Architectural and Furniture Hardware Market Size

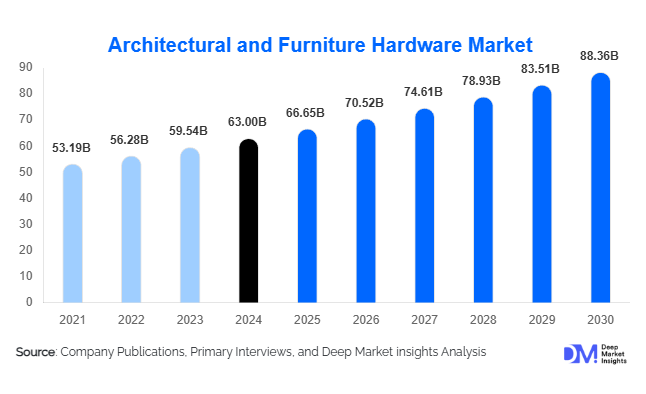

According to Deep Market Insights, the global architectural and furniture hardware market size was valued at USD 63 billion in 2024 and is projected to grow from USD 66.65 billion in 2025 to reach USD 88.36 billion by 2030, expanding at a CAGR of 5.8% during the forecast period (2025–2030). The market growth is primarily driven by increasing construction and renovation activities, rising demand for smart and automated hardware, and growing consumer preference for durable, aesthetically appealing, and sustainable furniture and architectural solutions.

Key Market Insights

- Door and furniture hardware dominate the product segment, with increasing adoption of smart locks, automated sliding systems, and modular fittings across residential and commercial sectors.

- Stainless steel and aluminum remain the preferred materials, offering durability, corrosion resistance, and modern aesthetics for premium construction projects.

- Asia-Pacific is the fastest-growing regional market, led by China, India, and Southeast Asia, driven by urbanization, industrialization, and government infrastructure investments.

- North America and Europe maintain substantial market share, supported by high renovation activity, advanced technology adoption, and preference for premium hardware solutions.

- Online and offline channels are complementing each other, with traditional hardware retailers dominating sales, while e-commerce platforms are increasingly driving convenience, product comparison, and direct manufacturer sales.

- Sustainability and smart integration are shaping product development, with manufacturers focusing on eco-friendly materials, IoT-enabled devices, and modular designs for modern construction and furniture solutions.

What are the latest trends in the architectural and furniture hardware market?

Smart and Automated Hardware Adoption

Manufacturers are increasingly integrating IoT and automation technologies into doors, windows, and furniture. Smart locks, sensor-based sliding doors, automated cabinet fittings, and app-controlled furniture hardware are gaining popularity in residential and commercial spaces. These innovations offer convenience, security, and energy efficiency, appealing to tech-savvy homeowners and premium commercial projects. Integration with smart home ecosystems is becoming a key differentiator among market leaders.

Sustainable and Eco-Friendly Materials

Demand for sustainable materials such as recycled metals, eco-friendly composites, and low-impact aluminum is growing, driven by environmental regulations and green building certifications. Manufacturers are developing products that align with LEED and other sustainability standards, catering to environmentally conscious consumers and large-scale commercial developers. The emphasis on longevity and corrosion resistance further supports the adoption of sustainable materials.

What are the key drivers in the architectural and furniture hardware market?

Rapid Construction and Renovation Activities

The surge in residential, commercial, and industrial construction, particularly in emerging economies, is driving demand for architectural and furniture hardware. Renovation and remodeling projects in developed regions such as North America and Europe further boost demand for premium and replacement hardware, contributing significantly to market growth.

Technological Advancements in Hardware

Innovations like automated sliding systems, modular furniture hardware, and smart locks are increasing adoption in both residential and commercial sectors. These products cater to convenience, security, and design aesthetics, attracting premium customers and boosting the average selling price of hardware solutions.

Urbanization and Growing Middle-Class Affluence

Rising urban populations and increasing disposable income in Asia-Pacific, Latin America, and parts of the Middle East are fueling demand for functional and decorative furniture and architectural hardware. The trend toward modern interiors and smart home integration is expanding market opportunities.

What are the restraints for the global market?

Volatility in Raw Material Prices

Fluctuations in steel, aluminum, and brass prices directly impact manufacturing costs, limiting profitability and pricing flexibility for hardware producers. Dependence on imported metals in some regions further exacerbates this issue.

Compliance with Regulatory and Technical Standards

Stringent safety, quality, and technical standards across regions, including fire-resistance, corrosion-resistance, and sustainability certifications, pose challenges for smaller manufacturers, slowing down market entry and product launches.

What are the key opportunities in the architectural and furniture hardware market?

Integration of Smart Home Technologies

Smart homes are creating new avenues for advanced hardware solutions, including IoT-enabled locks, automated sliding doors, and app-controlled furniture fittings. Companies investing in connected hardware solutions can capture high-value segments in residential and commercial construction.

Expansion in Emerging Markets

Urbanization and infrastructure development in the Asia-Pacific and Latin America present substantial growth opportunities. Affordable yet durable hardware solutions tailored to local construction needs can help new entrants establish a presence, while existing players can scale operations to capture additional market share.

Eco-Friendly and Sustainable Product Lines

With global emphasis on sustainability, hardware solutions made from recycled metals, corrosion-resistant alloys, and eco-composites are in high demand. Manufacturers providing LEED-certified and green-compliant products can differentiate themselves and secure long-term contracts with institutional and government projects.

Product Type Insights

Door hardware leads the market, accounting for approximately 35% of global sales in 2024 (USD 22 billion), driven by high adoption of locks, hinges, and handles in residential and commercial construction. Furniture hardware, particularly cabinet fittings and drawer slides, is growing due to modular furniture trends and increasing home improvement activities. Window hardware remains critical for high-rise residential and office projects, while other architectural fittings like railings, balustrades, and glass accessories are seeing steady demand in luxury construction.

Material Insights

Stainless steel is the leading material, representing 40% of the market (USD 25 billion in 2024), due to its durability, corrosion resistance, and aesthetic appeal. Aluminum and brass are preferred for premium applications, while zinc alloys and composite materials are gaining traction in cost-sensitive and modular hardware segments.

Distribution Channel Insights

Offline retail, including hardware stores and home improvement centers, accounts for 60% of market sales, driven by the need for physical inspection and immediate availability. Online channels are growing rapidly in developed markets like the US, Europe, and China, offering convenience, competitive pricing, and direct manufacturer access.

End-Use Insights

Residential buildings dominate hardware consumption, representing 45% of the market, fueled by new housing projects and renovations. Commercial construction and hospitality sectors are experiencing steady growth due to office expansions, retail outlets, and hotel developments. Institutional and industrial projects are niche yet high-value, requiring specialized hardware for durability and safety. Export-driven demand from APAC to North America and Europe is significant for stainless steel and modular hardware.

| By Product Type | By Material Type | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds 28% of the global market share (USD 17.6 billion in 2024), led by the US and Canada. Growth is driven by high renovation activity, smart home adoption, and preference for premium, technologically advanced hardware solutions. North America’s CAGR is 4.8% (2025-2030).

Europe

Europe accounts for 25% of the market (USD 15.8 billion), with Germany, the UK, and France leading demand due to remodeling projects, commercial construction, and stringent sustainability standards. CAGR is 4.5%.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with 32% market share (USD 20.1 billion). China, India, Japan, and Southeast Asia are driving growth due to urbanization, industrialization, and infrastructure spending. CAGR is 7.2%.

Middle East & Africa

MEA represents 8% of the market (USD 5 billion), with key countries including the UAE, Saudi Arabia, and South Africa. Growth is supported by luxury commercial projects, urban development, and rising disposable income.

Latin America

LATAM holds 7% of the market share (USD 4.4 billion), with Brazil and Mexico leading demand. Urban housing projects and commercial construction drive growth, with a CAGR of 5.5%.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Architectural and Furniture Hardware Market

- ASSA ABLOY

- Hafele

- Allegion

- Stanley Black & Decker

- Spectrum Brands

- C.R. Laurence

- Godrej & Boyce

- Sugatsune

- DormaKaba

- Roto Frank

- Hettich

- Blum

- Knape & Vogt

- Häfele India

- Kason Industries

Recent Developments

- In May 2025, ASSA ABLOY launched a new series of IoT-enabled smart locks across North America, integrating app-based remote access and security analytics for residential and commercial buildings.

- In April 2025, Hafele expanded its sustainable product line in Europe with eco-certified stainless steel and recycled aluminum furniture hardware solutions for green building projects.

- In February 2025, Allegion introduced automated sliding door systems in APAC markets, combining energy efficiency, security, and smart access control for commercial applications.