Agility Training Equipment Market Size

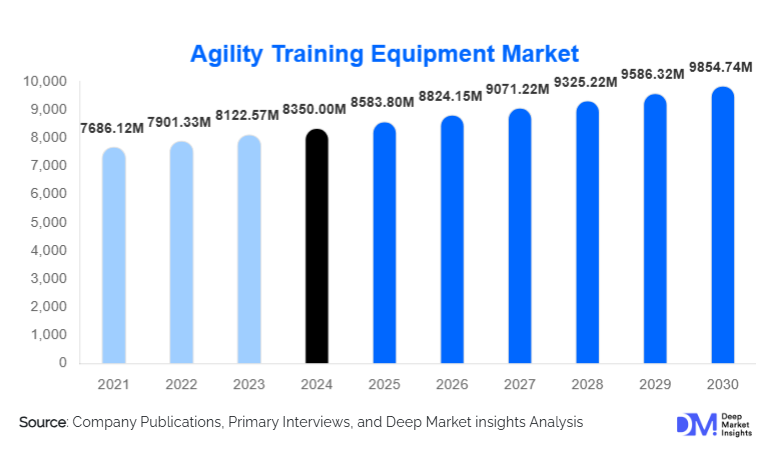

According to Deep Market Insights, the global agility training equipment market size was valued at USD 8,350.00 million in 2024 and is projected to grow from USD 8,583.80 million in 2025 to reach USD 9,854.74 million by 2030, expanding at a CAGR of 2.8% during the forecast period (2025–2030). Growth in this market is primarily driven by the rapid expansion of functional fitness activities, rising investments in youth sports development, the proliferation of boutique training studios, and increasing adoption of smart, sensor-enabled agility devices across professional training environments.

Key Market Insights

- Agility training is transitioning from basic mechanical tools toward smart, connected performance systems, integrating timing gates, wearables, and analytics dashboards.

- Professional sports clubs, academies, and fitness studios represent the largest buying segment, driven by standardized training programs and durable equipment demand.

- E-commerce dominates global distribution, accounting for nearly half of all agility equipment sales in 2024 due to rising home fitness adoption.

- North America leads the global market, driven by high participation in organized sports and strong collegiate athletic ecosystems.

- Asia-Pacific remains the fastest-growing region, fueled by large-scale youth sports initiatives in China and India.

- Material innovation and IoT integration are reshaping manufacturing, improving durability, and expanding premium product categories.

What are the latest trends in the agility training equipment market?

Smart Performance Tracking and Connected Training Ecosystems

The integration of smart timing systems, motion sensors, and wearable trackers is transforming the agility training landscape. Professional teams and advanced training centers increasingly rely on objective performance metrics such as acceleration curves, reaction times, and multi-directional movement efficiency. Manufacturers are bundling smart hardware with subscription-based analytics platforms, creating new recurring revenue streams. Athlete dashboards, real-time leaderboards, and cloud-stored training history are becoming standard features. This trend is particularly pronounced in North America and Europe, where data-driven coaching methods continue to gain traction.

Rise of Functional Fitness and Boutique Training Studios

Functional fitness movements, including HIIT, CrossFit-style training, and sports-performance facilities, are driving strong demand for agility ladders, cones, hurdles, and resistance devices. Boutique training studios increasingly rely on multi-user agility circuits to differentiate their offerings. Agility equipment has become a core component of programming designed around speed, plyometrics, and neuromuscular conditioning. The integration of agility tools into group classes, rehabilitation sessions, and youth-athlete development is widening the customer base and accelerating recurring purchases.

What are the key drivers in the agility training equipment market?

Rapid Expansion of Youth Sports and Professional Academies

Youth sports academies, particularly in soccer, basketball, rugby, and cricket, are investing heavily in standardized training protocols that require agility ladders, slalom poles, hurdles, and resistance equipment. These institutions purchase equipment in bulk, resulting in high-volume repeat orders driven by wear-and-tear cycles. Emerging markets such as India and China are launching nationwide talent development programs, boosting institutional procurement substantially.

Growing Adoption of Data-Driven Training

Sports science is becoming integral to athlete performance management. The shift toward quantifiable metrics, reaction speed, lateral quickness, and functional mobility has accelerated the adoption of smart training devices. This has increased average selling prices and expanded the market for connected ecosystems, including timing gates, accelerometer-based wearables, and cloud analytics. Teams and studios are willing to invest in premium technology that delivers competitive performance insights.

What are the restraints for the global market?

Price Commoditization in Basic Equipment

Agility ladders, cones, and markers face intense price pressure due to low manufacturing complexity and widespread availability of low-cost imports. High competition among small and medium players suppresses margins and limits differentiation. While premium materials and bundle kits help offset this, the bulk of global volume still operates under thin-profit conditions.

Supply Chain Volatility and Raw Material Costs

Fluctuations in polymer, rubber, and electronic component prices impact production costs. Extended lead times in electronics and rising international freight costs affect smart equipment manufacturers disproportionately. Smaller brands without diversified sourcing often struggle with inventory predictability, limiting scalability.

What are the key opportunities in the agility training equipment industry?

Growth of Smart, AI-Enabled Training Platforms

AI-driven motion analysis, cloud analytics, and app-based coaching present a significant opportunity for manufacturers to move beyond hardware sales. Smart agility systems that integrate video capture, real-time technique correction, and personalized training pathways are expected to redefine performance training. Companies that successfully pair hardware with proprietary software ecosystems can unlock high-margin subscription revenue.

Expansion in Rehabilitation, Tactical Training, and Animal Agility Sports

Rehabilitation centers increasingly utilize agility ladders, balance aids, and reaction tools for neuromuscular retraining. Police, military, and firefighting departments incorporate agility circuits in tactical fitness programs. Meanwhile, dog agility sports are growing rapidly, creating a niche but high-volume market for hurdles, tunnels, and marker kits. These segments reward durability and safety-certified equipment, enabling premium pricing.

Product Type Insights

Agility ladders, marker cones, and hurdles dominate global sales, accounting for more than 30% of the 2024 market. These items are essential across nearly all training environments, from home fitness routines to elite sports academies, due to their versatility and affordability. Premium products such as adjustable hurdles, reinforced slalom poles, and smart timing systems are expanding their share as professional buyers seek durability and quantifiable performance metrics. Wearables, electronic gates, and multi-use kits are the fastest-growing categories, driven by rising demand for precise performance tracking and structured training programs.

Application Insights

Sports performance training represents the largest application segment, heavily driven by professional teams, collegiate programs, and private academies. Functional fitness applications, including HIIT and boot-camp formats, continue to expand their use of agility circuits. Rehabilitation centers increasingly rely on agility tools for balance and coordination recovery. Tactical training for military and law enforcement agencies has emerged as a robust application area. Emerging applications include pet agility training, PE programs in schools, and esports performance training centers that integrate physical agility drills alongside cognitive training.

Distribution Channel Insights

E-commerce leads the global distribution landscape, holding approximately 45% of market share in 2024. Online marketplaces enable rapid global access to agility kits, while D2C brand websites offer training resources, digital programs, and product bundles. Specialty sports retailers remain critical for institutional and professional buyers seeking high-durability equipment. B2B direct sales dominate large academy, school, and gym procurement cycles. Hybrid channels, online ordering combined with local fulfillment, are emerging to improve delivery times and reduce inventory costs.

End-User Insights

Fitness centers, boutique studios, and sports clubs are the largest end-user segments, accounting for nearly 40% of 2024 global demand. Professional academies and schools contribute significantly to recurring volume growth. Home fitness enthusiasts represent a steadily expanding demographic, driven by online training programs and the convenience of compact agility kits. Rehabilitation and tactical training end-users are adopting higher-priced, specialized equipment, contributing disproportionately to premium product revenues.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest global share, driven by robust school sports participation, established professional leagues, and widespread fitness culture. High adoption of smart and premium equipment makes this region the most lucrative for sensor-integrated systems. Institutional procurement cycles in U.S. schools and colleges significantly boost volume.

Europe

Europe exhibits strong demand across the U.K., Germany, Spain, and France, supported by structured club ecosystems and youth sports programs. Buyers prioritize durable materials and standardized quality, driving demand for mid-to-premium class agility equipment. Rehabilitation and physiotherapy centers are a growing end-user group in this region.

Asia-Pacific

APAC is the fastest-growing region, driven by booming youth sports academies, increased household spending on fitness in China and India, and expanding urban boutique gym networks. Government-funded sports development programs further accelerate institutional purchases. The region also benefits from strong manufacturing capabilities, supporting competitive pricing.

Latin America

Demand in Brazil, Argentina, and Mexico is primarily fueled by soccer training academies and recreational fitness segments. Pricing sensitivity remains high, leading to strong penetration of mass-market agility kits imported from Asia.

Middle East & Africa

Growth in this region is supported by expanding sports infrastructure in the UAE, Saudi Arabia, and South Africa. Private fitness clubs, elite sports centers, and tactical training facilities are major customers. African nations also demonstrate rising adoption in school athletics and community sports development programs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Agility Training Equipment Market

- BSN Sports

- Champion Sports

- Kwik Goal

- SKLZ (Pro Performance Sports)

- Perform Better

- Power Systems

- Tandem Sport

- Vinex/Bhalla International

- Aosom

- Escape Fitness

- SPRI

- Champro Sports

- Pro Training Equipment

- Sports Invasion

- Great Gear Sports