UV Tapes Market Size

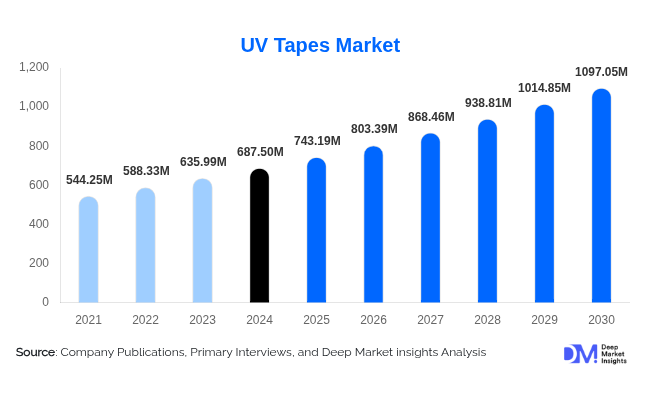

According to Deep Market Insights, the global UV tapes market size was valued at USD 687.5 million in 2024 and is projected to grow from USD 743.19 million in 2025 to reach USD 1,097.05 million by 2030, expanding at a CAGR of 8.1% during the forecast period (2025–2030). The UV tapes market growth is primarily driven by the rising adoption of semiconductor packaging, display manufacturing advancements, and the growing demand for precision adhesive materials in consumer electronics and automotive applications.

Key Market Insights

- Increasing demand from the semiconductor industry for wafer dicing and back-grinding processes is a major factor driving the adoption of UV tapes globally.

- Rising production of smartphones, tablets, and display panels continues to boost the need for high-performance UV-curable adhesive tapes with minimal residue and easy peelability.

- Asia-Pacific dominates the global UV tapes market, led by strong manufacturing bases in China, Japan, South Korea, and Taiwan.

- North America and Europe show stable growth supported by ongoing technological innovation in automotive electronics and solar cell applications.

- R&D investments by key manufacturers are focusing on improving UV resistance, heat durability, and eco-friendly formulations using solvent-free and halogen-free materials.

- Strategic collaborations between adhesive manufacturers and semiconductor producers are shaping product customization and performance optimization.

Latest Market Trends

Shift Toward Eco-Friendly and Solvent-Free UV Tapes

With increasing global emphasis on sustainability, UV tape producers are transitioning toward eco-friendly, solvent-free adhesive systems. These formulations minimize VOC emissions, reduce waste during dicing, and comply with stringent environmental standards such as RoHS and REACH. Manufacturers are also adopting biodegradable polymers and recyclable film substrates to align with circular economy goals. This shift enhances brand positioning while meeting the growing demand for green electronics manufacturing.

Rising Use in Automotive Electronics

The rapid electrification of vehicles and growing integration of electronic control units (ECUs), sensors, and LED displays in automobiles are boosting demand for UV tapes. These tapes ensure secure bonding and protection during microelectronic packaging and component handling. Advanced UV dicing tapes that offer high adhesion before exposure and low adhesion after UV curing are being increasingly used in automotive chip production, particularly for ADAS and EV battery management systems.

UV Tapes Market Drivers

Expanding Semiconductor Manufacturing Activities

The global semiconductor boom, driven by AI, IoT, and 5G technologies, continues to accelerate UV tape consumption. UV dicing tapes are essential in wafer processing, offering residue-free removal and high die strength during dicing. Asia-Pacific’s robust chip production, especially in Taiwan, Japan, and South Korea, ensures consistent demand. Government incentives for semiconductor capacity expansion in the U.S. and Europe further amplify growth opportunities.

Growing Adoption in Display and Optoelectronic Applications

UV tapes play a critical role in protecting delicate glass and display panels during cutting, grinding, and lamination. The surge in OLED, microLED, and flexible display production has significantly expanded the usage of UV-release adhesive tapes. These tapes provide temporary bonding with stable adhesion that can be precisely controlled during UV light exposure, improving production efficiency and yield rates.

Market Restraints

Volatility in Raw Material Prices

Fluctuating costs of base materials such as polyethylene (PE), polyvinyl chloride (PVC), and acrylic adhesives can impact overall production expenses. Dependence on petrochemical feedstocks creates pricing uncertainty, especially in regions sensitive to energy cost variations. This volatility can restrain profit margins for manufacturers and influence final product pricing in competitive markets.

Complex Manufacturing and Equipment Requirements

Producing UV tapes with uniform adhesive strength, UV-curing precision, and defect-free backing films requires advanced coating and curing equipment. High setup and maintenance costs may limit entry for small-scale producers. Additionally, stringent quality control standards in semiconductor applications impose barriers for new entrants lacking technical expertise or capital investment capabilities.

UV Tapes Market Opportunities

Emergence of Miniaturized and Advanced Packaging Technologies

The proliferation of compact and high-density integrated circuits (ICs) opens opportunities for specialized UV tapes designed for fine-pitch components and ultra-thin wafer processing. Next-generation UV tapes offering micro-level adhesion control and compatibility with 3D packaging and fan-out wafer-level packaging (FOWLP) are expected to witness strong adoption in the coming years.

Development of Smart and Functional Adhesive Films

Ongoing R&D efforts are exploring multifunctional UV tapes with built-in antistatic, thermal-conductive, or UV-filtering properties. These innovations cater to evolving requirements in flexible displays, medical devices, and precision optics. The convergence of nanotechnology and adhesive chemistry is also enabling UV tapes with adaptive performance under variable temperature and humidity conditions.

Product Type Insights

Based on product type, the market is segmented into polyolefin (PO), polyvinyl chloride (PVC), and other polymers. Polyolefin-based UV tapes dominate the market due to superior chemical resistance, low shrinkage, and high UV transparency. PVC-based tapes are preferred for cost-effective applications, while hybrid and advanced polymer tapes are gaining momentum in high-precision electronics packaging.

Application Insights

The key applications of UV tapes include wafer dicing, back grinding, LCD panel protection, glass processing, and semiconductor packaging. Wafer dicing accounts for the largest share owing to rising integrated circuit production. LCD and OLED display manufacturing represents a rapidly expanding segment, driven by increased demand for consumer electronics and smart devices.

| By Product Type | By Application | By End-Use Industry |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the UV tapes market, accounting for over 65% of global revenue. Countries such as Japan, South Korea, China, and Taiwan are home to major semiconductor foundries and display panel manufacturers. Strong government support for local chip production and rising exports of consumer electronics sustain market leadership in this region.

North America

North America exhibits steady growth due to semiconductor expansion initiatives and increasing demand for high-precision manufacturing materials. The U.S. CHIPS and Science Act is stimulating investments in domestic semiconductor fabs, indirectly benefiting the UV tapes market. Adoption in EV battery systems and MEMS sensors is further contributing to regional growth.

Europe

Europe’s UV tapes market is driven by the automotive and renewable energy sectors. Growing adoption of UV-curable adhesive materials in solar cell assembly and automotive electronics boosts market demand. Germany, the U.K., and France lead the regional market with a focus on sustainable, solvent-free tape innovations.

Latin America

Latin America is an emerging market for UV tapes, primarily fueled by rising electronics assembly operations in Mexico and Brazil. Gradual expansion of regional semiconductor packaging and the consumer electronics sector is expected to create growth opportunities over the forecast period.

Middle East & Africa

The Middle East and Africa region shows moderate growth, with demand driven by industrial manufacturing and solar energy projects. The UAE and Saudi Arabia are investing in renewable energy technologies where UV tapes are utilized for photovoltaic cell assembly and protective lamination.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the UV Tapes Market

- Nitto Denko Corporation

- Lintec Corporation

- Furukawa Electric Co., Ltd.

- Mitsui Chemicals, Inc.

- Tesa SE

- Denka Company Limited

- AI Technology, Inc.

- Toray Industries, Inc.

Recent Developments

- In September 2025, Nitto Denko launched a new UV dicing tape with enhanced low-residue performance designed for 300 mm wafer processing, improving throughput and yield rates.

- In July 2025, Lintec Corporation introduced an eco-friendly UV-curable adhesive tape line using solvent-free technology to comply with global sustainability standards.

- In March 2025, Tesa SE announced an expansion of its production facility in Germany to cater to rising European demand for precision electronic adhesive materials.