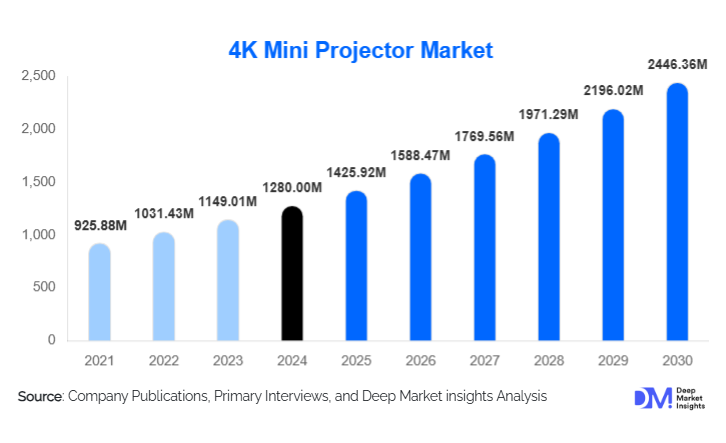

4K Mini Projector Market Size

According to Deep Market Insights, the global 4K mini projector market size was valued at USD 1,280 million in 2024 and is projected to grow from USD 1,425.92 million in 2025 to reach approximately USD 2,446.36 million by 2030, expanding at a CAGR of 11.4% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for immersive home entertainment, rapid adoption of smart and portable display solutions, and continuous advancements in projection technologies such as laser light sources, compact DLP chipsets, and AI-enabled image optimization.

Key Market Insights

- Home entertainment remains the dominant application, driven by OTT streaming, console gaming, and outdoor viewing trends.

- LED- and laser-based light sources are replacing traditional lamps, improving lifespan, portability, and energy efficiency.

- The Asia-Pacific region leads global production and consumption, supported by robust electronics manufacturing ecosystems in China, Japan, and South Korea.

- North America dominates premium adoption, with strong demand from gaming, enterprise, and smart home segments.

- Smart OS–integrated mini projectors are gaining traction, enabling standalone operation without external media devices.

- E-commerce channels account for the largest share of global sales, reflecting direct-to-consumer pricing and global accessibility.

What are the latest trends in the 4K mini projector market?

Smart OS and Wireless Ecosystem Integration

One of the most prominent trends shaping the 4K mini projector market is the integration of smart operating systems such as Android TV and proprietary OS platforms. These systems enable native access to streaming apps, voice assistants, and wireless screen casting, transforming mini projectors into all-in-one entertainment hubs. Consumers increasingly favor devices that eliminate the need for external dongles or media players. AI-powered autofocus, keystone correction, and adaptive brightness control are further enhancing ease of use, particularly for portable and outdoor applications.

Shift Toward Laser-Based Mini Projectors

Laser light sources are rapidly gaining adoption due to their superior brightness consistency, extended lifespan exceeding 20,000 hours, and improved color accuracy. As manufacturing costs decline, laser-based 4K mini projectors are moving beyond premium segments into mid-range consumer offerings. This shift is also aligned with sustainability trends, as laser projectors offer lower energy consumption and reduced maintenance compared to lamp-based systems.

What are the key drivers in the 4K mini projector market?

Growth in Home Entertainment and Gaming

The surge in streaming content, cloud gaming, and next-generation consoles has significantly boosted demand for large-screen, high-resolution display solutions. 4K mini projectors offer cinematic viewing experiences without the space constraints of large televisions, making them particularly attractive for urban households and renters.

Advancements in Miniaturized Projection Technology

Innovations in DLP chipsets, optical engines, and solid-state light sources have enabled manufacturers to deliver true 4K resolution in compact form factors. Improved thermal management and power efficiency have further accelerated adoption across both consumer and professional segments.

What are the restraints for the global market?

Brightness and Outdoor Visibility Limitations

Despite technological improvements, ultra-portable 4K mini projectors still face limitations in brightness output, particularly in well-lit or outdoor environments. This restricts their usability for certain applications and may slow adoption among first-time buyers.

Price Sensitivity in Emerging Economies

Although prices are declining, 4K mini projectors remain premium products in price-sensitive markets. High component costs, including laser modules and advanced optics, continue to challenge mass-market penetration in developing regions.

What are the key opportunities in the 4K mini projector industry?

Emerging Market Expansion

Rapid urbanization, rising disposable incomes, and expanding digital ecosystems in India, Southeast Asia, the Middle East, and Latin America present significant growth opportunities. Localized manufacturing and competitive pricing strategies can enable companies to tap into these high-growth regions.

Institutional and Government Adoption

Education, healthcare training, defense simulations, and smart classroom initiatives are driving institutional demand for compact, high-resolution projection systems. Long-term government procurement contracts offer stable revenue streams for manufacturers aligned with regulatory and compliance requirements.

Technology Type Insights

DLP-based 4K mini projectors dominate the market, accounting for approximately 48% of global revenue in 2024, due to superior contrast ratios, compact chip architecture, and long-term reliability. LCD and LCOS technologies continue to serve niche segments, while laser-based projection systems represent the fastest-growing technology category.

Light Source Insights

LED-based projectors hold the largest share at around 52%, driven by affordability and low maintenance. Laser-based systems are rapidly gaining share due to higher brightness and durability, particularly in premium and professional applications.

End-Use Application Insights

Home entertainment leads with nearly 46% market share in 2024, followed by corporate presentations and education. Healthcare simulation, retail digital signage, and outdoor entertainment are emerging applications that are expected to contribute incremental growth over the forecast period.

Distribution Channel Insights

Online e-commerce platforms dominate distribution, accounting for approximately 42% of global sales, supported by global reach, competitive pricing, and direct brand-to-consumer engagement. Specialty electronics retailers and institutional procurement channels remain important for premium and bulk purchases.

| By Technology Type | By Light Source | By Brightness Level | By End-Use Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific accounts for approximately 38% of the global 4K mini projector market in 2024, led by China, Japan, South Korea, and India. Strong manufacturing capabilities and rising domestic consumption underpin regional leadership.

North America

North America holds around 27% market share, driven by high adoption of premium home entertainment systems, gaming culture, and enterprise usage. The U.S. remains the largest single-country market.

Europe

Europe represents approximately 21% of global demand, with strong adoption in Germany, the U.K., and France, particularly in education and corporate sectors.

Latin America

Latin America is an emerging market, led by Brazil and Mexico, supported by rising digital entertainment consumption and improving e-commerce infrastructure.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, shows growing demand for premium and event-based applications, while Africa represents a smaller but steadily growing consumer base.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|