Action Cameras Market Size

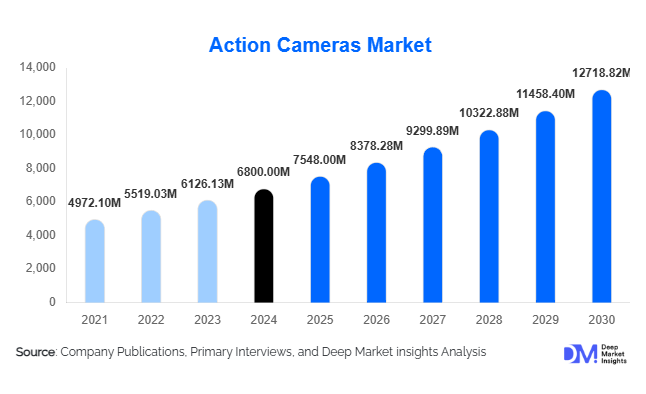

According to Deep Market Insights, the global action cameras market size was valued at USD 6,800 million in 2024 and is projected to grow from USD 7,548.0 million in 2025 to reach USD 12,718.82 million by 2030, expanding at a CAGR of 11.0% during the forecast period (2025–2030). The market growth is primarily driven by increasing adventure and outdoor tourism, rising adoption among content creators and social media enthusiasts, and technological advancements in Ultra HD, 360°, and wearable camera formats.

Key Market Insights

- Ultra HD and 360° cameras are increasingly popular, reflecting consumer demand for higher-quality, immersive video content.

- North America leads the market, with high adoption driven by adventure sports culture and strong content-creation demand.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class affluence, growing adventure tourism, and increasing social media use.

- Consumer/personal usage dominates, but professional and industrial applications are rapidly expanding, including law enforcement, industrial inspection, and broadcast media.

- E-commerce channels are gaining traction, complementing offline retail and specialty sports/outdoor stores.

- Technological integration, including AI-powered editing, live streaming, image stabilization, and cloud connectivity, is reshaping consumer expectations and product differentiation.

Latest Market Trends

Rise of Content-Creation and Adventure Tourism

The action cameras market is heavily influenced by the growth of social media, vlogging, and online content creation. Consumers increasingly demand compact, rugged cameras capable of capturing Ultra HD and 360° videos for travel, adventure sports, and lifestyle content. Adventure tourism and outdoor sports such as skiing, surfing, biking, and diving are expanding globally, driving the adoption of action cameras that can withstand harsh conditions. Manufacturers are responding by offering improved waterproofing, shockproofing, and mountable designs suitable for extreme activities. The combination of adventure tourism and content creation ensures a continuous demand cycle for durable, high-quality cameras.

Technology-Enhanced Action Cameras

Innovations such as AI-powered stabilization, live streaming, 360°/VR capture, and integration with mobile and social media platforms are transforming the market. These technologies appeal to tech-savvy consumers and professional users alike. Companies are also adopting modular designs, gimbals, and advanced lens systems to enhance capture quality. Additionally, wearable and helmet-mounted cameras are gaining traction in professional use cases such as law enforcement, rescue operations, and industrial inspections, further broadening the market scope.

Action Cameras Market Drivers

Increasing Demand from Content Creators and Social Media Users

The surge in video content creation for platforms such as YouTube, Instagram, and TikTok has become a major growth driver. Users seek compact, high-resolution cameras to capture adventures, travel experiences, and lifestyle content. The proliferation of vlogging and online streaming encourages the adoption of cameras capable of Ultra HD and high-frame-rate recording, pushing innovation and sales across both consumer and professional segments.

Growth of Adventure Tourism and Extreme Sports

Adventure tourism, outdoor sports, and experiential travel are rising globally. Activities such as mountain biking, skiing, surfing, and scuba diving are driving the need for rugged, portable cameras that can endure harsh environments. Regions with expanding outdoor tourism infrastructure are particularly contributing to the market’s growth, as consumers increasingly prefer high-quality documentation of experiences.

Technological Innovation and Product Advancements

Advancements in camera sensors, Ultra HD/4K/8K video resolution, image stabilization, connectivity, and modular accessories have increased consumer adoption. Miniaturization of components and enhanced durability allow for wearable and action-oriented designs. Manufacturers are leveraging these innovations to attract both hobbyists and professional users, fueling consistent market growth.

Market Restraints

Smartphone Substitution

High-end smartphones with advanced cameras, stabilization features, and waterproof designs pose a significant substitution risk for dedicated action cameras. This is particularly impactful in lower-priced segments, where consumer preference for multi-purpose devices can slow market adoption.

Intense Price Competition and Supply Chain Challenges

The market is highly competitive, with many companies offering budget models that compress margins. Short product lifecycles, high R&D costs, and reliance on key components such as sensors and memory modules add operational risks. Supply chain disruptions can increase costs and delay product launches, impacting profitability.

Action Cameras Market Opportunities

Emerging Markets and Adventure Tourism Expansion

Asia-Pacific, Latin America, and the Middle East & Africa represent high-growth potential due to rising disposable incomes, expanding outdoor tourism, and growing social media influence. Tailored mid-tier products with online distribution can capitalize on these emerging markets, while partnerships with local influencers and outdoor gear platforms can accelerate adoption.

Integration of New Technologies

Next-generation cameras incorporating 360°/VR capture, AI-powered editing, live streaming, and wearable formats offer high-margin opportunities. Innovations in software and hardware integration can differentiate products and attract premium users, including professionals in content creation, law enforcement, and industrial applications.

Non-Traditional End-Uses

Industrial inspection, emergency services, public safety, and professional content creation represent expanding market segments. These segments demand rugged, reliable, and feature-rich cameras, allowing higher average selling prices and longer replacement cycles. Specialized cameras for industrial and safety applications provide entry points outside the commoditized consumer market.

Product Type Insights

Box-style action cameras dominate the market, accounting for approximately 44.2% of global revenue in 2024. These cameras appeal to both consumers and professionals due to their established form factor, durability, and versatility. Cube-style, bullet-style, and wearable cameras are emerging niches, while 360° and VR-enabled cameras are gaining popularity among premium users and content creators seeking immersive experiences.

Resolution / Technology Insights

Ultra HD (4K and above) action cameras lead with roughly 46.8% share of the market in 2024. Consumer preference for high-quality video content and the increasing use of action cameras for professional filming and vlogging are driving demand. HD and Full HD cameras remain relevant in budget-conscious markets, while niche 360°/VR formats are expanding in specialized segments.

Distribution Channel Insights

Offline retail remains the dominant channel with 52.3% of the market in 2024, as consumers prefer evaluating cameras physically before purchase. However, e-commerce platforms are rapidly growing, enabling wider geographic reach, competitive pricing, and enhanced convenience. Professional rental and leasing channels are also emerging, particularly for industrial and content-creation use cases.

End-User Insights

The consumer/personal segment accounts for 63.5% of market revenue in 2024, driven by hobbyists, travelers, and social media content creators. The professional/enterprise segment, while smaller, is growing faster, driven by film production, industrial inspection, and law enforcement applications. Industrial and public safety segments represent high-value opportunities due to specialized requirements and higher ASPs.

| By Product Type | By Resolution / Technology | By Application / Use Case | By Distribution Channel | By End-User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 34.8% of the global market in 2024, led by the U.S. and Canada. Strong disposable income, widespread outdoor and adventure sports participation, and a content-creation culture drive demand. Professional applications and premium Ultra HD cameras contribute significantly to the region’s market share.

Europe

Europe accounts for 25% of the global market in 2024, with Germany, the U.K., and France leading demand. The region favors sustainable and high-quality products, with growing adoption of adventure, travel, and professional filming use cases. Moderate growth is observed due to market maturity.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, Japan, and South Korea. Rising disposable income, expanding adventure tourism, and strong social media usage contribute to high adoption rates. The region is expected to see significant market share expansion by 2030.

Latin America

Brazil, Mexico, and Argentina are leading Latin American markets. Demand is primarily from affluent consumers seeking adventure and travel documentation. Market share is smaller compared to North America and Europe, but is growing steadily.

Middle East & Africa

Africa is the home of diverse adventure tourism, contributing to local action camera adoption. The Middle East, led by the UAE and Saudi Arabia, is a high-income market for premium cameras. Intra-African tourism is gradually expanding camera adoption in the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Action Cameras Market

- GoPro

- DJI

- Sony

- Garmin

- Nikon

- Panasonic

- SJCAM

- YI Technology

- Drift Innovation

- Insta360

- Olympus

- Ricoh

- Akaso

- Veho

- Campark

Recent Developments

- In May 2025, GoPro launched a new line of 8K wearable cameras with AI-powered stabilization for professional content creators.

- In April 2025, DJI expanded its Osmo Action series with 360° VR capabilities targeted at extreme sports enthusiasts in the Asia-Pacific.

- In February 2025, Sony introduced a new ultra-compact action camera with modular accessories for industrial and safety applications.