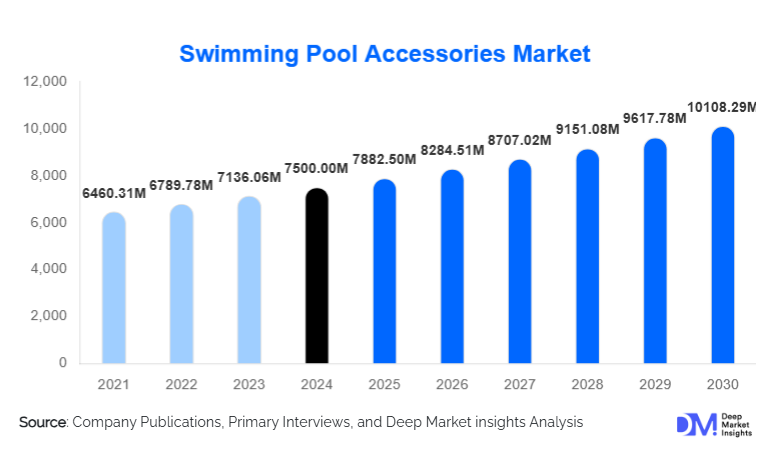

Swimming Pool Accessories Market Size

According to Deep Market Insights, the global swimming pool accessories market size was valued at USD 7,500.00 million in 2024 and is projected to grow from USD 7,882.50 million in 2025 to reach USD 10,108.29 million by 2030, expanding at a CAGR of 5.10% during the forecast period (2025–2030). The market growth is primarily driven by the rising adoption of smart and automated pool systems, increasing pool installations in residential and commercial spaces, and growing consumer preference for energy-efficient and sustainable pool maintenance solutions.

Key Market Insights

- Smart pool technologies such as IoT-based controllers, robotic cleaners, and automated filtration systems are reshaping the pool maintenance landscape.

- Energy-efficient products like solar-powered heaters and LED pool lighting are gaining traction amid stricter sustainability norms.

- North America leads the global market, supported by high pool ownership rates and significant refurbishment demand.

- Asia-Pacific is the fastest-growing region, fueled by rapid urbanization, increasing disposable incomes, and rising hospitality sector investments.

- Commercial and hospitality pools represent a significant demand base, driven by tourism and resort development projects.

- Online retail and e-commerce channels are emerging as dominant distribution avenues for aftermarket accessories.

What are the latest trends in the swimming pool accessories market?

Integration of Smart Pool Technologies

The integration of smart technologies such as automated filtration, chemical dosing systems, and app-controlled lighting is a defining trend in the swimming pool accessories market. IoT-enabled pool management systems allow users to monitor and control pH levels, temperature, and cleaning schedules remotely. These innovations enhance convenience, improve water quality, and reduce operating costs, especially in residential settings. The adoption of connected pool devices is projected to grow by over 25% annually, reflecting the broader shift toward smart home ecosystems.

Eco-Friendly and Energy-Efficient Solutions

Growing environmental awareness is driving demand for sustainable accessories such as solar-powered pool covers, LED lighting, and variable-speed pumps. Manufacturers are focusing on eco-friendly materials and designs that reduce energy consumption and extend product life cycles. For instance, solar covers help minimize water evaporation by up to 70%, reducing heating costs and promoting resource efficiency. These solutions align with global energy conservation mandates and position manufacturers to capture environmentally conscious consumer segments.

What are the key drivers in the swimming pool accessories market?

Rising Pool Installations in Residential and Commercial Spaces

The increasing number of residential pools, especially in North America, Europe, and Oceania, is a major growth driver. In addition, the booming hospitality industry in the Asia-Pacific and the Middle East has led to a surge in commercial pool installations in resorts, hotels, and wellness centers. This expansion directly stimulates demand for filtration systems, lighting, cleaning equipment, and safety accessories.

Technological Advancement and Product Innovation

Manufacturers are investing heavily in R&D to introduce advanced pool automation solutions. Robotic pool cleaners, sensor-based filtration units, and AI-driven water management systems are gaining mainstream acceptance. These technologies reduce labor dependence and improve operational efficiency, creating long-term cost benefits for users.

Growing Focus on Outdoor Living and Wellness Trends

The cultural shift toward home-based recreation and outdoor living is driving higher investments in home pool enhancements. Consumers increasingly view pools as lifestyle extensions, leading to rising demand for premium accessories like LED lighting, modular decking, and designer water features. The wellness and fitness trend also supports sustained use of pools for therapy and exercise.

What are the restraints for the global market?

High Initial and Maintenance Costs

The upfront investment in high-quality accessories and ongoing maintenance costs remain a key barrier for many consumers. Premium robotic cleaners, automation systems, and solar covers can be expensive, limiting their adoption in price-sensitive markets. Additionally, maintenance costs related to water treatment and electricity can deter frequent upgrades.

Seasonal Demand and Climate Dependency

Pool usage is heavily dependent on climate conditions, which restricts year-round demand in regions with colder weather. Seasonal fluctuations in pool operation reduce consistent accessory sales, particularly in Europe and parts of North America. This factor compels manufacturers to rely on replacement and refurbishment cycles rather than new installations.

What are the key opportunities in the swimming pool accessories industry?

Expansion of Smart Pool Ecosystems

With the growing smart home market, the integration of pools into broader home automation systems presents a major opportunity. Manufacturers are developing compatible systems that connect with smart speakers and home management apps. This interconnectivity enhances user convenience and allows predictive maintenance, reducing operational downtime.

Rising Adoption in Emerging Markets

Emerging economies in the Asia-Pacific and the Middle East are seeing rapid growth in luxury housing and hospitality infrastructure. Governments in countries such as India, the UAE, and Vietnam are promoting tourism and wellness resorts, spurring pool installations. This regional growth opens up new opportunities for accessory manufacturers to expand distribution networks and develop climate-adapted product lines.

Product Type Insights

Cleaning equipment dominates the global swimming pool accessories market, accounting for approximately 28% of the market share in 2024. Robotic and automatic pool cleaners are witnessing strong demand due to their efficiency and labor-saving benefits. These systems are increasingly used in both residential and commercial pools, driven by advancements in suction and pressure technologies.

Pool Type Insights

In-ground pools account for over 65% of the total market, supported by higher installation rates in developed economies and their compatibility with advanced accessories. Above-ground pools, while growing steadily, remain more common in budget-conscious segments and emerging economies.

End User Insights

Residential pools lead the market, representing nearly 55% of global revenue in 2024. Growth is driven by the rising number of luxury villas, private housing developments, and wellness-focused consumers investing in pool upgrades. Commercial pools, including hotels, spas, and fitness centers, are the second-largest end user, supported by expanding hospitality infrastructure in the Asia-Pacific and the Middle East.

| By Product Type | By Pool Type | By End User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America dominates the global swimming pool accessories market with a 38% share in 2024. The U.S. accounts for the largest portion of this demand, driven by high residential pool ownership and strong aftermarket sales. The region is also a hub for technological innovation, particularly in robotic cleaning systems and smart pool controls.

Europe

Europe holds around 26% of global revenue, led by countries such as France, Spain, and Italy, which have a long-standing pool culture. The region is increasingly focusing on eco-friendly products and energy-efficient pool equipment due to strict environmental regulations and rising energy costs.

Asia-Pacific

Asia-Pacific is the fastest-growing market, projected to expand at a CAGR of 6.3% during 2025–2030. Growth is supported by booming hospitality investments in China, India, Thailand, and Indonesia. The rising middle class and growth of luxury housing developments are accelerating demand for pool accessories in the region.

Middle East & Africa

The Middle East is witnessing strong growth driven by luxury resorts, wellness tourism, and residential developments in countries such as the UAE, Saudi Arabia, and Qatar. Africa, led by South Africa and Egypt, is also showing steady growth in resort-based pool infrastructure.

Latin America

Latin America, led by Brazil and Mexico, holds a growing market share due to rising consumer spending on home improvement and increased hospitality projects. Seasonal demand fluctuations remain a challenge, but the refurbishment segment offers consistent opportunities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Swimming Pool Accessories Market

- Pentair plc

- Fluidra S.A.

- Hayward Industries, Inc.

- Maytronics Ltd.

- Waterco Limited

- Aqua Leisure Industries, Inc.

- S.R. Smith, LLC

- Zodiac Pool Systems LLC

- Intex Recreation Corp

- Pool Corporation (POOLCORP)

Recent Developments

- In August 2025, Pentair launched a new line of AI-powered robotic cleaners designed to optimize energy consumption and cleaning precision.

- In June 2025, Fluidra announced the acquisition of a European automation startup to enhance its smart pool solutions portfolio.

- In April 2025, Hayward Industries introduced solar-integrated LED lighting systems, targeting sustainable residential installations.