Adult Day Care Market Size

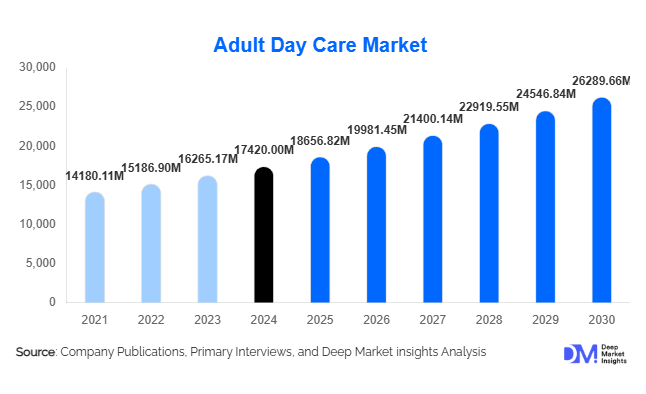

According to Deep Market Insights, the global adult day care market size was valued at USD 17,420.00 million in 2024 and is projected to grow from USD 18,656.82 million in 2025 to reach USD 26,289.66 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). The market growth is primarily driven by the rapidly ageing global population, increasing prevalence of chronic and cognitive conditions, and a global shift toward community-based and non-institutional long-term care models.

Key Market Insights

- Global ageing trends are the strongest demand driver, with over 1.4 billion people expected to be above age 60 by 2030, significantly expanding the addressable market for adult day services.

- Medical-model adult day care centres dominate the market, accounting for over 52% of global revenue in 2024 due to the integration of healthcare, therapy, and chronic condition management services.

- Public funding remains the leading source of revenue, representing nearly 55% of market value, driven by government subsidies, Medicare waivers, and community-care reimbursement schemes.

- North America leads the market with approximately 45% share in 2024, supported by mature infrastructure and established long-term care policies.

- Asia-Pacific is the fastest-growing region, expected to grow at over 7% CAGR owing to rapidly ageing populations in Japan, China, and India.

- Technology integration, including remote monitoring, electronic health records (EHRs), and engagement apps, is transforming operational efficiency and care delivery models.

Latest Market Trends

Integration of Digital Health and Hybrid Care Models

Adult day care providers are increasingly adopting digital health technologies to enhance service delivery, safety, and engagement. Remote health monitoring tools, wearable sensors, and AI-driven scheduling software are improving real-time patient oversight and reducing caregiver burden. Hybrid day care models that combine on-site programs with virtual participation options are emerging as a post-pandemic innovation, enabling continuity of care for less mobile adults. The integration of telehealth consultations and online activity programs is creating new revenue streams while broadening accessibility for clients in suburban and rural areas.

Specialized and Dementia-Focused Adult Day Programs

The rising prevalence of Alzheimer’s disease and other cognitive impairments is driving the development of specialized adult day programs tailored to these populations. Centres offering memory care, cognitive stimulation therapy, and caregiver education are seeing double-digit growth. These programs not only address unmet medical and social needs but also provide cost-effective alternatives to residential nursing care. Global initiatives promoting dementia-friendly communities are supporting the proliferation of these specialized facilities, enhancing both patient outcomes and market profitability.

Adult Day Care Market Drivers

Rapidly Ageing Global Population

The world’s population over 65 years old is expanding at an unprecedented rate. This demographic shift directly fuels demand for accessible and affordable daytime care options. Adult day care services meet the need for structured, safe, and socially engaging environments that help older adults maintain independence while relieving caregiver stress. Governments view these centres as essential to long-term care sustainability, further incentivizing market growth.

Shift Toward Community-Based and Cost-Efficient Care

Healthcare systems worldwide are transitioning from expensive institutional care to community-based solutions. Adult day care centres offer significant cost savings compared to full-time nursing homes while maintaining quality of care and improving quality of life. Policymakers and insurers increasingly reimburse such services, positioning adult day care as a key component of the continuum of care for elderly and disabled populations.

Increasing Dual-Income Households and Caregiver Burnout

With more dual-income families and fewer multigenerational households, family caregivers face growing pressure to balance work with care responsibilities. Adult day care programs provide essential respite care and professional support. This socio-economic shift, especially in urbanized regions, is driving consistent demand for reliable daytime care services, both publicly funded and private-pay.

Market Restraints

Workforce Shortages and High Operational Costs

Adult day care centres depend heavily on skilled healthcare professionals, therapists, and support staff. Global shortages of nursing and geriatric care personnel are limiting expansion and increasing operating expenses. Rising costs for transportation, facility maintenance, and food services further strain margins, particularly in small and mid-size centres.

Limited Reimbursement and Regulatory Complexity

In several regions, insurance and public reimbursement for adult day care remain fragmented or insufficient. Complex licensing, quality standards, and regulatory requirements also pose entry barriers for new providers. These challenges, coupled with variable coverage between states and countries, restrict access for lower-income populations and slow market penetration.

Adult Day Care Market Opportunities

Government and Policy Support Expansion

Many countries are introducing policy frameworks that emphasize ageing-in-place and community-based long-term care. Public-private partnerships, government subsidies, and grant programs are emerging as key enablers for scaling adult day care infrastructure. Providers who align services with these policy objectives can access stable funding streams, ensuring long-term growth and compliance advantages.

Technology-Enabled Care Delivery

Digital transformation presents significant opportunities for innovation. Integrating telemedicine, IoT-based health tracking, and AI-driven analytics can help centres improve care outcomes, optimize staffing, and enhance safety. Providers leveraging technology for remote engagement and caregiver coordination are better positioned to scale sustainably, attract younger clients, and participate in digital reimbursement models.

Expansion into Emerging Economies and Under-Served Segments

Rapid urbanization and ageing in emerging economies such as India, China, and Brazil create untapped potential for adult day care services. Providers entering these markets can capitalize on first-mover advantages by offering culturally adapted, affordable solutions. Beyond seniors, day care programs for adults with disabilities or chronic diseases represent additional growth segments, diversifying the revenue base.

Product Type Insights

The medical/clinical adult day care model dominates the market, contributing approximately 52% of global revenue in 2024. These centres offer skilled nursing, physical and occupational therapy, and chronic disease management, which are increasingly covered by public funding. The social day care model, focused on recreation, meals, and social interaction, accounts for a substantial share in mature markets. Meanwhile, dementia-specific and specialized programs are the fastest-growing subsegment, supported by global initiatives targeting cognitive health and caregiver education.

End-Use Insights

Older adults without severe disabilities remain the largest client segment, contributing around 45% of the total market in 2024. However, adults with cognitive impairments, particularly dementia and Alzheimer’s patients, represent the fastest-growing end-user group, projected to expand at a CAGR above 7%. Day care programs for adults with chronic illnesses such as diabetes or mobility impairments are also gaining traction. Export-driven demand primarily involves franchising and international partnerships, with U.S. and Japanese operators establishing centres in developing regions to share expertise and standards.

| By Service Type | By Funding Source | By Service Delivery Model | By End-User Condition | By Ownership Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the adult day care market, about 45% in 2024 (USD 7.9 billion). The U.S. leads due to comprehensive Medicaid waivers, strong long-term care infrastructure, and a high proportion of older adults. Canada follows with community-based programs integrated into provincial health systems. Growth is steady but mature, supported by public reimbursements and advanced dementia-care models.

Europe

Europe accounts for roughly 28% of the global market share (USD 4.9 billion in 2024). Aging demographics in Germany, Italy, France, and the U.K. sustain demand. EU member states are emphasizing community-based elder care through public grants and caregiver-support programs. Germany’s “Pflegeversicherung” (long-term care insurance) particularly drives consistent funding for adult day services.

Asia-Pacific

The Asia-Pacific region is the fastest-growing market, projected to expand at a 7–8% CAGR through 2030. Japan dominates, leveraging its established elder-care model, while China and India represent high-growth markets due to massive ageing populations and rapid social change. Government initiatives like China’s “Healthy Ageing 2030” and India’s “Senior Citizen Welfare Scheme” support infrastructure development and private investment in day-care facilities.

Latin America

Latin America represents 6% of the global share (USD 1.0 billion in 2024). Brazil and Mexico lead, supported by urbanization and growing awareness of structured elder care. Market development remains in early stages, but private providers and NGOs are filling service gaps with affordable, community-based solutions.

Middle East & Africa

This region accounts for approximately 5% of global market revenue (USD 0.9 billion in 2024). Countries like the UAE, Saudi Arabia, and South Africa are launching pilot community-care programs. While cultural preferences for family caregiving remain strong, government modernization plans (e.g., “Vision 2030”) are creating an emerging market for professional adult day services.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Adult Day Care Market

- Active Day / Senior Care, Inc.

- Adult Life Programs, Inc.

- Age UK

- Ascension Living

- Brookdale Senior Living

- Extendicare, Inc.

- Sunrise Senior Living

- BAYADA Home Health Care

- Deutsche Altenheim

- Badisa

- Grace Adult Day Health Care

- GerHogar

- Care Futures

- Epoch Elder Care

- CCACC Joyful Day Care Center

Recent Developments

- In May 2025, Active Day announced a USD 60 million investment plan to expand its medical-model adult day care centres across ten U.S. states, integrating telehealth capabilities and transportation upgrades.

- In April 2025, Brookdale Senior Living launched new hybrid day care programs in partnership with major health insurers, focusing on dementia-friendly and rehabilitation services.

- In February 2025, Age UK introduced a pilot digital-engagement platform connecting caregivers with adult day care participants for remote wellness tracking and virtual activity sessions.