Alpine Ski Equipment Market Size

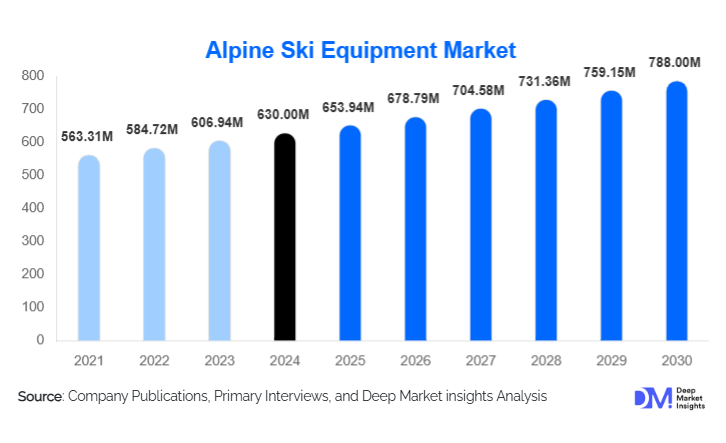

According to Deep Market Insights, the global alpine ski equipment market size was valued at USD 630.00 million in 2024 and is projected to grow from USD 653.94 million in 2025 to reach USD 788.00 million by 2030, expanding at a CAGR of 3.8% during the forecast period (2025–2030). The alpine ski equipment market growth is primarily driven by rising participation in winter sports, continuous investments in ski tourism infrastructure, premiumization of performance gear, and growing adoption of rental and resort-based equipment models.

Key Market Insights

- Alpine ski equipment demand is increasingly premium-driven, with advanced materials, customization, and performance-enhancing technologies boosting average selling prices.

- Europe remains the largest market, supported by dense ski resort infrastructure and strong domestic participation across Alpine nations.

- North America is the single largest country-level market, led by the United States, due to high discretionary spending and resort modernization.

- Asia-Pacific is the fastest-growing region, driven by rapid ski resort expansion in China, South Korea, and Japan.

- Rental and resort-based procurement is expanding, lowering entry barriers for beginners and stabilizing B2B demand for manufacturers.

- Sustainability-focused equipment design, including recycled composites and eco-certified production, is gaining importance among consumers and resorts.

What are the latest trends in the alpine ski equipment market?

Premiumization and Performance-Oriented Product Design

Manufacturers are increasingly focusing on premium and performance-oriented alpine ski equipment to cater to intermediate and advanced skiers. Lightweight composite skis, vibration-dampening technologies, customizable boot liners, and precision bindings are becoming standard across mid-range and premium price tiers. Consumers are prioritizing durability, comfort, and enhanced control, which has resulted in higher replacement cycles and rising value contribution from premium equipment categories. This trend is particularly strong in Europe and North America, where experienced skiers dominate participation.

Growth of Rental and Resort-Based Equipment Models

Ski resorts and tourism operators are investing heavily in modern rental fleets to accommodate growing recreational participation without requiring equipment ownership. This trend is reshaping demand patterns, with resorts purchasing standardized, high-durability skis, boots, and bindings in bulk. Advanced fitting technologies and digitally managed inventory systems are also improving rental efficiency, making this segment a stable and recurring revenue stream for manufacturers, especially during periods of consumer spending uncertainty.

What are the key drivers in the alpine ski equipment market?

Expansion of Global Ski Tourism Infrastructure

Continuous investments in ski resort infrastructure, including new lifts, snowmaking systems, and training facilities, are directly supporting alpine ski equipment demand. Europe and North America remain mature markets, while Asia-Pacific is witnessing rapid resort development, particularly in China. Resort expansion not only increases skier participation but also drives recurring demand for rental and institutional equipment, strengthening overall market stability.

Technological Innovation and Customization

Advancements in materials science, data analytics, and ergonomic design are enabling manufacturers to offer highly customized and performance-optimized equipment. AI-assisted boot fitting, precision-engineered skis, and safety-focused helmet innovations are enhancing the skier experience and reducing injury risks. These innovations support premium pricing strategies and improve brand differentiation, contributing positively to market growth.

What are the restraints for the global market?

Climate Variability and Snowfall Uncertainty

Unpredictable snowfall patterns and rising temperatures pose challenges for alpine skiing, particularly in lower-altitude regions. While artificial snowmaking mitigates some risk, it increases operating costs for resorts, which can indirectly impact equipment procurement budgets. Long-term climate concerns remain a structural restraint for the market.

High Cost of Participation

Alpine skiing involves significant costs related to equipment, travel, and training, which can limit participation growth among price-sensitive demographics. Although rental models reduce initial barriers, ownership demand remains constrained in emerging markets, potentially slowing market expansion.

What are the key opportunities in the alpine ski equipment industry?

Asia-Pacific Ski Market Expansion

Asia-Pacific presents a major growth opportunity as governments and private investors continue developing ski resorts and winter sports infrastructure. China, in particular, is emerging as a high-potential market for entry-level and rental-focused alpine ski equipment, creating opportunities for localized manufacturing and pricing strategies.

Sustainable and Circular Equipment Models

Growing environmental awareness is driving demand for sustainable alpine ski equipment made from recycled or bio-based materials. Circular business models, including refurbishment, buy-back programs, and modular designs, offer opportunities to improve margins while aligning with regulatory and consumer sustainability expectations.

Product Type Insights

Alpine skis represent the largest product category, accounting for approximately 34% of the global market value in 2024. Their leadership is driven by frequent replacement cycles, continuous technological upgrades, and growing demand among intermediate and advanced skiers for performance-optimized equipment. Innovations such as carbon fiber composites, vibration-dampening technology, and all-mountain skis have strengthened this segment’s premium appeal. Ski boots follow as a high-value segment due to customization and fit requirements, with adjustable liners and heat-moldable designs enhancing comfort and performance. Bindings and poles contribute steady demand through both retail and resort rental channels, driven by safety standards and enhanced performance specifications. Protective gear—including helmets, guards, and back protectors—and alpine-specific apparel are experiencing steady growth, fueled by increasing awareness around skier safety and the rising adoption of premium, weather-resistant apparel for enhanced comfort and style on slopes.

Skier Type Insights

Intermediate skiers account for the largest share of demand, contributing nearly 41% of total market value. This segment upgrades equipment regularly and seeks a balance between performance and affordability, making it highly attractive to manufacturers for mid-range and premium products. Recreational beginners drive significant demand for rental and entry-level equipment, supporting B2B and resort-based sales, while advanced and professional skiers, though smaller in number, create a high-margin market for elite performance gear that incorporates cutting-edge materials and technological enhancements.

Distribution Channel Insights

Specialty sports retail stores dominate distribution with around 38% market share in 2024. Their success is supported by expert fitting services, professional advice, and strong brand partnerships, which are critical for premium and performance-focused equipment. Direct-to-consumer online channels are expanding rapidly as brands implement digital customization tools, 3D boot fitting technologies, and robust logistics solutions, allowing consumers to access premium equipment without visiting physical stores. Resort-based pro shops remain essential for rental-driven sales, particularly in Europe and North America, where resort infrastructure continues to expand, and beginner skier participation is high.

End-Use Application Insights

Recreational skiing dominates end-use demand, accounting for approximately 62% of global revenue, supported by growing tourism participation, resort expansion, and seasonal travel trends. Competitive skiing contributes to premium demand for professional-grade equipment, including elite skis, boots, and bindings designed for high-performance use in national and international competitions. Institutional and rental applications, such as resort fleets and training academies, provide stable B2B revenue streams, particularly in high-tourism regions with consistent skier footfall.

| By Product Type | By Skier Type | By Distribution Channel | By End-Use Application | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Europe

Europe leads the global alpine ski equipment market with approximately 43% market share in 2024. Austria, Switzerland, France, Italy, and Germany are the key demand centers due to dense resort networks, high participation rates, and strong domestic manufacturing capabilities. Growth in Europe is driven by investments in modern lift systems, snowmaking technologies, and rental fleet upgrades. Additionally, a culture of winter sports participation, high disposable income, and the prevalence of ski clubs and competitive leagues sustain consistent demand for premium equipment and technological upgrades.

North America

North America accounts for around 31% of global demand, led by the United States and Canada. High disposable income, premium consumption trends, and continuous resort modernization support strong equipment sales, particularly in mid-range and premium segments. Drivers include increased investment in ski tourism infrastructure, the expansion of ski schools and recreational programs, and rising demand for high-performance and technologically enhanced equipment among advanced and intermediate skiers. Seasonal tourism peaks in Colorado, Utah, and the Canadian Rockies also contribute to stable rental and retail demand.

Asia-Pacific

Asia-Pacific represents approximately 17% of global demand and is the fastest-growing region, with a CAGR exceeding 8%. China is the fastest-growing country market, followed by Japan and South Korea, driven by rapid resort development, government-supported winter sports initiatives, and increasing disposable incomes among urban populations. Rising participation in ski tourism, coupled with the growth of indoor ski facilities in metropolitan areas, is fueling year-round demand. Additionally, marketing campaigns promoting winter sports and international events such as the Winter Olympics have accelerated awareness and adoption, particularly among younger demographics seeking premium and performance-focused alpine equipment.

Latin America

Latin America remains a niche market, led by Chile and Argentina, where alpine skiing is concentrated in select resort destinations. Demand is primarily tourism-driven and seasonal, supported by ski tourism promotion and international visitors. Drivers include investments in resort modernization, government incentives for winter sports tourism, and the increasing popularity of recreational skiing among middle- and upper-class populations. While smaller in volume, this market is seeing gradual growth due to the expansion of ski schools, rental programs, and high-end resort offerings, attracting international travelers.

Middle East & Africa

This region accounts for a small but emerging share of global demand, supported by indoor ski facilities in the UAE and limited alpine tourism in select African destinations. Growth is driven by high disposable incomes, luxury-oriented tourism, and increasing adoption of indoor skiing as a year-round recreational activity. Government investment in sports infrastructure, along with rising awareness of winter sports through international competitions and urban leisure initiatives, is also contributing to market expansion in this region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|