings and bio-based infill materials, are gaining rapid traction.

- Indoor and commercial play zones are emerging as high-margin application areas, especially in dense urban and extreme-climate regions.

What are the latest trends in the artificial turf for playgrounds market?

Adoption of Advanced Safety and Shock-Absorption Systems

Modern playground turf systems are increasingly designed with multi-layer shock pads, cushioned foam backing, and advanced infill materials to reduce head injury risk from falls. Certified impact-attenuation turf has transitioned from a premium option to a standard requirement in public and school playgrounds. Manufacturers are focusing on modular safety systems that meet varying fall-height requirements, enabling customization based on playground equipment design. This trend is strengthening replacement demand in mature markets while accelerating first-time installations in emerging regions.

Sustainable and Eco-Friendly Turf Solutions

Environmental considerations are shaping procurement decisions globally. Municipalities and school boards are prioritizing recyclable polyethylene fibers, organic infill materials such as cork and coconut husk, and PFAS-free turf formulations. Lifecycle sustainability, including end-of-life recyclability and reduced water consumption, has become a key differentiator among suppliers. Heat-reduction technologies, including infrared-reflective fibers and cooling infills, are also being adopted to address concerns related to surface temperature in warmer climates.

What are the key drivers in the artificial turf for playgrounds market?

Rising Emphasis on Playground Safety and Injury Prevention

Governments and educational institutions are increasingly mandating certified playground surfaces to reduce injury-related liabilities. Artificial turf systems that comply with global safety standards provide consistent fall protection, driving widespread adoption. Growing awareness among parents and communities regarding playground safety has further accelerated demand for high-performance turf solutions.

Lower Lifecycle Cost Compared to Traditional Surfaces

While artificial turf requires higher upfront investment, its significantly lower maintenance costs make it financially attractive over the long term. Reduced spending on irrigation, mowing, reseeding, and surface repairs results in lifecycle cost savings of 30–50% compared to natural grass or loose-fill surfaces. This economic advantage is particularly appealing to budget-constrained municipalities.

What are the restraints for the global market?

High Initial Installation Costs

Premium playground turf systems with shock pads and safety certifications involve substantial upfront costs. This can limit adoption in developing regions or smaller municipalities with constrained budgets. Cost sensitivity remains a key barrier despite favorable long-term economics.

Environmental and Microplastic Concerns

Concerns related to microplastic shedding, recyclability, and environmental impact continue to challenge market perception. Regulatory scrutiny around synthetic materials is increasing, requiring continuous innovation and compliance investments from manufacturers.

What are the key opportunities in the artificial turf for playgrounds industry?

Government-Led Urban and School Infrastructure Programs

Large-scale investments in public parks, schools, and inclusive play spaces represent a major growth opportunity. Urban redevelopment initiatives and smart-city programs are prioritizing durable, accessible, and safe playground surfaces, creating long-term demand pipelines for turf manufacturers.

Growth of Indoor and Commercial Play Facilities

The rapid expansion of indoor play centers, family entertainment venues, and amusement parks is opening new, high-margin opportunities. These facilities demand visually appealing, durable, and hygienic turf systems, encouraging customization and premium pricing.

Product Type Insights

Polyethylene-based artificial turf dominates the market, accounting for approximately 48% of global demand in 2024 due to its softness, durability, and child-friendly texture. Polypropylene turf serves cost-sensitive applications, while nylon turf is preferred for high-traffic zones requiring superior resilience. Hybrid and composite fiber systems are gaining adoption for premium playgrounds that require enhanced performance and longevity.

Application Insights

School playgrounds represent the largest application segment, contributing nearly 38% of total market demand in 2024. Public parks and municipal playgrounds follow closely, driven by urban beautification initiatives. Daycare centers and preschools are increasingly adopting certified turf for child safety, while indoor play zones and amusement centers are emerging as the fastest-growing application segment.

Installation Type Insights

Fully bonded and glued turf systems dominate installations due to their durability and long-term stability, accounting for over 50% of global installations. Modular and interlocking turf tiles are gaining popularity in temporary or indoor playgrounds due to ease of installation and replacement.

| By Product Type | By Installation Type | By Infill Material | By Application | By Safety & Performance Standard |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 34% of the global market share, led by the United States. Strong safety regulations, high replacement demand, and robust public infrastructure spending support market leadership. Canada also shows steady growth driven by school modernization programs.

Europe

Europe accounts for nearly 28% of global demand, with Germany, the U.K., and France leading adoption. Strict safety and accessibility regulations and strong sustainability mandates drive consistent market growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 11% CAGR. China, India, Japan, and Australia are key markets, supported by rapid urbanization, education infrastructure expansion, and rising awareness of playground safety.

Latin America

Latin America is an emerging market led by Brazil and Mexico. Growth is supported by increasing urban development and the gradual adoption of international safety standards.

Middle East & Africa

The Middle East shows strong growth potential, particularly in the UAE and Saudi Arabia, driven by smart-city projects and premium recreational developments. In Africa, South Africa leads adoption in urban and private school playgrounds.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Artificial Turf for Playgrounds Market

- Tarkett

- Shaw Sports Turf

- TenCate Grass

- Polytan

- FieldTurf

- CCGrass

- SIS Pitches

- Act Global

- Sports Group Holding

- Limonta Sport

- Edel Grass

- TigerTurf

- AstroTurf

- Domo Sports Grass

- GreenFields