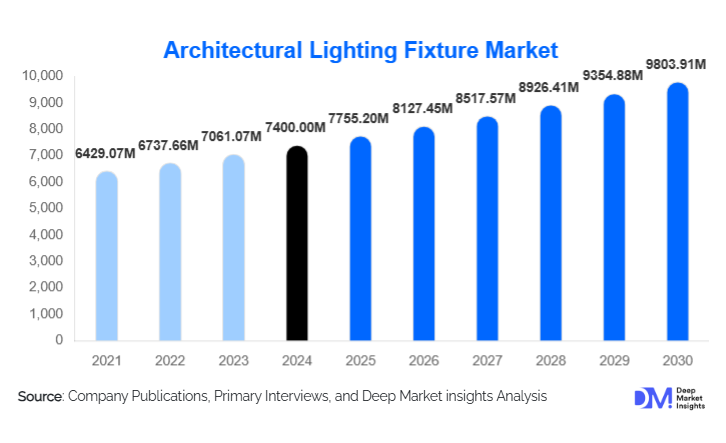

Architectural Lighting Fixture Market Size

According to Deep Market Insights, the global architectural lighting fixture market size was valued at USD 7,400.00 million in 2024 and is projected to grow from USD 7,755.20 million in 2025 to reach USD 9,803.91 million by 2030, expanding at a CAGR of 4.8% during the forecast period (2025–2030). The architectural lighting fixture market growth is primarily driven by rapid urbanization, increasing adoption of LED and smart lighting technologies, and rising investments in commercial construction and public infrastructure projects worldwide.

Key Market Insights

- LED-based architectural lighting dominates the market, accounting for over three-fourths of global demand due to superior energy efficiency and design flexibility.

- Commercial buildings remain the largest application segment, driven by office, retail, hospitality, and mixed-use developments.

- Asia-Pacific leads global demand, supported by rapid urban development and large-scale government infrastructure investments.

- Smart and connected lighting systems are the fastest-growing sub-segment, fueled by smart building and IoT adoption.

- Retrofit and renovation projects are gaining momentum, especially in North America and Europe, due to stricter energy-efficiency regulations.

- Design-centric and human-centric lighting solutions are reshaping customer preferences in premium architectural projects.

What are the latest trends in the architectural lighting fixture market?

Shift Toward Smart and Connected Architectural Lighting

The architectural lighting fixture market is witnessing a strong shift toward smart and connected lighting solutions. Integration of IoT-enabled sensors, wireless communication protocols, and centralized control systems is transforming lighting from a static utility into a dynamic building asset. Smart architectural fixtures enable adaptive brightness, occupancy-based controls, and daylight harvesting, significantly reducing energy consumption. This trend is particularly prominent in commercial offices, airports, healthcare facilities, and smart city infrastructure, where lighting efficiency and real-time monitoring are critical. Vendors offering interoperable platforms compatible with building management systems are gaining a competitive advantage.

Design-Driven and Human-Centric Lighting Adoption

Another key trend is the growing adoption of design-driven and human-centric lighting solutions. Architects and developers increasingly view lighting as a core design element that enhances spatial aesthetics, occupant comfort, and well-being. Tunable white lighting and glare-controlled fixtures are being deployed to support circadian rhythms, especially in workplaces, educational institutions, and healthcare settings. Premium architectural projects are prioritizing customized luminaires with advanced optics and minimalist designs, reinforcing the role of lighting as both a functional and experiential component of modern architecture.

What are the key drivers in the architectural lighting fixture market?

Rapid Adoption of LED Technology

The widespread adoption of LED technology is the most influential growth driver for the architectural lighting fixture market. LEDs offer significantly higher energy efficiency, longer operational life, and lower maintenance costs compared to fluorescent and halogen alternatives. Government regulations phasing out inefficient lighting technologies have accelerated LED penetration across residential, commercial, and public infrastructure projects. Continuous innovation in LED chip efficiency and optical performance further supports sustained demand growth.

Growth in Urban Infrastructure and Commercial Construction

Rapid urbanization and expansion of commercial construction projects are fueling demand for architectural lighting fixtures globally. New offices, shopping centers, hotels, airports, and cultural landmarks require advanced lighting solutions to enhance visual appeal and functionality. Emerging economies in the Asia-Pacific and the Middle East are investing heavily in urban redevelopment and smart infrastructure, directly boosting large-scale architectural lighting deployments.

What are the restraints for the global market?

High Initial Cost of Advanced Architectural Lighting Systems

Advanced architectural lighting solutions, particularly smart and custom-designed fixtures, involve higher upfront costs for products, controls, and installation. This can limit adoption in cost-sensitive projects and developing regions. Although lifecycle cost savings are substantial, budget constraints often slow decision-making among small developers and municipal buyers.

Complexity in Integration and Standardization

The lack of universal standards for smart lighting communication protocols poses integration challenges. Compatibility issues between fixtures, control systems, and building management platforms can increase installation complexity and maintenance costs, acting as a restraint for widespread smart lighting adoption.

What are the key opportunities in the architectural lighting fixture industry?

Government-Led Infrastructure and Smart City Programs

Large-scale government investments in public infrastructure and smart city initiatives present major growth opportunities. Architectural lighting is a critical component of airports, transit hubs, museums, and urban landmarks. Vendors aligned with public procurement standards and sustainability mandates can secure long-term, high-value contracts.

Retrofit and Renovation of Existing Buildings

The growing need to upgrade aging building stock to meet modern energy codes creates strong opportunities in the retrofit segment. Architectural lighting retrofits deliver higher margins, especially when bundled with smart controls and lighting-as-a-service models. This trend is particularly strong in North America and Europe.

Product Type Insights

Indoor architectural lighting fixtures dominate the market, accounting for approximately 58% of global revenue in 2024. Demand is driven by offices, retail spaces, hotels, and residential interiors, where lighting aesthetics and comfort are essential. Outdoor architectural lighting fixtures, including façade and landscape lighting, are gaining traction due to increased investments in urban beautification and public spaces.

Light Source Technology Insights

LED-based architectural lighting fixtures lead the market with an estimated 76% share in 2024. Fluorescent and halogen fixtures continue to decline due to regulatory restrictions and higher operating costs. Smart LED fixtures are the fastest-growing technology sub-segment.

Application Insights

Commercial applications represent the largest share of the architectural lighting fixture market at around 46% in 2024, driven by offices, retail, hospitality, and healthcare facilities. Residential architectural lighting is the fastest-growing application, supported by premium housing developments and smart home adoption. Institutional and public infrastructure applications remain stable contributors.

| By Product Type | By Light Source Technology | By Control & Connectivity | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global market with approximately 38% share in 2024. China accounts for nearly 18% of global demand, driven by urban redevelopment and smart city projects. India is the fastest-growing country, supported by infrastructure expansion and commercial construction growth.

North America

North America holds around 24% of the global market, led by the United States. Strong demand for energy-efficient retrofits, smart offices, and premium architectural lighting solutions supports market stability.

Europe

Europe accounts for roughly 22% market share, driven by stringent energy regulations and high adoption of sustainable building practices in Germany, the U.K., and France.

Middle East & Africa

The Middle East is a fast-growing region due to large-scale infrastructure and hospitality projects in the UAE and Saudi Arabia. Africa shows steady demand in urban centers and tourism-driven developments.

Latin America

Latin America represents a smaller but growing market, led by Brazil and Mexico, where commercial construction and urban modernization projects are expanding.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Architectural Lighting Fixture Market

- Signify

- Acuity Brands

- Zumtobel Group

- Panasonic Corporation

- Hubbell Incorporated

- Fagerhult Group

- Cree Lighting

- Trilux Group

- OSRAM (Lighting Business)

- Delta Electronics

- Eaton Corporation

- WAC Lighting

- Schréder Group

- Lutron Electronics

- Iguzzini Illuminazione