3D Printed Wearables Market Size

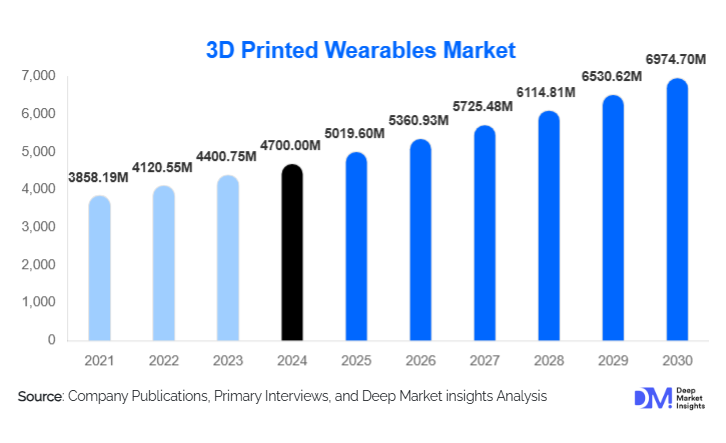

According to Deep Market Insights, the global 3d printed wearables market size was valued at USD 4,700.00 million in 2024 and is projected to grow from USD 5,019.60 million in 2025 to reach USD 6,974.70 million by 2030, expanding at a CAGR of 6.8% during the forecast period (2025–2030). The market growth is primarily driven by the rising demand for mass customization, rapid advancements in additive manufacturing technologies, and the increasing adoption of personalized healthcare, smart consumer electronics, and lifestyle wearables.

Key Market Insights

- Healthcare applications dominate the market, driven by strong demand for customized prosthetics, orthotics, hearing aids, and dental wearables.

- Selective Laser Sintering (SLS) and Multi Jet Fusion (MJF) technologies lead adoption due to superior mechanical strength and design flexibility.

- North America holds the largest market share, supported by high healthcare expenditure, early technology adoption, and strong R&D ecosystems.

- Asia-Pacific is the fastest-growing region, driven by manufacturing scale, government initiatives, and rising consumer electronics demand.

- Polymers remain the most widely used materials, accounting for nearly half of total market revenue due to their lightweight and cost advantages.

- Integration of IoT, sensors, and AI into 3D printed wearables is transforming functionality across fitness, medical, and industrial use cases.

What are the latest trends in the 3D printed wearables market?

Shift Toward Mass Customization and Personalization

One of the most prominent trends in the 3D printed wearables market is the rapid shift toward mass customization. Consumers increasingly prefer wearables that are tailored to individual body dimensions, comfort requirements, and aesthetic preferences. 3D printing enables manufacturers to economically produce low-volume or one-off designs without expensive tooling, making personalization commercially viable. This trend is especially strong in medical wearables, where patient-specific prosthetics and orthotics significantly improve clinical outcomes, as well as in fashion and lifestyle wearables that emphasize uniqueness and brand differentiation.

Integration of Smart Electronics and Embedded Sensors

Another major trend shaping the market is the integration of smart electronics directly into 3D printed structures. Advances in flexible electronics and conductive materials allow sensors, batteries, and connectivity components to be embedded within printed wearable housings. This reduces assembly complexity, lowers production costs, and improves durability. Smart rings, fitness trackers, and industrial safety wearables are increasingly benefiting from this convergence, enabling real-time health monitoring, activity tracking, and predictive maintenance applications.

What are the key drivers in the 3D printed wearables market?

Rising Demand for Personalized Healthcare Solutions

The healthcare sector is the largest driver of the 3D printed wearables market. Custom-fit prosthetics, orthopedic braces, dental aligners, and hearing aids produced through additive manufacturing offer superior comfort, accuracy, and patient satisfaction compared to mass-produced alternatives. Aging populations, increasing incidences of musculoskeletal disorders, and growing rehabilitation needs are accelerating adoption. Reimbursement support and regulatory approvals for bio-compatible materials further strengthen this growth driver.

Technological Advancements in Additive Manufacturing

Continuous innovation in 3D printing technologies and materials has significantly expanded wearable applications. Improvements in printing speed, resolution, and material strength have enabled the production of durable, lightweight, and flexible wearables suitable for long-term use. Technologies such as SLS and MJF are increasingly preferred for complex geometries and functional components, driving broader commercial adoption across industries.

What are the restraints for the global market?

High Initial Capital and Material Costs

Despite its advantages, the adoption of advanced 3D printing technologies requires significant upfront investment. Industrial-grade printers, particularly SLS and MJF systems, involve high capital expenditure, while specialized materials such as medical-grade polymers and metal powders remain costly. These factors can limit adoption among small and mid-sized manufacturers and slow penetration in price-sensitive markets.

Regulatory and Certification Challenges

Regulatory compliance remains a key restraint, particularly for medical and industrial wearables. Certification processes involving FDA, CE, and ISO standards can be time-consuming and expensive, delaying commercialization. Inconsistent regulatory frameworks across regions further complicate global scaling strategies for manufacturers.

What are the key opportunities in the 3D printed wearables industry?

Expansion in Emerging Markets Supported by Government Initiatives

Emerging economies present significant growth opportunities for the 3D printed wearables market. Government initiatives such as Made in China 2025, Make in India, and South Korea’s Smart Factory programs are promoting domestic additive manufacturing capabilities. These policies reduce reliance on imports, encourage local innovation, and create favorable conditions for new entrants and partnerships in Asia-Pacific, Latin America, and the Middle East.

Development of Industrial and Safety Wearables

Industrial safety wearables represent a high-growth opportunity, particularly in construction, mining, and manufacturing sectors. 3D printed smart helmets, protective gloves, and exoskeleton components can be customized for ergonomic fit and enhanced safety. Growing emphasis on worker safety regulations and productivity optimization is expected to drive demand for such applications over the coming years.

Product Type Insights

Medical wearables account for the largest share of the 3D printed wearables market, contributing approximately 38% of total revenue in 2024. This dominance is driven by strong demand for prosthetics, orthotics, hearing aids, and dental wearables that require high levels of customization. Smart wearables, including smartwatches, fitness trackers, and smart rings, represent a rapidly growing segment as consumer electronics brands adopt additive manufacturing for rapid prototyping and limited-edition designs. Fashion and lifestyle wearables are gaining traction among luxury and designer brands, while industrial and safety wearables are emerging as a niche but fast-growing category.

Technology Insights

Selective Laser Sintering (SLS) leads the market with an estimated 34% share in 2024, owing to its ability to produce strong, lightweight, and complex wearable components without support structures. Multi Jet Fusion (MJF) is gaining momentum due to faster production speeds and consistent part quality. Fused Deposition Modeling (FDM) remains widely used for prototyping and cost-sensitive applications, while SLA and DLP technologies are preferred for high-resolution medical and dental wearables.

Material Insights

Polymers dominate the material segment, accounting for approximately 46% of the market, driven by their flexibility, comfort, and cost-effectiveness. Bio-compatible polymers are particularly important in healthcare applications. Metals such as titanium and stainless steel are used in premium medical and industrial wearables, while composite materials are gaining adoption for applications requiring high strength-to-weight ratios.

End-Use Industry Insights

Healthcare remains the largest end-use industry, representing around 41% of total market demand. Consumer electronics and sports & fitness segments are among the fastest-growing, supported by rising demand for smart and connected devices. Industrial and manufacturing applications are emerging steadily, driven by safety regulations and productivity-focused wearable solutions.

| By Product Type | By Technology | By Material | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 36% of the global 3D printed wearables market in 2024. The United States leads regional demand due to advanced healthcare infrastructure, high adoption of smart wearables, and strong investment in additive manufacturing technologies. Favorable reimbursement policies and a mature innovation ecosystem further support market growth.

Europe

Europe holds nearly 27% of the market, with Germany, the U.K., and France being major contributors. Strong medical device manufacturing capabilities, supportive regulatory frameworks, and increasing demand for sustainable production methods drive adoption across the region.

Asia-Pacific

Asia-Pacific represents about 29% of global revenue and is the fastest-growing region, expanding at over 22% CAGR. China, Japan, South Korea, and India are key markets, supported by large-scale manufacturing, government incentives, and rising consumer electronics demand.

Latin America

Latin America accounts for roughly 5% of the market, with Brazil and Mexico leading adoption. Growth is driven by expanding healthcare access and increasing interest in customized consumer products.

Middle East & Africa

The Middle East & Africa region holds about 3% of global demand. Countries such as the UAE and Saudi Arabia are investing in advanced healthcare infrastructure and smart manufacturing, while South Africa shows steady adoption in medical and industrial wearables.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the 3D Printed Wearables Market

- Stratasys

- 3D Systems

- Materialise

- HP Inc.

- EOS GmbH

- Carbon Inc.

- Formlabs

- GE Additive

- Renishaw

- Desktop Metal

- Proto Labs

- SLM Solutions

- Nexa3D

- EnvisionTEC

- Shapeways