Tufting Machine Market Size

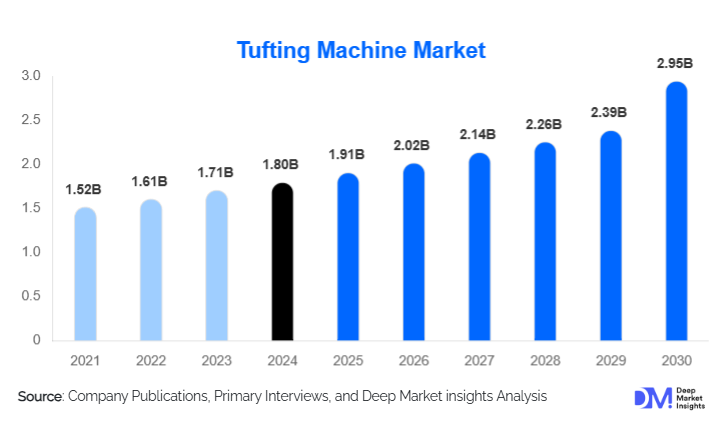

According to Deep Market Insights, the global tufting machine market size was valued at USD 1.8 billion in 2024 and is projected to grow from USD 1.91 billion in 2025 to reach USD 2.95 billion by 2030, expanding at a CAGR of 5.8% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for carpets, rugs, upholstery textiles, and automotive interiors, technological advancements in automation and smart controls, and increasing adoption of sustainable manufacturing processes across the globe.

Key Market Insights

- Automation and digitalization are transforming the tufting machine industry, with fully automatic and IoT-enabled machines enabling higher precision, reduced labor dependency, and increased production efficiency.

- Carpets & rugs remain the dominant application segment, with residential and commercial demand driving global sales, particularly in emerging markets of the Asia-Pacific and Latin America.

- Asia-Pacific leads the market, with China and India contributing the largest shares in both production and consumption, supported by strong infrastructure development and growing textile exports.

- Technological adoption, including digital patterning, smart controls, and predictive maintenance, is reshaping the competitive landscape and enabling manufacturers to cater to premium product demand.

- Sustainability initiatives in yarn recycling and energy-efficient machine designs are creating opportunities for environmentally conscious manufacturers and end-users.

- Emerging applications such as automotive interiors, artificial grass, and acoustic panels are diversifying the market and driving incremental demand for specialized tufting machines.

Latest Market Trends

Shift Toward Fully Automated and Smart Machines

Manufacturers are increasingly adopting fully automated tufting machines equipped with digital patterning, IoT-enabled sensors, and predictive maintenance systems. These technologies improve production efficiency, reduce downtime, and allow manufacturers to quickly adapt to complex design requirements. Semi-automatic and manual machines are gradually being replaced, especially in large-scale carpet and rug manufacturing facilities. The trend is also evident in emerging markets, where rising labor costs encourage investment in automation to maintain competitive pricing and quality standards.

Sustainability and Eco-Friendly Manufacturing

As consumer preference shifts toward environmentally responsible products, tufting machine manufacturers are focusing on energy-efficient designs and machines capable of processing recycled or blended fibers. Reducing yarn waste and minimizing energy consumption have become key differentiators. Some manufacturers are integrating modular systems that allow existing machines to process recycled yarns, helping companies comply with environmental regulations and appeal to eco-conscious end-users.

Tufting Machine Market Drivers

Growth in Construction and Home Décor Sectors

Rising urbanization, increased housing construction, and renovations in both developed and emerging markets are boosting demand for carpets, rugs, and upholstery textiles. Residential and commercial sectors, including hotels and offices, are driving the need for higher-quality tufted products, which, in turn, propels investment in advanced tufting machinery. The growth of luxury interiors and premium floor coverings has also led manufacturers to adopt automated machines capable of producing complex textures and patterns.

Technological Advancements and Automation

Innovations such as digital control systems, pattern design software, and IoT-enabled monitoring are allowing manufacturers to produce more intricate designs with improved efficiency. Automated tufting machines reduce reliance on skilled labor while enhancing precision and productivity. This technological shift has also enabled customization, faster product changeovers, and improved total cost of ownership, supporting long-term growth in both mature and emerging markets.

Market Restraints

High Capital Expenditure

Fully automated and high-speed tufting machines require significant upfront investment, limiting adoption among small and medium-sized manufacturers, particularly in emerging economies. While the long-term benefits are substantial, the initial costs can delay purchasing decisions, and financing options are not universally available.

Skilled Workforce Shortages

Operating and maintaining modern, automated tufting machines demands trained personnel. A lack of skilled operators and technicians in certain regions slows down machine adoption and can increase operational inefficiencies. Manufacturers must invest in training programs or risk underutilization of advanced equipment.

Tufting Machine Market Opportunities

Integration of Sustainability and Recycled Materials

The rising focus on eco-friendly products presents an opportunity to develop machines capable of handling recycled fibers and minimizing energy consumption. This not only addresses regulatory pressures but also meets growing consumer demand for sustainable textiles. Manufacturers that innovate in this space can capture premium pricing and strengthen brand differentiation.

Expansion into Emerging Applications

Beyond traditional carpets and rugs, tufting machines are increasingly used in automotive interiors, artificial grass, acoustic panels, and decorative installations. These emerging applications offer higher margins and allow manufacturers to diversify revenue streams. Companies can tailor machines for specific requirements in these niches, such as durability for automotive carpets or precise pile height for acoustic panels.

Product Type Insights

Fully automated tufting machines dominate the market, accounting for roughly 35–40% of the 2024 market share. These machines are preferred by large manufacturers due to their high efficiency, precision, and ability to produce complex patterns. Semi-automatic machines cater to mid-sized manufacturers, balancing cost and productivity, while manual machines remain relevant in small-scale or artisanal production. The trend is shifting toward higher automation as labor costs rise and demand for complex designs grows.

Application Insights

Carpets and rugs remain the largest application, contributing over 50% of global demand. Upholstery textiles, automotive interiors, and wall coverings are emerging applications gaining traction. Automotive interiors are particularly promising due to increasing vehicle production and the adoption of premium interior designs. Artificial grass and acoustic panel applications offer niche opportunities, driven by commercial and recreational infrastructure development.

Distribution Channel Insights

Direct OEM sales dominate for industrial buyers seeking fully automated machines. Distributors and dealers are important in emerging markets, facilitating access to semi-automatic and manual machines. E-commerce is gaining traction for smaller machines, parts, and upgrades. Manufacturers are increasingly offering modular systems, service packages, and remote diagnostics to strengthen customer engagement and maintain long-term relationships.

End-Use Industry Insights

The residential sector accounts for roughly 35–40% of market demand, driven by home décor and renovation projects. Commercial sectors, including offices, hotels, and retail, are rapidly growing due to increased demand for high-quality carpets and upholstery. Automotive interiors are an emerging segment requiring specialized machines for durability and design precision. Export-driven demand from Asia-Pacific to Europe and North America further supports growth, particularly in carpet and rug manufacturing.

| By Product Type | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 20–25% of the 2024 market. The U.S. dominates regional demand due to refurbishment, luxury home interiors, and automotive manufacturing. Technological adoption and sustainability standards are driving purchases of automated machines. Canada follows similar trends, with strong demand in residential and commercial segments.

Europe

Europe accounts for roughly 20–25% of the market, with Germany, Italy, and the U.K. leading demand. Focus on high-quality, sustainable carpets, and automation drives the adoption of advanced machines. Eastern Europe is witnessing faster growth due to the modernization of local textile industries.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region (~30–35%), led by China and India. Strong infrastructure development, textile exports, and increasing domestic consumption drive demand. Southeast Asia is also emerging as a growth hotspot due to urbanization and expanding commercial construction.

Latin America

Latin America holds a 5–8% market share, with Brazil and Mexico leading growth. Demand is fueled by rising middle-class spending, infrastructure projects, and emerging industrialization in textile production.

Middle East & Africa

MEA contributes 5–8% of global demand, with GCC countries and South Africa driving the market. Luxury construction projects, tourism, and regional textile modernization initiatives are boosting tufting machine adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Tufting Machine Market

- Tuftco Corporation

- Card-Monroe Corp (CMC)

- Cobble

- Yamaguchi Sangyo Co., Ltd

- NAKAGAWA

- Van De Wiele

- Staubli International

- Groz-Beckert

- Guangzhou Dayang Technology Co., Ltd

- Changzhou Wuding Carpet Machinery Co., Ltd

- Alvan Blanch

- Oerlikon Textile

- KraussMaffei Berstorff

- Lexmark Tufting Solutions

- Schlafhorst Textile Machines

Recent Developments

- In March 2025, Tuftco Corporation launched a new fully automated cut & loop tufting machine with IoT-enabled monitoring and predictive maintenance capabilities.

- In January 2025, Van De Wiele expanded its Asia-Pacific operations, establishing a new service and training center in India to support local manufacturers and improve after-sales support.

- In February 2025, Card-Monroe Corp introduced energy-efficient tufting machines capable of processing recycled synthetic fibers, catering to growing demand for sustainable textiles.