Robotic Pool Cleaner Market Size

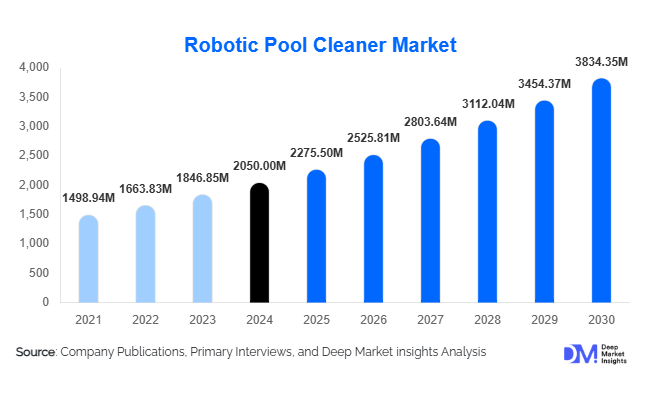

According to Deep Market Insights, the global robotic pool cleaner market size was valued at USD 2,050.00 million in 2024 and is projected to grow from USD 2,275.50 million in 2025 to reach USD 3,834.35 million by 2030, expanding at a CAGR of 11.0% during the forecast period (2025–2030). The market growth is primarily driven by rising adoption of automated pool maintenance solutions, technological advancements in robotic cleaners, and increasing investments in residential, commercial, and public swimming pool infrastructure worldwide.

Key Market Insights

- Technological innovation in robotic cleaners, including AI navigation, smart sensors, and app-controlled scheduling, is increasing operational efficiency and consumer convenience.

- Residential pools dominate adoption due to widespread private pool installations, particularly in North America and Europe.

- Commercial and public pool segments are rapidly growing, driven by resorts, hotels, municipal pools, and water parks seeking cost-effective cleaning solutions.

- North America remains the largest market, led by the U.S., due to high disposable income and pool ownership rates.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rising middle-class income, and expanding hospitality and recreational infrastructure.

- Eco-friendly and energy-efficient robotic cleaners are gaining traction, aligning with global sustainability trends and regulatory standards.

Latest Market Trends

Smart and AI-Enabled Pool Cleaners

Manufacturers are increasingly integrating AI, IoT, and smart home compatibility into robotic pool cleaners. These advancements allow automated navigation, debris detection, and optimized cleaning cycles, minimizing human intervention. App-based control and real-time monitoring are appealing to tech-savvy consumers, particularly in developed markets. Integration with pool chemical monitoring and energy-efficient motors further enhances value, driving preference for fully automated solutions over traditional or semi-automated cleaners.

Eco-Friendly and Energy-Efficient Cleaning Solutions

Environmental sustainability is a significant market driver. Energy-efficient models with solar-powered options and biodegradable filtration components are gaining popularity. Governments and commercial pool operators are increasingly encouraging the adoption of eco-friendly cleaners, resulting in premium pricing opportunities. Companies differentiating with environmentally conscious solutions can capture a higher share of both residential and public pool segments, aligning with long-term regulatory and consumer trends.

Robotic Pool Cleaner Market Drivers

Rising Pool Ownership and Disposable Income

Increasing residential swimming pool installations, particularly in North America, Europe, and the Middle East, are driving demand for automated cleaning solutions. High disposable incomes enable consumers to invest in advanced robotic pool cleaners that reduce manual labor and maintenance effort. Luxury residential developments and private villas are emerging as key adoption segments.

Technological Advancements in Robotics

Advanced sensors, AI-driven navigation, and smart scheduling improve cleaning efficiency and minimize human supervision. These innovations allow robotic cleaners to operate autonomously, adapt to pool size and shape, and optimize energy use. The trend is particularly strong in premium residential and commercial segments, supporting higher ASP and customer retention.

Labor Cost Reduction in Commercial Pools

For hotels, resorts, and public pools, robotic pool cleaners reduce operational labor requirements and associated costs. Automated cleaners deliver consistent cleaning quality, making them attractive for large-scale installations. Commercial adoption is increasing due to efficiency gains and long-term operational savings.

Market Restraints

High Initial Cost

The significant upfront investment of robotic pool cleaners compared to manual or semi-automated options can limit adoption in price-sensitive markets. Emerging economies with low-cost pool maintenance alternatives face slower penetration rates, restricting overall market growth.

Maintenance Complexity

Advanced robotic cleaners require periodic maintenance, software updates, and technical support. Limited local service networks in some regions may deter consumers, particularly in emerging markets, from investing in fully automated solutions.

Robotic Pool Cleaner Market Opportunities

Integration with Smart Homes and IoT

The growing adoption of smart home ecosystems presents an opportunity to offer app-controlled and AI-integrated pool cleaners. Consumers increasingly seek remote monitoring, energy optimization, and maintenance alerts. Companies providing seamless smart home integration can capture higher-value residential segments.

Expansion in Emerging Markets

Asia-Pacific and Latin America present high-growth opportunities. Urbanization, rising middle-class income, and luxury resort developments in China, India, Brazil, and Mexico are fueling demand for affordable semi-automated and premium robotic cleaners. Companies targeting emerging market segments can unlock significant growth potential.

Eco-Friendly Product Innovation

Energy-efficient and environmentally sustainable pool cleaners are in demand. Products utilizing low-power motors, solar energy, and biodegradable components are attractive to both environmentally conscious consumers and regulatory-compliant commercial pools. This innovation allows differentiation and premium pricing opportunities.

Product Type Insights

Floor-only robotic pool cleaners dominate the market (40% of 2024 revenue) due to their affordability, ease of use, and universal compatibility with most residential and commercial pools. Wall-climbing and pressure-side cleaners are gaining traction in niche applications, particularly in pools with complex layouts or high debris accumulation. Fully automated models (55% of 2024 revenue) remain the preferred choice for both residential and commercial segments, as they minimize manual intervention and provide consistent cleaning performance. AI-enabled smart cleaners are emerging in premium markets, offering features such as app-based control, adaptive cleaning cycles, and chemical monitoring integration, which appeal to tech-savvy consumers and large-scale commercial operators seeking efficiency and precision.

Application Insights

Cleaning and maintenance represent 70% of total market demand, reflecting the primary function of robotic pool cleaners in both residential and commercial pools. Debris collection and filtration remain critical applications, particularly for public and high-traffic commercial pools, where maintaining hygiene standards is essential. Integrated water treatment capabilities, including chemical monitoring and optimization, are gradually being adopted, especially in high-end residential and commercial installations, further expanding the functionality of robotic pool cleaners and driving higher adoption rates through 2030.

Distribution Channel Insights

Direct sales, e-commerce platforms, and specialty pool equipment retailers dominate the distribution landscape. Online channels provide transparency, product comparisons, and convenience, making them particularly attractive to residential buyers. Direct sales and B2B channels remain key for commercial and municipal clients, ensuring tailored solutions and after-sales service. Additionally, social media and digital marketing campaigns have become critical for driving consumer awareness, especially among younger, tech-savvy demographics seeking energy-efficient and smart-enabled pool cleaning solutions.

End-Use Insights

Residential pools (60% market share in 2024) continue to dominate end-use demand, largely due to the convenience and time-saving benefits of robotic pool cleaners. Homeowners prefer automated solutions that reduce maintenance effort while ensuring consistent pool hygiene. Commercial and public pools, including hotels, resorts, and municipal facilities, are the fastest-growing segments (8–10% CAGR), as operators prioritize operational efficiency and labor cost reduction. Export-driven demand is particularly strong from Asia-Pacific to North America and Europe, where premium, AI-enabled robotic pool cleaners are imported to meet high-end consumer and commercial requirements.

| By Type | By Technology | By Pool Type | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America (35% market share in 2024) remains the largest market, led by the U.S. due to high pool ownership, widespread disposable income, and growing smart home adoption. The key driver for this region is labor cost reduction, as robotic pool cleaners significantly reduce the need for manual maintenance in residential and commercial pools, providing cost savings and operational efficiency. The hospitality sector, including hotels, resorts, and municipal pools, is increasingly adopting robotic cleaners to streamline operations and maintain hygiene standards. Technological integration and energy-efficient models further enhance market penetration in North America.

Europe

Europe (25% market share in 2024) is driven by high residential pool penetration and urban development in countries such as Germany, the UK, and France. A key growth driver is environmental awareness, with consumers and commercial operators seeking energy-efficient and eco-friendly robotic cleaners to minimize electricity and water usage. Regulatory initiatives promoting sustainable solutions, coupled with rising adoption of smart and automated pool maintenance, support steady growth (6% CAGR) in both residential and commercial segments.

Asia-Pacific

Asia-Pacific is the fastest-growing region (12% CAGR), with China, India, and Australia leading demand. The region benefits from rapid urbanization and infrastructure development, which is increasing the number of residential, commercial, and hospitality properties. Rising middle-class income, luxury resort expansion, and increasing awareness of automated, time-saving solutions are further accelerating adoption. Governments are also investing in urban leisure infrastructure, indirectly boosting demand for robotic pool cleaners. Premium and semi-automated models are gaining popularity among residential homeowners and commercial operators seeking efficiency and reduced maintenance costs.

Latin America

Brazil and Mexico lead adoption (9% CAGR), supported by rising residential and commercial pool installations. The primary regional driver is rising disposable income, which enables a broader consumer base to afford robotic pool cleaners. Economic improvements, coupled with increased awareness of convenience and hygiene benefits, are encouraging adoption in both private and hospitality sectors. Premium imports from North America and Europe are also strengthening the market, particularly in upscale residential and commercial pools.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, shows strong demand for luxury residential and commercial pool installations, while Africa benefits from growing tourism and hospitality infrastructure. Key drivers include high disposable incomes, increasing adoption of automated pool solutions in luxury resorts, and operational efficiency needs in commercial and municipal pools. Growing urbanization and leisure industry expansion in major cities are also contributing to market growth, particularly in premium and commercial segments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Robotic Pool Cleaner Market

- Maytronics Ltd.

- Zodiac Pool Systems

- Hayward Industries

- Pentair Plc

- Dolphin

- Aquabot

- Polaris Pool Systems

- Water Tech Pool Products

- Blue Haven Pools & Spas

- Jandy (Fluidra)

- AstralPool

- H2O Robotics

- Aquatron

- Maytronics Dolphin

- Hayward Pool Products

Recent Developments

- In May 2025, Maytronics launched a new AI-enabled pool cleaner with energy-efficient motors targeting premium residential segments.

- In April 2025, Zodiac Pool Systems introduced a solar-powered robotic cleaner for commercial pools in Europe and the Middle East.

- In February 2025, Hayward Industries expanded its smart home-compatible robotic pool cleaner lineup across North America and APAC.