AR and VR Smart Glasses Market Size

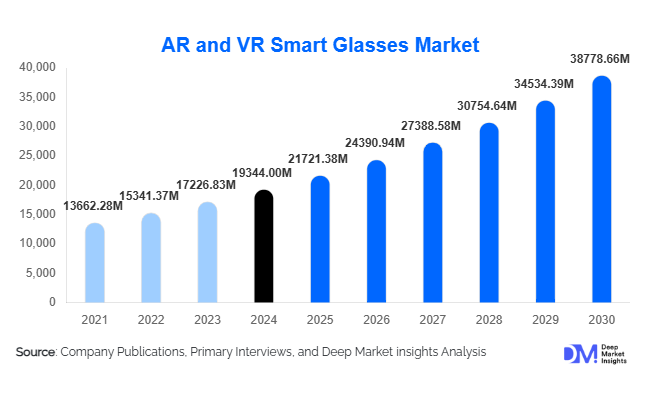

According to Deep Market Insights, the global AR and VR smart glasses market size was valued at USD 19,344.00 million in 2024 and is projected to grow from USD 21,721.38 million in 2025 to reach USD 38,778.66 million by 2030, expanding at a CAGR of 12.29% during the forecast period (2025–2030). The market growth is primarily driven by increasing enterprise adoption, rapid technological advancements in display and sensor systems, rising demand for immersive consumer experiences, and expanding healthcare and industrial applications globally.

Key Market Insights

- AR smart glasses are leading the market, particularly in enterprise applications such as industrial training, remote assistance, and logistics optimization.

- Enterprise adoption dominates the application segment, with industries investing heavily in AR/VR solutions to reduce operational errors and increase productivity.

- North America holds the largest market share, led by the USA due to early adoption, strong consumer and enterprise demand, and robust technological infrastructure.

- Asia-Pacific is the fastest-growing region, driven by government initiatives, increasing digital infrastructure, and rising consumer and industrial demand in China, India, and Japan.

- Consumer gaming and entertainment are expanding, particularly with immersive VR experiences, fueling adoption in premium and mid-range segments.

- Technological integration, including AI, IoT, and cloud connectivity, is enhancing smart glasses' capabilities for both enterprise and consumer applications.

What are the latest trends in the AR and VR smart glasses market?

Enterprise-Focused AR Applications

AR smart glasses are increasingly adopted across industrial and logistics sectors. Use cases include real-time data overlays, remote maintenance guidance, and workforce training. These solutions help reduce downtime, improve safety, and enhance operational efficiency. Enterprises are also leveraging AR glasses for inventory management and quality control, which streamlines processes and reduces human error. Partnerships between AR/VR manufacturers and industrial software providers are enabling seamless integration into existing enterprise workflows.

Immersive Consumer Experiences

VR smart glasses are gaining popularity among gamers, entertainment enthusiasts, and social media users. The devices provide immersive 3D experiences for gaming, VR concerts, virtual travel, and interactive media. Integration with AI and cloud-based platforms enhances content personalization, enabling users to engage in real-time multiplayer interactions. Consumer demand is driving innovation in lightweight form factors, enhanced display technologies, and wireless connectivity.

What are the key drivers in the AR and VR smart glasses market?

Rising Enterprise Adoption

Enterprises across manufacturing, logistics, healthcare, and education are increasingly using AR/VR smart glasses to boost productivity and efficiency. Real-time guidance, remote collaboration, and training solutions reduce operational costs and improve workforce performance. Industrial use cases have become particularly critical in reducing errors and enhancing precision in high-stakes environments.

Technological Advancements

Advances in microLED and OLED displays, motion tracking sensors, eye-tracking, and AI integration are enhancing the functionality and usability of smart glasses. Lightweight designs and improved battery life have increased adoption across enterprise and consumer applications. The introduction of 5G-enabled smart glasses allows low-latency, high-speed AR/VR experiences, further driving market expansion.

Consumer Demand for Immersive Experiences

The gaming, entertainment, and social media sectors are creating high demand for VR-based immersive experiences. Consumers increasingly seek hands-free, interactive content, pushing manufacturers to develop ergonomic designs and high-resolution displays. This trend is particularly prominent among younger, tech-savvy users in North America, Europe, and APAC.

What are the restraints for the global market?

High Device Costs

Premium AR and VR smart glasses are often expensive, restricting adoption in price-sensitive regions. While mid-range and budget options are emerging, the cost remains a barrier for widespread consumer and enterprise use, particularly in emerging markets.

Battery Life and Comfort Issues

Prolonged use of smart glasses can cause discomfort due to the weight and limited battery life. This hampers adoption in enterprise settings and for continuous consumer use, highlighting the need for ergonomic designs and energy-efficient components.

What are the key opportunities in the AR and VR smart glasses market?

Healthcare Applications Expansion

AR and VR smart glasses are transforming surgery, diagnostics, therapy, and medical training. Remote guidance and AR overlays enhance surgical precision and reduce errors. VR-based therapy is increasingly adopted in mental health, rehabilitation, and physiotherapy. Integrating AI and real-time imaging provides significant opportunities for market entrants targeting healthcare innovation.

Emerging Markets and Regional Adoption

APAC and LATAM are emerging as high-growth regions due to government-led digital initiatives, rising smartphone penetration, and improving internet infrastructure. India, China, and Brazil offer opportunities for cost-effective smart glasses solutions targeting the enterprise, education, and healthcare sectors. Regional customization and competitive pricing can accelerate market penetration.

Integration with Advanced Technologies

Integration of AI, IoT, cloud computing, and AR/VR software platforms enhances device functionality. Predictive maintenance, contextual data overlays, and analytics-driven insights are key differentiators for enterprise applications. Companies investing in R&D to integrate these technologies can capture high-value contracts and strengthen market leadership.

Product Type Insights

AR smart glasses dominate the technology segment with a 45% share of the 2024 market, driven by industrial and enterprise applications. VR smart glasses are prominent in consumer gaming and entertainment. Lightweight form factors represent 50% of the market, favored for comfort during prolonged use. Premium devices (>USD 1,000) account for 55% of the market, primarily adopted in healthcare and enterprise sectors. Mid-range and budget segments are growing in APAC and emerging markets.

Application Insights

Enterprise applications hold the largest share at 40%, including industrial training, logistics optimization, and remote maintenance. Healthcare adoption is growing rapidly due to AR-assisted surgeries and VR therapy. Consumer applications, such as gaming, immersive entertainment, and social media, are expanding, particularly in North America, Europe, and APAC. Education and research applications are emerging, with AR/VR devices enabling interactive learning and virtual labs.

Distribution Channel Insights

Online retail dominates smart glasses distribution, driven by direct-to-consumer platforms and e-commerce adoption. Enterprise direct sales are significant for industrial applications, with manufacturers providing customized solutions. Offline retail channels are growing in APAC and Europe, where consumer adoption is expanding. Partnerships with technology integrators and software providers enhance market penetration and customer support services.

End-Use Insights

Enterprises, particularly in manufacturing, logistics, and healthcare, are the fastest-growing end-use segment, projected to expand at a CAGR of 14% through 2030. Consumer gaming and entertainment are also key drivers, particularly for mid-range and premium devices. Emerging applications in education, military, and research sectors provide additional growth avenues. Export-driven demand from APAC manufacturers to North America and Europe is increasing, driven by enterprise adoption and premium device consumption.

| By Technology | By Component | By Application | By Form Factor | By Price Range | By Distribution Channel |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America holds 35% of the 2024 market, led by the USA due to early adoption, enterprise investments, and consumer demand for VR gaming and AR solutions. Canada contributes 10% of the regional market. Government support, industrial digitalization, and robust technology infrastructure drive adoption.

Europe

Europe accounts for 25% of the market, led by Germany, the UK, and France. Industrial applications, healthcare solutions, and immersive entertainment contribute to growth. Europe is also highly receptive to sustainable, ergonomic, and high-performance smart glasses.

Asia-Pacific

APAC is the fastest-growing region with a CAGR of 15%. China, India, and Japan lead growth, driven by government initiatives, industrial digitalization, and rising consumer adoption. India is emerging as a key market for enterprise and educational applications. Expansion of manufacturing capabilities and local R&D hubs further accelerates growth.

Middle East & Africa

The region accounts for 8% of the global market, driven by the UAE, Saudi Arabia, and South Africa. Industrial and enterprise adoption is growing due to smart infrastructure initiatives and government-led digitalization programs. Intra-regional enterprise adoption is also contributing to market expansion.

Latin America

Latin America contributes 7% of the global market, led by Brazil and Mexico. Demand is primarily enterprise-driven, with growing interest in industrial digitalization and emerging consumer applications.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the AR and VR Smart Glasses Market

- Microsoft

- Meta Platforms

- Apple

- Sony

- Magic Leap

- HTC

- Epson

- Vuzix

- Lenovo

- RealWear

- Samsung

- North

- Nreal

- Snap

- Rokid

Recent Developments

- In January 2025, Microsoft launched an updated HoloLens model with enhanced AR overlays for industrial applications and improved battery life for extended enterprise use.

- In March 2025, Meta Platforms introduced Quest Pro smart glasses with advanced VR display technology for gaming and collaborative enterprise solutions.

- In June 2025, Apple unveiled AR glasses integrated with the iOS ecosystem, offering real-time navigation, immersive content, and enterprise productivity tools.