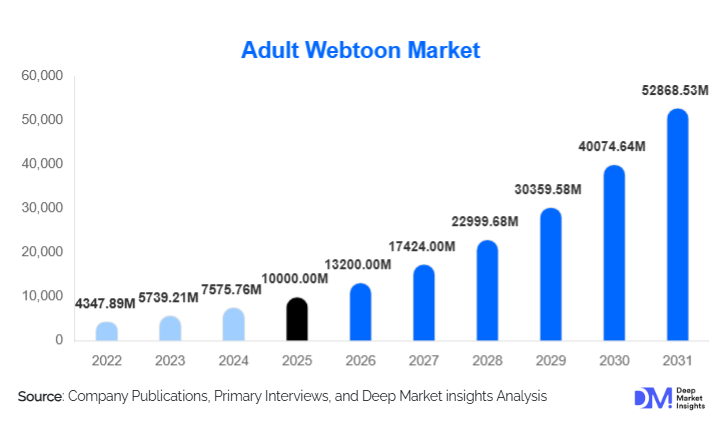

Adult Webtoon Market Size

According to Deep Market Insights, the global adult webtoon market size was valued at USD 10,000.00 million in 2025 and is projected to grow from USD 13,200.00 million in 2026 to reach USD 52,898.53 million by 2031, expanding at a CAGR of 32.0% during the forecast period (2026–2031). The market growth is primarily driven by increasing smartphone penetration, growing adoption of subscription-based premium models, and rising global demand for mature, immersive, and interactive digital storytelling content.

Key Market Insights

- Romance and relationship-oriented adult webtoons dominate the genre segment, attracting a broad global audience with engaging, serialized storylines and cliffhangers that encourage repeat subscriptions.

- Subscription and premium monetization models are becoming the preferred revenue strategy, as consumers are willing to pay for ad-free, exclusive, and uncensored content experiences.

- Asia-Pacific leads the global adult webtoon market, with South Korea and Japan contributing the largest shares due to mature platform ecosystems and strong cultural acceptance of serialized adult content.

- North America shows rapid growth, driven by high ARPU, mobile adoption, and the increasing popularity of multilingual, localized adult webtoons among millennial and Gen Z audiences.

- Emerging markets in Latin America and Europe are witnessing growing demand for localized content, mobile accessibility, and freemium subscription models.

- Technological integration, including AR/VR immersive storytelling, interactive narratives, and AI-driven personalization, is reshaping consumer engagement and retention.

What are the latest trends in the adult webtoon market?

Premium and Interactive Storytelling Gaining Traction

Adult webtoon platforms are increasingly emphasizing subscription-based premium models with exclusive content access, early-release chapters, and ad-free experiences. Interactive storytelling features, such as choice-based plot progression, gamified panels, and motion-enabled illustrations, are enhancing user engagement. By providing immersive narrative experiences, platforms are improving retention, increasing microtransaction revenues, and fostering loyal readership communities. These developments appeal particularly to tech-savvy millennials and Gen Z consumers seeking unique, participatory entertainment formats.

Technology-Enhanced Webtoon Experiences

Technologies such as augmented reality (AR), virtual reality (VR), and interactive animation are being integrated into adult webtoons, enabling immersive scene exploration and gamified narrative engagement. AI-driven content recommendations and data analytics enhance personalized reading experiences, suggesting episodes and genres that align with individual preferences. Mobile apps provide real-time notifications, community interaction, and in-app purchasing, transforming how readers engage with serialized content. These innovations also support cross-platform expansion and adaptations into other media, such as animation or OTT series.

What are the key drivers in the adult webtoon market?

Rising Mobile and Digital Content Consumption

The widespread adoption of smartphones and tablets has accelerated adult webtoon consumption globally. Mobile-first design, vertical scrolling formats, and episodic storytelling allow users to engage conveniently on the go. Push notifications, offline reading, and social sharing features enhance engagement, making mobile platforms the primary vehicle for content delivery and monetization.

Growth of Premium and Subscription Models

Adult webtoon readers are increasingly willing to pay for premium, ad-free content. Subscription models and pay-per-chapter systems are unlocking recurring revenue streams and increasing average revenue per user (ARPU). Platforms offering tiered access and loyalty rewards are reducing churn and improving lifetime customer value, driving profitability for service providers and creators alike.

Globalization and Cross-Cultural Appeal

Adult webtoons are expanding beyond Asia-Pacific through localization and multilingual content, attracting audiences in North America, Europe, and Latin America. Platforms that offer culturally adapted storytelling and support international distribution are expanding the total addressable market and creating global revenue opportunities.

What are the restraints for the global market?

Regulatory Challenges and Content Censorship

Adult webtoon platforms face complex regulations around mature content in different regions. Restrictions on explicit content, age-verification requirements, and censorship policies can limit discoverability and monetization potential. Platforms must comply with these regulations, requiring additional investment in moderation and compliance infrastructure.

Payment and Monetization Barriers

Converting free users to paying subscribers remains a challenge, particularly in regions with limited digital payment infrastructure. Economic disparities and privacy concerns regarding payment systems may hinder subscription uptake and slow overall revenue growth, especially for sensitive adult content.

What are the key opportunities in the adult webtoon industry?

Expansion of Premium Subscriptions

Increasing consumer willingness to pay for exclusive content presents a major opportunity for platforms. Bundled subscriptions, early-access content, and loyalty incentives can attract and retain high-value readers, boosting ARPU and platform revenue. Platforms leveraging data analytics for personalization can further capitalize on engagement trends and reduce churn.

Regional Market Penetration and Localization

Emerging markets in Latin America, Europe, and the Middle East represent growth opportunities. Localizing content for language, culture, and social norms can unlock latent demand, while partnerships with local creators and studios accelerate market entry and community building.

Integration of Immersive Technologies

AR, VR, and gamified storytelling present avenues for differentiated content delivery. Platforms integrating immersive experiences can enhance user engagement, attract tech-savvy audiences, and create additional monetization channels, particularly in high-income markets seeking novel entertainment experiences.

Product Type Insights

Within the adult webtoon market, romance and relationship genres dominate, accounting for approximately 32% of the market, due to broad global appeal and high reader retention. Subscription and premium models represent 45% of total revenue, highlighting the shift toward recurring monetization. Mobile apps are the primary platform, capturing roughly 78% of total consumption, while smartphones remain the dominant device with 83% usage. Asia-Pacific leads regionally, contributing 57% of global revenue, supported by strong cultural adoption and high mobile penetration.

Application Insights

Adult webtoons are primarily consumed as digital entertainment, but new applications are emerging in interactive storytelling, AR/VR-enhanced experiences, and cross-media adaptations. Serialized narrative content is increasingly being used for IP development, animations, and gamified content, expanding revenue streams. End-user engagement is highest among 18–34-year-old audiences, who actively consume and pay for premium, immersive digital experiences.

Distribution Channel Insights

Digital platforms, including proprietary mobile apps and web portals, dominate adult webtoon distribution. Subscription-based and freemium models are the primary monetization channels. Direct-to-consumer marketing, social media promotion, and platform-specific engagement features such as notifications and in-app purchases are key distribution strategies. Emerging channels include AR/VR platforms and interactive storytelling apps.

Age Group Insights

Readers aged 18–34 years represent the fastest-growing segment, driven by mobile consumption, digital literacy, and willingness to pay for premium content. The 35–44 segment contributes to sustained subscription revenues due to disposable income and consistent engagement, while the 45+ demographic, though smaller in volume, is an emerging high-value segment for specialized adult content and curated storytelling experiences.

| By Genre | By Monetization Model | By Platform / Channel | By Device | By Creator Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 25–28% of the global adult webtoon market, with strong adoption in the U.S. and Canada. Mobile and subscription-driven models dominate consumption, and localized English content is driving readership among millennials and Gen Z. Market growth is fueled by high ARPU and demand for interactive and premium content experiences.

Europe

Europe is a rapidly expanding market, particularly in the U.K., Germany, and France, with demand driven by localized adult webtoons, mobile accessibility, and premium subscription models. Eco-conscious content and digital literacy trends are boosting adoption among younger demographics.

Asia-Pacific

Asia-Pacific remains the largest regional market (57% share), led by South Korea, Japan, and China. Mature content acceptance, robust platform ecosystems, and cultural integration of serialized digital storytelling contribute to market leadership. Emerging markets like India and Southeast Asia are demonstrating strong growth potential.

Latin America

Latin America, led by Brazil and Mexico, is an emerging market where mobile penetration and digital content adoption are increasing. Localized Spanish and Portuguese content is fueling growth, particularly in freemium and subscription-based models.

Middle East & Africa

MEA is a nascent market due to regulatory restrictions on adult content, but interest is growing in the UAE, Saudi Arabia, and South Africa. Age-verification systems and culturally sensitive content are enabling gradual market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Companies in the Adult Webtoon Market

- Naver Webtoon

- Kakao Entertainment

- Tapas Media

- Lezhin Comics

- Toomics

- Comico (Japan)

- Webcomics (China)

- Tappytoon

- Manta

- TopToon

- Peanutoon

- ManhwaPro

- Piccoma

- Line Webtoon

- Joara