Algae Skincare Products Market Size

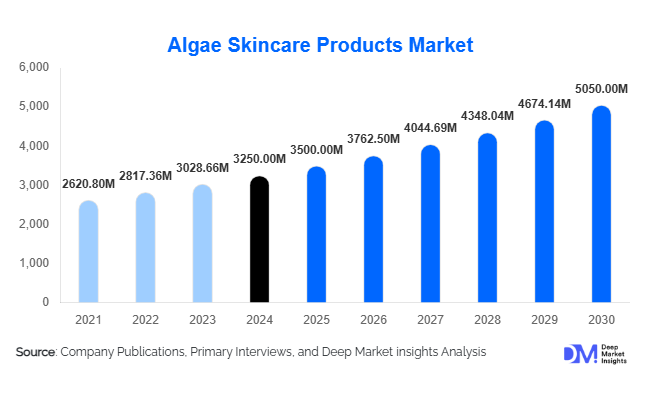

According to Deep Market Insights, the global algae skincare products market size was valued at USD 3,250 million in 2024 and is projected to grow from USD 3,500 million in 2025 to reach USD 5,050 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer preference for natural and organic skincare, increasing demand for anti-aging and functional products, and growing adoption of sustainable and eco-friendly formulations.

Key Market Insights

- Algae skincare products are increasingly preferred for their multifunctional benefits, including hydration, anti-aging, and skin repair, appealing to eco-conscious and health-aware consumers.

- Facial care dominates the market, particularly anti-aging creams and serums, reflecting high consumer investment in visible skin improvement products.

- Online channels are becoming the dominant distribution medium, driven by e-commerce growth, direct-to-consumer models, and wider accessibility of premium algae skincare products.

- North America and Europe are the largest markets, led by high disposable income, wellness consciousness, and early adoption of natural skincare formulations.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class affluence, urbanization, and increasing beauty awareness in countries like China, India, and South Korea.

- Technological innovations, including bioactive algae extraction, nanoencapsulation, and sustainable sourcing, are reshaping product performance and premiumization.

Latest Market Trends

Rise of Natural and Organic Skincare

Consumers are shifting away from synthetic chemicals, parabens, and sulfates, favoring plant-based ingredients like algae. Skincare products enriched with red, brown, green, and blue-green algae offer antioxidant, vitamin, and mineral benefits, promoting anti-aging, hydration, and skin regeneration. This trend is particularly strong in developed regions like North America and Europe, where eco-consciousness and health-driven purchasing influence product selection. Premium formulations with algae extracts are gaining traction, often marketed as high-efficacy, multifunctional skincare solutions.

Technological Innovations Enhancing Product Efficacy

Advances in biotechnology and extraction methods, such as enzyme-based extraction and microalgae fermentation, have improved the bioavailability of active ingredients. Nanoencapsulation technology ensures deeper skin penetration, increasing product effectiveness. Additionally, sustainable sourcing and eco-friendly production practices are being incorporated, aligning with global regulatory standards and consumer expectations. Companies are investing in research to combine algae with other functional ingredients for high-margin, premium skincare solutions.

Algae Skincare Products Market Drivers

Increasing Consumer Preference for Natural Products

Growing awareness of the harmful effects of synthetic chemicals is driving demand for natural and organic skincare. Algae, rich in bioactive compounds like fucoidan, phycocyanin, and antioxidants, offer visible benefits for anti-aging, skin repair, and hydration, making them a preferred ingredient among health-conscious consumers globally.

High Demand for Anti-Aging and Functional Skincare

The aging population, coupled with heightened beauty consciousness, has accelerated the adoption of functional skincare products. Algae extracts are valued for their ability to reduce wrinkles, improve skin elasticity, and combat oxidative stress. This trend has significantly contributed to the growth of facial serums, creams, and masks containing algae-based bioactives.

Expansion of E-Commerce and Direct-to-Consumer Channels

The rise of digital platforms has democratized access to premium algae skincare products. E-commerce enables global reach, comparison shopping, and subscription-based delivery, fostering adoption in both developed and emerging markets. Direct-to-consumer sales models also allow brands to enhance margins and gain consumer insights for product innovation.

Market Restraints

High Raw Material Costs

Premium algae varieties and sustainable extraction methods increase production costs. Higher retail prices can limit consumer adoption in price-sensitive regions, restraining market expansion.

Regulatory and Standardization Challenges

Stringent cosmetic regulations vary by region, impacting product approval, labeling, and safety compliance. New entrants must navigate these differences to ensure global distribution, which can slow market penetration and limit scale for some manufacturers.

Algae Skincare Products Market Opportunities

Emerging Markets Expansion

Countries in Asia-Pacific, Latin America, and the Middle East present strong growth potential due to rising disposable income and evolving skincare awareness. India, China, Brazil, and the UAE are rapidly adopting mid-to-premium algae skincare products through both offline and online channels, enabling companies to capture new customer bases.

Integration of Advanced Biotechnologies

Innovations in microalgae fermentation, enzyme extraction, and nanoencapsulation allow the development of high-performance, eco-friendly products. These technologies support premium product differentiation and high-margin formulations for skincare enthusiasts seeking multifunctional benefits.

Regulatory Support and Sustainability Initiatives

Government programs and sustainability initiatives are promoting plant-based cosmetic solutions. Regulatory frameworks supporting eco-friendly practices, traceable sourcing, and reduced chemical usage provide opportunities for compliant, innovative products to capture premium consumer segments.

Product Type Insights

Facial care dominates the algae skincare market, accounting for 45% of global revenue in 2024. Anti-aging serums and creams are leading segments due to their high consumer spending and functional benefits. Body care and sun care products are also growing steadily, with body lotions and hydrating scrubs increasingly incorporating algae extracts. Specialty skincare targeting acne and sensitive skin is witnessing adoption in developed markets, driven by personalized skincare trends.

Algae Type Insights

Brown algae are the most utilized ingredient, representing 35% of the global market in 2024. It is preferred for its hydrating, anti-aging, and antioxidant properties. Red and green algae are popular in premium facial care, while blue-green algae, such as spirulina, are gaining traction in organic and vegan formulations. This distribution reflects the global preference for multifunctional, high-efficacy ingredients.

Distribution Channel Insights

Online channels dominate 40% of global sales, driven by e-commerce adoption, direct-to-consumer models, and convenience. Offline retail remains significant, particularly through specialty stores, pharmacies, and department stores in mature markets. The trend toward omnichannel marketing, subscription services, and influencer partnerships is reshaping consumer access and engagement.

End-Use Insights

Personal consumers account for 50% of demand, driven by home skincare routines and rising awareness of natural ingredients. Beauty and wellness centers, spas, and dermatology clinics are adopting algae-based treatments, expanding B2B demand. Export-driven growth is notable from North America and Europe to APAC, supporting premium segment expansion. Emerging applications include wellness resorts and personalized skincare subscriptions.

| By Product Type | By Algae Type | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds 30% of the global market, led by the U.S. and Canada. High disposable income, wellness consciousness, and early adoption of natural products drive growth. Consumers prioritize functional and premium formulations, including anti-aging serums and moisturizers.

Europe

Europe represents 28% of the market, with Germany, France, and the U.K. leading demand. Sustainable and eco-friendly formulations are increasingly adopted. Anti-pollution and climate-adapted products contribute to market growth, while younger demographics drive innovation and adoption of online channels.

Asia-Pacific

APAC is the fastest-growing region, with China, India, and South Korea leading adoption. Rising middle-class affluence, social media influence, and beauty-conscious urban populations are driving premium and mid-range product demand. Japan and Australia provide stable growth through high-value skincare adoption.

Middle East & Africa

The UAE and Saudi Arabia show growing demand for luxury algae skincare. Africa’s market is emerging, primarily driven by urban elites in South Africa and Nigeria. Regional consumer awareness of plant-based and sustainable skincare is gradually rising.

Latin America

Brazil, Argentina, and Mexico present emerging markets with gradual adoption. Outbound demand is rising for premium imported algae skincare products, while domestic production remains limited.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Algae Skincare Products Market

- L'Oréal

- Estée Lauder

- Shiseido

- Amorepacific

- Unilever

- KAO Corporation

- Beiersdorf AG

- The Body Shop

- Innisfree

- Natura &Co

- Herbivore Botanicals

- Algenist

- ELEMIS

- Tata Harper

- Dr. Hauschka

Recent Developments

- In May 2025, L'Oréal expanded its algae-based skincare line in North America, introducing new anti-aging serums using brown and red algae extracts.

- In April 2025, Shiseido launched a sustainable algae extraction process in Japan, reducing chemical use and enhancing bioactive retention for facial creams.

- In February 2025, Amorepacific introduced a direct-to-consumer subscription model for algae skincare, offering personalized formulations based on skin type and regional climatic conditions.