Adult City & Urban Bicycle Helmets Market Size

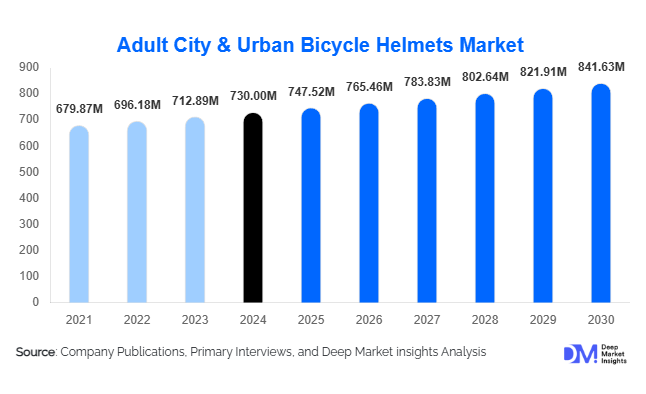

According to Deep Market Insights, the global adult city & urban bicycle helmets market size was valued at USD 730 million in 2024 and is projected to grow from USD 747.52 million in 2025 to reach USD 841.63 million by 2030, expanding at a CAGR of 2.4% during the forecast period (2025–2030). The market growth is primarily driven by increasing urban cycling adoption, rising awareness of head safety, and the proliferation of smart, technologically integrated helmets tailored for adult urban commuters and micromobility users.

Key Market Insights

- Urban commuting and micromobility are fueling demand for adult city helmets as more adults in cities use bicycles and e-bikes for daily travel.

- Smart helmet integration with Bluetooth, LED signaling, crash sensors, and connectivity features is transforming the urban cycling safety segment.

- Europe leads the market, with countries like Germany, the Netherlands, and Denmark dominating helmet adoption due to cycling culture, infrastructure, and helmet regulations.

- North America remains a key mature market, led by U.S. and Canadian urban commuters, especially in metropolitan regions with bike-sharing programs and e-bike adoption.

- Asia-Pacific is emerging as the fastest-growing region, driven by rising urbanization, e-bike penetration, and expanding micromobility infrastructure in China, India, and Southeast Asia.

- Regulatory and safety standard compliance (CPSC, EN 1078, MIPS integration) is increasing consumer confidence and shaping global helmet demand.

What are the latest trends in the adult city & urban bicycle helmets market?

Smart and Connected Helmets

Manufacturers are increasingly incorporating technology into urban helmets, including Bluetooth connectivity, turn signals, integrated lighting, GPS tracking, and crash-detection sensors. These features appeal to tech-savvy commuters who prioritize both safety and convenience. Smart helmets are emerging as a premium segment, commanding higher price points and improving adoption among adult urban riders. Integration with mobile apps enables real-time monitoring, navigation assistance, and safety alerts, creating a holistic urban commuting experience.

Lightweight and Eco-friendly Materials

Polycarbonate shells with EPS liners remain dominant, but manufacturers are innovating with lightweight composites, carbon fiber, and eco-materials derived from recycled plastics or bio-based polymers. These materials enhance comfort and ventilation while reducing weight, addressing common barriers to daily helmet usage among adult urban cyclists. Eco-friendly materials also resonate with environmentally conscious consumers, particularly in Europe and APAC.

What are the key drivers in the adult city & urban bicycle helmets market?

Rising Urban Cycling Adoption

Urbanization and congestion in major cities worldwide have increased cycling as a practical, cost-effective, and eco-friendly commuting option. Governments are expanding cycling infrastructure, including protected bike lanes and bike-share programs, boosting adult urban helmet demand. Daily commuters and micromobility users increasingly prioritize safety and comfort, driving steady growth for city and urban helmets.

Increasing Safety Awareness and Helmet Legislation

Rising awareness of head injuries and growing enforcement of helmet regulations in developed and emerging markets are key growth drivers. Campaigns promoting safe cycling practices, insurance incentives, and workplace safety programs further reinforce helmet adoption among urban adults.

Product Innovation and Design

Innovations in ventilation, fit, style, and technology integration enhance user adoption. Helmets now combine comfort, aesthetics, and smart features, making them suitable for everyday use in city settings. This trend encourages broader uptake among adult commuters and recreational urban cyclists.

What are the restraints for the global market?

Behavioral and Social Perception Barriers

Many adult urban cyclists remain reluctant to wear helmets due to perceived inconvenience, discomfort, or style considerations. Such behavior limits market penetration, particularly in regions with lower enforcement of helmet laws or cultural resistance to protective gear.

Price Sensitivity and Shared-Mobility Usage

Commuters using bike-share systems may forgo helmets, and cost-sensitive consumers in emerging markets often prioritize bicycle purchase over helmet investment. This limits growth in mid-tier and high-tech helmet segments, constraining overall market expansion.

What are the key opportunities in the adult city & urban bicycle helmets market?

Micromobility and Fleet Integration

Partnerships with bike-share and e-bike fleet operators offer volume sales opportunities. Supplying helmets for fleet use or subscription-based safety programs provides recurring demand and market visibility for manufacturers, particularly in urban centers across Europe, North America, and APAC.

Smart Helmet Innovations

Integrating connectivity, crash sensors, lighting, and navigation into helmets enables differentiation in an increasingly competitive market. Smart helmets cater to premium segments, enhancing safety, convenience, and user appeal while supporting higher profit margins.

Expansion in Emerging Markets

Rising urbanization, e-bike adoption, and developing cycling infrastructure in Asia-Pacific, Latin America, and parts of the Middle East are creating new market opportunities. Early entrants with cost-effective, certified helmets can capture volume growth before markets saturate.

Product Type Insights

Urban/commuter helmets dominate the market, representing approximately 54% of the 2024 value. They cater to daily adult commuters and micromobility users, combining safety, comfort, and style. Polycarbonate shell helmets with EPS liners form 60% of the material segment, balancing safety and affordability. Basic certified helmets (70% of the 2024 market) remain the mainstream, while premium and smart helmets capture niche high-value consumers.

Application Insights

Daily commuting remains the largest application (50% of the market), followed by recreational urban cycling and micromobility use. Corporate commuter programs, e-bike rentals, and last-mile delivery services are emerging applications that further drive demand. Export-driven supply to micromobility operators also contributes to market growth, particularly in North America and Europe.

Distribution Channel Insights

Online retail dominates (60% share), offering convenience, comparison shopping, and direct-to-consumer engagement. Offline retail continues to serve specialty bike shops and sporting goods stores, while OEM/fleet supply channels are growing via partnerships with bike-share and corporate programs. E-commerce and D2C platforms are increasingly used to market smart and premium helmet variants.

End-Use Insights

Adult urban commuters and micromobility users drive the fastest growth. Recreational urban riders contribute steadily, while new end-uses such as corporate fleets and e-bike subscription services are expanding the market. Emerging industries like last-mile logistics are adopting helmets for delivery staff, increasing overall demand.

| By Product Type | By Material / Construction | By Safety Certification / Feature Set | By Distribution Channel | By End-Use Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 30–31% of the 2024 adult city & urban bicycle helmets market, with the U.S. and Canada leading regional demand. Urban commuting, micromobility adoption, and e-bike penetration are primary growth drivers, encouraging adult cyclists to prioritize safety gear. Helmet regulations in cities and states, particularly in California, New York, and select Canadian provinces, have created a strong compliance-driven market for daily commuters. Key metropolitan areas, including New York City, San Francisco, Chicago, and Toronto, are major demand hubs due to high traffic congestion, well-developed cycling infrastructure, and widespread bike-share systems. The dominance of urban/commuter helmets (54% of the global market) is especially pronounced here, as these products meet the needs of daily riders seeking lightweight, comfortable, and stylish protection for city cycling. The market is further bolstered by rising consumer awareness of head-safety risks, corporate wellness programs promoting cycling, and a trend toward smart helmets integrating connectivity and safety sensors.

Europe

Europe is the largest regional market, representing 35–38% of the 2024 market. Countries such as Germany, the Netherlands, Denmark, and France are at the forefront of adoption due to a deeply ingrained cycling culture, stringent helmet regulations, and extensive urban infrastructure. The popularity of premium and smart helmets is driven by consumers’ focus on both safety and design aesthetics, as well as the integration of advanced technologies such as MIPS and Bluetooth connectivity. Regulatory enforcement, including mandatory helmet use in some regions and incentivized commuting programs, further propels market growth. Urban/commuter helmets lead the segment in Europe, reflecting the dominance of daily city cycling. Drivers for regional growth include high disposable incomes, extensive city planning for cycling networks, and strong micromobility adoption, including e-bikes and bike-share systems. Increasing awareness of environmental sustainability and the health benefits of cycling also contributes to expanding helmet demand.

Asia-Pacific

Asia-Pacific accounts for approximately 20% of the market and is the fastest-growing region. Rapid urbanization, rising population density in cities, and expanding micromobility networks are driving the adoption of adult city & urban bicycle helmets. China and India are leading contributors due to government-backed initiatives promoting cycling infrastructure, electric bike adoption, and helmet safety awareness campaigns. Southeast Asian markets such as Singapore, Thailand, and Vietnam are also witnessing increased helmet usage, propelled by urban commuting trends and local e-bike sharing programs. The growth of online retail channels, the availability of cost-effective commuter helmets, and rising disposable income levels are key regional drivers. Urban/commuter helmets continue to dominate, while premium and smart helmet adoption is gradually rising among tech-savvy urban populations, further boosting market value.

Latin America

Latin America represents approximately 5% of the global market and is gradually developing as an emerging hub for adult city & urban bicycle helmets. Brazil and Mexico are the leading markets, driven by expanding urban cycling culture, growing awareness of safety, and increasing adoption of bike-share and e-bike programs. Government initiatives to promote sustainable urban mobility, alongside urban congestion challenges, are encouraging commuters to cycle, which in turn supports helmet demand. Premium helmet adoption remains limited, while commuter helmets remain the dominant segment. Drivers for regional growth include government investments in cycling infrastructure, rising middle-class incomes, and increasing penetration of online sales channels that provide convenient access to certified helmets.

Middle East & Africa

The Middle East & Africa account for approximately 3–5% of the market, with limited penetration compared to other regions. Key urban hubs such as Dubai, Abu Dhabi, Riyadh, and Johannesburg are driving small but growing demand, especially among high-income adult urban cyclists and micromobility users. Helmet adoption is propelled by urban development initiatives, government-backed cycling programs, and the introduction of bike-share and e-bike schemes in select cities. Drivers for growth include rising safety awareness, expanding urban infrastructure, and increasing disposable income in Gulf countries. Urban/commuter helmets dominate the segment, although premium and smart helmets are slowly gaining traction among affluent, tech-savvy consumers in metropolitan areas. Regional expansion is also being supported by emerging sustainability trends and the adoption of eco-friendly commuting solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Adult City & Urban Bicycle Helmets Market

- Vista Outdoor

- Dorel (Bell Helmets)

- Giant Manufacturing

- Trek Bicycle Corporation

- KASK

- Mavic

- Specialized Bicycle Components

- Uvex

- POC Sports

- Scott Sports

- ABUS

- Lazer Sport

- Rudy Project

- MET Helmets

- LAS Helmets

Recent Developments

- In March 2025, Vista Outdoor expanded its urban helmet portfolio with lightweight smart helmets featuring integrated turn signals and crash-detection sensors.

- In January 2025, Dorel (Bell Helmets) launched a new eco-friendly line for urban commuters, using recycled plastics and enhanced ventilation designs.

- In February 2025, Specialized introduced a premium smart helmet integrating GPS, Bluetooth connectivity, and real-time ride analytics for city cyclists.