Air Duster Market Size

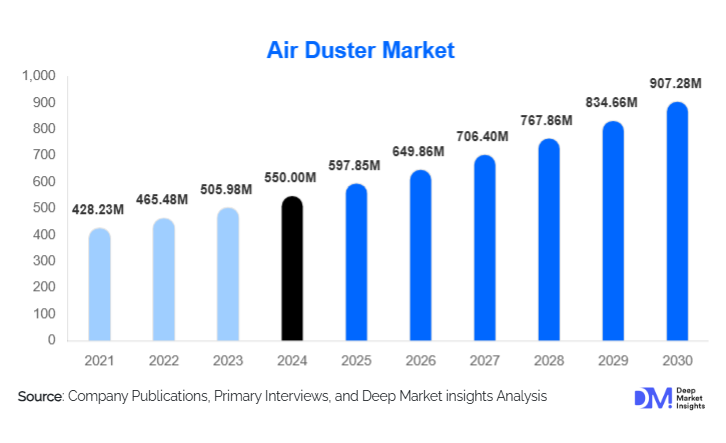

According to Deep Market Insights, the global air duster market size was valued at USD 550 million in 2024 and is projected to grow from USD 597.85 million in 2025 to reach USD 907.28 million by 2030, expanding at a CAGR of 8.7% during the forecast period (2025–2030). The air duster market growth is primarily driven by the rising need for dust-free electronic and industrial equipment, rapid expansion of data centers and semiconductor fabrication, and the increasing adoption of eco-friendly electric air dusters as replacements for traditional HFC-based compressed gas products.

Key Market Insights

- The market is rapidly shifting from disposable compressed gas products toward reusable electric air dusters, driven by tightening regulations on fluorinated gases and corporate sustainability targets.

- Electronics and semiconductor applications dominate global demand, as air dusters are critical for cleaning sensitive components, server racks, and precision assemblies without moisture or residue.

- Asia-Pacific is emerging as the fastest-growing production and consumption hub, supported by large-scale electronics manufacturing and expanding data center infrastructure.

- Medium-pressure (61–90 PSI) and ergonomically designed handheld models lead adoption, balancing cleaning power, safety, and ease of use for both professional and household users.

- B2B online procurement platforms and e-commerce channels are gaining share, enabling bulk orders, standardized pricing, and direct sourcing from manufacturers.

- Product innovation is centered on brushless motors, higher airflow efficiency, and low-noise designs, alongside anti-static and ESD-safe variants tailored to high-tech environments.

What are the latest trends in the air duster market?

Shift Toward Electric and Eco-Friendly Dusters

One of the most prominent trends in the air duster market is the accelerated shift toward electric and low-GWP (Global Warming Potential) alternatives. Governments and regulatory bodies are steadily restricting the use of HFC-152a and HFC-134a propellants, prompting manufacturers to introduce rechargeable electric units and HFO-based canned dusters. Electric air dusters are increasingly designed with high-efficiency brushless motors, variable speed controls, and longer battery life, making them suitable for professional use in IT maintenance, industrial plants, and repair workshops. These products offer strong lifetime value by eliminating recurring can purchases and reducing waste, while also aligning with corporate ESG and sustainability commitments. Recyclable materials, compact foldable designs, and anti-static attachments are further enhancing appeal among both enterprise users and tech-savvy consumers.

Growing Use in High-Tech, Cleanroom, and Precision Environments

Another key trend is the expanding use of air dusters in high-precision environments such as semiconductor fabs, advanced electronics assembly, medical device manufacturing, optics labs, and aerospace facilities. As components become smaller and more sensitive, dry, residue-free cleaning is essential to maintain reliability and yield. Air dusters, particularly electric and industrial-pressure variants, are being integrated into preventive maintenance protocols for pick-and-place machines, SMT lines, inspection systems, and laboratory instruments. This trend is supported by rising investments in cleanrooms and controlled environments, where compressed air quality and contamination control are critical KPIs. Specialized nozzles, adjustable PSI levels, and ESD-safe accessories are being introduced to meet stringent technical standards, positioning air dusters as indispensable tools in precision manufacturing and laboratory settings.

What are the key drivers in the air duster market?

Proliferation of Electronics, IT Hardware, and Smart Devices

The global surge in electronics usage, ranging from laptops, gaming consoles, monitors, and peripherals to industrial control units and IoT devices, is a fundamental driver for the air duster market. Dust accumulation on circuit boards, cooling fans, keyboards, and connectors can cause overheating, signal disruption, and premature failure. As organizations and households depend more heavily on digital devices, regular non-contact cleaning has become part of routine maintenance. Air dusters provide a fast, safe, and cost-efficient way to remove particulates, reducing downtime and extending equipment life. This trend is particularly strong in commercial offices, shared workspaces, and education institutions, where large device fleets need periodic cleaning to maintain performance and hygiene.

Expansion of Data Centers and Semiconductor Fabrication Facilities

Rapid growth in cloud computing, AI workloads, streaming services, and 5G networks is driving a global wave of data center construction. These facilities house densely packed servers, storage units, and networking hardware that must operate within tight thermal and reliability parameters. Even minor dust accumulation can impair cooling and airflow, increasing energy consumption and failure risk. Air dusters, especially high-performance electric models, are widely used for on-site maintenance of server racks, power supplies, and cooling systems. Parallelly, semiconductor fabs, assembly plants, and PCB manufacturing lines rely on particulate control to ensure yield and reliability. The combination of data center and semiconductor expansion is creating a sustained and structurally embedded demand base for professional-grade air dusters.

What are the restraints for the global market?

Regulatory Pressure on HFC-Based Compressed Gas Dusters

One of the primary restraints for the air duster market is mounting regulatory scrutiny of HFC-based compressed gas products. Environmental policies aimed at reducing greenhouse gas emissions are imposing restrictions, phase-down schedules, and levies on fluorinated gases. This raises compliance costs, reduces product lifecycles for traditional canned air lines, and forces manufacturers to invest heavily in reformulation, re-certification, and packaging redesign. Smaller players with limited R&D budgets face particular challenges in adapting to evolving standards, potentially leading to market exits or consolidation. In regions with aggressive climate regulations, some end users are also shifting directly to alternative cleaning solutions, moderating growth in conventional compressed gas segments.

Competition from Alternative Cleaning Tools and Compressed Air Systems

The air duster market also faces competition from alternative cleaning tools such as shop air compressors with inline dryers, mini vacuum systems, microfiber-based cleaning kits, and specialized cleaning robots. For industrial sites that already operate compressed air networks, dedicated nozzles and hoses can serve as substitutes for canned air dusters in certain tasks. In the consumer segment, low-cost cleaning brushes and compact vacuums are sometimes favored for general-purpose dust removal. While air dusters remain superior for moisture-free, targeted cleaning of sensitive electronics, the availability of these alternatives can limit adoption in price-sensitive markets and in applications where high-performance, non-contact cleaning is not strictly required.

What are the key opportunities in the air duster market?

Premiumization and Smart Electric Air Dusters

There is a substantial opportunity to move up the value chain through the development of premium, smart electric air dusters. Features such as digital airflow control, battery health indicators, smart safety cut-offs, and integrated sensors to optimize air output for specific devices can differentiate offerings in competitive markets. Manufacturers can create product ecosystems with interchangeable nozzles, ESD-safe accessories, and docking/charging stations targeted at professional IT service providers, repair shops, and industrial maintenance teams. Subscription-based replacement part programs, extended warranties, and B2B fleet management solutions provide avenues for recurring revenue. As enterprises increasingly prioritize total cost of ownership over upfront price, such premium, feature-rich solutions are poised to gain traction.

Expansion into Healthcare, Laboratory, and Precision Industry Segments

Healthcare and scientific environments present another high-growth opportunity. Hospitals, diagnostic labs, dental clinics, and research institutions require meticulous cleaning of devices such as imaging systems, ventilators, microscopes, and lab analyzers, where moisture or chemical residues are unacceptable. Purpose-built air dusters with medical-grade materials, fine-tipped nozzles, and validated anti-static performance can command premium pricing in these niches. Similarly, optics manufacturing, camera and lens servicing, aerospace electronics, and high-end automotive assembly lines rely heavily on contamination control. Targeted product lines for these precision industries, combined with certifications, compliance documentation, and tailored training, can open up resilient, high-margin demand segments for leading air duster manufacturers.

Product Type Insights

Electric air dusters have emerged as the most dynamic and strategically important product type in the market, accounting for roughly 38% of global revenue in 2024 and steadily gaining share. Their appeal lies in reusability, strong and consistent airflow, and the absence of greenhouse-gas propellants. High-performance brushless motor models are particularly favored in data centers, repair workshops, and industrial facilities, where they can replace dozens of disposable cans over their lifecycle. Traditional compressed gas dusters still hold a significant share, around the mid-50% range, due to their low upfront cost, portability, and familiarity among consumers and office users. Vacuum-assisted and hybrid solutions remain a smaller but growing niche, targeting professional users who require both blowing and suction capabilities for complex cleaning tasks.

Application Insights

Electronics and IT hardware cleaning remains the dominant application segment for air dusters, driven by widespread use in keyboards, desktop PCs, laptops, gaming rigs, printers, and peripherals. Data center maintenance represents a fast-growing subsegment, as operators seek efficient ways to maintain airflow and cooling efficiency. Industrial and manufacturing applications, including cleaning of sensors, control cabinets, conveyors, and robotic joints, are expanding in line with Industry 4.0 adoption. In laboratories and healthcare, air dusters are increasingly used for cleaning optical instruments, diagnostic systems, and delicate medical devices. Automotive workshops and detailing centers also rely on air dusters to clean dashboards, vents, switches, and electronic modules without abrasion. Collectively, these applications reinforce the role of air dusters as versatile tools across both consumer and professional environments.

Distribution Channel Insights

Online platforms, including major e-commerce marketplaces and B2B procurement portals, have become the leading distribution channels for air dusters, especially for bulk and recurring purchases. These platforms enable easy comparison of specifications, reviews, and pricing, while offering convenient replenishment options for businesses. Specialist IT and industrial suppliers leverage digital catalogs and integrated procurement systems to serve corporate clients and institutions. Offline channels remain important, with electronics retailers, office supply chains, hardware stores, and industrial distributors catering to walk-in and regional demand. Direct-to-customer (D2C) sales through branded websites are rising as manufacturers build their online presence, deploy targeted marketing, and offer bundle deals or extended warranties. Hybrid distribution strategies that combine online reach with local stocking and after-sales support are becoming a common model among leading brands.

End-User Type Insights

Enterprise and institutional buyers, including IT service providers, data centers, manufacturing plants, hospitals, and educational institutions, constitute a major share of the air duster market, driven by recurring, volume-based demand. These users typically favor higher-spec electric dusters and bulk multipacks of compressed gas units to support preventive maintenance schedules. Small and medium-sized businesses represent an important mid-tier segment, purchasing air dusters for office IT upkeep, workshops, and light industrial use. Household and individual consumers form a growing base, particularly among technology enthusiasts, gamers, and home-office users who require occasional cleaning for electronics and peripherals. Professional repair and service centers, covering computers, smartphones, cameras, and automotive electronics, remain a high-value niche, prioritizing performance, durability, and compatibility with ESD-sensitive environments.

End-Use Industry Insights

Among end-use industries, electronics and semiconductor manufacturing hold the largest share, reflecting the intensive need for contamination control during assembly, inspection, and testing. The IT and telecom sector, including data centers, enterprise IT departments, and managed service providers, forms another cornerstone of demand, as air dusters are embedded into regular maintenance protocols. Automotive manufacturing and aftermarket services increasingly rely on air dusters for cleaning components tied to safety and performance, including sensors, control units, and infotainment systems. Healthcare and life sciences are growing at an above-average pace, with medical device manufacturers, hospitals, and laboratories adopting air dusters for precise, non-contact cleaning. Finally, commercial offices, education, retail, and hospitality sectors contribute a steady baseline demand for routine cleaning of shared electronics and equipment.

| By Product Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains one of the largest regional markets for air dusters, supported by a high penetration of electronics, substantial data center capacity, and a mature IT services ecosystem. The U.S. accounts for the majority of regional demand, with strong uptake from corporate offices, cloud service providers, electronics retailers, and repair centers. Canada contributes notably through its growing technology and digital infrastructure sectors. Environmental regulations are accelerating the shift toward electric and low-GWP canned dusters, prompting leading brands in the region to expand their portfolios and invest in sustainable formulations. Online procurement and subscription-based supply programs are particularly prevalent in this region.

Europe

Europe is characterized by strong regulatory pressure on fluorinated gases and a high degree of environmental awareness among both businesses and consumers. Countries such as Germany, the U.K., France, and the Nordics are at the forefront of adopting electric air dusters and HFO-based alternatives. The region’s advanced manufacturing base, including automotive, aerospace, and industrial machinery, supports robust professional demand. Data centers in Western and Northern Europe further reinforce consumption, while Central and Eastern Europe are emerging as competitive manufacturing and logistics hubs. European buyers tend to prioritize compliance, eco-labels, and product certifications, rewarding suppliers that invest in sustainable technologies and recyclable packaging.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the air duster market, underpinned by large-scale electronics and semiconductor manufacturing in China, South Korea, Japan, and Taiwan, as well as rising IT infrastructure in India and Southeast Asia. The region’s status as a global electronics production hub drives heavy usage of air dusters in assembly plants, component manufacturing, and quality control operations. Growing middle-class affluence and rapid adoption of consumer electronics fuel household and small business demand. At the same time, many international and domestic brands manufacture electric air dusters in APAC for export, reinforcing the region’s strategic importance. Investments in 5G networks, cloud data centers, and industrial automation are expected to sustain high growth rates over the coming years.

Latin America

Latin America represents a developing but increasingly relevant market for air dusters, with Brazil, Mexico, and Argentina leading regional demand. Expansion of electronics assembly, automotive manufacturing, and service industries drives professional usage, while growing urbanization and digitalization support rising consumption in offices and homes. Market growth is somewhat constrained by price sensitivity and the availability of lower-cost substitutes, but opportunities exist for competitively priced electric models and bulk compressed gas products targeted at the IT, retail, and light industrial segments. Channel partnerships with established office supply, electronics retail, and industrial distributors are key to unlocking regional potential.

Middle East & Africa

The Middle East & Africa region is gradually expanding its demand for air dusters in line with investments in digital infrastructure, industrial diversification, and healthcare. In the Gulf Cooperation Council (GCC) countries, particularly the UAE and Saudi Arabia, growth in data centers, smart city projects, and high-end commercial spaces supports the adoption of both electric and canned air dusters. Across Africa, improving connectivity, growing SME activity, and the spread of IT equipment in education and government are generating incremental demand, though market penetration remains relatively low compared to other regions. As local distribution networks strengthen and awareness of equipment maintenance benefits increases, the region is expected to see steady, long-term growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Company Market Share

The air duster market is moderately consolidated at the top, with the leading manufacturers collectively accounting for roughly 40–45% of global revenue. A small group of well-established brands commands strong visibility in North America, Europe, and parts of Asia-Pacific, especially in the compressed gas and premium electric duster segments. Below these leaders, a long tail of regional and niche manufacturers competes on price, specialized formulations, or application-specific designs. Competitive dynamics are increasingly driven by innovation in electric models, sustainability credentials, and digital selling capabilities, rather than simple volume-based competition in disposable canned air products.

Key Players in the Air Duster Market

- Falcon Safety Products

- Fellowes Brands

- Staples Inc.

- ITW Chemtronics

- MicroCare LLC

- Metro DataVac (MetroVac)

- XPOWER Manufacturing

- TechSpray

- Maxell Holdings Ltd.

- Würth Group