Architectural Lighting Market Size

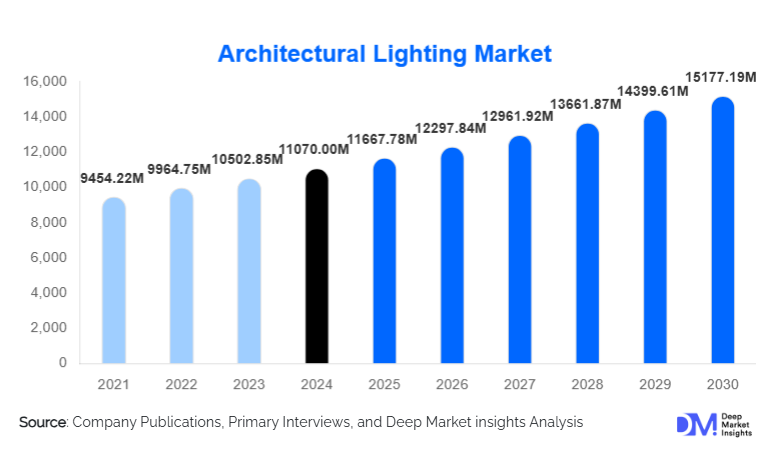

According to Deep Market Insights, the global architectural lighting market size was valued at USD 11,070.00 million in 2024 and is projected to grow from USD 11,667.78 million in 2025 to reach USD 15,177.19 million by 2030, expanding at a CAGR of 5.40% during the forecast period (2025–2030). Market growth is driven by rapid urbanization, increasing investments in commercial and public infrastructure, the global shift toward energy-efficient LED and smart lighting technologies, and rising demand for aesthetic and human-centric lighting in modern architectural design.

Key Market Insights

- LED lighting dominates the architectural lighting landscape, accounting for over 55% of global market share due to its energy efficiency, long lifespan, and design versatility.

- Smart lighting systems integrated with IoT, sensors, and building management systems are rapidly transforming lighting into an intelligent infrastructure layer.

- Asia-Pacific leads global demand, driven by mega infrastructure projects and rapid construction activities in China and India.

- North America remains a strong retrofit-driven market, supported by stringent energy-efficiency regulations and commercial renovation cycles.

- Europe maintains high standards for sustainable building practices, fueling the adoption of LED and low-energy architectural luminaires.

- Architectural lighting is shifting toward human-centric and wellness-focused solutions, particularly in offices, hospitality, and premium residential spaces.

What are the latest trends in the architectural lighting market?

Smart & IoT-Enabled Lighting Driving Intelligent Building Ecosystems

Architectural lighting is undergoing a major transformation with the integration of IoT, advanced sensors, automation platforms, and building management systems (BMS). Smart luminaires equipped with occupancy sensors, daylight harvesting features, and wireless connectivity are now being deployed in large commercial complexes, airports, and modern office environments. These systems optimize energy consumption, enhance occupant comfort, and enable remote monitoring. Cloud-based lighting analytics, AI-driven brightness modulation, and predictive maintenance are gradually becoming mainstream. As smart cities continue expanding globally, architectural lighting is evolving from a design element into a critical infrastructure component supporting sustainability and efficiency goals.

Human-Centric & Aesthetic Lighting Gaining Momentum

Human-centric lighting (HCL), which aligns illumination with circadian rhythms, is influencing design philosophies in workplaces, hospitality environments, and premium residences. Architectural lighting is now expected to enhance mood, productivity, and overall well-being while supporting the aesthetic identity of buildings. Tunable white LEDs, dynamic ambient lighting, and façade lighting systems are increasingly used by architects to craft experiential spaces. Social-media-driven visual design trends, especially in retail and hospitality, are accelerating the adoption of decorative and accent lighting solutions that allow creative expression without compromising sustainability.

What are the key drivers in the architectural lighting market?

Rapid Construction & Infrastructure Expansion

Urbanization in emerging economies and continuous commercial development worldwide are propelling architectural lighting installations. Large-scale projects, including airports, mixed-use complexes, metro stations, hotels, and luxury residences, require advanced lighting solutions for safety, functionality, and aesthetic appeal. Governments are investing heavily in smart cities and public infrastructure modernization, raising demand for façade lighting, landscape lighting, and interior architectural lighting systems.

Shift Toward Energy-Efficient LED Lighting

LED lighting is now the global standard due to its superior durability, low power consumption, and minimal maintenance needs. Regulatory legislation in major markets such as the U.S., Europe, India, and China increasingly mandates energy-efficient lighting solutions. As a result, LED penetration continues to rise across commercial, residential, and outdoor architectural projects. LEDs also enable flexible design elements, color tuning, dynamic dimming, and seamless integration with smart controls, making them ideal for modern architecture.

Growing Emphasis on Design, Aesthetics & Brand Identity

Architectural lighting is now a core component of spatial and brand design. Retail, hospitality, and commercial offices use sophisticated lighting schemes to enhance customer experience and employee productivity. Designers increasingly demand customizable and modular luminaires, specialty accent lighting, and façade lighting to highlight architectural features. This trend drives high-value product segments and accelerates demand for advanced fixtures and smart lighting controls.

What are the restraints for the global market?

High Installation & Upfront Costs

Advanced architectural lighting systems, especially IoT-enabled or custom-designed fixtures, often require substantial initial investment. Retrofitting older buildings involves complexities such as rewiring, structural modifications, and integration with existing control systems. In cost-sensitive markets, these expenses delay adoption and restrict uptake of premium lighting technologies. Moreover, supply chain constraints and rising prices of LED drivers, aluminum housings, and electronic components continue to pressure project budgets.

Regulatory Variability & Market Fragmentation

The architectural lighting industry faces inconsistent safety, certification, and energy-efficiency standards across countries and regions. Navigating diverse codes for commercial lighting, public infrastructure, and residential installations increases compliance costs for manufacturers. Market fragmentation, characterized by hundreds of regional and local manufacturers, also intensifies pricing pressures, making it harder for high-quality global brands to maintain margins in highly competitive segments.

What are the key opportunities in the architectural lighting industry?

Smart Lighting & Building Automation Integration

The rise of intelligent buildings presents a transformative opportunity for lighting vendors. Integration of luminaires with IoT platforms, occupancy analytics, and AI-driven automation is creating new revenue streams. Lighting-as-a-Service (LaaS), predictive maintenance, cloud-connected controls, and interoperability with HVAC and security systems are emerging as high-value offerings. As urban environments shift toward digital infrastructure, smart lighting will play a pivotal role in shaping energy-efficient, responsive spaces.

Retrofit Programs in Aging Infrastructure

Large commercial buildings, public institutions, and transport hubs worldwide are undergoing energy-efficiency upgrades. Replacing fluorescent or HID systems with LED-based architectural lighting offers significant energy savings. Retrofit projects represent recurring and stable demand for manufacturers, installers, and engineering firms. Historical building restorations and façade modernization projects are particularly promising as they require specialized luminaires and custom architectural lighting solutions.

Product Type Insights

LED luminaires dominate the architectural lighting market, capturing more than 55% of global revenue due to their extensive lifespan, low energy usage, and compatibility with smart systems. Luminaires such as downlights, wall washers, track lights, façade projectors, and decorative pendants are in high demand in commercial and hospitality environments. Traditional lighting technologies such as fluorescent and HID systems continue to decline as global regulations tighten. Smart lighting systems, featuring connected controls, dimmers, sensors, and automation, are gaining strong momentum, especially in premium commercial developments. Accessories such as drivers, housings, and lenses also represent steady demand, driven by increased use of modular fixture designs.

Application Insights

Ambient lighting leads application demand, forming the backbone of architectural illumination in commercial and residential buildings. Accent lighting is experiencing rapid growth as designers emphasize aesthetics, branding, and sensorial experiences in hospitality, retail, and cultural spaces. Exterior and façade lighting are expanding due to urban beautification projects and smart city initiatives. Task lighting remains essential in work environments, whereas decorative and specialty lighting cater to premium design-focused installations. Human-centric lighting, a niche but fast-growing application, is gaining adoption in workplaces, hospitals, and educational facilities.

Distribution Channel Insights

Direct sales to contractors, architects, and project developers dominate due to the highly customized nature of architectural lighting projects. However, online channels, including B2B e-commerce platforms, are growing as manufacturers expand digital catalogs and project configuration tools. Specialist lighting design firms and engineering procurement contractors (EPCs) remain pivotal intermediaries for large-scale commercial and public infrastructure projects. Retail stores and distributors primarily serve residential and small commercial customers seeking standardized lighting solutions. Digital product configurators, visualization tools, and virtual lighting simulations are increasingly influencing purchase decisions.

End-Use Insights

The commercial sector leads global adoption, accounting for nearly 50% of the architectural lighting market. Offices, hotels, shopping centers, and airports rely heavily on sophisticated lighting designs that balance function, aesthetics, and energy efficiency. Public infrastructure, including government buildings, metro stations, and airports, is a fast-growing segment driven by modernization and smart city initiatives. The residential sector is also expanding, especially in premium housing markets where designers incorporate accent and decorative lighting to enhance living spaces. Industrial facilities contribute modestly but show rising interest in efficient lighting for modernized plants and warehouses.

| By Product Type | By Lighting Technology | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains a key market driven by strong retrofit activity, stringent energy-efficiency mandates, and dense commercial building stock. The U.S. accounts for the majority share, supported by high investments in office renovations, retail modernization, and infrastructure upgrades. Smart lighting adoption is accelerating due to advanced building automation standards and sustainability certifications such as LEED and WELL.

Europe

Europe is a leader in sustainable architectural lighting, with Germany, the U.K., France, and the Nordics at the forefront. The region's strict ecodesign regulations, carbon-neutral building initiatives, and heritage restoration projects drive demand for high-quality LED and smart lighting fixtures. Retrofit programs in legacy buildings ensure consistent market growth, while smart city initiatives boost demand for façade and landscape lighting.

Asia-Pacific

Asia-Pacific dominates global demand, accounting for over 40% of the market in 2024. China and India lead construction activity, driven by mega infrastructure projects, commercial real estate development, and luxury residential growth. Japan and South Korea continue to adopt advanced smart lighting technologies. Regional demand is expected to grow fastest due to rapid urban development and government-backed modernization initiatives.

Latin America

Latin America is gradually adopting advanced architectural lighting solutions as commercial real estate and hospitality sectors expand in countries such as Brazil, Mexico, and Chile. Economic fluctuations limit high-end project growth, but mid-range lighting solutions remain in steady demand for retail, residential, and institutional buildings. Urban improvement projects in major cities contribute to growing façade and public-space lighting installations.

Middle East & Africa

The Middle East, particularly the UAE, Saudi Arabia, and Qatar, is experiencing strong demand for premium architectural lighting driven by luxury real estate, large hospitality investments, and mega infrastructure developments. Africa is emerging steadily, with South Africa, Kenya, and Nigeria witnessing growing adoption of LED lighting solutions in commercial and public spaces.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Architectural Lighting Market

- Signify Holding B.V.

- Osram GmbH

- Acuity Brands Lighting, Inc.

- Cree Lighting

- Samsung Electronics Co., Ltd.

- Seoul Semiconductor Co., Ltd.

- Hubbell Incorporated

- Zumtobel Group

- Delta Light

- GE Current

- GVA Lighting

- IDEAL Industries, Inc.

- Technical Consumer Products (TCP)

- Griven S.r.l.

- Siteco GmbH

Recent Developments

- In March 2025, Signify expanded its IoT-enabled Interact lighting platform across key North American smart city projects, integrating street and façade lighting with urban data analytics.

- In January 2025, Acuity Brands launched a new line of human-centric architectural luminaires designed for WELL-certified buildings.

- In November 2024, Osram introduced high-efficiency LED modules optimized for tunable white and dynamic architectural lighting applications.