Area Rugs Market Size

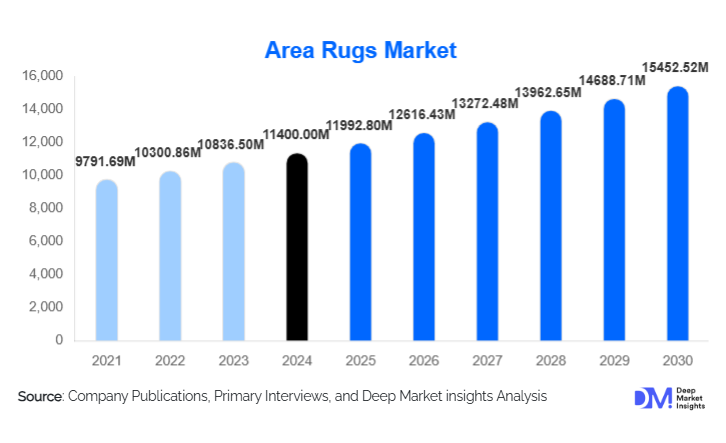

According to Deep Market Insights, the global area rugs market size was valued at USD 11,400.00 million in 2024 and is projected to grow from USD 11,992.80 million in 2025 to reach USD 15,452.52 million by 2030, expanding at a CAGR of 5.20% during the forecast period (2025–2030). The market’s growth is primarily driven by rising residential renovation activities, increasing adoption of e-commerce for home décor products, and growing demand for premium, sustainable, and customizable rug designs across global markets.

Key Market Insights

- Synthetic fiber rugs dominate global sales, driven by affordability, durability, and large-scale machine-made production.

- E-commerce is the fastest-growing distribution channel, supported by AR-based visualization tools and direct-to-consumer rug brands.

- North America remains the highest-value regional market, driven by premiumization and strong interior décor spending.

- Asia-Pacific leads in volume and manufacturing capacity, with India, China, and Turkey serving as global production hubs.

- Sustainability trends are reshaping product design, with increasing adoption of recycled fibers, natural materials, and low-VOC finishing techniques.

- Hospitality and commercial refurbishment cycles are accelerating demand for bespoke and contract-specified rugs.

What are the latest trends in the area rugs market?

Premium, Sustainable & Recycled Fiber Rugs Gaining Traction

Eco-conscious purchasing is transforming the product mix within the area rugs market. Manufacturers are expanding collections made from recycled polyester, reclaimed nylon, organic wool, and natural plant fibers such as jute and sisal. Certifications like OEKO-Tex and GRS (Global Recycled Standard) are increasingly used as brand differentiators. This trend is amplified by government regulations targeting microplastic shedding and chemical emissions in home textiles. Retailers are promoting eco-lines through dedicated sustainability labels, and hospitality buyers are prioritizing certified rugs for LEED, BREEAM, and ESG compliance. The shift not only meets regulatory and consumer expectations but also enables brands to access premium pricing and reduce margin pressure.

Digital Customization & E-commerce Acceleration

Digital design tools, AR-enabled room previews, and on-demand customization platforms are reshaping consumer engagement. Online-first rug brands are leveraging virtual showrooms, 3D rug customization, and free swatch programs to improve conversion rates. Machine-washable rugs, popularized by leading D2C brands, are disrupting traditional rug categories due to convenience and lower lifetime maintenance costs. Commercial and hospitality buyers increasingly use digital specification portals for bespoke rugs, allowing faster iterations, automated sampling, and reduced lead times. This technological shift significantly widens the accessible customer base and lowers inventory risk for suppliers.

What are the key drivers in the area rugs market?

Growing Demand for Home Renovation & Interior Upgrades

Rising global urbanization and the expansion of middle-income households are uplifting spending on home décor. Area rugs, being a high-impact aesthetic upgrade, benefit directly from renovation cycles. In mature markets like the U.S. and Europe, homeowners increasingly prioritize interior personalization, driving demand for contemporary, premium, and bespoke rugs. The growth of rental apartments also supports recurring purchases of small-sized and washable rugs.

Accelerating E-commerce & Omnichannel Retail

E-commerce penetration in home décor has transformed rug-buying behavior. Virtual rug placement tools, consumer reviews, fast shipping, and easy returns remove friction traditionally associated with textile product purchases. Online marketplaces and D2C brands are expanding SKU availability, enabling consumers to access both global and niche artisan-made designs. This shift supports rapid market expansion and greater product diversity.

What are the restraints for the global market?

Raw Material Price Volatility & Margin Pressure

Prices of key raw materials, including polypropylene, nylon, wool, and cotton, are highly sensitive to global commodity cycles and logistics disruptions. Sudden increases in petrochemical feedstock prices directly raise production costs for synthetic rugs, affecting budget and mid-range segments where margins are already thin. Wool supply variability adds further uncertainty to high-end categories.

Competition from Low-Cost Alternatives

Hard flooring options, modular carpet tiles, vinyl plank flooring, and low-cost washable mats increasingly serve as substitutes for area rugs in certain applications. These alternatives appeal to consumers seeking longer-lasting or lower-maintenance products, particularly in commercial spaces. The abundance of low-priced imports also intensifies price competition in budget segments.

What are the key opportunities in the area rugs industry?

Premiumization & Bespoke Contract Rugs

Hotels, office spaces, and luxury residences are increasingly opting for high-end, customized rugs that offer unique designs, acoustic benefits, and brand identity reinforcement. This segment commands high margins and stable long-term contracts. Digitally printed and custom-tufted rugs provide suppliers with substantial flexibility to deliver tailored solutions at competitive lead times.

Expanding Demand for Sustainable & Certified Rugs

Adoption of recycled yarns, natural fibers, and eco-certification creates a strong competitive advantage. As green procurement standards tighten globally, suppliers that invest in sustainable materials and low-impact dyeing processes will gain preferential access to lucrative markets, especially in Europe and North America.

Product Type Insights

Machine-tufted rugs dominate the market, accounting for over 60% of global sales due to affordability, durability, and ease of mass production. Hand-knotted and hand-woven rugs represent the premium category, offering high craftsmanship and long lifecycle value. Synthetic fiber rugs lead volume sales, while wool and natural fiber rugs grow steadily in premium and sustainable product lines. Washable rugs are emerging as a high-growth subcategory, particularly in rental homes and pet-friendly households.

Application Insights

Residential applications represent the largest share, contributing over 58% of market revenue. Consumers purchase rugs for living rooms, bedrooms, hallways, and outdoor spaces. Commercial and hospitality applications are the fastest-growing value segment, driven by refurbishment cycles and demand for bespoke rugs in hotels, retail stores, and corporate offices. Educational and healthcare facilities increasingly specify area rugs for acoustic and ergonomic benefits.

Distribution Channel Insights

Brick-and-mortar stores currently hold a slightly higher share than online channels, as high-touch evaluation remains important for premium and textured rugs. However, online channels are growing at double-digit rates due to convenience, greater design variety, and robust return policies. Direct-to-consumer rug brands are reshaping market expectations with washable rugs, subscription-based rug swaps, and digitally personalized designs.

End-User Type Insights

Residential consumers dominate overall demand, but commercial buyers, including hospitality chains, office developers, and retail outlets, represent the most attractive high-margin user group. Hotels and co-working spaces increasingly install custom area rugs to enhance ambiance and acoustic performance. Institutional buyers seek durable, stain-resistant synthetic rugs for high-traffic settings.

| By Material Type | By Construction Type | By End-Use Application | By Price Tier | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for around 28% of global revenues, supported by high discretionary spending, widespread adoption of premium rugs, and strong e-commerce penetration. The U.S. remains the single largest country market for area rugs globally, driven by renovation cycles and demand for contemporary, washable, and designer rugs.

Europe

Europe holds approximately 18% market share, driven by strong preferences for sustainable, design-led, and certified products. Germany, the U.K., France, and Italy are leading markets. European consumers are early adopters of eco-friendly rugs and artisanal craftsmanship.

Asia-Pacific

Asia-Pacific leads in production and holds 38% of the market volume. China and India dominate manufacturing and increasingly contribute to demand growth through rising urbanization, expanding home décor spending, and growth in residential real estate. The region is also the fastest-growing exporter of mid-range and premium hand-crafted rugs.

Latin America

Latin America holds around 10% market share, with Brazil and Mexico leading regional demand. Consumers increasingly adopt mid-range synthetic rugs due to affordability and durability.

Middle East & Africa

MEA accounts for approximately 6% of the global market. High-income households and hospitality projects in GCC countries drive premium rug adoption. Africa remains the center of traditional artisanal rug production and exports.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Area Rugs Market

- Mohawk Industries

- Shaw Industries

- Oriental Weavers

- Engineered Floors LLC

- Nourison

- Jaipur Rugs

- Surya Inc.

- Safavieh

- Balta Group

- Milliken & Company

- Interface Inc.

- The Dixie Group

- Couristan Inc.

- Capel Inc.

- Ruggable LLC

Recent Developments

- In 2024, several global rug manufacturers expanded their recyclable and eco-certified rug lines, focusing on GRS-certified polyester and natural fiber blends.

- In 2025, leading D2C rug brands introduced AI-powered room preview tools to enhance personalization and customer experience.

- Major hospitality groups initiated multi-year refurbishment programs requiring large volumes of custom-designed, sustainable commercial rugs.