Airlaid Paper Market Size

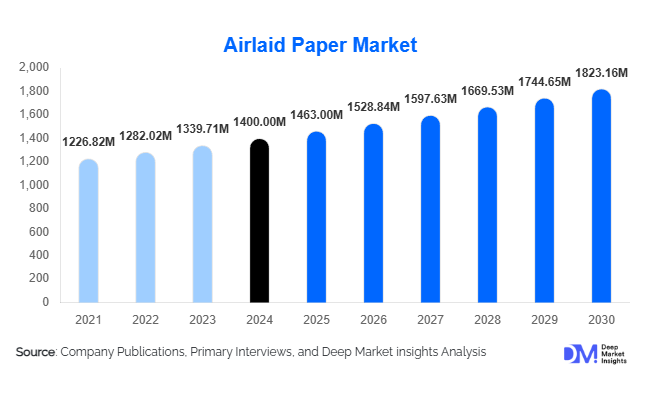

According to Deep Market Insights, the global airlaid paper market size was valued at USD 1,400 million in 2024 and is projected to grow from USD 1,463.00 million in 2025 to reach USD 1,823.16 million by 2030, expanding at a CAGR of 4.5% during the forecast period (2025–2030). The airlaid paper market growth is primarily driven by the rising global demand for disposable hygiene products, increasing emphasis on sustainable packaging, and technological advancements in bonding and fiber-dispersion processes that enhance absorbency and softness.

Key Market Insights

- Rising demand for eco-friendly and biodegradable materials is positioning airlaid paper as a preferred substitute for plastic-based and synthetic nonwoven materials.

- Hygiene applications dominate the market, led by feminine hygiene and adult incontinence products, which account for more than half of global consumption.

- Europe and North America together hold over 55% of the global market share, supported by mature hygiene industries and advanced manufacturing infrastructure.

- Asia-Pacific is the fastest-growing regional market, driven by rapid urbanization, rising incomes, and expanding hygiene awareness in China, India, and Southeast Asia.

- Technological innovations in latex and thermal bonding are enabling lighter, stronger, and more cost-efficient airlaid substrates for emerging applications such as food pads and medical disposables.

- Sustainability initiatives by manufacturers are boosting the production of bio-based and compostable airlaid grades, catering to regulatory and consumer pressure for green materials.

What are the latest trends in the airlaid paper market?

Eco-Friendly Airlaid Variants Gaining Traction

Manufacturers are intensifying R&D efforts to create biodegradable and compostable airlaid papers made from 100% natural fibers and bio-resins. The growing restrictions on single-use plastics and heightened consumer demand for sustainable hygiene and packaging products are accelerating this trend. Producers are introducing premium eco-grades that combine softness with high absorbency while maintaining environmental compliance. These variants are especially popular in Europe and North America, where sustainability certifications and carbon-neutral operations are becoming key purchasing criteria among major hygiene brands.

Diversification into Food Packaging and Industrial Applications

The market is witnessing diversification beyond hygiene. Airlaid paper’s absorbent and bulk properties make it ideal for food pads in meat and seafood packaging, spill-control mats, and industrial wipes. The food packaging segment, in particular, is expanding rapidly with global retail and e-commerce growth. Manufacturers are customizing airlaid structures with enhanced wet strength and fluid management, creating new profit pools beyond traditional consumer hygiene applications.

Technological Integration and Process Automation

Automation, real-time process monitoring, and advanced fiber dispersion technologies are transforming production efficiency. Modern airlaid lines can now achieve high uniformity at reduced grammage, optimizing costs and sustainability. Manufacturers are integrating AI-assisted quality control and energy-efficient dryers to improve yield. This wave of technological modernization supports cost reduction and enables flexible production of specialty grades tailored for new applications such as medical drapes, wound care, and filtration media.

What are the key drivers in the airlaid paper market?

Growing Demand for Disposable Hygiene Products

Global population growth, rising healthcare awareness, and the ageing demographic are propelling the consumption of sanitary napkins, baby diapers, and adult incontinence products. Airlaid paper, known for its softness and high absorbency, has become an indispensable substrate for these applications. Post-pandemic hygiene consciousness has further strengthened this demand base, especially in emerging economies.

Shift Toward Sustainable and Bio-Based Materials

With governments banning or limiting plastics, industries are seeking greener alternatives. Airlaid paper, being largely cellulose-based, fits this requirement. Producers are capitalizing on this shift by introducing biodegradable and compostable airlaid variants, especially in packaging and wipes. Corporate sustainability pledges from global hygiene brands are also driving consistent procurement of eco-friendly airlaid substrates.

Technological Advancements Enhancing Performance

Advances in bonding methods such as latex, thermal, and multi-bonding have improved product strength, texture, and moisture control. Innovations allow manufacturers to produce lighter, thinner, and stronger sheets that meet performance standards at lower material cost. Such developments are expanding airlaid paper use into non-traditional sectors like industrial cleaning, filtration, and food packaging.

What are the restraints for the global market?

High Production and Raw-Material Costs

Airlaid paper manufacturing is capital-intensive, requiring advanced dispersion and bonding lines. Volatility in pulp and binder resin prices affects production costs and margins, limiting price competitiveness against substitutes like tissue or spun-bond nonwovens. Manufacturers must optimize operations and secure long-term raw-material contracts to remain profitable.

Competition from Substitute Materials

Alternative substrates such as wet-laid paper, tissue, and synthetic nonwovens offer cost advantages in many applications. In lower-end markets where performance demands are minimal, these substitutes can restrain the adoption of airlaid materials. Overcoming this challenge requires continuous innovation and differentiation through quality and sustainability.

What are the key opportunities in the airlaid paper industry?

Expansion in Emerging Economies

Asia-Pacific, Latin America, and Africa represent major untapped markets. Rising hygiene awareness, expanding middle-class incomes, and local manufacturing incentives (e.g., “Make in India”) are generating demand for affordable hygiene and packaging materials. Establishing regional production facilities can help players reduce logistics costs and serve local OEMs efficiently.

Product Innovation in Sustainable Grades

There is a strong opportunity to innovate biodegradable, bio-resin-bonded, and lightweight airlaid papers. These products meet sustainability mandates and attract premium pricing. Companies investing in circular production systems and green certifications are expected to gain a significant competitive advantage over the next five years.

New End-Use Applications

Airlaid paper’s versatility allows expansion into high-growth sectors such as food packaging pads, medical disposables, and industrial spill control. These applications not only diversify revenue streams but also stabilize demand against cyclical hygiene consumption patterns. Collaborations with packaging converters and medical OEMs can unlock new business segments for existing players.

Product Type Insights

Latex-bonded airlaid paper dominates the global market, accounting for about 43% of total demand in 2024. Its balanced cost-performance profile and adaptability make it the preferred choice for hygiene and wipes production. Thermal-bonded and multi-bonded types follow, used primarily where softness and durability are critical. The eco-friendly and biodegradable grades segment, though smaller (12–15% of market value), is the fastest growing due to surging environmental awareness and regulatory incentives worldwide.

Application Insights

Feminine hygiene is the leading application segment, representing roughly 30–35% of global market share in 2024. Its growth is supported by population expansion, improved distribution of sanitary products in developing regions, and innovations in comfort and absorbency. Adult incontinence is the fastest-growing application (CAGR > 5%) owing to the ageing population trend. Food packaging pads and industrial wipes are emerging as profitable new uses, expected to collectively account for over 15% of global airlaid paper demand by 2030.

Distribution Channel Insights

Direct B2B sales to hygiene and packaging OEMs account for more than 50% of market revenue. These partnerships involve long-term supply contracts for customized substrates. Indirect channels through converters and distributors cater to smaller buyers and regional converters, while private-label or contract manufacturing is rising in Asia to serve multinational hygiene brands seeking cost efficiency and local supply security.

End-Use Industry Insights

The hygiene industry dominates airlaid paper consumption, but demand is accelerating in food packaging and medical disposables. The global hygiene products market is valued at over USD 100 billion, providing a stable anchor for airlaid substrate demand. The food packaging and healthcare sectors, collectively valued at more than USD 800 billion, offer long-term growth potential as manufacturers replace plastics with cellulose-based absorbents. Export-driven demand from Asia-Pacific producers supplying North American and European OEMs is also increasing steadily.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds around 30% of the global market share ( USD 420 million in 2024). The U.S. leads the region, driven by mature hygiene brands, advanced R&D, and consistent adoption of sustainable packaging. Growth remains moderate (3–4% CAGR) but stable, supported by high living standards and product premiumization.

Europe

Europe accounts for about 25–30% of global demand (USD 350–420 million). Germany, France, the U.K., and Italy dominate consumption due to stringent environmental policies and early adoption of biodegradable substrates. The region is a hub for innovation and sustainability certification, with growth around a 4–5% CAGR through 2030.

Asia-Pacific

Asia-Pacific represents roughly 20–25% of global demand and is the fastest-growing region (6–7% CAGR). China and India are major growth engines, driven by urbanization, expanding hygiene sectors, and local manufacturing capacity. Southeast Asia and Japan also contribute to rising exports of airlaid rolls and converted products.

Latin America

Latin America captures around 6% of the global share, led by Brazil and Mexico. Growth is supported by expanding hygiene awareness and local production of wipes and disposable napkins. The region’s market is small but growing steadily (4% CAGR) with opportunities for regional manufacturing expansion.

Middle East & Africa

MEA accounts for about 5–7% of the global share in 2024, led by GCC countries and South Africa. Rising healthcare infrastructure and population growth are driving hygiene product demand. Government initiatives for local manufacturing and import substitution are expected to boost regional output during the forecast period.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Airlaid Paper Market

- Glatfelter

- Georgia-Pacific

- Duni AB

- Fitesa

- Oji Kinocloth

- M&J Airlaid Products

- EAM Corporation

- National Nonwovens

- China Silk (Shanghai) New Material Technology

- Qiaohong New Materials

- Ningbo Qixing Nonwoven

- Elite Paper

- Main S.p.A.

- C-airlaid

- Kinsei Seishi

Recent Developments

- In March 2025, Glatfelter announced the installation of a next-generation airlaid line in the U.S. to increase capacity for sustainable hygiene substrates.

- In February 2025, Fitesa introduced a bio-binder-based airlaid paper designed for compostable wipes and feminine hygiene applications.

- In January 2025, Oji Kinocloth expanded its Japanese facility to meet rising export demand for lightweight food-pad substrates across Asia.

- In late 2024, Duni AB launched a fully recyclable airlaid napkin line targeting the hospitality sector’s transition away from plastic-coated disposables.