Analog Security Cameras Market Size

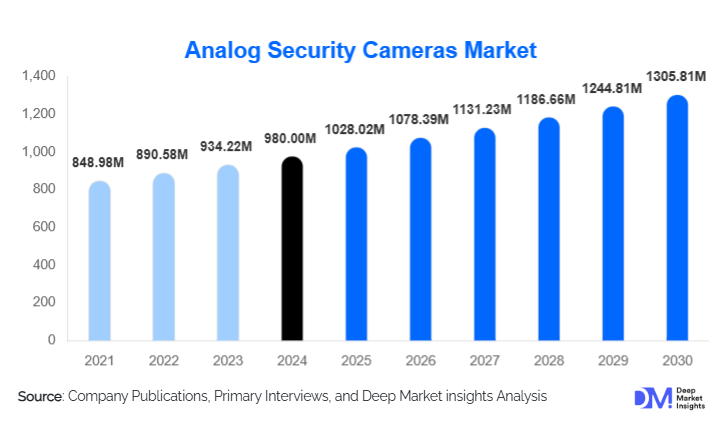

According to Deep Market Insights, the global analog security cameras market size was valued at USD 980.00 million in 2024 and is projected to grow from USD 1,028.02 million in 2025 to reach USD 1,305.81 million by 2030, expanding at a CAGR of 4.9% during the forecast period (2025–2030). The market growth is primarily driven by the continued demand for cost-effective video surveillance solutions, large-scale public infrastructure deployments, and the widespread adoption of high-definition analog technologies that enhance performance while retaining compatibility with legacy systems.

Key Market Insights

- HD analog cameras (AHD, HD-TVI, HD-CVI) dominate deployments, accounting for over 60% of installations as users upgrade legacy SD systems.

- Public infrastructure and government surveillance projects remain the largest demand drivers, particularly in emerging economies.

- Asia-Pacific leads the global market, supported by urbanization, smart city initiatives, and cost-sensitive surveillance requirements.

- Hybrid surveillance systems combining analog cameras with digital video management platforms are extending product lifecycles.

- Outdoor and perimeter security applications represent the largest share of analog camera demand globally.

- Affordability and ease of installation continue to differentiate analog cameras from IP-based alternatives.

What are the latest trends in the analog security cameras market?

Transition from SD to HD Analog Surveillance

The analog security cameras market is experiencing a steady transition from standard-definition systems toward HD analog technologies. Organizations with large installed bases of coaxial cabling are increasingly opting for HD analog upgrades to achieve improved resolution, night vision, and longer transmission distances without replacing existing infrastructure. This trend is particularly strong in retail chains, industrial facilities, transportation hubs, and residential complexes where full IP migration is cost-prohibitive. HD analog cameras now support resolutions comparable to entry-level IP cameras, reinforcing their relevance in modern surveillance ecosystems.

Integration with Hybrid and AI-Enabled Video Management Systems

Another key trend is the integration of analog cameras with hybrid DVRs and advanced video management systems. These platforms enable features such as motion detection, intrusion alerts, and basic video analytics, enhancing the functional value of analog systems. Manufacturers are increasingly positioning analog cameras as part of hybrid architectures rather than standalone solutions, ensuring compatibility with analytics, centralized monitoring, and remote access. This approach is helping analog surveillance remain competitive in commercial and public-sector deployments.

What are the key drivers in the analog security cameras market?

Cost-Effective Surveillance for Mass Deployment

Cost efficiency remains the strongest driver of the analog security cameras market. Analog systems typically offer lower upfront equipment costs, reduced installation complexity, and minimal networking requirements compared to IP-based surveillance. This makes them particularly attractive for large-scale deployments such as city-wide surveillance, transportation corridors, public housing, and educational institutions. Budget-constrained governments and small-to-medium enterprises continue to favor analog solutions for reliable, wide-area monitoring.

Expansion of Public Infrastructure and Urban Surveillance

Rapid urbanization and increased government spending on public safety infrastructure are significantly boosting demand for analog security cameras. Surveillance mandates across transportation networks, industrial zones, and municipal facilities are driving procurement volumes, especially in Asia-Pacific, the Middle East, and Africa. Analog cameras are widely selected for outdoor and perimeter security due to their robustness, ease of maintenance, and suitability for long-distance monitoring.

What are the restraints for the global market?

Rising Adoption of IP and Cloud-Based Surveillance

The growing availability of affordable IP cameras and cloud-based surveillance platforms poses a structural challenge to the analog security cameras market. As network infrastructure improves in developed regions, enterprises are increasingly adopting IP systems that offer higher scalability, advanced analytics, and cloud storage. This shift limits long-term growth opportunities for analog cameras in technologically mature markets.

Limited Native Intelligence and Scalability

Analog cameras inherently lack native intelligence and seamless scalability compared to IP solutions. Although hybrid systems mitigate some limitations, analog surveillance remains less suitable for applications requiring real-time analytics, facial recognition, or cloud integration. These constraints restrict adoption in high-security and data-intensive environments such as banking, critical infrastructure, and smart buildings.

What are the key opportunities in the analog security cameras market?

Replacement and Upgrade of Legacy Surveillance Systems

A significant opportunity lies in the global replacement cycle of aging SD analog cameras. Millions of legacy systems installed over the past decade are reaching end-of-life, creating sustained demand for HD analog upgrades. Organizations are increasingly choosing HD analog solutions to enhance image quality while retaining existing cabling and infrastructure, generating recurring revenue opportunities for manufacturers.

Emerging Market and Government-Led Surveillance Demand

Emerging economies across Asia-Pacific, Latin America, and the Middle East present strong growth opportunities driven by public safety initiatives and expanding urban infrastructure. Government-funded surveillance projects, border security, and transportation monitoring programs continue to prioritize analog cameras for their affordability, scalability, and ease of deployment.

Product Type Insights

Bullet cameras dominate the analog security cameras market, accounting for approximately 34% of global revenue in 2024. Their long-range visibility, weather resistance, and suitability for outdoor installations make them the preferred choice for perimeter security and public surveillance. Dome cameras hold a significant share in indoor commercial and residential applications due to their discreet design and vandal resistance. PTZ cameras, while smaller in volume, command higher value in critical infrastructure and traffic monitoring applications where wide-area coverage is required.

Application Insights

Video surveillance and monitoring represent the largest application segment, contributing nearly 68% of total market demand. This dominance is driven by crime prevention, asset protection, and operational monitoring across public and private facilities. Perimeter security applications are growing steadily, particularly in industrial parks, warehouses, and transportation hubs. Traffic and public safety monitoring applications are expanding rapidly in urban centers, supported by government investments in smart transportation systems.

End-Use Industry Insights

The commercial sector leads the market with approximately 36% share, driven by retail surveillance, office security, and hospitality applications. Government and public infrastructure represent the fastest-growing end-use segment, accounting for around 29% of demand in 2024, supported by city surveillance and transportation projects. Industrial applications are witnessing increased adoption for warehouse security, process monitoring, and compliance requirements. Residential demand remains strong in emerging markets, where analog cameras serve as entry-level security solutions.

| By Product Type | By Installation Type | By Application | By End Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global analog security cameras market with approximately 41% share in 2024. China leads regional demand due to extensive urban surveillance networks and large-scale infrastructure projects, while India is the fastest-growing market, supported by smart city initiatives and expanding public safety investments. Southeast Asia continues to witness strong adoption across transportation and commercial infrastructure.

North America

North America accounts for around 22% of global demand, driven primarily by the replacement and upgrade of legacy surveillance systems. The U.S. leads the region, with hybrid analog-IP deployments gaining traction in retail, education, and industrial sectors.

Europe

Europe holds approximately 20% market share, with demand concentrated in Germany, the U.K., and France. Public transportation security and industrial surveillance are key application areas, while replacement demand sustains market stability.

Middle East & Africa

The Middle East & Africa region represents about 10% of the market, supported by smart city projects and infrastructure development in the UAE, Saudi Arabia, and South Africa. Government-funded surveillance programs continue to drive adoption.

Latin America

Latin America accounts for nearly 7% of global demand, with Brazil and Mexico leading regional adoption due to crime prevention initiatives and expanding commercial infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|