Volleyball Equipment Market Size

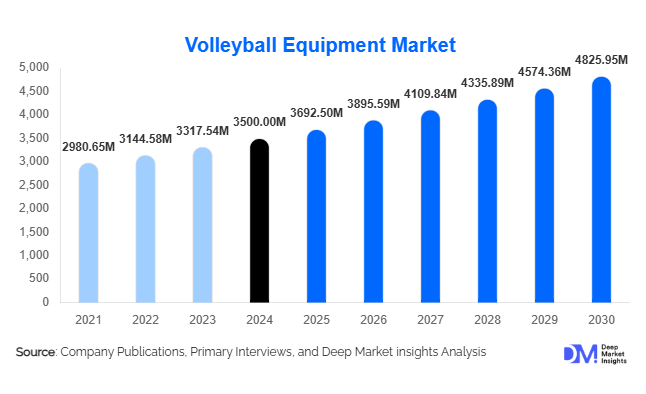

According to Deep Market Insights, the global volleyball equipment market size was valued at USD 3,500 million in 2024 and is projected to grow from USD 3,692.50 million in 2025 to reach approximately USD 4,825.95 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). This growth is supported by rising participation in indoor and beach volleyball worldwide, increasing institutional spending on sports infrastructure, and steady innovation in performance, comfort, and sustainability within volleyball gear and accessories.

Key Market Insights

- Volleyball balls remain the largest product segment, accounting for roughly 45% of market value in 2024 due to their essentiality and high replacement rate.

- Asia Pacific dominates global growth, contributing about 35% of the market and showing the fastest expansion rate thanks to school sports initiatives and urban recreation trends.

- Indoor volleyball equipment leads demand globally, representing approximately 60% of revenue, reflecting established leagues and institutional adoption.

- Online retail channels are rapidly gaining traction, capturing 30–35% of sales amid the e-commerce boom and post-pandemic digital shift.

- Technological innovations such as smart volleyballs and connected training aids are emerging, creating new revenue opportunities in premium and professional segments.

Latest Market Trends

Smart and Connected Training Equipment

Manufacturers are investing in smart volleyballs, motion-tracking sensors, and AI-driven training tools that allow athletes to monitor performance metrics such as speed, spin, and accuracy. These innovations are finding strong uptake in professional training centers and sports academies, supporting data-driven coaching and personalized training plans. The integration of IoT technologies and mobile-based analytics platforms is reshaping player engagement, enhancing accuracy, and elevating the perceived value of volleyball gear.

Sustainable and Eco-Friendly Materials

Growing environmental awareness among consumers is accelerating the adoption of eco-friendly materials such as recycled polymers, water-based adhesives, and sustainably sourced leather alternatives. Brands are incorporating carbon-neutral production processes and promoting recyclable packaging. Premium brands that align with sustainability standards are gaining preference among clubs, educational institutions, and conscious recreational players, influencing long-term purchasing behavior.

Volleyball Equipment Market Drivers

Rising Global Participation in Volleyball

Volleyball has become one of the most widely played team sports globally, with participation expanding across schools, colleges, and recreational clubs. International events and television exposure have enhanced its popularity. This surge directly drives sales of volleyballs, nets, apparel, and protective accessories, particularly in markets such as the U.S., Brazil, Japan, and India.

Investment in Sports Infrastructure and Education

Governments and private institutions are investing heavily in gymnasiums, school courts, and beach facilities, increasing institutional procurement of nets, posts, balls, and uniforms. As a result, educational institutions now account for about 25–30% of total equipment demand. Such infrastructure investments also create recurring replacement cycles, stabilizing long-term growth.

Innovation and Premiumization of Gear

Manufacturers are focusing on performance-enhancing innovations lighter footwear, anti-slip balls, advanced padding materials, and ergonomic apparel. These upgrades have led to steady value growth as consumers and teams upgrade to higher-end equipment, raising average selling prices across product lines.

Market Restraints

High Price Sensitivity in Emerging Markets

Affordability remains a key constraint. While professional and institutional segments readily adopt premium gear, budget limitations in schools and local clubs, especially in developing nations, result in slow replacement cycles and limit brand penetration for advanced equipment.

Competition from Other Sports and Leisure Activities

Volleyball competes with alternative recreational options such as basketball, football, and digital leisure. The rising popularity of e-sports and gym-based fitness programs can divert youth participation, potentially dampening growth in certain regional markets.

Volleyball Equipment Market Opportunities

Expanding Demand in Emerging Economies

Rapidly urbanizing regions such as Southeast Asia and Latin America are witnessing a surge in youth sports participation and community-based recreation projects. Equipment manufacturers entering these markets with affordable and durable products stand to benefit from high-volume institutional contracts and grassroots programs.

Smart Equipment and Performance Analytics

Integrating sensors and IoT technology into volleyballs and training aids presents a premium growth frontier. Partnerships with sports academies and fitness-tech companies are enabling the rollout of connected gear, helping players and coaches enhance performance through real-time analytics and feedback.

Sustainability and Customization as Differentiators

Eco-conscious consumers are driving demand for sustainable, ethically manufactured gear. At the same time, custom-branded apparel and personalized team kits offer manufacturers and retailers new high-margin segments. Sustainability certifications and team-specific customization platforms are becoming essential value propositions for leading brands.

Product Type Insights

Volleyballs dominate the market, representing approximately 45% of global revenue in 2024. Constant replacement needs and universal usage across indoor, beach, and training contexts sustain their leadership. Technological improvements in surface texture and pressure retention are supporting premium segment growth. Other major categories, protective gear, nets & posts, footwear, and apparel, are expanding as consumers prioritize performance and comfort.

Distribution Channel Insights

Online retail has emerged as the fastest-growing distribution channel, accounting for 30–35% of sales. E-commerce platforms enable direct-to-consumer reach, transparent pricing, and broad selection. Offline specialty stores and institutional procurement remain significant, especially for large-scale educational and professional purchases, but digital platforms are reshaping brand visibility and customer loyalty programs.

End-Use Insights

Educational institutions are the leading end-use segment, contributing about 25–30% of market demand through bulk procurement for schools and colleges. Sports clubs & recreation centers form another substantial segment as they adopt volleyball programs for fitness and leisure. Home and residential users represent a smaller but growing category driven by compact and portable volleyball setups designed for casual play. Collectively, these segments ensure broad-based and recurring equipment replacement cycles worldwide.

| By Product Type | By Material Type | By End Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for roughly 30–35% of the global market value in 2024. The U.S. dominates regional demand with its established collegiate and professional volleyball ecosystems (e.g., NCAA leagues). Growth is steady, supported by youth development programs and beach volleyball popularity in coastal states.

Europe

Europe contributes around 20–25% of the market, with countries such as Germany, Italy, France, and Poland leading participation. Indoor volleyball infrastructure and club systems are mature, while growth opportunities lie in women’s leagues and expanded beach tournaments across Southern Europe.

Asia Pacific

Asia Pacific holds about 35% of the market and is the fastest-growing region, driven by rising middle-class income, government-funded school sports initiatives, and rapid e-commerce adoption. China, Japan, India, and South Korea lead regional growth, while Southeast Asia contributes through expanding recreational play and local manufacturing bases.

Latin America

Latin America, led by Brazil, Argentina, and Mexico, represents roughly 8–10% of the global market. Beach volleyball is a national pastime in Brazil, fostering strong domestic consumption. Local brands and distributors are increasingly exporting to North America and Europe, boosting cross-regional trade.

Middle East & Africa

Accounting for 3–5% of market share, the MEA region is showing gradual growth. Infrastructure investments in Gulf countries and increasing tourism-linked beach volleyball programs are driving incremental demand, while South Africa leads regional participation in organized indoor leagues.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Volleyball Equipment Market

- Mikasa Sports Corporation

- Molten Corporation

- Wilson Sporting Goods Co.

- ASICS Corporation

- Nike, Inc.

- Adidas AG

- Puma SE

- Under Armor, Inc.

- Mizuno Corporation

- Tachikara USA

- Baden Sports Inc.

- Gared Holdings LLC

- Senoh Corporation

- PowerNet USA

- Spalding (Russell Brands)