Acrylic Bathtub Market Size

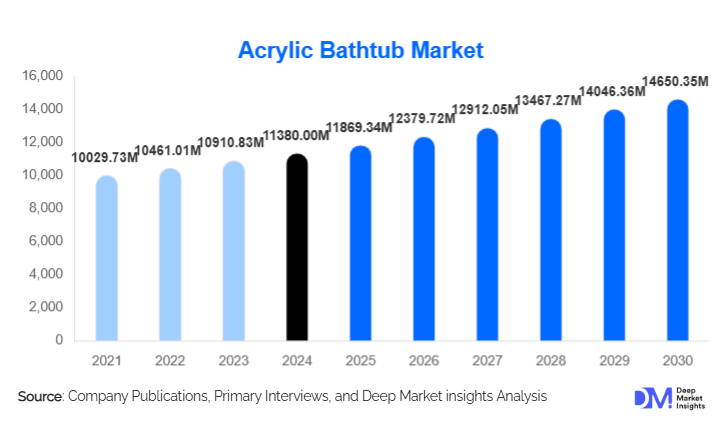

According to Deep Market Insights, the global acrylic bathtub market size was valued at USD 11,380 million in 2024 and is projected to grow from USD 11,869.34 million in 2025 to reach USD 14,650.35 million by 2030, expanding at a CAGR of 4.3% during the forecast period (2025–2030). The acrylic bathtub market growth is primarily driven by rising home renovation activity, accelerated residential and commercial construction in emerging economies, growing consumer preference for lightweight and design-flexible bathtubs, and continuous advancements in acrylic materials and manufacturing technologies.

Key Market Insights

- Freestanding acrylic bathtubs lead the market, driven by premium bathroom aesthetics and growing adoption in upscale residential and hospitality environments.

- Residential renovation remains the largest application segment, supported by aging housing stock and increased homeowner spending on modern bathroom upgrades.

- Asia-Pacific dominates global demand and stands as the fastest-growing region, fueled by urbanization, rising disposable incomes, and strong construction activity.

- Offline/traditional retail channels continue to command the majority share, though e-commerce penetration is rising rapidly for standardized and mid-range acrylic tubs.

- Smart features and wellness-focused bathtub innovations such as hydrotherapy jets, digital controls, and antimicrobial surfaces are redefining product differentiation.

- Manufacturing modernization, including high-efficiency thermoforming and eco-friendly acrylic composites, is lowering costs and improving product quality.

Latest Market Trends

Premium & Design-Centric Bathroom Upgrades

Growing consumer prioritization of bathroom aesthetics is accelerating demand for freestanding and uniquely shaped acrylic bathtubs. Interior designers and homeowners increasingly view bathtubs as statement pieces in modern bathrooms. Acrylic’s moldability enables curved silhouettes, minimalist edges, and spa-inspired designs that previously required high-cost materials. The shift toward wellness-oriented bathrooms, featuring mood lighting, soaking tubs, and integrated massage systems, is further strengthening premium acrylic bathtub adoption, particularly in urban renovation projects and luxury hotel developments.

Smart & Wellness-Integrated Bathtubs

Advanced features are transforming the bathing experience. Manufacturers are integrating hydrotherapy jets, chromotherapy lighting, water temperature memory, Bluetooth audio systems, and digital control panels directly into acrylic tubs. These technologies cater to wellness-focused consumers seeking stress relief and spa-like comfort at home. Smart monitoring systems that optimize water usage and provide maintenance alerts are also emerging. The trend resonates strongly in premium residential projects and upscale hospitality settings, positioning acrylic tubs as versatile platforms for technological enhancement.

Acrylic Bathtub Market Drivers

Growing Residential Renovation & Remodeling Activity

In North America and Europe, a significant portion of housing stock is over 20–30 years old, prompting widespread bathroom renovation cycles. Acrylic bathtubs, lighter, easier to install, and more cost-effective than cast iron or steel tubs, are increasingly preferred as replacement fixtures. Homeowners are seeking modern, durable, and heat-retaining tubs that elevate comfort while enabling simple upgrades. Renovation-driven demand is further amplified by rising home-improvement spending and shifting consumer focus toward wellness-oriented bathroom designs.

Booming Construction in Emerging Markets

Fast-growing urban populations in Asia-Pacific, Latin America, and the Middle East are driving increased construction of apartments, residential complexes, hotels, and mixed-use buildings. Acrylic bathtubs benefit from their lightweight structure, installation flexibility, and affordability, making them ideal for high-rise developments and mass housing projects. Government-backed housing programs in India, China, and Southeast Asia further support acrylic tub demand, as large-scale residential expansion requires reliable, cost-efficient bathroom solutions.

Market Restraints

Competition from Alternative Bathtub Materials

Acrylic bathtubs face competition from cast iron, steel-enameled, and engineered stone bathtubs, especially in premium and ultra-premium segments where durability and luxury finishes are prioritized. Consumers seeking a solid, premium tactile feel may still favor heavier materials. This material preference in high-end categories, combined with the growing popularity of solid-surface tubs, limits acrylic penetration among top-tier customers and high-luxury hotel projects.

Durability Concerns and Installation Challenges

Despite significant improvements in acrylic formulations, some consumers remain concerned about scratching, discoloration, and structural stability over time. In addition, installation challenges arise in older buildings with non-standard plumbing configurations or limited bathroom space. Variations in local installation standards and shortages of trained installers in certain developing markets further restrict growth potential. These limitations require improved consumer education and stronger after-sales support from manufacturers and distributors.

Acrylic Bathtub Market Opportunities

Eco-Friendly & Recycled Acrylic Materials

Growing environmental awareness is driving demand for sustainable building materials. Manufacturers are exploring recycled acrylic blends, bio-based resins, and low-VOC production processes to reduce their carbon footprint. Eco-friendly acrylic bathtubs appeal to environmentally conscious homeowners, green building certifiers, and hospitality developers pursuing LEED or similar certifications. Brands that position sustainability as a key value proposition will gain an early advantage in upcoming green-construction initiatives, particularly in Europe and the Asia-Pacific.

Expansion of Hospitality & Multi-Family Housing Projects

Hotels, resorts, serviced apartments, and multi-family developments increasingly prefer acrylic tubs due to their easy installation, cost-efficiency, and design flexibility. Renovation cycles in hospitality, driven by guest experience upgrades, are particularly attractive for manufacturers offering quick-install, customizable acrylic bathtub solutions. Additionally, the rise of rental housing and co-living spaces in major cities opens large-volume opportunities for standardized acrylic bathtubs that combine durability, affordability, and aesthetic appeal.

Product Type Insights

Freestanding acrylic bathtubs continue to dominate the premium segment, accounting for approximately 35% of the global market. Their popularity is driven by consumer preference for spa-like bathroom experiences, flexibility in interior design, and suitability for luxury homes and hotel suites. Acrylic’s lightweight nature allows for innovative shapes and sleek finishes that appeal to design-conscious homeowners and hospitality developers. Alcove and drop-in acrylic tubs remain widely adopted in mass residential applications due to their space efficiency, cost-effectiveness, and ease of installation. Corner tubs are increasingly used in compact urban apartments, addressing space limitations without compromising functionality. Meanwhile, custom and platform-mounted acrylic tubs are gaining traction in design-intensive renovation projects, particularly where aesthetic personalization or therapeutic features, such as integrated jets or chromotherapy, are desired. Overall, the product type trends reflect a balance between functionality, design versatility, and premium wellness-oriented features, positioning acrylic tubs as the material of choice across market tiers.

Application Insights

Residential renovation is the leading application segment, contributing around 40% of global demand. Homeowners replacing outdated fixtures are increasingly opting for acrylic tubs due to their lightweight installation, aesthetic flexibility, and thermal insulation properties. Residential new construction is steadily expanding, especially in high-growth regions such as Asia-Pacific and the Middle East, where new housing units and condominiums are rising rapidly. Commercial applications, including hospitality, wellness centers, and multi-family housing, are the fastest-growing segment. Drivers include hotel and resort refurbishments aimed at enhancing guest experience, adoption of therapeutic tubs in spas and wellness centers, and standardized bathroom solutions in rental properties. Healthcare facilities are also integrating acrylic bathtubs for ergonomic and therapeutic benefits, further diversifying commercial demand.

Distribution Channel Insights

Offline/traditional retail channels dominate the market, as specialty sanitary-ware stores and building-material distributors remain essential for product inspection, tactile experience, and consultation with installers. This is particularly important for premium freestanding and custom tubs, where design and finish quality are critical considerations. Online platforms are gaining rapid traction, especially for mid-range and standardized acrylic tubs, offering convenience, transparent pricing, digital catalogs, and direct-to-consumer engagement. OEM and contractor-driven purchases account for high-volume demand in new residential projects, multi-family housing, and hospitality refurbishments, driven by bulk procurement, standardized design specifications, and reliable supply chains.

End-User Insights

Residential homeowners remain the largest end-user group, primarily driven by bathroom renovation cycles and the preference for modern, aesthetically appealing fixtures. Hospitality developers are the fastest-growing segment, as hotels and resorts increasingly integrate freestanding and wellness-oriented acrylic tubs to enhance the guest experience. Multi-family housing operators and rental property owners are standardizing acrylic bathtubs across units to combine durability, cost-effectiveness, and design consistency. Wellness and spa facilities represent a high-potential emerging niche, incorporating hydrotherapy and therapeutic acrylic tubs into holistic wellness environments, further supporting product innovation and premiumization trends.

| By Product Type | By Application | By Distribution Channel | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 28% of the global acrylic bathtub market, driven by high consumer spending, strong renovation activity, and widespread adoption of premium bathroom fixtures. The U.S. leads demand due to its extensive housing stock, aging bathrooms requiring upgrades, and growing investment in luxury real estate. Key drivers include urban remodeling projects in cities such as New York, Miami, and Los Angeles, increasing popularity of spa-like bathroom experiences, and the preference for freestanding tubs in premium residential and hospitality segments. Canada mirrors these trends with rising multi-family construction and renovation investments.

Europe

Europe holds around 22% of the global market, with major demand originating from Germany, the U.K., France, and Italy. Growth is driven by bathroom modernization, sustainability-focused building standards, and design-conscious homeowners. Freestanding acrylic tubs are particularly favored in design-forward regions such as Italy and the Nordics, where interior aesthetics and wellness features are highly valued. Renovation cycles in urban apartments, increased investments in luxury hotels, and regulatory support for eco-friendly construction materials further stimulate adoption. The combination of mature construction markets and strong consumer preference for premium bathroom experiences supports steady growth.

Asia-Pacific

Asia-Pacific leads the global market with a 30% share and the highest growth rate. China and India dominate due to rapid urbanization, rising disposable incomes, and large-scale residential and hospitality construction. Southeast Asia and Australia contribute strongly through luxury home development and hotel expansions. Regional growth is further driven by government-supported affordable housing programs, increased multi-family urban projects, and a rising middle-class preference for modern, aesthetically appealing, and functional bathroom fixtures. Additionally, consumer awareness of wellness-centric and ergonomically designed bathtubs fuels the adoption of premium acrylic products.

Latin America

Latin America, led by Brazil, Mexico, and Chile, is witnessing growing demand for modern bathroom fixtures as residential construction and middle-class spending increase. Hospitality renovations, particularly in urban and coastal regions, are driving the adoption of freestanding and design-oriented acrylic tubs. Growth drivers include rising hotel and resort investments, urbanization, and the modernization of apartment complexes. While economic volatility presents a challenge, mid-range acrylic tubs are increasingly preferred due to affordability, ease of installation, and suitability for urban residential projects.

Middle East & Africa

The Middle East & Africa region is experiencing increasing demand for acrylic bathtubs, particularly in the GCC countries (UAE, Saudi Arabia, Qatar) and urban African centers (South Africa, Kenya, Nigeria). Luxury real estate developments, hospitality infrastructure, and tourism-focused investments are major growth drivers. In Africa, urbanization, rising middle-class housing, and remodeling of older residential units are fueling demand. High-end hotels, resorts, and wellness-focused hospitality projects are increasingly adopting freestanding and customized acrylic tubs to enhance guest experience. Government initiatives to improve urban infrastructure and modernize housing further support market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Acrylic Bathtub Market

- TOTO Ltd.

- Kohler Co.

- American Standard Brands

- RAK Ceramics PJSC

- Roca Sanitario S.A.

- Duravit AG

- Jacuzzi Brands LLC

- SSWW Sanitary Ware Co.

- Villeroy & Boch AG

Recent Developments

- In March 2025, Kohler Co. expanded its acrylic bathtub production capabilities in India to support growing Asia-Pacific demand and reduce import dependency.

- In January 2025, TOTO Ltd. introduced a new line of smart acrylic bathtubs featuring hydrotherapy, antimicrobial surfaces, and IoT-enabled water monitoring.

- In September 2024, RAK Ceramics announced the launch of eco-friendly acrylic bathtub models made from recycled resin composites to strengthen its sustainability portfolio.