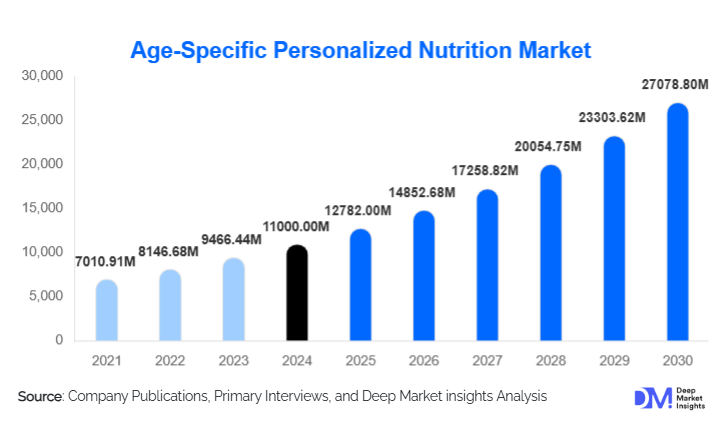

Age-Specific Personalized Nutrition Market Size

According to Deep Market Insights, the global age-specific personalized nutrition market size was valued at USD 11,000 million in 2024 and is projected to grow from USD 12,782.00 million in 2025 to reach USD 27,078.80 million by 2030, expanding at a CAGR of 16.2% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer emphasis on preventive health, rapid advancements in genomics and AI-driven nutrition platforms, and increasing demand for age-tailored supplements, functional foods, and biomarker-based nutrition solutions.

Key Market Insights

- Personalized nutrition is shifting toward scientific, age-tailored formulations, driven by biomarker analysis, microbiome testing, and genotype-based recommendations.

- Dietary supplements dominate the product landscape, supported by strong consumer preference for convenient, science-backed health optimization across age groups.

- Adults (19–64 years) account for the largest share of global demand due to high purchasing power and rising interest in metabolic and lifestyle-related nutrition solutions.

- Asia-Pacific is the fastest-growing region, benefitting from rising disposable income, digital health penetration, and government-supported preventive health programs.

- Online platforms and D2C subscription models lead distribution, enabled by personalized dashboards, AI-guided recommendations, and automated refills.

- Integration of multi-omics technology, genomics, metabolomics, and microbiome profiling is redefining product innovation and enabling hyper-personalized nutrition systems.

What are the latest trends in the age-specific personalized nutrition market?

Hyper-Personalization Enabled by Genomics & Multi-Omics

Companies are integrating multi-omics data, including genetics, microbiome composition, blood biomarkers, and metabolic profiling, to deliver precision nutrition tailored to each life stage. Platforms combine AI decision engines with consumer data to customize supplement doses, meal-replacement formulations, and functional food components. This trend is especially strong in adult and senior groups, where genomic insights help optimize metabolic, cognitive, and cardiovascular health. Start-ups and major nutrition corporations are increasingly offering at-home test kits, using biological data to auto-generate dynamic nutrition plans that adapt as user biomarkers evolve.

Digital Subscription Ecosystems & AI-Powered Nutrition Coaching

Digital subscription models are rapidly gaining traction as consumers seek seamless access to personalized supplements, functional foods, and nutrition guidance. AI-powered apps now evaluate user habits, symptoms, and biometric data to deliver real-time dietary recommendations. Personalized dashboards track adherence, micronutrient levels, and progress toward health goals. The combination of recurring subscription revenue and data-driven optimization is enhancing consumer retention while elevating the value of personalized nutrition services.

What are the key drivers in the age-specific personalized nutrition market?

Growing Global Emphasis on Preventive and Lifestyle Health

With rising rates of obesity, diabetes, hypertension, and metabolic syndrome, consumers are increasingly turning to age-tailored nutrition as a preventive health strategy. Adults and seniors, in particular, are prioritizing solutions that help manage metabolic risk, cognitive aging, and immune health. Governments and insurers are encouraging preventive health measures, creating opportunities for clinically integrated personalized nutrition programs. The shift from treatment to prevention is fueling sustained demand for scientifically validated, customized nutrition products.

Advancements in Biotechnology, Diagnostics & AI

Technological breakthroughs, such as affordable genetic testing, microbiome sequencing, and biomarker analysis, are enabling highly tailored nutritional formulations. AI systems interpret complex health data to recommend precise nutrient levels for each age group. These advancements not only increase the accuracy of personalization but also support premium pricing. Nutrition companies are investing heavily in R&D capabilities and digital infrastructure, driving rapid innovation and differentiation within the market.

What are the restraints for the global market?

Regulatory Complexity and Scientific Validation Requirements

Age-specific personalized nutrition often requires clinical validation, especially when linked to genomics or biomarker-based claims. Regulations differ significantly across regions, making it challenging for companies to market products globally. Strict rules surrounding health claims, genetic data use, and supplement formulation increase operational complexity. Smaller companies may struggle to navigate compliance costs, slowing market penetration and innovation.

High Cost of Testing, Personalization, and Data Management

Personalized nutrition solutions, particularly those involving genetic or microbiome testing, remain expensive for many consumers. Cost barriers limit adoption in price-sensitive markets and reduce accessibility for younger or lower-income segments. In addition, companies must invest heavily in secure data infrastructures to protect sensitive health data, adding to operational expenses. These combined costs create barriers to mass-market scalability.

What are the key opportunities in the age-specific personalized nutrition industry?

Healthcare System Integration & Clinical Nutrition Pathways

Partnerships with hospitals, insurers, and clinicians offer significant long-term growth opportunities. Personalized nutrition can support chronic disease prevention, maternal health, pediatric nutrition, and healthy aging. Clinically validated formulations and diagnostics-integrated nutrition programs enable companies to serve high-value segments, including seniors and patients with metabolic or cognitive conditions. Reimbursement and employer wellness programs further enhance market potential.

Emerging Market Expansion in Asia-Pacific & Latin America

Rising disposable income, urbanization, and increased preventive health awareness are driving strong demand in emerging markets. Countries such as China, India, Brazil, and Mexico offer massive underpenetrated consumer bases. Localization of formulations, digital-first distribution models, and government-led nutrition initiatives further support growth. Companies that establish early presence and regional manufacturing capabilities can capture substantial market share in the coming years.

Product Type Insights

Dietary supplements remain the dominant product type in the age-specific personalized nutrition market, accounting for the largest share due to their convenience, scientific validation, and adaptability to age-driven nutrient demands. These include targeted multivitamins, probiotics, metabolic enhancers, cognitive support complexes, and bone-health supplements, all optimized using biomarker, DNA, and lifestyle inputs. This segment benefits from continuous R&D, clinical endorsements, and expanding subscription-driven personalized packs.

Functional foods and beverages are experiencing strong momentum as consumers increasingly favor whole-food-based personalization. Enhanced with age-specific nutrient profiles, such as omega-3-rich beverages for cognitive support in seniors and protein-fiber blends for adults, they hold a strong growth trajectory.

Personalized meal replacements, including shakes, bars, and nutritionally complete beverages, are rapidly expanding due to their appeal among fitness-conscious, convenience-oriented consumers. Meanwhile, emerging formulations such as custom nutrient powders, AI-designed blends, and microbiome-targeted formulations are accelerating innovation and driving premiumization across the market.

Application Insights

Metabolic health and weight management lead global adoption, supported by high obesity prevalence, lifestyle-related disorders, and growing interest in preventive wellness. Personalized programs integrating glucose monitoring, metabolic typing, and DNA-based dietary insights are fueling this demand.

Cognitive health solutions are rapidly expanding, particularly for aging adults seeking memory support, neural optimization, and long-term cognitive resilience. The rising incidence of neurodegenerative conditions further accelerates product innovation in this category.

Immune health remains a universal driver across all age groups, with personalized vitamin-mineral complexes and microbiome-strengthening formulations gaining traction. Skin, hair, and beauty nutrition is growing notably among millennials and Gen Z, driven by social media, clean-label preferences, and the rise of "beauty-from-within" supplements.

Sports and fitness nutrition continues to rise as biomarker-driven personalization becomes mainstream, incorporating insights from hormone panels, metabolic testing, and gut-health diagnostics to optimize athletic performance.

Distribution Channel Insights

Online retail and direct-to-consumer (D2C) subscription models dominate the market, offering customized dashboards, automated refills, AI-driven dietary analysis, and at-home testing kits. This channel benefits from high consumer engagement, data-driven personalization, and recurring revenue streams.

Pharmacies and drugstores maintain steady demand due to trust, clinical guidance, and the availability of age-specific supplement packs supported by pharmacists.

Specialty nutrition stores perform strongly in premium categories, targeting athletes, seniors, and consumers seeking advanced formulations.

Healthcare channels, including hospitals, clinics, telehealth platforms, dietitians, and wellness centers, are emerging as high-value pathways, owing to clinical-grade personalization, insurance integration, and medically supervised nutrition programs.

End-User Insights

Direct-to-consumer (D2C) users represent the largest end-user segment, driven by app-based engagement, self-monitoring tools, and seamless delivery models. Healthcare institutions (hospitals, nutritionists, medical wellness programs) are the fastest-growing segment as diagnostics-driven personalization becomes a core component of preventive healthcare. Corporate wellness programs are increasingly adopting age-based personalized nutrition plans to improve workforce productivity and reduce healthcare costs. Offerings include biomarker-driven nutritional coaching, supplement kits, and AI-enabled dietary recommendations.

Export-driven demand is rising, with key companies scaling personalized nutrition solutions into growing wellness markets across Asia-Pacific and Latin America, supported by digital distribution and cross-border e-commerce.

Age Group Insights

Adults (19–64 years) account for the largest share of the market, supported by strong demand for metabolic health, cognitive performance, immunity, and lifestyle optimization. This demographic benefits from higher disposable income and increased interest in preventive health.

Teenagers and children represent a rapidly growing segment as parental awareness of developmental nutrition rises. Personalized solutions for immunity, gut health, and cognitive development are gaining momentum.

Seniors (65+) are emerging as high-value consumers, driven by needs related to bone health, cardiovascular support, cognitive wellness, and age-related nutrient deficiencies. This category is attracting companies offering medical-grade personalized nutrition.

Maternal and pre-conception nutrition is expanding steadily, with personalized formulations designed for prenatal health, early childhood development, and postpartum recovery.

| By Age Group | By Solution Type | By Health Goal | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America leads the global market, driven by advanced healthcare systems, high consumer purchasing power, and early adoption of genomics and biomarker-based nutrition. The U.S. dominates regional demand due to its robust ecosystem of AI-driven personalization platforms, widespread subscription models, and heavy investment in digital health.

Key growth drivers include rising preventive wellness adoption, strong insurance-driven health programs, corporate wellness expansion, and rapid acceptance of telehealth-based nutritional diagnostics. Increasing obesity rates and aging demographics further strengthen the region’s long-term demand for personalized, age-specific nutrition solutions.

Europe

Europe is a mature yet rapidly evolving market, led by Germany, the U.K., France, and the Nordics. Consumer preference for evidence-based nutrition, organic products, and clean-label formulations supports strong demand. The region benefits from advanced regulatory structures such as GDPR, which strengthen consumer trust in data-driven personalization.

Growth is additionally driven by rising demand for aging-related nutrition, microbiome-targeted functional foods, and physician-guided supplement programs. Europe’s emphasis on sustainability and traceability further enhances the adoption of premium personalized nutrition products.

Asia-Pacific

Asia-Pacific is the fastest-growing region, fueled by rapid urbanization, expanding middle-class populations, and rising lifestyle-related health challenges. China and India are powering mass adoption of personalized nutrition apps, home-testing kits, and subscription-based supplements.

Japan and South Korea lead in technological innovation with microbiome-based personalization, longevity-focused nutrition, and AI-integrated wellness platforms. Government-led preventive health programs, increasing smartphone penetration, and cultural interest in functional foods are key drivers of regional growth.

Latin America

Latin America is gradually adopting age-specific personalized nutrition, with strong demand emerging from Brazil, Mexico, and Chile. Growth is driven by rising chronic disease management needs, growing health awareness, and increased penetration of digital commerce.

Regional players are partnering with global brands to localize formulations, address unique nutritional deficiencies, and expand distribution in urban centers. Young consumer demographics and rising adoption of global wellness trends contribute to steady market expansion.

Middle East & Africa

The Middle East shows strong demand for premium personalized nutrition solutions, led by the UAE, Saudi Arabia, and Qatar, where high disposable incomes and luxury wellness culture dominate consumer preferences. AI-driven wellness apps, longevity programs, and biomarker-based supplements are gaining fast traction.

Africa, while still an emerging market, is witnessing increasing adoption of preventive nutrition and digital health platforms, particularly in South Africa, Kenya, and Nigeria. Government-backed public health nutrition initiatives and improved healthcare access are expected to gradually accelerate market growth across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Age-Specific Personalized Nutrition Market

- Nestlé S.A.

- Danone

- Abbott Laboratories

- DSM-Firmenich

- Unilever

- Persona Nutrition

- Viome

- Nutrigenomix

- DNAfit

- AHARA Personalized Nutrition

Recent Developments

- In March 2025, Nestlé expanded its personalized nutrition portfolio by launching a multi-omics testing kit integrated with AI-driven supplement recommendations.

- In January 2025, Viome introduced an advanced microbiome-based metabolic health program tailored for seniors, featuring adaptive supplement formulations.

- In November 2024, Danone partnered with leading genomics labs to co-develop maternal and infant personalized nutrition products with clinically validated formulations.