Anti-Cellulite Care Products Market Size

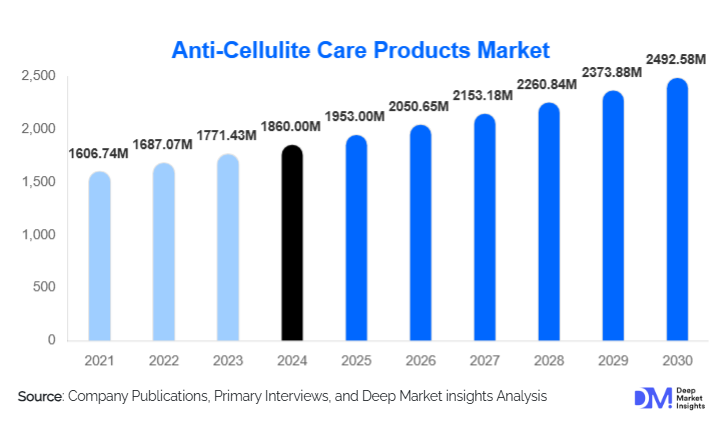

According to Deep Market Insights, the global anti-cellulite care products market size was valued at USD 1,860.00 million in 2024 and is projected to grow from USD 1,953.00 million in 2025 to reach USD 2,492.58 million by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). The market growth is primarily driven by rising beauty consciousness, increasing adoption of non-invasive body-contouring solutions, and rapid advancements in cosmetic science, enabling more effective cellulite-reducing formulations. The surge in online retail penetration and consumer preference for clinical-grade, clean-label skincare also significantly contributes to market expansion worldwide.

Key Market Insights

- Topical creams and lotions remain the most widely used product type, accounting for 42% of the global market in 2024 due to affordability and convenience.

- Caffeine-based formulations dominate ingredient preferences, holding a 36% share as consumers increasingly seek fast-absorbing, circulation-boosting actives.

- Asia-Pacific is the fastest-growing region, with a 9.2% CAGR driven by rising middle-class incomes and strong e-commerce absorption.

- Women represent 89% of global demand, making them the most influential consumer segment for anti-cellulite product adoption.

- Online retail leads distribution, capturing 34% of global sales due to influencer marketing, product reviews, and convenient replenishment cycles.

- Premium and clinical-grade products are expanding rapidly as consumers increasingly seek proven, science-backed solutions for body sculpting.

- Device-plus-serum combinations (radiofrequency, ultrasound) are reshaping at-home cellulite treatment trends.

What are the latest trends in the anti-cellulite care products market?

Clean-Label and High-Performance Cosmetic Formulations

The market is experiencing a strong shift toward clean, natural, and dermatology-backed formulations. Consumers now demand ingredient transparency and clinically validated performance, prompting brands to develop plant-based retinol alternatives, marine extracts, peptide complexes, encapsulated caffeine, and non-synthetic emulsifiers. The clean-beauty movement has driven premium price acceptance, while sustainability concerns have led to biodegradable packaging, cruelty-free certifications, and ethical sourcing. This trend is especially prominent in Europe and North America, where eco-conscious skincare purchasing behaviors are well established.

Rise of At-Home Body Contouring Devices

Technologically advanced at-home cellulite treatment devices, such as radiofrequency tools, microcurrent rollers, and ultrasound massagers, are becoming mainstream. These devices are increasingly paired with targeted serums to enhance absorption and boost results, creating a high-value hybrid product ecosystem. Younger consumers, particularly in APAC, are adopting these solutions due to convenience and cost-effectiveness compared to clinical procedures. E-commerce channels now heavily feature device-plus-serum bundles, subscription refills, and app-integrated usage guides, further accelerating adoption. This emerging segment is set to become one of the strongest growth areas through 2030.

What are the key drivers in the anti-cellulite care products market?

Increasing Beauty and Body-Contouring Awareness

Global consumers are more focused than ever on body aesthetics, influenced by social media, influencer culture, and the popularity of fitness and skin-sculpting trends. With rising desire for smooth skin and improved texture, demand for high-performance cellulite reduction products has surged. This is especially strong among women aged 18–45, who contribute the majority of global sales.

Innovation in Skincare Science and Dermatology

Breakthroughs in cosmetic chemistry, including nano-emulsions, encapsulated actives, peptide technologies, and marine extracts, have enhanced product efficacy and consumer confidence. These innovations allow deeper penetration of active ingredients and more consistent results, driving premium segment growth. Clinical-grade products once confined to aesthetic clinics are now widely available through retail channels.

Expansion of E-Commerce and Digital Beauty Ecosystems

The proliferation of digital commerce platforms has significantly expanded the reach of anti-cellulite products. Online channels offer extensive consumer education, product comparisons, influencer testimonials, and subscription-based replenishment models. This ease of access has pushed online retail to 34% of global sales, making it the leading distribution channel in 2024.

What are the restraints for the global market?

Variability in Product Results and Limited Clinical Proof

Despite strong demand, product outcomes can vary greatly among individuals, which occasionally results in consumer skepticism. Lack of standardized testing and inconsistent clinical evidence across brands also limits widespread adoption of premium-priced solutions. This restraint is particularly relevant in emerging markets where price sensitivity is higher.

High Cost of Premium and Device-Based Solutions

Advanced cellulite reduction devices, professional-grade serums, and clinical formulations remain expensive, restricting their accessibility among cost-conscious consumers. This price barrier affects adoption especially in Latin America, Southeast Asia, and Africa, where disposable incomes are lower and mass-market alternatives are preferred.

What are the key opportunities in the anti-cellulite care products industry?

Expansion Across Emerging Markets

APAC, Latin America, and the Middle East are witnessing rapid beauty market expansion driven by rising disposable incomes, urbanization, and social media influence. Localized formulations, such as lightweight gels for humid climates or herbal-based products preferred in India and Indonesia, present significant opportunities for global brands to penetrate these high-growth markets.

Integration of Wellness and Aesthetic Body Care

The convergence of wellness, spa therapies, and beauty routines is creating new premium opportunities. Anti-cellulite massages, thermal wraps, spa-based slimming rituals, and device-assisted wellness treatments are gaining traction in resorts and high-end spas. This shift offers manufacturers new B2B channels beyond traditional retail.

Clean Beauty and Sustainable Ingredient Innovations

As consumers increasingly demand environmentally friendly and transparently sourced cosmetic products, brands that innovate with sustainable botanicals, organic essential oils, biodegradable packaging, and eco-friendly emulsification technologies can gain a competitive edge. This opportunity is especially strong in Europe, where regulatory and consumer pressure are highest.

Product Type Insights

Topical creams & lotions lead the category, accounting for 42% of the global market in 2024 due to affordability, ease of application, and widespread retail penetration. Gels and serums are rapidly rising in popularity because of their lightweight texture and fast absorption, especially in warm climates. Device-driven solutions are gaining momentum as part of home-based body-contouring routines, while supplements and patches remain niche categories supported by consumers seeking holistic or targeted solutions.

Application Insights

Thighs and hips represent the largest application segment, contributing 51% of total product usage in 2024 due to high cellulite prevalence in these areas. Abdomen and buttocks applications are also growing rapidly, supported by fitness and body-toning trends. Arm-specific products, though smaller in volume, are emerging as new opportunities as consumers increasingly seek complete body-care routines. Thermal wraps, massage tools, and focused serums continue to expand application-specific product ecosystems.

Distribution Channel Insights

Online retail dominates, contributing 34% of market revenue in 2024. E-commerce platforms allow access to niche brands, international products, and dermatologist-endorsed formulations. Specialty beauty stores and pharmacies remain vital for premium and clinical-grade sales, offering expert guidance and product trials. Dermatology clinics are expanding their retail sections with professional-grade serums and device-compatible formulas, driving higher-margin sales. Supermarkets cater primarily to value and mass-market consumers.

Consumer Type Insights

Women dominate the market with a 89% share due to higher cellulite prevalence and greater investment in body-care regimens. Men represent a smaller but steadily growing segment, supported by rising interest in fitness, grooming, and aesthetic self-care. Urban consumers drive premium product adoption, while rural markets lean toward mass and value-based products. Younger consumers prefer lightweight, clean-label formulas, while older buyers gravitate toward high-efficacy, clinical-grade products.

Age Group Insights

Consumers aged 25–45 account for the largest market share, driven by aesthetic awareness and purchasing power. The 18–25 segment is rapidly adopting device-based solutions and affordable serums promoted on social media platforms. Older demographics (45+) emphasize anti-aging and firming benefits, driving demand for retinol and peptide-based complex formulations. This group also prefers dermatologist-endorsed and clinically validated brands.

| By Product Type | By Ingredient Type | By Gender | By Distribution Channel | By Price Range |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 32% of global demand, with the U.S. leading due to high skincare expenditure and rapid adoption of premium cosmeceuticals. Strong presence of dermatology chains and aesthetic clinics further boosts sales of advanced products. Canadian consumers display a high affinity for natural and clean-label formulations.

Europe

Europe maintains a 29% market share and remains the world’s most mature region for clean beauty and sustainable personal care. Germany, France, Italy, and the U.K. lead demand, driven by strong skincare culture and regulatory emphasis on product safety and transparency. Specialty beauty retailers and pharmacies dominate distribution.

Asia-Pacific

APAC is the fastest-growing region with a 9.2% CAGR. China, Japan, South Korea, and India drive demand through rising disposable incomes and strong beauty retail ecosystems. K-beauty and J-beauty trends influence product innovation, especially in formulation aesthetics and skincare routines.

Latin America

Brazil and Mexico dominate regional demand, propelled by strong beauty culture and high consumption of body-care products. Brazil, in particular, is one of the world’s largest body-care markets, driven by fitness, fashion, and beach-oriented lifestyles. Digital influencers significantly shape consumer preferences.

Middle East & Africa

The Middle East shows growing demand, led by the UAE and Saudi Arabia, where consumers favor premium cosmetic and dermatology-backed brands. Africa’s demand is centered in South Africa, where Western beauty standards and strong retail distribution support market growth. Rising spa and wellness tourism in both regions is boosting sales of professional-grade body-contouring formulations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Anti-Cellulite Care Products Market

- L’Oréal Group

- Beiersdorf AG

- Unilever

- Clarins Group

- Shiseido Co. Ltd.

- Estée Lauder Companies

- Procter & Gamble

- Oriflame

- Avon

- Amorepacific Corporation

- Coty Inc.

- Elemis (L’Occitane Group)

- Galderma

- Natura & Co.

- Kao Corporation

Recent Developments

- In 2025, L’Oréal expanded its clinical-grade body-care line with encapsulated caffeine serums designed for deeper penetration and longer-lasting results.

- In 2025, Clarins introduced a sustainable reformulation of its flagship anti-cellulite cream using marine extracts sourced through eco-certified harvesting.

- In early 2025, Shiseido launched an AI-enabled skin diagnostic tool for personalized cellulite care routine recommendations.