Tourism Vehicle Rental Market Size

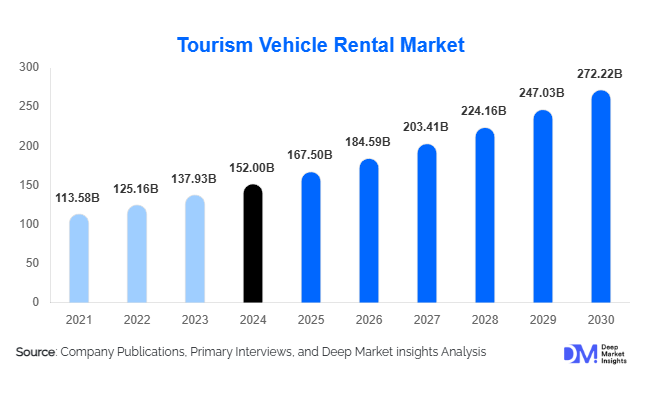

According to Deep Market Insights, the global tourism vehicle rental market size was valued at USD 152 billion in 2024 and is projected to grow from USD 167.5 billion in 2025 to reach USD 272.22 billion by 2030, expanding at a CAGR of 10.2% during the forecast period (2025–2030). The market growth is fueled by the post-pandemic rebound in global travel, increasing preference for self-drive and flexible mobility solutions, and rapid digitalization of car rental booking platforms worldwide.

Key Market Insights

- Rising demand for self-drive and experiential travel is significantly boosting vehicle rentals among leisure tourists seeking freedom and flexibility.

- Online and app-based booking channels dominate, accounting for nearly 60% of global rentals in 2024, supported by growing smartphone penetration and digital convenience.

- Economy and mid-range car rentals hold the largest share, representing about 35% of the global market, driven by affordability and high fleet availability.

- North America leads the global market with around 30% share in 2024, while Asia-Pacific is emerging as the fastest-growing region with 8–10% annual growth.

- Electrification of rental fleets and adoption of hybrid and electric vehicles are transforming the market landscape, supported by government sustainability initiatives.

- Digital integration, AI-based pricing, and connected car technologies are reshaping customer experience and operational efficiency in tourism vehicle rental services.

What are the latest trends in the tourism vehicle rental market?

Digital and Mobile-First Booking Platforms

Digital transformation is redefining the tourism vehicle rental market. Online platforms and mobile apps are now the primary mode of reservation, providing travelers with real-time pricing, digital keyless entry, and instant check-ins. Integration of AI and data analytics allows personalized recommendations and dynamic pricing models. Peer-to-peer rental services and app-based micro-leasing options are also rising, targeting millennial and Gen-Z travelers seeking flexibility. This tech-driven evolution is increasing transparency, efficiency, and customer loyalty across markets.

Rise of Electric and Sustainable Fleet Rentals

With global travel shifting toward sustainability, rental operators are accelerating the adoption of electric vehicles (EVs), hybrids, and low-emission fleets. Partnerships with charging infrastructure providers and tourism boards are enabling EV-friendly destinations. Tourists are increasingly opting for green vehicles to reduce their carbon footprints during travel. Incentives such as reduced rental rates for EVs, dedicated parking, and tax rebates are further driving this trend. The sustainable fleet transformation is expected to reshape competitive positioning in the coming years.

What are the key drivers in the tourism vehicle rental market?

Rebound in Global Tourism and Road Travel

The recovery of international travel and growing interest in domestic tourism have significantly driven vehicle rental demand. Tourists now prefer road trips and flexible itineraries over rigid package tours. Well-developed road networks in North America and Europe, coupled with emerging routes in the Asia-Pacific region, are expanding the market base.

Technological Advancements and Mobile Connectivity

Advanced booking systems, telematics, GPS-enabled vehicles, and AI-driven customer interfaces have modernized rental services. Travelers increasingly prefer contactless experiences, from digital check-ins to cashless payments. Rental companies investing in such technology gain a competitive advantage through improved customer satisfaction and operational efficiency.

Rising Popularity of Self-Drive Experiences

Consumers are gravitating toward self-driven holidays that offer independence and adventure. Younger demographics, particularly in Asia-Pacific and Europe, are driving this demand. This trend has led rental companies to expand SUV and crossover offerings, improve insurance options, and introduce cross-border rental flexibility.

What are the restraints for the global market?

High Operational and Maintenance Costs

Fleet acquisition, insurance premiums, and maintenance costs are major challenges for rental companies. Vehicle depreciation and seasonal tourism cycles limit profitability, especially for small and regional operators. Rising fuel and vehicle prices also affect pricing strategies and margins.

Regulatory and Licensing Complexities

Diverse regulations across countries regarding insurance, licensing, and cross-border vehicle usage complicate international operations. Stringent local rules, documentation requirements, and varying insurance norms can deter foreign tourists and limit the ease of renting vehicles abroad.

What are the key opportunities in the tourism vehicle rental industry?

Integration of Electric and Hybrid Fleets

The global shift toward sustainability provides a major opportunity for rental operators to electrify their fleets. Government incentives and growing environmental awareness among travelers are driving demand for eco-friendly vehicles. Companies introducing charging partnerships and sustainable branding can attract a premium customer base.

Expansion in Emerging Tourism Destinations

Emerging markets such as India, Vietnam, Mexico, and South Africa offer untapped potential for vehicle rental expansion. Infrastructure upgrades, visa liberalization, and domestic tourism growth in these regions create strong opportunities for fleet deployment and regional partnerships with tour operators and hotels.

AI and Data-Driven Personalization

Rental firms leveraging big data and AI for predictive pricing, demand forecasting, and customer personalization can significantly enhance user experience. Integration of travel itineraries, mapping tools, and concierge services into rental apps can create new revenue streams and improve retention.

Vehicle Type Insights

Economy and compact cars continue to dominate the global tourism vehicle rental market, holding around 35% share in 2024. Their popularity is driven by affordability, high vehicle availability, and fuel efficiency, making them the preferred choice for price-sensitive leisure travelers and short-term urban tourists. SUVs and crossovers are rapidly gaining traction, supported by family travelers and adventure tourists who value space, comfort, and off-road capability, particularly in regions such as North America, Latin America, and parts of Africa where terrain and trip length demand larger vehicles. Luxury and premium cars cater to high-spend tourists and business travelers, driven by status appeal, partnerships with premium hotels and cruise operators, and the growing luxury tourism trend in the Middle East and Europe. Vans and minivans serve the growing group and family travel segment, supporting airport transfers and multi-destination itineraries. RVs and campervans are expanding in popularity, fueled by the rise of experiential tourism, RV culture, and social-media-driven road-trip trends. Meanwhile, motorcycles and scooters are thriving in dense urban and coastal destinations, especially across Southeast Asia, where tourists seek low-cost, short-term, and flexible mobility.

Rental Mode Insights

Self-drive rentals account for the majority of global market revenue, driven by travelers seeking independence, flexibility, and digital convenience. The growing popularity of mobile apps, keyless entry, and digital payment options further enhances the appeal of this mode. Chauffeured rentals remain strong in markets where tourists prefer local expertise or lack familiarity with driving norms, especially in the Middle East, Africa, and Asia-Pacific. This segment benefits from luxury-focused tourists and business travelers who prioritize convenience, safety, and personalized service.

Booking Channel Insights

Online booking channels dominate the global tourism vehicle rental market, accounting for nearly 60% of total bookings in 2024. Key drivers include mobile penetration, real-time comparison tools, and metasearch aggregators that allow travelers to make quick, informed decisions. Digitalization also enables last-minute reservations and personalized offers, which are particularly popular among millennial and Gen-Z travelers. Offline channels, while declining in share, remain significant among older demographics, complex itinerary planners, and B2B tour operators who prefer package bundling and personal assistance for large-group bookings.

Rental Duration Insights

Short-term rentals, lasting from a single day to less than a week, represent about 50% of the global market value in 2024, driven by weekend getaways, city sightseeing, and airport transit rentals. Medium-term rentals (one to two weeks) align with typical vacation durations and account for a significant portion of leisure bookings. Meanwhile, long-term rentals exceeding 14 days are gaining traction among digital nomads, RV travelers, and relocation tourists who prefer extended self-drive experiences for flexibility and cost efficiency.

Customer Purpose Insights

Leisure tourism continues to dominate, representing approximately 70% of total demand. Growth is driven by family holidays, sightseeing tours, and destination marketing campaigns. Adventure tourism is an expanding sub-segment, characterized by off-road, wilderness, and eco-tourism trips that require SUVs and 4x4 vehicles. Transit and transfer passengers, such as airport or cruise travelers, create steady demand for short-duration rentals supported by partnerships with airlines and port operators. Increasing emphasis on flexible mobility options continues to diversify demand across both leisure and business travel categories.

Fuel & Propulsion Insights

Internal Combustion Engine (ICE) vehicles remain the largest share of global rental fleets, supported by existing refueling infrastructure and cost advantages. However, the industry is undergoing a major shift toward hybrid and battery electric vehicles (BEVs), driven by emission regulations, urban low-emission zones, and growing traveler preference for sustainable options. Rental companies across Europe and North America are rapidly expanding hybrid fleets, while government incentives in Asia-Pacific are encouraging BEV adoption. A niche yet emerging category includes alternative-fuel vehicles (biofuel or hydrogen-powered), promoted by eco-conscious tour operators seeking sustainability branding.

| By Vehicle Type | By Rental Mode | By Booking Channel | By Trip Duration | By Customer Purpose |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, accounting for about 30% of global value in 2024. The U.S. continues to dominate due to a strong road-trip and RV culture, extensive domestic travel, and a highly mature online booking ecosystem. The region also benefits from robust ancillary revenue streams such as insurance upgrades, GPS rentals, and add-on services. Long-term and RV rentals are particularly popular among retirees, families, and digital nomads exploring extended routes across the U.S. and Canada. In addition, wide highway networks, abundant vehicle supply, and advanced customer loyalty programs strengthen regional growth. Increasing adoption of electric vehicles across major cities and national parks is expected to further reshape the North American rental landscape.

Europe

Europe holds around 20% market share in 2024 and is characterized by dense tourism corridors, cross-border travel routes, and hybrid travel models combining train and car rentals. Growth is supported by high inbound tourism volumes and established domestic travel networks. Strict emissions regulations in major cities such as London, Paris, and Berlin are accelerating the shift toward hybrid and BEV rentals, particularly for short-term urban mobility. Additionally, premium short-term rentals and intercity connectivity drive demand for compact, eco-friendly vehicles. The region’s leading markets, Germany, France, Italy, Spain, and the U.K., are also embracing cross-border digital rental systems, ensuring seamless travel across the EU. Europe’s focus on sustainability and carbon neutrality positions it as a frontrunner in the transition to low-emission mobility solutions.

Asia-Pacific

Asia-Pacific is the fastest-growing region, accounting for approximately 25% of global market value in 2024 and projected to grow at a CAGR of 8–10% through 2030. This rapid growth is underpinned by rising middle-class income, growing domestic and inbound tourism, and expanding online booking penetration. Travelers in China, India, Japan, and Australia are increasingly opting for self-drive rentals and affordable compact cars for domestic vacations. App-based short-term rentals and digital payment systems are becoming dominant, particularly in metropolitan and tourist hubs. Additionally, urban scooter and motorcycle rentals in Southeast Asia, especially Thailand, Vietnam, and Indonesia, are growing rapidly due to low cost, convenience, and flexible access. Government investments in smart mobility and EV charging infrastructure are further driving market expansion and enabling regional players to scale efficiently.

Middle East & Africa

The Middle East & Africa region represents around 15% of the global market in 2024, supported by high demand for 4x4s, SUVs, and luxury vehicles for desert safaris, premium travel, and business use. The UAE and Saudi Arabia are key hubs for luxury chauffeured rentals, fueled by expanding tourism infrastructure, luxury hospitality developments, and growing high-net-worth traveler segments. Seasonal peaks align with pilgrimage and leisure travel, while infrastructure gaps create opportunities for chauffeured and guided rental services. In Africa, emerging destinations such as South Africa, Kenya, and Morocco are witnessing rising demand for adventure and eco-tourism-oriented rentals, backed by government tourism promotion and increasing regional connectivity. Continued investment in airport expansion and digital mobility platforms will further strengthen the region’s growth outlook.

Latin America

Latin America accounts for approximately 10% of the global market value in 2024, led by Brazil, Mexico, and Argentina. Growth in this region is driven by expanding adventure and eco-tourism trends, with increasing demand for SUVs, off-road, and campervan rentals for overland journeys. The region’s improving road networks and growing domestic tourism base are key enablers of market expansion. Informal rental operators and local distribution channels continue to coexist with emerging online travel agencies (OTAs) and digital aggregators, improving accessibility for international tourists. Currency fluctuations and regulatory variations remain challenges, but rising investments in tourism infrastructure and eco-friendly mobility options are paving the way for long-term growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players Tourism Vehicle Rental Market

- Enterprise Holdings

- Hertz Global Holdings

- Avis Budget Group

- Sixt SE

- Europcar Mobility Group

- Alamo Rent A Car

- Dollar Thrifty Automotive Group

- Auto Europe

- Green Motion Rental

- Zoomcar India Pvt. Ltd.

- Carzonrent India Pvt. Ltd.

- EasyCar.com

- Kemwel

- Fox Rent A Car

- Budget Rent A Car

Recent Developments

- In August 2025, Enterprise Holdings announced an expansion of its electric rental fleet across Europe, targeting a 25% EV mix by 2028.

- In June 2025, Hertz introduced a new AI-based dynamic pricing system across its global booking platform to enhance utilization rates.

- In March 2025, Zoomcar partnered with multiple Indian tourism boards to promote self-drive rentals across heritage and coastal routes.