Aluminum-Free Deodorant Market Size

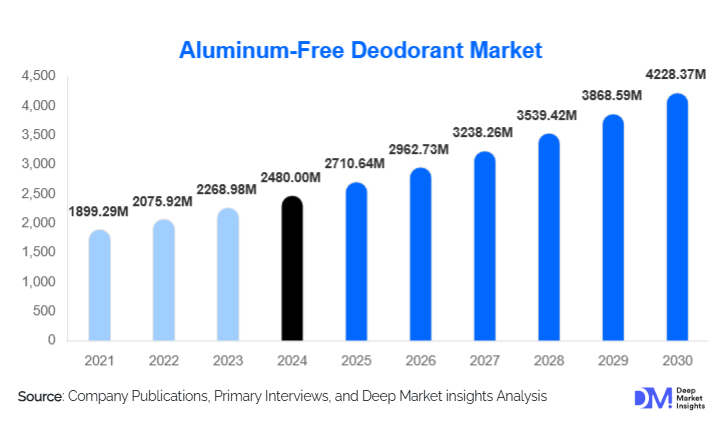

According to Deep Market Insights, the global aluminum-free deodorant market size was valued at USD 2,480.00 million in 2024 and is projected to grow from USD 2,710.64 million in 2025 to reach USD 4,228.37 million by 2030, expanding at a CAGR of 9.3% during the forecast period (2025–2030). The aluminum-free deodorant market growth is primarily driven by rising consumer awareness of clean-label personal care, increasing concerns related to chemical ingredients in traditional antiperspirants, and the rapid expansion of natural, sustainable deodorant brands across online and offline retail channels.

Key Market Insights

- Demand for clean-label and chemical-free personal care is surging, supported by global consumer preference for natural deodorants free from aluminum, parabens, and synthetic fragrances.

- Spray and aerosol deodorants dominate global sales due to convenience, ease of application, and broader availability in supermarkets and drugstores.

- Women and unisex segments lead market adoption, with women accounting for the largest share owing to higher ingredient-conscious purchasing behavior.

- North America remains the largest regional market, driven by high awareness, strong retail penetration, and widespread adoption of clean-beauty products.

- Asia-Pacific is the fastest-growing region, as rising disposable income, urbanization, and e-commerce expansion boost product penetration.

- Major global FMCG companies are rapidly entering the category, intensifying competition and speeding up the transition from niche to mainstream consumption.

What are the latest trends in the aluminum-free deodorant market?

Clean-Label & Ingredient Transparency Leading Product Development

Ingredient-conscious consumers are reshaping product development strategies as brands adopt full transparency in sourcing, formulation, and manufacturing. Aluminum-free deodorants are increasingly marketed as 100% natural, vegan, cruelty-free, and free from parabens, PEGs, baking soda, and artificial fragrances. Many brands now highlight microbiome-friendly formulations, plant-based odor neutralizers, and naturally derived preservatives. This shift is strengthening the market position of premium and mid-range clean-beauty brands. Furthermore, dermatologists, wellness influencers, and sustainability advocates play a growing role in driving consumer trust through education-oriented marketing campaigns. Certification labels, such as USDA Organic, COSMOS, and EcoCert, are becoming important purchase drivers.

Technology-Enhanced Formulations & Sustainable Packaging

Technology is increasingly being integrated into aluminum-free deodorants through innovative formulas and high-performance delivery systems. Companies are investing in sweat-absorption powders, encapsulated fragrances, bio-based preservatives, and long-lasting odor-protection technologies that narrow the performance gap between natural deodorants and aluminum-based antiperspirants. On the packaging front, the shift toward sustainability has accelerated the use of refillable systems, biodegradable materials, and PCR (post-consumer recycled) plastics. E-commerce-friendly packaging and lightweight travel formats are also expanding as brands optimize for digital-first retail. This combination of formulation innovation and sustainability is reshaping user experience and boosting adoption.

What are the key drivers in the aluminum-free deodorant market?

Increasing Global Awareness of Skin Health and Chemical Safety

Heightened consumer concern over the long-term effects of synthetic chemicals used in conventional antiperspirants, such as aluminum salts, parabens, and artificial fragrances, is one of the strongest market drivers. Consumers are actively seeking safer alternatives, especially those with sensitive skin or allergies. The clean-beauty movement has amplified this shift, promoting deodorants that allow natural perspiration while neutralizing odors through botanical and mineral ingredients. Social media education and influencer advocacy have accelerated market penetration among younger demographics.

Growth of Sustainable and Natural Personal Care Trends

Eco-conscious consumers increasingly prefer brands that incorporate natural ingredients, sustainable sourcing, and eco-friendly packaging. Governments and regulatory bodies are also supporting environmentally safe cosmetic formulations, further encouraging manufacturers to shift toward clean-label deodorants. This driver is particularly strong in regions like Europe and North America, where sustainability significantly influences purchasing decisions. Growing interest in vegan, cruelty-free, and zero-waste deodorant formats has also expanded product variety and boosted market demand.

Entry of Global FMCG Giants and Rapid Retail Expansion

The entry of multinational personal-care players has accelerated the transition of aluminum-free deodorants from niche to mainstream. Companies such as Unilever, P&G, L'Oréal, and Beiersdorf have launched or expanded dedicated aluminum-free lines, improving accessibility and affordability. Their large-scale marketing efforts and extensive distribution networks have rapidly increased market penetration across supermarkets, pharmacies, and online platforms. This expansion has reinforced consumer trust, normalized aluminum-free usage, and driven significant market growth.

What are the restraints for the global market?

Performance Limitations Compared to Traditional Antiperspirants

Aluminum-free deodorants do not block sweat glands, which creates a perception of lower protection, especially in hot climates or for consumers with heavy perspiration. While newer formulations are improving performance, many customers still associate aluminum-based antiperspirants with stronger sweat control. This perception remains a barrier in transitioning price-sensitive or performance-dependent users to natural deodorants.

Higher Manufacturing Costs and Premium Pricing

Natural ingredients, essential oils, plant extracts, and sustainable packaging materials significantly increase production costs. As a result, aluminum-free deodorants often retail at premium prices compared to mass-market antiperspirants, limiting their appeal in cost-sensitive regions. Furthermore, complex supply chains for ethically sourced ingredients increase volatility in raw material costs, reducing manufacturers’ profit margins.

What are the key opportunities in the aluminum-free deodorant industry?

Expansion Across Emerging Markets in Asia-Pacific and Latin America

Rising disposable incomes, rapid urbanization, and the growing influence of global beauty standards are driving strong future demand in APAC and LATAM. Penetration of aluminum-free deodorants remains low in these regions, creating a large untapped customer base. E-commerce growth in India, China, Brazil, and Mexico is enabling niche brands to enter without heavy retail investment. Developing localized fragrances, heat-resistant formulas, and affordable price points presents additional opportunities for new entrants.

Advanced Formulation Innovation and New Product Categories

There is high potential for innovation in sweat-absorption technology, probiotic deodorants, pH-balancing formulations, and long-wear botanical systems that offer competitive odor protection. Waterless stick and concentrated cream formats provide scalable opportunities with lower transportation and packaging costs. As demand for gender-neutral and sensitive-skin products rises, specialized variants will create profitable micro-segments within the market.

Institutional and Commercial Demand Expansion

Hotels, wellness resorts, gyms, spas, and corporate wellness programs are adopting aluminum-free deodorants within their amenity and retail portfolios. Demand in this category is growing as businesses align with sustainability goals and consumer health preferences. This B2B opportunity can provide stable recurring revenue for deodorant brands, especially those that offer customizable packaging and bulk supply options.

Product Type Insights

Spray and aerosol deodorants dominate the aluminum-free segment, accounting for 35–40% of the 2024 market share. Their popularity stems from ease of application, fast absorption, and widespread availability in mainstream retail stores. Stick and roll-on formats also maintain strong adoption, particularly among consumers seeking longer-lasting formulas. Creams, balms, and wipes are expanding as niche premium products targeting sensitive-skin users and eco-conscious buyers. These emerging formats often use minimal packaging and emphasize botanical ingredients, supporting clean-beauty positioning.

Application Insights

The women's segment remains the dominant application category, contributing 50–55% of the global 2024 market. Women are early adopters of clean-label personal care and show higher ingredient sensitivity, driving faster conversion to aluminum-free alternatives. The unisex segment is rapidly growing as gender-neutral product lines gain mainstream acceptance. Men’s usage is increasing but remains slower due to perceptions of weaker sweat control. Overall, consumer behavior shifts toward wellness, health-conscious grooming, and natural lifestyles continue to amplify application diversity.

Distribution Channel Insights

E-commerce and multi-brand retail stores collectively account for 45–55% of global 2024 sales, making them the dominant distribution channels. Online platforms facilitate brand discovery, consumer education, and subscription-based reorder models, particularly effective for natural deodorant brands. Pharmacies, specialty beauty stores, and D2C brand platforms are also expanding as shoppers prefer curated personal-care assortments. Direct-to-consumer (D2C) brands are leveraging social media marketing, influencer culture, and community-based promotions to achieve rapid scale without traditional retail dependency.

| By Product Type | By Application | By Distribution Channel | By Packaging Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest market share at 30–35% in 2024, driven by well-established clean-beauty trends, a mature retail ecosystem, and high disposable income. The U.S. is the global leader in aluminum-free deodorant consumption, with strong adoption in urban centers and wellness-conscious communities. Continued expansion of organic and vegan deodorant brands will sustain market growth.

Europe

Europe represents the second-largest regional market, holding 25–30% of the global share. Strong regulatory standards for cosmetic ingredients and a cultural shift toward sustainability drive consumer preference for natural deodorant products. Germany, the U.K., and France lead demand due to high per-capita personal-care spending and widespread acceptance of eco-friendly products.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with increasing adoption in China, India, Japan, and Southeast Asia. Rising middle-class income, exposure to global beauty trends, and aggressive e-commerce expansion are supporting rapid market penetration. APAC’s large population base presents significant long-term growth potential, particularly for affordable and climate-adapted product lines.

Latin America

Latin America is steadily adopting aluminum-free deodorants, particularly in Brazil, Mexico, and Argentina. While market share is smaller compared to mature regions, expanding interest in natural grooming and influencer-driven beauty trends is accelerating adoption. Local and imported natural deodorant brands are gaining traction via online platforms.

Middle East & Africa

MEA holds a smaller market share but displays growing demand driven by urbanization and rising consumer interest in wellness-focused personal care. GCC countries such as the UAE and Saudi Arabia lead regional adoption due to higher purchasing power and preference for premium products. African nations show early-stage demand growth, supported primarily by imports and specialty retail.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Aluminum-Free Deodorant Market

- Unilever

- Procter & Gamble

- L’Oréal

- Beiersdorf

- Henkel

- Church & Dwight

- Weleda

- Native (P&G-owned brand but listed as product line)

- Schmidt’s Naturals

- Tom's of Maine

- Crystal Deodorant

- Soapwalla

- Adidas (Personal Care)

- Avon Products

- Lavera

Recent Developments

- In March 2025, Unilever expanded its natural deodorant line, launching sustainable refillable aluminum-free deodorant sticks across North America and Europe.

- In January 2025, L'Oréal announced an investment in plant-based odor-control biotechnology to enhance long-wear performance in natural deodorant products.

- In September 2024, Beiersdorf launched a new eco-friendly packaging innovation for NIVEa’s aluminum-free segment, reducing plastic usage by over 30%.