AI Camera Market Size

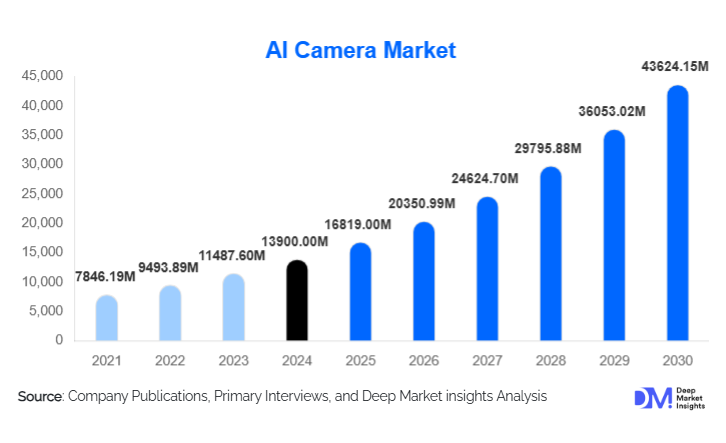

According to Deep Market Insights, the global AI camera market size was valued at USD 13,900.00 million in 2024 and is projected to grow from USD 16,819.00 million in 2025 to reach USD 43,624.15 million by 2030, expanding at a CAGR of 21.0% during the forecast period (2025–2030). The AI camera market growth is primarily fueled by rapid advancements in computer vision, rising deployment of AI-enabled surveillance systems, and the increasing integration of edge-AI cameras across industrial, automotive, and consumer electronics applications.

Key Market Insights

- Smart city infrastructure upgrades are significantly accelerating the adoption of AI-powered surveillance and traffic management cameras worldwide.

- Edge-AI cameras are overtaking cloud-dependent models due to lower latency, improved privacy, and reduced bandwidth burden.

- North America leads the global AI camera market, driven by strong enterprise and smart infrastructure investments.

- Asia-Pacific is the fastest-growing region, supported by urbanization, industrial automation, and massive public safety initiatives.

- Industrial and manufacturing sectors are rapidly adopting AI cameras for quality inspection, robotics, and process automation.

- Automotive demand for in-vehicle AI cameras is rising sharply with ADAS, driver-monitoring systems, and semi-autonomous vehicle development.

What are the latest trends in the AI Camera Market?

AI-Driven Surveillance Expands Through Smart Cities

Governments worldwide are investing heavily in smart-city surveillance infrastructure, driving widespread deployment of AI cameras with real-time analytics. These systems enhance public safety by enabling crowd monitoring, license plate recognition, anomaly detection, and incident prediction. Integration with urban IoT systems, including traffic lights, emergency response networks, and public transport, allows seamless intelligence sharing. Cities in Asia-Pacific, the Middle East, and North America are implementing multi-billion-dollar modernization programs, positioning AI cameras as core components of urban digital transformation. Privacy-centric AI frameworks and edge processing are increasingly added to comply with regulatory requirements while maintaining analytic capabilities.

Industrial Automation Accelerates AI Vision Adoption

AI-powered cameras have become essential tools within Industry 4.0. Manufacturers, logistics hubs, and warehouses are deploying AI cameras for automated quality inspection, defect detection, asset tracking, and occupational safety monitoring. Edge-AI chips enable real-time processing on the factory floor, reducing reliance on centralized computing infrastructure. Robotics applications, such as automated picking, handling, and assembly, now heavily depend on AI vision systems. As global industrial production scales and labor shortages intensify, AI cameras are expected to become standard equipment across automated facilities.

What are the key drivers in the AI Camera Market?

Government Investment in Public Safety & Smart Infrastructure

The rising need for efficient public safety and urban security is significantly driving the adoption of AI cameras. Large-scale government initiatives, covering traffic monitoring, border surveillance, emergency response, and crime prevention, are fueling demand across North America, Asia-Pacific, the Middle East, and Europe. AI cameras offer automated threat detection, behavioral analysis, and predictive alerts, making them indispensable to modern surveillance ecosystems. The strong alignment between AI cameras and national digital transformation agendas ensures sustained long-term demand.

Advancements in Edge Computing, Vision AI & Sensor Technologies

Rapid improvements in AI processors, CMOS imaging sensors, and machine-learning algorithms have made AI cameras more accurate, affordable, and energy efficient. Edge-AI computing enables real-time analysis directly within the camera, minimizing latency and privacy risks. These innovations have lowered the entry barrier for enterprises and SMBs, expanding adoption across retail, industrial, automotive, and residential applications. The continuous decline in hardware costs, alongside powerful AI algorithm upgrades, is a key enabler of global market expansion.

Growing Adoption Across Industrial, Automotive, and Consumer Markets

AI cameras are increasingly integrated into diverse use cases, from smart home security systems and industrial quality inspection to advanced driver-assistance systems (ADAS) in automobiles. Consumer electronics manufacturers are embedding AI into smartphones and IoT devices to enhance imaging quality, recognition capabilities, and automation. Automotive OEMs leverage AI cameras for lane detection, driver monitoring, and collision avoidance. The widening range of applications continues to broaden the overall market base.

Restraints: Privacy Regulations and Infrastructure Gaps

Despite strong adoption, strict privacy frameworks, such as GDPR in Europe, limit the deployment of facial recognition and behavioral analytics. The lack of uniform surveillance regulations across markets further complicates implementation for global vendors. Additionally, inadequate network bandwidth, outdated infrastructure, and high storage requirements pose operational challenges. SMEs and developing economies often face deployment delays due to cost constraints and integration complexities.

What are the key opportunities in the AI Camera Industry?

Smart-City Expansion and Urban Infrastructure Modernization

With more than 70% of the global population expected to live in urban centers by 2050, governments are prioritizing digital infrastructure investments. Smart-city programs worldwide require AI-enabled surveillance for traffic control, crowd management, and emergency response. Vendors offering scalable AI camera platforms, edge-AI analytics, and IoT integration will capture significant value. Long-term public contracts and government-backed initiatives create predictable, multi-year revenue streams.

Industry 4.0, Robotics & Automation Ecosystem Growth

AI cameras are vital to next-generation manufacturing, logistics automation, and robotics. Companies specializing in industrial-grade AI vision, high-speed defect detection, and robotic guidance systems stand to benefit. As factories upgrade to highly automated, sensor-rich environments, demand for precision AI cameras will surge. The expansion of autonomous warehouses and high-throughput sorting facilities further strengthens this opportunity.

Rising Demand from Consumer and Automotive Sectors

The integration of AI into smartphone cameras, smart-home devices, and personal electronics is driving unprecedented volume demand. Meanwhile, automotive OEMs are incorporating AI cameras for ADAS, driver monitoring, and autonomous navigation features. Vendors capable of developing compact, energy-efficient, and cost-effective modules for mass-market applications will gain a competitive advantage. Export-led growth from Asian manufacturers also presents strong commercial potential.

Product Type Insights

Surveillance and security cameras dominate the AI camera market, accounting for over 40% of global demand due to extensive deployment in smart cities, enterprise buildings, and public infrastructure. Edge-AI cameras in particular are growing rapidly as organizations shift from traditional CCTV to analytics-enabled systems. Industrial AI cameras are expanding as manufacturers deploy them for defect detection, robotic vision, and operational analytics. Their adoption is supported by Industry 4.0 upgrades and automation-driven productivity initiatives.

Consumer AI cameras, including smartphones and smart-home security devices, represent the highest-volume segment. AI-enhanced photography, facial recognition, and home monitoring continue to strengthen demand across global households.

Application Insights

Public safety and surveillance remain the largest application segment, widely used for urban monitoring, crime prevention, and traffic analytics. Government-led investments in infrastructure modernization drive this segment’s dominance.

Industrial applications such as quality control, automation, and robotics are among the fastest-growing due to the shift toward AI-powered manufacturing ecosystems. Automotive applications, driver monitoring systems, ADAS, and in-cabin sensing are rapidly expanding with the rise of intelligent and semi-autonomous vehicles. Retail analytics uses AI cameras for customer behavior tracking, loss prevention, and checkout automation, contributing to steady demand growth.

Distribution Channel Insights

Direct enterprise sales and integrator-led deployments dominate the AI camera distribution landscape, especially for large-scale city surveillance and industrial automation projects. Online B2B channels are expanding as vendors offer modular AI camera hardware through digital procurement platforms, enabling easier comparison and faster adoption by SMBs. OEM partnerships with automotive, smartphone, and IoT manufacturers constitute a major revenue stream, particularly for compact AI camera modules.

End-User Insights

Government and public infrastructure authorities represent the largest end-user segment, driven by smart-city initiatives and public safety mandates. Industrial and manufacturing firms are among the fastest-growing customers, adopting AI cameras for automation, safety, and efficiency improvements. Automotive OEMs contribute significantly to future demand as AI camera systems become essential to driver monitoring and autonomous features. Consumer electronics manufacturers sustain high volume demand, especially in smartphones and home security ecosystems.

| By Component | By Camera Type | By Technology | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest regional market, holding over 30% of global AI camera demand. The U.S. leads adoption, driven by enterprise security upgrades, smart-city projects, and rapid integration of AI in industrial and retail sectors. Strong R&D focus and early adoption of AI standards further reinforce growth.

Europe

Europe maintains a strong demand for AI cameras across public safety, industrial automation, and automotive applications. The region’s stringent privacy regulations encourage adoption of compliant edge-AI systems. Germany, the U.K., and France lead the market, supported by rapid digital transformation initiatives.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, Japan, and South Korea. Massive infrastructure development, expanding urban populations, and strong manufacturing ecosystems drive AI camera adoption. China dominates regional demand, while India is emerging as a high-growth market due to smart-city investments.

Latin America

Latin America shows steady adoption, particularly in Brazil, Mexico, and Colombia. Rising crime rates, improving economic conditions, and expanding enterprise digitization support market growth. However, infrastructural constraints limit penetration in some areas.

Middle East & Africa

The region is witnessing the accelerating adoption of AI cameras, driven by large-scale smart-city programs in the UAE, Saudi Arabia, and Qatar. Africa is also increasing deployment for public safety and border security, with South Africa leading regional momentum.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the AI Camera Market

- Hikvision

- Axis Communications

- Bosch Security Systems

- Honeywell International

- Sony Corporation

- Samsung Electronics

- Panasonic Corporation

- Canon Inc.

- Dahua Technology

- Advantech Co., Ltd.

- e-con Systems

- FLIR Systems

- Google (AI imaging platforms)

- Ambarella (AI chipsets & camera modules)

- Omron (industrial vision systems)

Recent Developments

- In March 2025, Axis Communications launched a new series of edge-AI security cameras with onboard analytics for smart-city applications.

- In January 2025, Honeywell expanded its industrial AI camera line, integrating real-time defect detection for high-speed manufacturing environments.

- In April 2025, Sony introduced advanced AI imaging sensors designed for next-generation automotive driver-monitoring systems.