Activated Charcoal Mouthwash Market Size

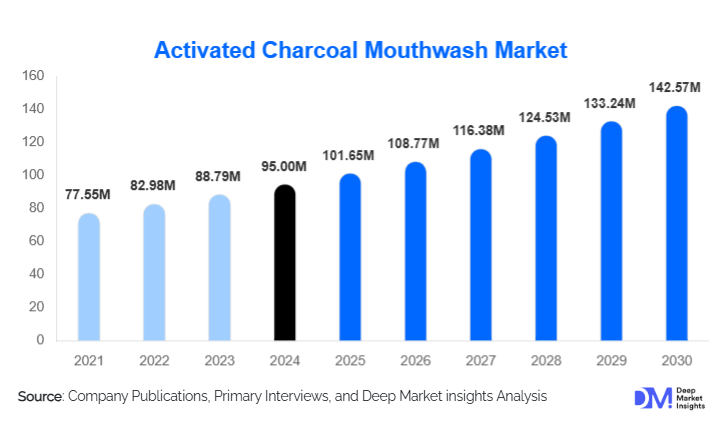

According to Deep Market Insights, the global activated charcoal mouthwash market size was valued at USD 95.00 million in 2024 and is projected to grow from USD 101.65 million in 2025 to reach USD 142.57 million by 2030, expanding at a CAGR of 7% during the forecast period (2025–2030). The activated charcoal mouthwash market growth is primarily driven by rising consumer preference for natural and clean-label oral care products, increasing awareness of cosmetic dental hygiene, and the growing penetration of premium oral care solutions through digital retail channels.

Key Market Insights

- Alcohol-free activated charcoal mouthwash formulations dominate demand, supported by regulatory preference and suitability for sensitive oral care needs.

- Online retail channels account for the largest share of global sales, driven by D2C models, influencer marketing, and subscription-based oral care solutions.

- North America leads global consumption, supported by high oral care spending and strong premium product adoption.

- Asia-Pacific is the fastest-growing regional market, fueled by rising disposable income, urbanization, and cosmetic dental awareness.

- Mid-premium price positioning dominates, balancing affordability and perceived therapeutic and whitening benefits.

- Sustainable packaging and herbal formulations are emerging as key differentiators among leading brands.

What are the latest trends in the activated charcoal mouthwash market?

Rising Demand for Alcohol-Free and Herbal Formulations

Consumers are increasingly shifting away from alcohol-based mouthwashes due to concerns over oral dryness, irritation, and long-term gum sensitivity. This has accelerated the adoption of alcohol-free and herbal activated charcoal mouthwash variants that incorporate natural ingredients such as tea tree oil, aloe vera, peppermint, and clove. These formulations appeal strongly to health-conscious consumers and families seeking gentle yet effective oral care solutions. Brands are positioning these products as daily-use mouthwashes that offer detoxification, odor control, and plaque reduction without harsh chemicals.

Digital-First Branding and Direct-to-Consumer Expansion

The activated charcoal mouthwash market is witnessing strong growth through digital-first brands that leverage e-commerce, social media marketing, and influencer endorsements. Subscription-based oral care models are gaining traction, offering recurring delivery and personalized oral hygiene routines. Enhanced product storytelling around whitening benefits, sustainability, and clean ingredients has significantly improved consumer engagement, particularly among younger demographics. As a result, online retail has become the dominant distribution channel globally.

What are the key drivers in the activated charcoal mouthwash market?

Growing Preference for Natural and Clean-Label Oral Care

Increasing awareness of the potential side effects of synthetic oral care ingredients has driven demand for natural alternatives. Activated charcoal mouthwash benefits from strong consumer perception as a detoxifying, chemical-free solution that aligns with broader wellness trends. This driver is particularly strong in North America and Europe, where consumers actively seek transparency in ingredient sourcing and formulation.

Rising Cosmetic Dental and Whitening Awareness

Social media influence, aesthetic consciousness, and growing dental tourism have increased demand for whitening-support oral care products. Activated charcoal mouthwash is increasingly positioned as a maintenance product for teeth whitening, driving repeat purchases and higher consumption frequency. This trend has significantly expanded the market among adults aged 18–45 years.

What are the restraints for the global market?

Concerns Over Enamel Safety and Dental Recommendations

Despite growing popularity, some dental professionals express caution regarding prolonged use of activated charcoal products due to potential enamel abrasion. This has led to selective recommendations and slower adoption in certain markets. Manufacturers are addressing this restraint through formulation improvements and clinical validation.

Price Sensitivity in Developing Markets

Activated charcoal mouthwash products typically command a premium price compared to conventional mouthwashes. In price-sensitive regions, this limits adoption among mass consumers. Brands must balance cost optimization with premium positioning to expand penetration.

What are the key opportunities in the activated charcoal mouthwash industry?

Expansion in Emerging Markets

Asia-Pacific, Latin America, and parts of the Middle East present significant growth opportunities due to rising disposable income, expanding middle-class populations, and increasing awareness of oral hygiene. Localization of formulations and pricing strategies can unlock substantial demand in these regions.

Formulation Innovation and Sustainable Packaging

Opportunities exist in developing probiotic-infused charcoal mouthwashes, enzyme-based formulations, and eco-friendly packaging such as refill pouches and biodegradable bottles. Sustainability-driven innovation is expected to strengthen brand differentiation and pricing power.

Product Type Insights

Alcohol-free activated charcoal mouthwash continues to dominate the global market, accounting for approximately 42% of market share in 2024. This segment is preferred for daily use, particularly among consumers with sensitive gums or those seeking a gentle, chemical-free oral care routine. Its dominance is fueled by rising awareness of oral health risks associated with alcohol-based mouthwashes and regulatory encouragement in several regions for alcohol-free formulations. Whitening-focused variants are experiencing rapid growth, driven by cosmetic dental trends, social media influence, and increased consumer desire for aesthetic oral care solutions. Herbal and therapeutic charcoal mouthwashes are gaining traction, especially in Europe and Asia-Pacific, where consumers increasingly prioritize holistic wellness, natural ingredients, and multifunctional oral care products that combine whitening, antibacterial, and gum-care benefits. The growing focus on preventive oral healthcare and the premiumization of daily hygiene products further reinforce demand for these specialized segments.

Distribution Channel Insights

Online retail channels have emerged as the leading distribution route for activated charcoal mouthwash, contributing nearly 36% of total global sales in 2024. This growth is driven by increasing digital penetration, influencer marketing, and direct-to-consumer subscription models, which provide convenience, personalized routines, and higher repeat purchase potential. Pharmacies and drugstores remain essential for trust-driven purchases, particularly for therapeutic or dentist-recommended variants, while supermarkets and hypermarkets facilitate mass adoption through volume sales and promotional campaigns. Dental clinics and professional oral care channels are emerging as niche yet growing avenues, especially for medicinal or whitening-focused activated charcoal formulations, as dental professionals increasingly recommend these products for plaque reduction, gum care, and cosmetic maintenance. Integration of digital consultation services and e-prescriptions is further enhancing the reach of professional channels.

End-User Insights

Adults aged 18–45 years represent the largest consumer group, accounting for approximately 61% of total market demand. This demographic is highly influenced by cosmetic and wellness trends, social media exposure, and urban lifestyle-driven hygiene routines. Older adults form a stable segment, focused on oral sensitivity, gum care, and preventive maintenance, contributing steadily to market demand. Pediatric and teen formulations remain niche but are gradually expanding, propelled by growing parental awareness of early oral hygiene habits and the introduction of milder, safe charcoal blends suitable for younger consumers. The adoption among this group is also boosted by the increased availability of flavored and alcohol-free variants, designed to encourage routine usage while addressing safety concerns.

| By Product Type | By Distribution Channel | By End User | By Price Positioning |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the global market share in 2024, with the United States leading demand. The region’s growth is primarily driven by high consumer awareness of oral health, increasing adoption of premium oral care products, and strong e-commerce penetration that enables wide accessibility of niche products. Consumers in North America demonstrate a strong preference for alcohol-free formulations and sustainable packaging, reinforcing the growth of wellness-oriented variants. Key drivers include rising cosmetic dental awareness, prevalence of preventive oral care routines, and aggressive marketing by multinational brands highlighting natural and whitening benefits.

Europe

Europe holds nearly 23% of the global market, supported by demand in Germany, the U.K., France, and Italy. The region’s growth is fueled by consumers’ preference for eco-friendly and organic-certified oral care products. Regulatory encouragement for natural and safe formulations, coupled with widespread retail availability in pharmacies and health stores, strengthens market adoption. Key drivers include rising interest in holistic wellness, stringent quality and safety standards, and strong sustainability consciousness, which has led to higher acceptance of herbal and therapeutic charcoal variants. Cosmetic dental trends also contribute to increased demand for whitening-focused products.

Asia-Pacific

Asia-Pacific represents 29% of global demand and is the fastest-growing region, with a forecast CAGR of 11.8%. China, India, Japan, and South Korea are key contributors. Regional growth is driven by rising disposable income, urbanization, expanding middle-class populations, and increased awareness of cosmetic and preventive oral care. Key drivers include a growing emphasis on natural and herbal products, rising demand for premium oral hygiene solutions, and expanding e-commerce and modern retail infrastructure, which provide easier access to niche products. Cultural trends favoring aesthetic enhancement, along with aggressive marketing of whitening and herbal variants, further propel market adoption.

Latin America

Latin America accounts for a smaller but steadily growing share of the market, led by Brazil and Mexico. Demand is fueled by urban consumers seeking affordable premium oral care solutions, increasing health awareness, and expanding retail networks. Drivers include rising exposure to global cosmetic trends, growing middle-class purchasing power, and the increasing penetration of online and modern retail channels that enhance product accessibility.

Middle East & Africa

The Middle East & Africa region is showing rising demand, particularly in the UAE and South Africa. Growth is driven by high-income consumer segments, urbanization, and expanding modern retail and e-commerce infrastructure. Key drivers include a growing preference for premium and cosmetic oral care products, increased awareness of oral health benefits associated with natural formulations, and exposure to global wellness trends through social media and international travel. Furthermore, government initiatives promoting health awareness and private investments in the oral care sector are enhancing market potential in the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Activated Charcoal Mouthwash Market

- Colgate-Palmolive

- Unilever

- Procter & Gamble

- GlaxoSmithKline

- Church & Dwight

- Lion Corporation

- Sunstar Group

- Dabur

- Himalaya Wellness

- Hello Products