Antiseptic Bathing Products Market Size

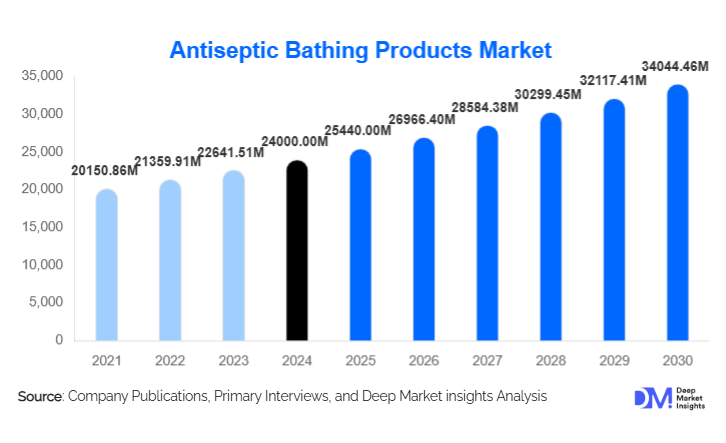

According to Deep Market Insights, the global antiseptic bathing products market size was valued at USD 24,000.00 million in 2024 and is projected to grow from USD 25,440.00 million in 2025 to reach USD 34,044.46 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). The market growth is primarily driven by rising hospital-acquired infection (HAI) rates, increasing surgical volumes, stricter infection prevention protocols, and the expanding adoption of antiseptic hygiene practices across hospitals, long-term care facilities, and home healthcare settings.

Key Market Insights

- Hospitals and surgical centers dominate global demand, driven by mandatory pre-operative bathing and ICU infection control protocols.

- Chlorhexidine-based formulations remain the gold standard in clinical antiseptic bathing due to their broad-spectrum antimicrobial efficacy.

- Antiseptic bathing wipes are the leading product category, favored for ease of use, waterless application, and reduced cross-contamination risk.

- North America leads global consumption, supported by stringent healthcare regulations and high healthcare spending.

- Asia-Pacific is the fastest-growing region, driven by healthcare infrastructure expansion and rising awareness of infection prevention.

- Innovation in skin-friendly and alcohol-free formulations is reshaping product development strategies.

What are the latest trends in the antiseptic bathing products market?

Rising Adoption of Disposable Antiseptic Bathing Wipes

Disposable antiseptic bathing wipes are increasingly replacing traditional soap-and-water bathing in hospitals and long-term care facilities. These wipes reduce water usage, minimize infection risk, and improve caregiver efficiency. ICUs, burn units, and isolation wards are the primary adopters, with daily antiseptic bathing protocols becoming standard practice. Manufacturers are focusing on lint-free, biodegradable, and skin-pH-balanced wipes to meet both clinical and sustainability requirements.

Shift Toward Skin-Safe and Natural Formulations

Concerns over skin irritation and antimicrobial resistance have accelerated demand for alcohol-free, fragrance-free, and herbal antiseptic bathing products. Hospitals and long-term care facilities are increasingly opting for formulations that balance antimicrobial efficacy with patient comfort, particularly for elderly and neonatal patients. Natural antiseptic actives and dermatologically tested formulations are gaining traction, especially in Europe and parts of the Asia-Pacific.

What are the key drivers in the antiseptic bathing products market?

Increasing Incidence of Hospital-Acquired Infections

HAIs remain a major global healthcare challenge, leading to longer hospital stays, higher treatment costs, and increased mortality. Antiseptic bathing has proven effective in reducing bloodstream infections, MRSA colonization, and surgical site infections. As a result, healthcare providers worldwide are adopting daily antiseptic bathing protocols, significantly driving market demand.

Growth in Surgical Procedures and Critical Care Admissions

The steady rise in elective and emergency surgeries has reinforced the use of antiseptic bathing products as part of pre-operative preparation. Additionally, growing ICU admissions due to chronic illnesses and aging populations are increasing the need for routine antiseptic hygiene, further supporting market growth.

What are the restraints for the global market?

Skin Sensitivity and Allergic Reactions

Prolonged use of certain antiseptic formulations, particularly high-concentration chlorhexidine products, may cause skin irritation or allergic reactions in sensitive patients. This limits long-term usage in specific patient groups and necessitates continuous formulation improvements.

Cost Constraints in Emerging Markets

Premium antiseptic bathing products are often cost-prohibitive for low-resource healthcare systems, restricting widespread adoption in developing regions. Budget limitations in public hospitals remain a key barrier to market penetration.

What are the key opportunities in the antiseptic bathing products industry?

Expansion of Home Healthcare and Elderly Care

The rapid growth of home healthcare services and aging populations presents a major opportunity. Antiseptic bathing wipes and mild antiseptic washes designed for self-care and caregiver-assisted use are gaining popularity, particularly in North America, Europe, and Japan.

Government-Led Infection Prevention Initiatives

Mandatory infection control guidelines and hospital accreditation requirements are creating long-term procurement opportunities. Manufacturers aligned with public healthcare tenders and national infection prevention programs stand to gain sustained revenue growth.

Product Type Insights

Antiseptic bathing wipes account for approximately 34% of the global market in 2024, driven by their convenience, reduced water dependency, and suitability for critical care settings. Liquid antiseptic soaps and body washes follow, widely used for pre-operative and routine patient bathing. Antiseptic bar soaps remain relevant in cost-sensitive markets, while foams, mousses, and pre-operative cleansing kits cater to specialized clinical applications.

Active Ingredient Insights

Chlorhexidine-based products dominate the market with a 42% share, supported by strong clinical evidence and widespread guideline endorsement. Povidone-iodine formulations are widely used in surgical settings, while benzalkonium chloride and herbal antiseptics are gaining traction for sensitive skin applications.

End-Use Insights

Hospitals and surgical centers represent nearly 48% of global demand, driven by high patient volumes and institutional procurement contracts. Long-term care facilities are the fastest-growing end-use segment, expanding at over 9% CAGR, while home healthcare is emerging as a high-growth application due to aging populations and chronic disease management.

Distribution Channel Insights

Direct institutional procurement dominates distribution, accounting for approximately 41% of sales, supported by bulk purchasing and long-term supply agreements. Hospital pharmacies, retail pharmacies, and online channels are gaining importance, particularly for home healthcare consumers.

| By Product Type | By Active Ingredient | By Application | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 36% of the global market share in 2024, led by the United States. Strong regulatory enforcement, high healthcare expenditure, and widespread adoption of infection prevention protocols drive demand. Canada also contributes steadily through long-term care and home healthcare usage.

Europe

Europe accounts for nearly 28% of global demand, with Germany, France, and the UK as key markets. The region emphasizes patient safety, antimicrobial stewardship, and sustainable healthcare products, supporting consistent market growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at over 10% CAGR. China, India, and Japan lead demand, driven by hospital expansion, rising surgical volumes, and improving healthcare standards. Government-backed healthcare investments are accelerating adoption.

Latin America

Brazil and Mexico dominate regional demand, supported by expanding private healthcare networks and rising awareness of infection prevention practices.

Middle East & Africa

Growth is driven by hospital infrastructure expansion in Saudi Arabia, the UAE, and South Africa. Government healthcare modernization initiatives are increasing antiseptic bathing product adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Antiseptic Bathing Products Market

- 3M

- Johnson & Johnson

- Reckitt Benckiser

- Medline Industries

- Cardinal Health

- Ecolab

- Becton Dickinson (BD)

- Stryker

- Mölnlycke Health Care

- Kimberly-Clark

- Paul Hartmann AG

- ConvaTec

- Sage Products

- GOJO Industries

- PDI Healthcare