Wooden Interior Doors Market Size

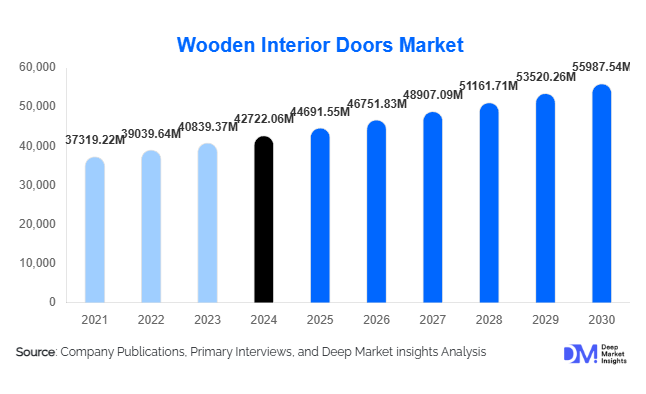

According to Deep Market Insights, the global wooden interior doors market size was valued at USD 42,722.06 million in 2024 and is projected to grow from USD 44,691.55 million in 2025 to reach USD 55,987.54 million by 2030, expanding at a CAGR of 4.61% during the forecast period (2025–2030). The market growth is primarily driven by rising construction and renovation activities, increasing consumer preference for aesthetically appealing and durable interior solutions, and growing adoption of sustainable and engineered wood products across residential, commercial, and institutional applications.

Key Market Insights

- Solid wood doors dominate the market, accounting for over 55% of global demand in 2024, due to durability, premium appeal, and long lifespan.

- Panel doors are the most preferred design style, with 40% market share globally, favored for customization and traditional aesthetics.

- Residential applications lead demand, representing around 60% of the market, driven by new housing and urban renovation projects.

- Offline retail remains the primary distribution channel, contributing 65% of sales, though e-commerce adoption is growing rapidly in APAC and North America.

- APAC is the fastest-growing regional market, with India, China, and Japan driving urbanization-led construction and premium door adoption.

- Technological adoption, including CNC machining, automated finishing, and smart door integration, is reshaping product offerings and market competitiveness.

What are the latest trends in the wooden interior doors market?

Eco-Friendly and Sustainable Doors

Manufacturers are increasingly offering doors made from FSC-certified timber, recycled wood, and engineered wood alternatives like MDF and HDF. These products cater to growing consumer awareness of environmental sustainability and compliance with green building regulations. Europe and North America are leading markets for eco-certified doors, while APAC is rapidly adopting sustainable alternatives in urban housing and commercial developments. Government initiatives promoting energy-efficient and eco-friendly construction materials are also boosting the adoption of sustainable wooden doors globally.

Smart and Technology-Integrated Doors

Smart doors featuring biometric access, automated locking systems, and IoT-based security solutions are emerging in premium residential and commercial segments. Technological integration is enabling manufacturers to differentiate products, offering added security, convenience, and modern aesthetics. This trend is gaining traction, particularly in urban housing, office spaces, and luxury hospitality projects. CNC machining, precision cutting, and automated finishing are also improving quality, reducing costs, and enhancing design flexibility, which is influencing overall market dynamics.

What are the key drivers in the wooden interior doors market?

Increasing Construction and Renovation Activities

Urbanization, rising disposable incomes, and growing real estate developments in North America, Europe, and APAC are driving demand for wooden interior doors. New residential projects and commercial office spaces require durable, visually appealing doors, boosting adoption across the solid wood and engineered wood segments.

Consumer Preference for Premium and Aesthetic Interiors

End-users increasingly seek doors that blend functionality with design. Solid wood panel doors and modern flush doors are highly favored due to their luxurious appeal and customizability. High-end residential projects, offices, and hotels are driving demand for premium finishes and unique designs.

Government Initiatives for Sustainable Building

Policies promoting green construction and energy-efficient materials have encouraged the adoption of eco-friendly doors. Incentives and regulations in Europe, North America, and APAC for sustainable building practices support manufacturers offering certified timber and engineered wood alternatives, accelerating market growth.

What are the restraints for the global market?

Fluctuating Raw Material Prices

Timber and engineered wood prices are highly volatile due to supply constraints, environmental regulations, and global trade policies. This increases production costs, particularly for premium solid wood doors, impacting profit margins and slowing market growth in price-sensitive segments.

Competition from Alternative Materials

PVC, metal, and composite doors are gaining popularity due to low maintenance and cost-effectiveness. This creates competitive pressure for wooden doors, especially in mid-range residential projects and commercial spaces with tight budgets.

What are the key opportunities in the wooden interior doors market?

Expansion in Emerging Economies

Rapid urbanization and infrastructure development in APAC, Latin America, and the Middle East present opportunities for market expansion. India and China are witnessing high demand for residential and commercial construction, creating substantial growth potential for both solid and engineered wood doors. New entrants and established players can capitalize on these markets through localized production and distribution.

Integration of Smart and Innovative Features

Smart locks, automated access, and IoT-enabled doors are becoming increasingly desirable in premium residential and commercial projects. Offering technologically advanced wooden doors provides differentiation, attracts high-end buyers, and opens new product categories in established markets.

Export-Driven Demand for Timber-Rich Regions

Manufacturers in countries like India, China, and Malaysia can leverage export opportunities to serve high-demand regions in Europe, North America, and the Middle East. Increasing e-commerce penetration also enables direct-to-consumer sales internationally, enhancing revenue streams and market presence.

Product Type Insights

Solid wood doors dominate the global wooden interior doors market, catering primarily to premium residential, commercial, and hospitality sectors due to their durability, long lifespan, and aesthetic appeal. Engineered wood doors such as MDF and HDF are increasingly gaining traction in mid-range and cost-conscious segments, driven by affordability, sustainability, and customizable finishes. Panel doors hold a significant share, supported by their versatility in design, raised, flat, hollow, or solid, which makes them suitable for both new builds and renovation projects. Flush and sliding doors are expanding in modern residential and commercial applications, propelled by the growing need for space-efficient solutions in urban apartments and open-plan interiors. Bypass, bifold, and pocket doors are also emerging as space-saving options, especially in regions with high-density housing.

Application Insights

Residential applications remain the dominant driver of the wooden interior doors market, representing approximately 60% of global demand. Rising homeownership, increasing disposable incomes, renovation cycles, and evolving interior design trends are fueling adoption. New construction projects require durable and aesthetically pleasing doors, while refurbishment of older housing stock creates significant replacement demand. Commercial applications, including office spaces, hotels, and resorts, are steadily growing, driven by modernization efforts and a focus on premium interior finishes. Public infrastructure projects are also increasingly incorporating wooden interior doors, particularly for schools, hospitals, and government offices, where aesthetics, sound insulation, and fire-resistance compliance are important considerations.

Distribution Channel Insights

Offline retail continues to dominate, contributing around 65% of total sales through specialty stores and big-box retailers. Customers prefer seeing and physically assessing door quality, finishes, and customization options. However, e-commerce platforms are rapidly growing, offering direct-to-consumer access, a wider variety, and competitive pricing. Manufacturers are increasingly investing in online platforms that enable virtual visualization, customization, and direct engagement with consumers, bridging the gap between traditional and digital sales channels.

End-Use Industry Insights

The construction and real estate sector is the largest end-use segment, accounting for approximately 70% of market demand. Growth is driven by urban housing, commercial office developments, and renovation projects. The hospitality and hotel sector is increasingly adopting premium wooden doors for aesthetics, functionality, and guest experience enhancement. Emerging applications include smart homes, modular offices, and luxury renovation projects, where integration of advanced door mechanisms, sound insulation, and premium finishes creates new avenues for manufacturers to expand their product offerings.

| By Product Type | By Mechanism | By End-Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 25% of the global market, with the U.S. and Canada leading demand. The region’s growth is supported by a combination of rising home renovation projects and a strong DIY culture. High disposable incomes enable consumers to invest in premium wooden interior doors, while the refurbishment of older housing stock drives significant replacement demand. Renovations in urban centers, combined with preferences for sustainable and energy-efficient doors, further strengthen adoption. Panel doors remain highly popular due to their versatility in both new builds and renovations, while sliding and bifold doors are gaining traction in urban apartments with space constraints.

Europe

Europe holds around 28% of the global market, led by Germany, the U.K., and France. Strong sustainability and green-building regulations drive the adoption of eco-certified timber and engineered wood doors. A rich tradition of wood craftsmanship in certain countries contributes to the continued demand for high-quality, aesthetically appealing products. Energy efficiency and sound insulation requirements also influence product choice, making wooden doors a preferred solution in both residential and commercial applications. Renovation and luxury residential projects, particularly in Germany and France, are driving a CAGR of 5.8%, with panel doors and solid wood options dominating due to design flexibility and premium appeal.

Asia-Pacific

APAC is the fastest-growing region with a CAGR of 6.2%, led by India, China, and Japan. Rapid urbanization, expanding government housing initiatives, and robust commercial construction fuel demand for interior finishing products, including wooden doors. Rising middle-class incomes support premium solid wood adoption, while engineered wood options cater to cost-sensitive segments. Urban housing projects with space optimization requirements are increasing the popularity of sliding, folding, and pocket doors. Panel doors continue to lead due to their versatility, while flush doors are favored in modern interior layouts. The combination of new builds, renovations, and rising interior design awareness drives sustained growth across the region.

Middle East & Africa

Growth is moderate at 4.5% CAGR. UAE, Saudi Arabia, and South Africa are key markets, driven primarily by the expansion of hospitality, hotel, and resort construction, as well as luxury residential developments seeking premium finishes. Demand is further fueled by high-income populations and the adoption of modern interior design trends. Panel doors and custom/French doors are particularly preferred in high-end projects, while sliding and folding doors are increasingly installed in urban residential complexes for space optimization. Intra-regional trade and strong government support for construction and tourism infrastructure further enhance market growth prospects.

Latin America

Brazil and Mexico are the largest markets in the region, contributing a 3–4% CAGR. Demand is driven by growing real-estate development in major cities and increasing renovation of existing housing, influenced by aesthetic trends and rising awareness of interior design. Premium residential projects are adopting solid wood and panel doors for their durability and visual appeal. Sliding and bifold doors are increasingly favored in urban apartments where space optimization is critical. Commercial construction, including office spaces and hospitality, also contributes to steady market growth, although at a moderate pace compared to APAC and Europe.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Wooden Interior Doors Market

- JELD-WEN Holding, Inc.

- Masonite International Corporation

- ASSA ABLOY Group

- Hörmann KG

- Pella Corporation

- TATA Timber Products

- De La Espada

- Steves & Sons

- Simpson Door Company

- Swedoor Group

- Hufcor Inc.

- Trident Doors

- Shandong Liyuan Wood Industry

- Guandong Meijing Wood Co. Ltd.

- Royal Wood Doors

Recent Developments

- In March 2025, Masonite International launched a range of eco-friendly MDF doors in Europe, targeting sustainable residential projects.

- In January 2025, JELD-WEN expanded its premium solid wood door offerings in North America, integrating automated finishing technologies for custom designs.

- In February 2025, ASSA ABLOY Group introduced smart access-enabled wooden doors for commercial and luxury residential applications, combining security and aesthetic appeal.